Approaching the date of Ethereum’s Merge, users have speculated about what it really means for projects and also the wider ecosystem. Some argue the Merge may have little effect on gas charges and believe transaction speeds might improve.

However, generally, most ordinary users won’t notice much change. The actual changes for average users are only seen following the sharding mechanism is introduced six several weeks later.

The Merge will reduce energy consumption while increasing security

The Merge is really a planned update towards the Ethereum network scheduled for Sept. 15. It’ll move transaction validation from proof-of-work (Bang) to proof-of-stake (PoS). PoS continues to be a part of Ethereum’s plans for several years, but the amount of technical sophistication it takes has had time for you to develop. This means a transition from miners being accountable for validating blocks to the staked proprietors of ETH.

Related: How Sharding-Based Blockchains Could Handle More Transactions Than Visa

This can have a lot of major significant lengthy-term effects. First of all, it’ll mean an enormous decrease in the quantity of electricity utilized by Ethereum (around 99.9%). While Bang is a powerful way of validation, it’s been proven to make use of exactly the same levels of electricity as whole countries, meaning it’s highly harmful towards the atmosphere.

Under PoS, validators will only have to stake 32 Ether (ETH). The switch may also mean a rise in security. It is because it decreases the possibility of a 51% attack (needed to consider within the network), that is much more likely on the Bang system. On the PoS system, the chance of launching a panic attack may be the staked ETH — instead of electricity cost on Bang — so there’s an natural penalty to fail.

Whereas a unsuccessful Bang attack leads to losing discovered another means, slashing a validator’s stake may be the PoS same as a miner burning lower a whole Bang server farm inside a unsuccessful attack. The economical incentive reduces considerably. The Merge may also ultimately level the arena economically.

Don’t expect better speed or lower gas charges

Even though, right now, the Merge doesn’t need immeasureable action in the projects themselves. However, there’s still the issue of methods the Merge will modify the people that use the projects.

Many users hold certain assumptions and guesses about how exactly the machine can change following the Merge. However, a lot of individuals assumptions are wrong.

Little effect on gas charges

The Ethereum Foundation, the business behind the Ethereum blockchain, has asserted the Merge may have little effect on gas charges. Which means that gas charges will stay relatively high, with respect to the supply and demand of computation power.

Improved speed

The declare that transaction speeds is going to be improved continues to be frequently denied by Ethereum core developers. They reason that this will depend around the application that employs the blockchain and never the chain itself.

High NFT charges

To produce a new nonfungible token (NFT) around the Ethereum network, you’ll need to pay a transaction fee. However, the switch from Ethereum’s current Bang consensus formula to the approaching PoS system won’t affect NFT minting charges.

Rewards from staking

Individuals who’ve staked their crypto will discover the rewards will stay locked. These can be locked before the Shanghai upgrade, the next major upgrade following a Merge. At these times, new ETH will accumulate around the Beacon Chain and turn into locked not less than six to 12 several weeks.

Generally, ordinary users won’t notice much change, but there’s a couple of facts to consider.

The cost of ETH will probably rise

It’s expected the cost of ETH will rise soon after the Merge, partly because of projection because of Goerli’s success along with a potential system of hedging exposure. But the concept that ETH charges is going to be burned consequently is only a myth. Rather, unburned charges and execution-level tips will be delivered to stakers. Validators will get 30% of transaction charges.

Related: Ethereum Merge on the right track as Goerli test merge effectively finalized

Commissions will stay, and withdrawals will not be instantly possible

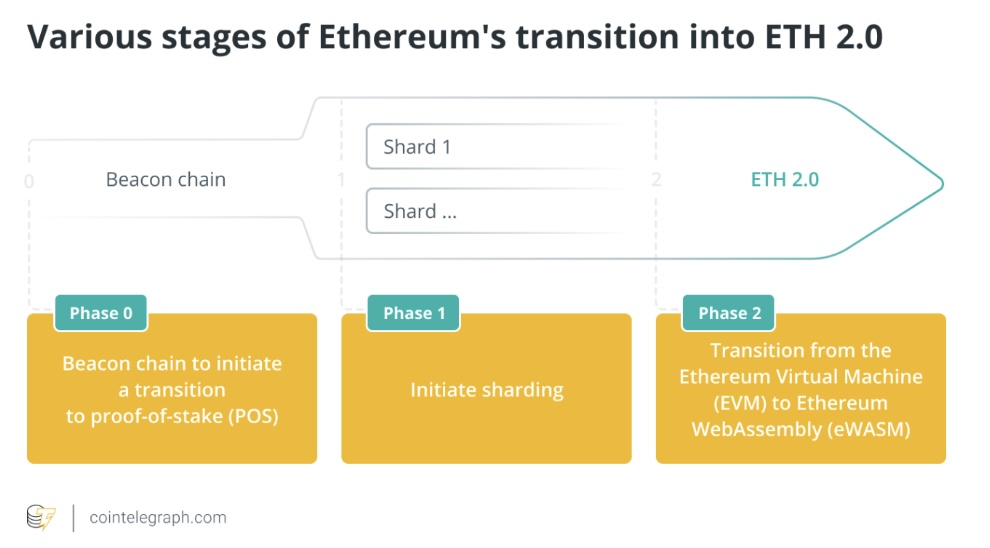

There’s been much discuss the way the Merge can change commissions, charges and withdrawals. However, this stuff are unlikely to happen before the next thing from the network’s transformation. A lot of individuals benefits can come when Ethereum proceeds to another update step of sharding. This will make it that commissions will probably lower. Similarly, it’s at this time that users can withdraw merged ETH (an issue which has received significant speculation).

Being a validator may incur bugs or non-synchronization from the blockchain

For users who would like to become validators, there’s the potential of bugs and non-synchronization from the blockchain. The very best factor to complete would be to take proper care of updating clients to check out specific risks pertinent towards the alterations in consensus. But many aspects will occur instantly.

Exactly what does “being ready” for that Merge seem like?

Even though the Merge continues to be made to have minimal effect on smart contract and decentralized application developers, there’s a couple of tiny problems devs might want to understand. Essentially, the Merge includes changes to consensus, that also includes changes associated with:

- Block structure

- Slot/block timing

- Opcode changes

- Causes of on-chain randomness

- Idea of safe mind

- Finalized blocks.

Therefore, in case your application or service depends on studying the block structure, you will have to update it. Any application that reads the condition from the blockchain, just like a centralized exchange, must update its nodes. The “readiness” from the task for the Merge really means the alterations which will occur throughout the Merge shouldn’t modify the clients from the project by any means. Still, the more knowledge about each project are unique. When the process goes easily, decentralized apps and services shouldn’t be affected, although Ethereum hasn’t been through a similar update previously.

The next thing from the process

Users will begin to see significant change after upgrades scheduled to consider palace following the Merge, most particularly the Shanghai hard fork, that will let the withdrawal of staked funds while increasing scalability. As well as in 2023, the sharding mechanism is going to be deployed. Sharding increases Ethereum’s bandwidth even more, additionally to likely reducing network costs.

The Merge holds huge promise for future years, but it’s a measure inside a lengthy process. Users need to comprehend that to reap the advantages and become prepared.

Svyatoslav Dorofeev is the Chief executive officer of TheWatch and it is a crypto enthusiast using more than fifteen years in product. He launched and brought products in multiple areas, including OTT/IPTV, gaming, travel (OTT), e-commerce and fintech. He was formerly the main vendor at among the largest banks in Eastern Europe.

The opinions expressed would be the author’s alone and don’t always reflect the views of Cointelegraph. This information is for general information purposes and isn’t supposed to have been and cannot be used as legal or investment recommendations.