During the last couple of years, the cryptocurrency industry is a primary target for regulators within the U . s . States.

The legal fight between Ripple and also the U . s . States Registration (SEC), Nexo’s suit using the securities regulators of eight states, and also the scrutiny targeting Coinbase’s Lend program this past year are a couple of high-profile examples. This season, even Kim Kardashian had first-hands knowledge about regulatory scrutiny after saying yes to pay for a $1.26 million acceptable for promoting the dubious crypto project EthereumMax.

While Ethereum developers meant to create key network upgrades later on, it appears such as the recent Merge has further complicated matters between crypto projects and U.S. regulators.

Ethereum: Too substantial for that crypto market?

On Sept. 15 – within 24 hours Ethereum’s Merge required place – SEC Chairman Gary Gensler mentioned throughout a congressional hearing that proof-of-stake (PoS) digital assets might be considered securities. Gensler stated his reasoning was that holders can earn revenue by staking PoS coins, which would mean that there’s an “expectation of profit to become produced from the efforts of others.” The second is among the essential areas of the Howey test, utilized by the SEC along with other U.S. government bodies to find out whether a good thing is definitely an investment contract and falls under federal securities law because it was passed into law in 1946.

As you know, Ethereum has shifted in the mining-based proof-of-work (Bang) to PoS, requiring validators to stake Ether (ETH) to include new blocks towards the network. Quite simply, which means that Ether could come under the Securities Act of 1933, which may require project to join up using the SEC and adhere to strict standards to guard investors.

Related: Federal regulators are intending to pass judgment on Ethereum

Gensler contended that intermediaries like crypto exchanges along with other providers offering staking services “look very similar” to lending. And, cryptocurrency lending is really a sector that’s been under heavy SEC scrutiny, particularly if we think about the agency’s $100 million fines against BlockFi in Feb.

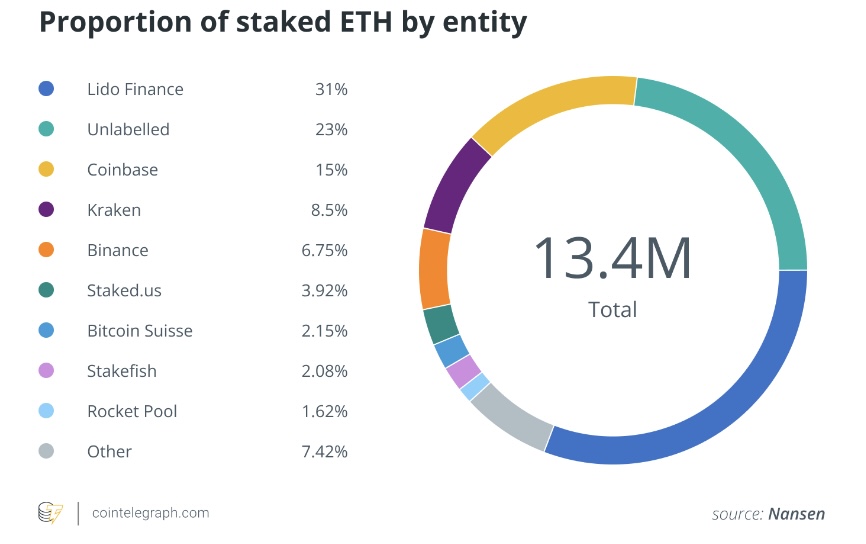

Actually, Gensler’s latter argument is extremely relevant within the situation of Ethereum, where one must stake 32 ETH (worth $42,336 in the current cost of $1,323 per gold coin) to become validator. As this is a substantial sum for a lot of, most users are embracing staking providers to stake their digital assets on their own account to avert this capital requirement in return for a charge.

Simultaneously, this would mean that, sooner or later, large centralized providers increases what they can control within the network. Thus, by falling underneath the SEC’s supervision, there is a chance the company could stop them from validating individual transactions (censorship), that will lead that such transactions will harder to become confirmed. That stated, confirmation speed ought to be the most critical issue here, as there’ll always be some validators which will subsequently read the transaction.

Within this setting, Ethereum, among the major systems for decentralized finance (DeFi), will be the primary lever for regulatory policy. Tokens for example USD Gold coin (USDC) and many more contain blacklisting and blocking mechanisms in the development level, instead of the DeFi market generally — so it seems sensible that validators and also the MEV market will act as leverage tools. For the short term, however, this really is much more of a scare because there are a lot of validators, and no-one can control this method at reasonable prices.

Concerning the above, U.S. regulators may plan to oblige individuals node validators under their jurisdiction to apply Know Your Customer (KYC) and Anti-Money Washing (AML) procedures for validating transactions.

Ethereum’s Merge gives possibilities for that SEC to do something. How?

Additionally towards the Howey test argument, the SEC also claims that ETH transactions come under U.S. jurisdiction because of the high power of the network’s nodes within the U . s . States. If the statement happens to be accurate and finds further development nationwide, this implies the U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN) will need all companies operating around the Ethereum blockchain to conform with KYC and AML needs.

Used, which means that customers will need to verify their identities and residencies, in addition to provide more information to providers before they are able to employ a DeFi service. This considerably boosts the burden for crypto projects (and something could reason that this method would not in favor of the thought of decentralized finance). However, regulatory compliance will facilitate trust between investors and providers, which supports attract investment from institutional clients.

That stated, it’s fundamental to mention the SEC’s debate regarding its approach, communication and decisions about crypto regulation, which digital asset market players have heavily belittled. BlockFi’s situation is a superb example. The SEC announced actions against the organization over its failure to join up high-yield interest accounts the commission considered securities. Based on the case’s documents, among the agency’s needs ended up being to bring BlockFi’s business activity into compliance using the Investment Company Act of 1940.

Consequently, BlockFi wound up around the auction block, and 2 others concentrating on the same companies went belly up — they were Ripple general counsel Stu Alderoty’s words.

Thus, a scenario has come to light in which the SEC used the legislation of 1940 to manage modern and never yet full-grown technology, that is absurd.

Related: Tax on earnings you won’t ever earned? It’s possible after Ethereum’s Merge

In addition, the SEC’s statement that Ether falls under U.S. jurisdiction is, to say the least, false. (Whether it were, it might be convenient for that agency.) The SEC’s logic here would be that the Ethereum blockchain’s node network is much more densely clustered within the U.S. than elsewhere, so that all ETH transactions worldwide might be considered when they were of yankee origin.

But, based on Etherscan, the U.S. is presently the place to find a bit more than 46% of Ethereum nodes — not really an easy majority. In line with the SEC’s statement, you could reason that just the Eu should regulate Bitcoin (BTC). Obviously, the second argument is equally as absurd because the agency’s claim.

In my opinion these statements derive from the SEC lawyers’ very rough knowledge of cryptocurrencies. But, we can’t eliminate the prior habits from the SEC to manage through enforcement.

Regulatory compliance includes a large sacrifice for Ethereum

U.S. regulators are more and more expressing concerns concerning the huge sums circulating in DeFi with no control. Because the Ethereum blockchain can serve as the main chain for many tokens, its recent shift from Bang to PoS can be utilized being an argument for his or her tries to influence (a minimum of part of) the decentralized market.

When the SEC along with other U.S. regulators flourish in the second, it might restructure DeFi so that another transformative blockchain becomes the best choice. But, what’s certain within the situation of full Ethereum regulation is the fact that traditional banks and investment funds will boost ETH’s usage being an asset for investments and payment means.

Thinking about all of this, supplying any timeline is challenging as a result statements in the SEC are very recent and raw right now. Let’s wait and find out what further actions U.S. regulators will require soon and whether or not they will change up the KYC and AML procedures from the crypto space too.

Slava Demchuk may be the Chief executive officer and co-founding father of AMLBot, a business that monitors a worldwide database of cryptocurrency addresses to help companies and users with compliance needs.

This information is for general information purposes and isn’t supposed to have been and cannot be used as legal or investment recommendations. The views, ideas, and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.