The current downturn within the broader crypto landscape has highlighted several flaws natural with proof-of-stake (PoS) systems and Web3 protocols. Mechanisms for example connecting/unbonding and lock-up periods were architecturally included in many PoS systems and liquidity pools using the intent of mitigating a complete bank run and promoting decentralization. Yet, the lack of ability to rapidly withdraw funds has turned into a reason most are taking a loss, including probably the most prominent crypto companies.

In their most fundamental level, PoS systems like Polkadot, Solana and also the ill-fated Terra depend on validators that verify transactions while securing the blockchain by continuing to keep it decentralized. Similarly, liquidity providers from various protocols offer liquidity over the network and improve each particular cryptocurrency’s velocity — i.e., the speed where the tokens are exchanged over the crypto rail.

Download and buy reports on the Cointelegraph Research Terminal.

In the soon-to-be-released report “Web3: The Following Type of the web,” Cointelegraph Research discusses the problems faced by decentralized finance (DeFi) considering the present economic background assesses the way the market will build up.

The unstable stable

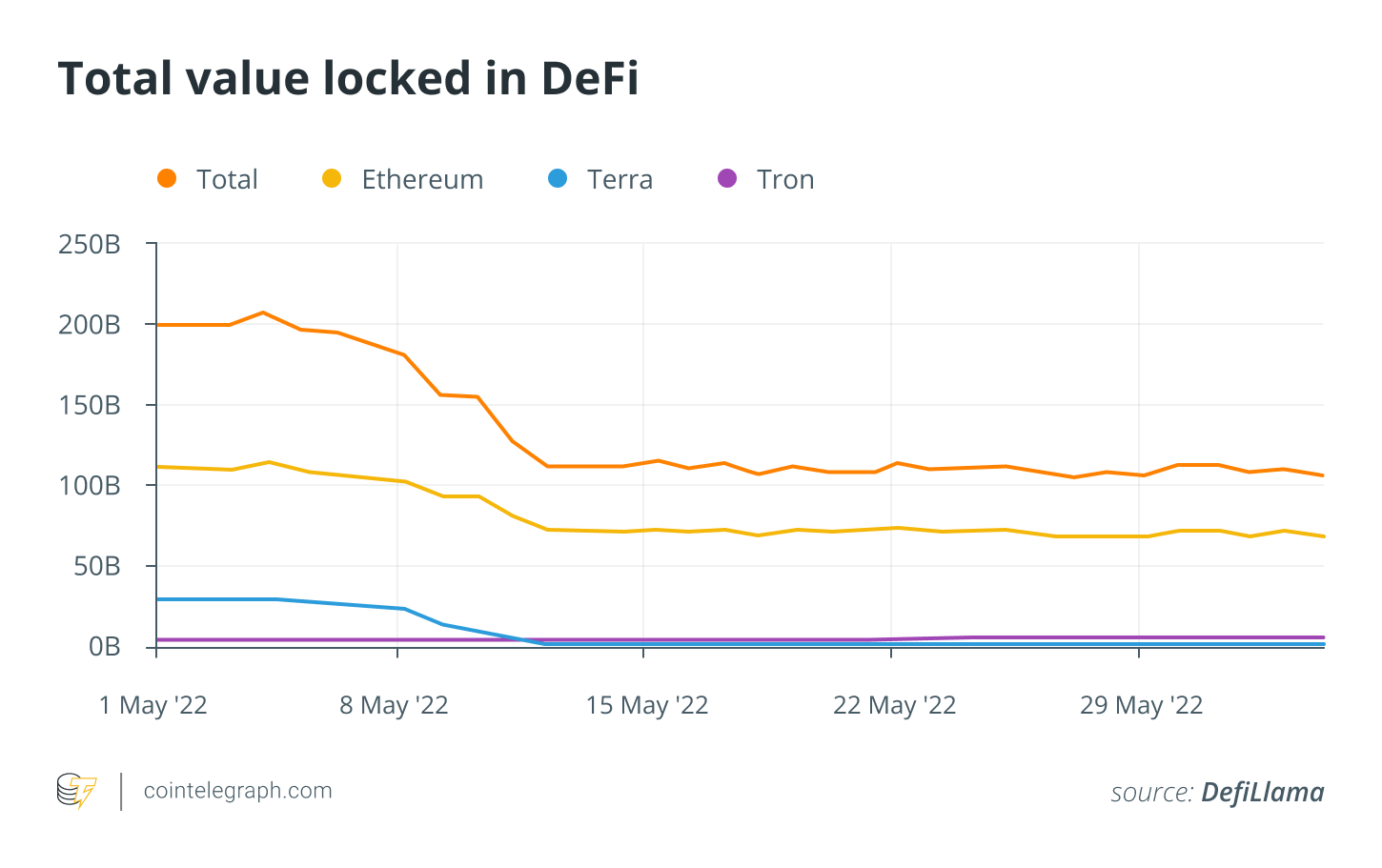

The Terra meltdown elevated many questions concerning the sustainability of crypto lending protocols and, most significantly, the security from the assets deposited through the platforms’ users. Particularly, crypto lending protocol Anchor, the centerpiece of Terra’s ecosystem, battled to handle depeg of TerraUSD (UST), Terra’s algorithmic stablecoin. This led to users losing vast amounts of dollars. Prior to the depeg, Anchor Protocol had greater than $17 billion as a whole value locked. By June 28, it stands just under $1.8 million.

The assets deposited in Anchor possess a three-week lock-up period. Consequently, many users couldn’t exit their LUNA — that has since been renamed Luna Classic (LUNC) — and UST positions at greater prices to mitigate their losses throughout the crash. As Anchor Protocol collapsed, its team made the decision to lose the locked-up deposits, raising the liquidity output in the Terra ecosystem to $30 billion, subsequently causing a 36% reduction in the entire TVL on Ethereum.

While multiple factors brought to Terra’s collapse — including UST withdrawals and volatile market conditions — it’s obvious the lack of ability to rapidly remove funds in the platform represents a substantial risk and entry barrier for many users.

Shedding the Celsius

The present bear market has shown that even curated investment decisions, carefully evaluated making through the leading market players, have become similar to a bet because of lock-up periods.

Regrettably, the most thought-out, calculated investments aren’t safe from shocks. The token stETH is minted by Lido when Ether (ETH) is staked on its platform and enables users use of an expression backed 1:1 by Ether that they’ll keep using in DeFi while their ETH is staked. Lending protocol Celsius set up 409,000 stETH as collateral on Aave, another lending protocol, to gain access to $303.84 million in stablecoins.

However, as stETH depegged from Ether and also the cost of ETH fell among the marketplace downturn, the need for the collateral began falling too, that has elevated accusations that Celsius’ stETH continues to be liquidated and that the organization is facing personal bankruptcy.

Considering that there’s 481,000 stETH on Curve, the 2nd-largest DeFi lending protocol, the liquidation of the position would subsequently cause extreme token cost volatility along with a further stETH depeg. Thus, lock-up periods for lending protocols act not just being an additional risk factor for a person investor but could sometimes trigger an unpredictable chain of occasions that change up the broader DeFi market.

3AC in danger

Three Arrows Capital can also be in danger, using the ETH cost decline apparently resulting in the liquidation of 212,000 ETH utilized as collateral because of its $183 million debt in stablecoins and putting the venture fund on the edge of personal bankruptcy.

Furthermore, the lack of ability of lending protocols to negate the liquidations lately pressed Solend, probably the most prominent lending protocol on Solana, to intervene and propose overtaking a whale’s wallet “so the liquidation could be performed OTC and steer clear of pushing Solana to the limits.” Particularly, the liquidation from the $21-million position might cause cascading liquidations when the cost of SOL would drop lacking. The first election was pressed through by another whale wallet, which contributed 95.1% from the total votes. Despite the fact that a second election overturned this decision, the truth that the developers went from the core concepts of decentralization, and revealed its lack thereof, alarmed many within the crypto community.

Ultimately, too little versatility with connecting/unbonding and locked liquidity farming pools may deter future contributors from joining Web3 unless of course there is a strong knowledge of DeFi design and commensurate risk. This really is exacerbated through the collapse of “too big to fail” protocols like Terra and uncertainty around hybrid investment capital firms/hedge funds like Three Arrows Capital. It might be time for you to evaluate some alternative methods to lock-up periods to match sustainable yields and true mass adoption.

This information is for information purposes only to represent neither investment recommendations nor a good investment analysis or perhaps an invitation to purchase or sell financial instruments. Particularly, the document doesn’t function as a replacement for individual investment or any other advice.