A lengthy-dormant Ether whale who took part in the Ethereum Initial Gold coin Offering (ICO) may be going to stake an enormous 32,015 ETH tokens, based on on-chain analytics-focused Twitter account @lookonchain.

The ICO participant staked 48,992 ETH in October, ending six many years of dormancy at that time. Based on @lookonchain, the whale transferred 32,015 ETH tokens to a different address the 2009 week, that they think the whale might be going to stake.

The Ethereum ICO whale received 120,000 ETH tokens in the genesis from the Ethereum mainnet in 2015 across three separate wallets. When they do stake an additional 32,015 tokens, which means the whale may have staked 67.5% from the 120,000 tokens they received in the Ethereum ICO.

More ETH Shifts Towards Staking

The above mentioned-noted whale’s (possible) shift towards staking a larger part of its ETH holdings reflects a transfer of the ETH market. ETH staking first grew to become possible around the beacon chain in late 2020.

But until recently, most ETH proprietors have opted to not stake their tokens, despite attractive yields of presently around 7-8% for node operators and 4-5% for staking pool participants.

That’s because, right now, staked ETH tokens can’t be withdrawn. Based on Ethereum, the possible lack of versatility in staked ETH withdrawals ended up being to safeguard the network’s integrity because it transitioned from proof-of-try to proof-of-stake.

However that transition has been finished (the “Merge” required place last September). And Ethereum developers will work around the blockchain ecosystem’s newest upgrade, the so-known as “Shanghai” hard fork that’s presently scheduled to occur prior to the finish of March.

The approaching upgrade allows staked ETH to become withdrawn the very first time. While withdrawals will not be immediate, the shift towards greater withdrawal versatility appears to become attracting more ETH proprietors to staking.

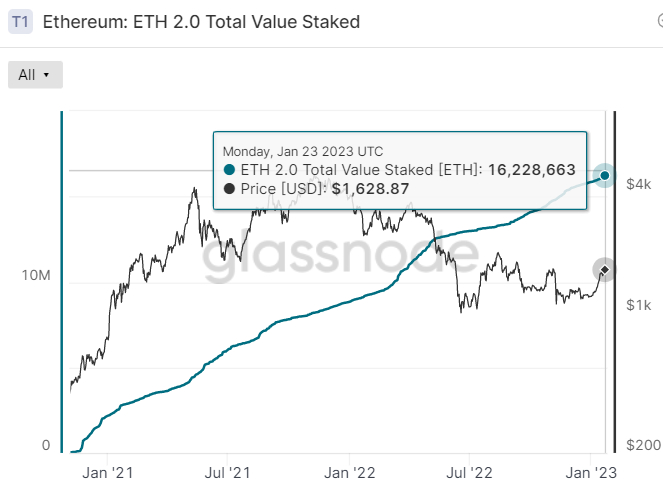

Since September 2022, once the merge required place, the amount of staked ETH has risen by a couple of.seven million ETH to 16.two million, and therefore presently around 13.5% from the ETH supply is kept in staking. That’s still far from staking participation on Ethereum rival Cardano’s blockchain, with a participation rate well over 70%, thank you for its flexible withdrawals. However the trend appears to become towards rising staking participation.

How Greater Staking Participation Can Boost ETH’s Cost

Staking is an optimistic for ETH’s cost – why possess a cryptocurrency that provides no yield whatsoever whenever you could possess a cryptocurrency that provides a foreseeable yield, many crypto investors may ask.

But until recently, the possible lack of versatility in withdrawals was deterring investors who value liquidity more than a steady yield. Now ETH investors might have (nearer to) both. As ETH staking participation increases, which should boost ETH for any couple of reasons.

To begin with, it encourages HODLing, with HODLers guaranteed to access least a 5-8% return (based on whether or not they really are a node operator or staking pool participant) on their own staked ETH, no matter market conditions.

Presuming most individuals attracted into staking given its new versatility do finish up HODLing their ETH tokens, this produces a decrease in the commonly available way to obtain ETH tokens. Ether buyers will basically be fielding sell offers from the smaller sized pool of willing sellers.

Many analysts believe that a shift to elevated staking participation might be a key driver of lengthy-term appreciation within the cost of ETH. As crypto matures being an asset class and cost fluctuations tend towards what is common in traditional markets, many expect major banking institutions to get more and more attracted to ETH staking, with a few talking about ETH because the bond from the crypto world.

Other motorists of lengthy-term ETH appreciation are anticipated to become factors like the blockchain’s ongoing efforts to upgrade (sharding might make Ethereum more scalable later this season), its ongoing mainstream adoption (non-zero balance addresses should soon hit 100 million) cheap it’s now a deflationary asset.

Ethereum Alternatives

If you are searching for other high-potential crypto projects alongside ETH, we have reviewed the very best 15 cryptocurrencies for 2023, as examined through the CryptoNews Industry Talk team.

Their email list is updated weekly with new altcoins and ICO projects.

Disclaimer: The Talk section features insights by crypto industry players and isn’t an element of the editorial content of Cryptonews.com.