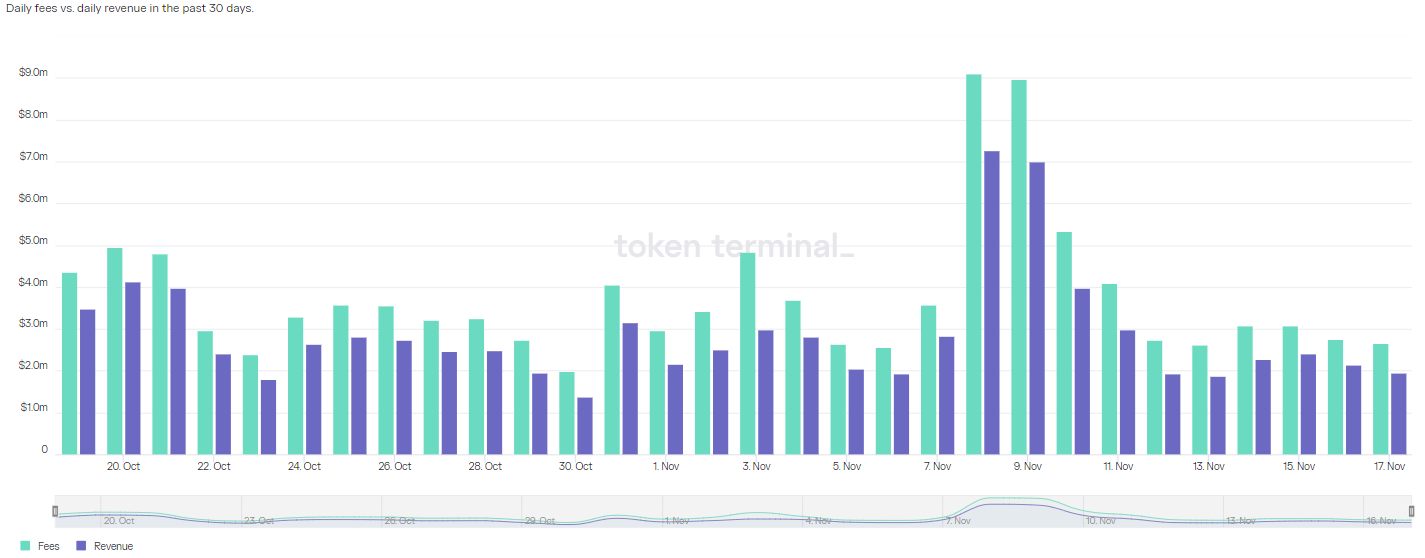

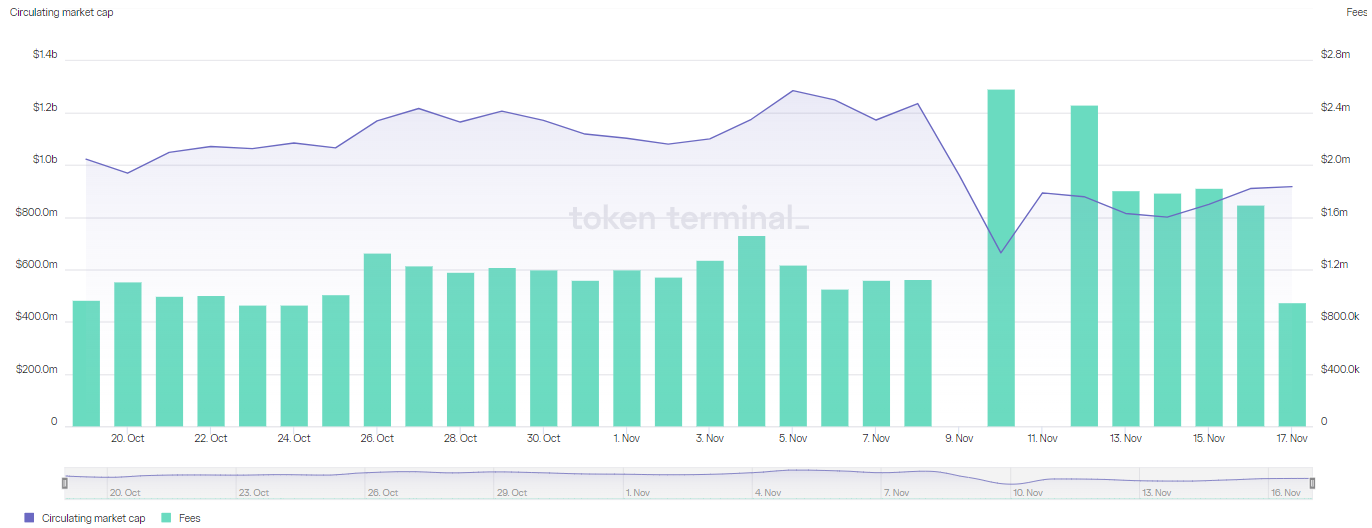

The crypto market has observed a turbulent couple of days following the FTX collapse but Lido Finance, a liquid staking protocol, is a vibrant place amongst the chaos. Based on Data from DeFiLlama, Lido protocol has earned $a million or even more in charges daily since October 26.

Lido charges and revenue with time. Lido has collected over $1M in charges every single day since October 26th pic.twitter.com/GHkzSzYIOo

— DefiLlama.com (@DefiLlama) November 18, 2022

Let’s evaluate the on-chain fundamentals to determine why this trend has ongoing.

What’s behind Lido Finance’s growth?

Lido’s growth began in May 2021, pre-FTX collapse. The charges arrived at an exciting-time at the top of November. 10 as fee revenue nearly capped $2.six million. The protocol earns 10% from the total Ethereum (ETH) staking rewards generated from user deposits.

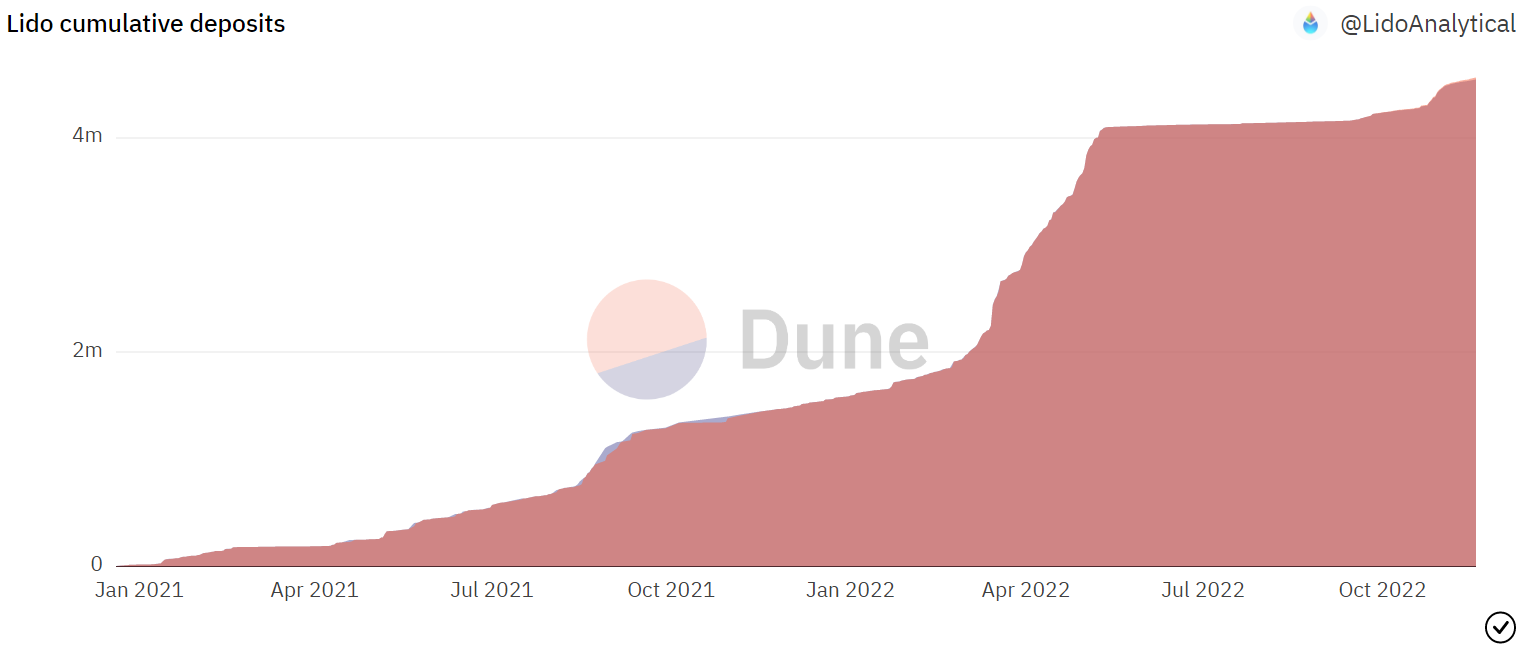

Data also shows a stable rise in deposits to Ethereum’s PoS consensus means an uptick in Lido’s fee capture.

Lido’s fee revenue moves together with Ethereum Proof-of-stake (PoS) earnings since Lido transmits received Ether towards the staking protocol. Following the FTX collapse, Ethereum activity is continuing to grow because of an uptick in decentralized exchange (DEX) activity. Ethereum charges and revenue also arrived at a 30-day peak on November. 8, posting $9.a million in charges and $7.3 million in revenue.

New and daily active users keep growing

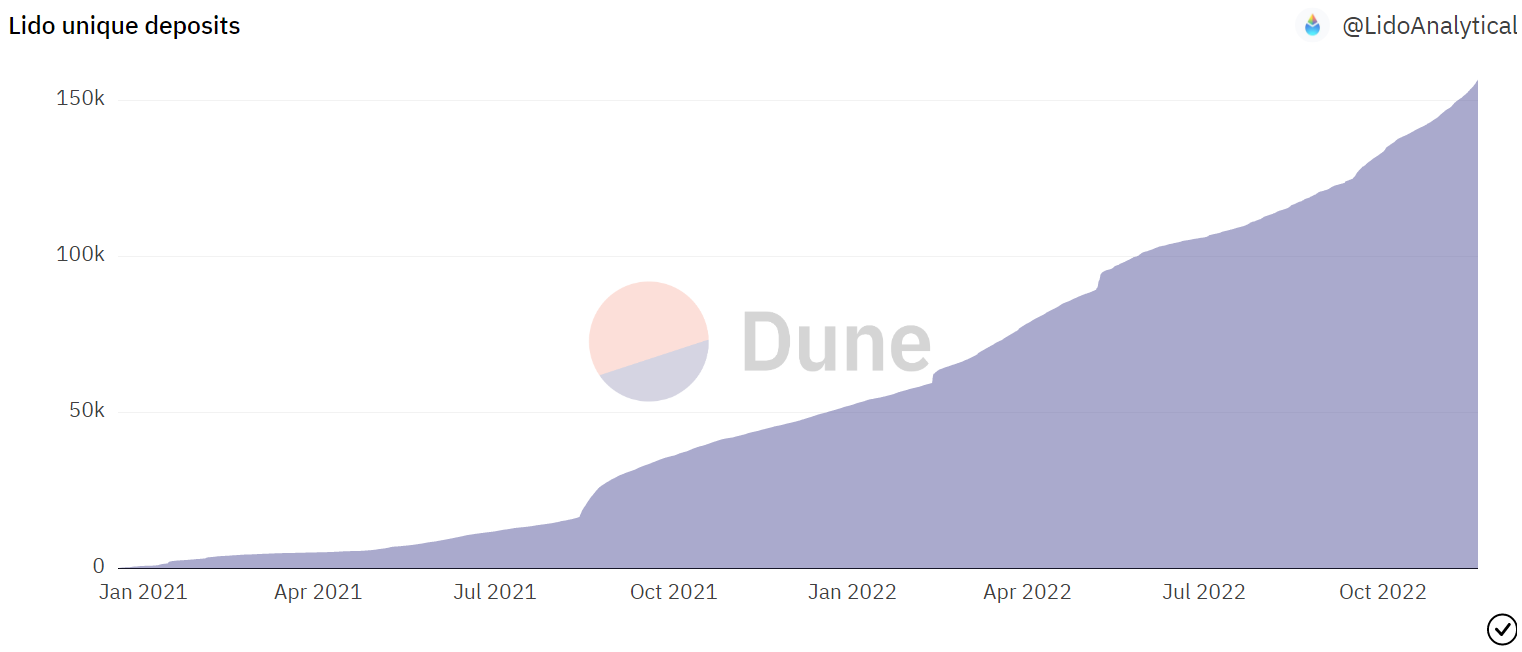

Unique depositors in to the Lido protocol have arrived at 150,000, demonstrating that Lido is ongoing to draw in new users. The rise in unique deposits uses centralized “earn” programs have proven weaknesses because of contact with their contact with FTX, Genesis, BlockFi yet others.

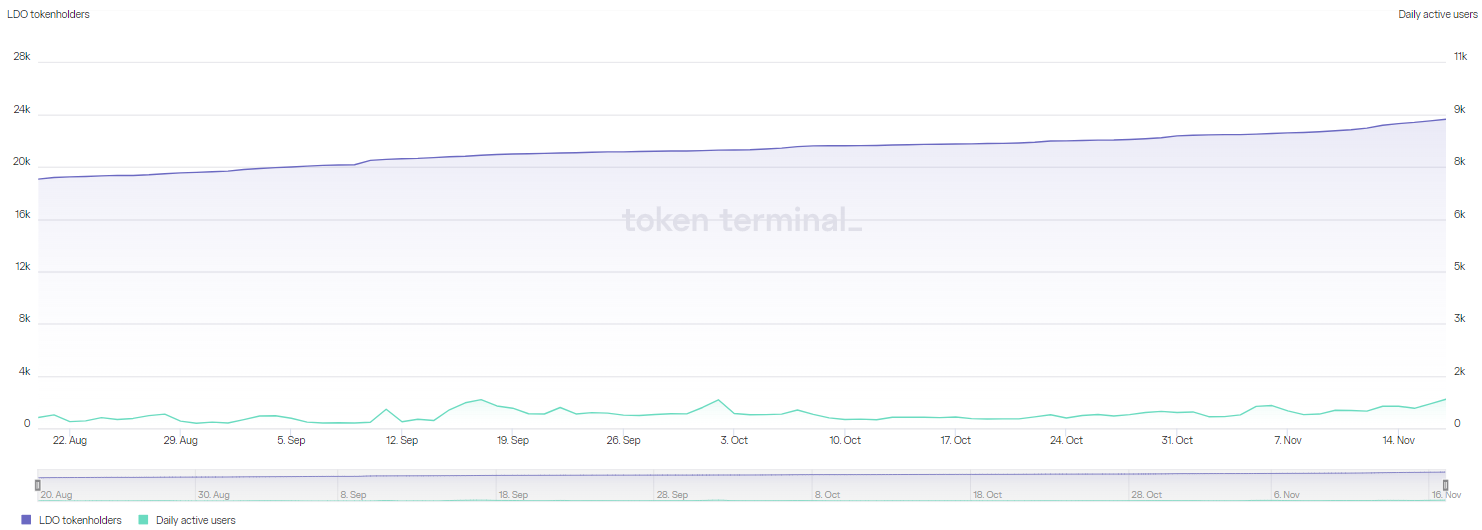

Daily active users and Lido (LDO) token holders will also be growing on Lido. Based on data from Token Terminal, daily active users hit a 90-day a lot of 837 on November. 17 further bolstering the platform’s positive momentum.

Related: DeFi platforms see profits among FTX collapse and CEX exodus

Lido’s market capital doesn’t match its on-chain fundamentals

While charges, deposits and revenue still increase for Lido, the marketplace cap of LDO tokens isn’t keeping pace.

As pointed out above, Lido hit an archive quantity of charges on November. 10, simultaneously the marketplace cap decreased from $1.2 billion to $663.seven million.

Based on Coingecko, in this same period, the cost of LDO tokens dropped from $1.80 to some low of $.90.

Regardless of the market-wide downturn, Lido is showing strong fundamentals on multiple fronts. The steady uptick in DAUs, revenue and new unique participants are critical factors for assessing growth and sustainability inside a DeFi platform.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.