When purchasing markets, people frequently underestimate the chance that, during a period of time, an investment may lose its value, and it’ll make time to recover temporary losses. The much deeper losing becomes, the greater energy needed to recuperate the losses increases from proportion. Basically invest $100 and lose 10%, I finish track of $90 (whether I keep your investment or liquidate it). So, to return to $100, which returns must i make? I must make 11% because, having a base of $90, basically make 10%, I finish track of $99. This effect is amplified basically lose 20% — to obtain away from $80 to $100, I will need to make 25%.

So, the losses aren’t exactly symmetrical towards the gains you have to make to recuperate them. Basically find myself getting lost 50% of my investment, to return to $100 from $50, I have to double it, so it ought to be intuitive towards the readers the more losing is amplified, the greater energy needed to recuperate.

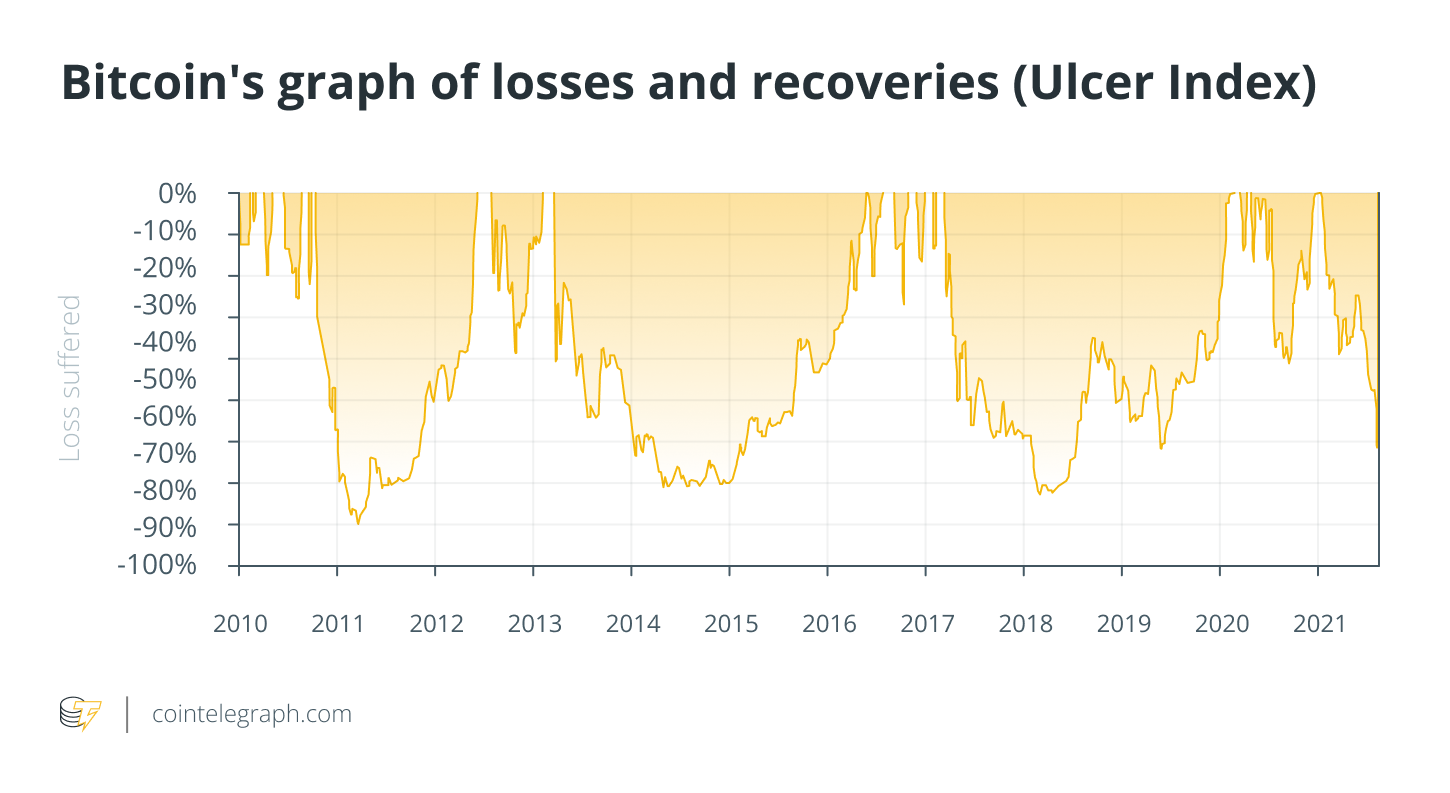

Unhealthy news is the fact that Bitcoin (BTC) has lost greater than 90% of their value one time, greater than 80% on two other occasions, hitting during this time period a performance number of -75%. But the good thing is it has always retrieved (a minimum of to date) from losses in an exceedingly reasonable time-frame — the heaviest losses.

Related: Forecasting Bitcoin cost using quantitative models, Part 2

The Ulcer Index, i.e., the index produced by Peter Martin that calculates how lengthy a good thing continues to be underneath the previous high, is very obvious. Purchasing Bitcoin results in ulcers for a lot of several weeks, but results in incredible returns that, if a person has got the persistence to hold back on their behalf, make one your investment duration of bellyaches in the losses incurred.

When compared to previous two graphs, that go over a time period of half a century although this one only covers 12 years, the existence of losing area is predominant, despite the fact that, the truth is, Bitcoin has always achieved incredibly preferred tax treatment which have permitted it to recuperate around 900% in under 2 yrs.

Coming back towards the subject of the publish, here are a few further methodological notes:

- Digital asset into consideration is Bitcoin

- The comparison currency used may be the U.S. dollar

- The regularity of research is daily and

- The time comes from This summer 23, 2010, until June 16, 2022, your day case study was transported out.

Although Bitcoin’s history is extremely recent, its volatility and speed of recovering losses is outstanding, a sign this asset has characteristics its own to become explored and understood towards the maximum before possibly choosing to include it inside a diversified portfolio.

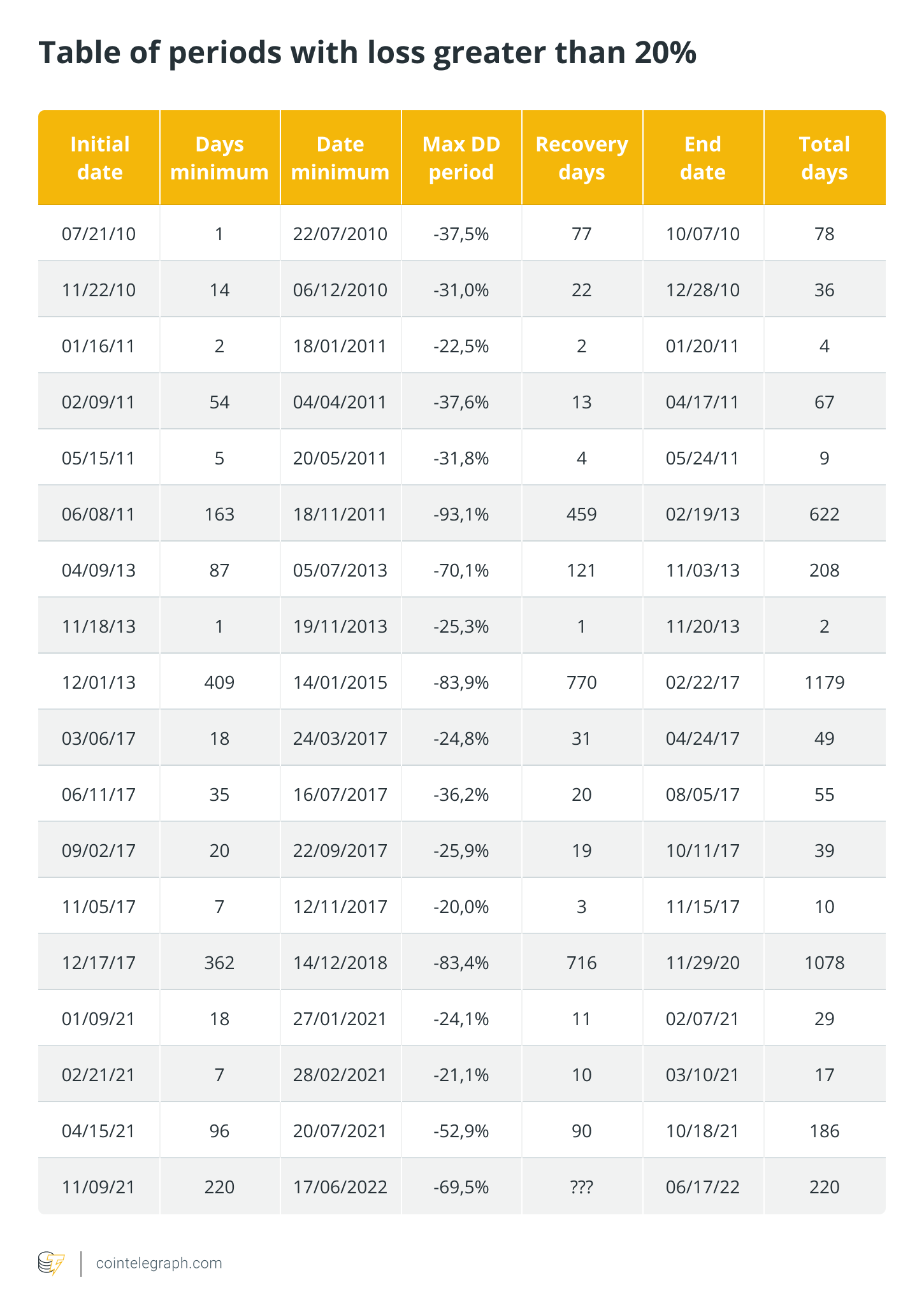

As you can tell from the size of the above mentioned table, there has been many periods of loss and recovery more than 20%, although in just 12 many years of history.

It’s a broadly held opinion that certain year in crypto matches five in traditional markets. This is because, typically, volatility, drawdowns and descend speed are five occasions better than stocks. According to this assumption, while knowing the period into consideration is brief, we are able to attempt to compare it towards the 50-year research into the markets.

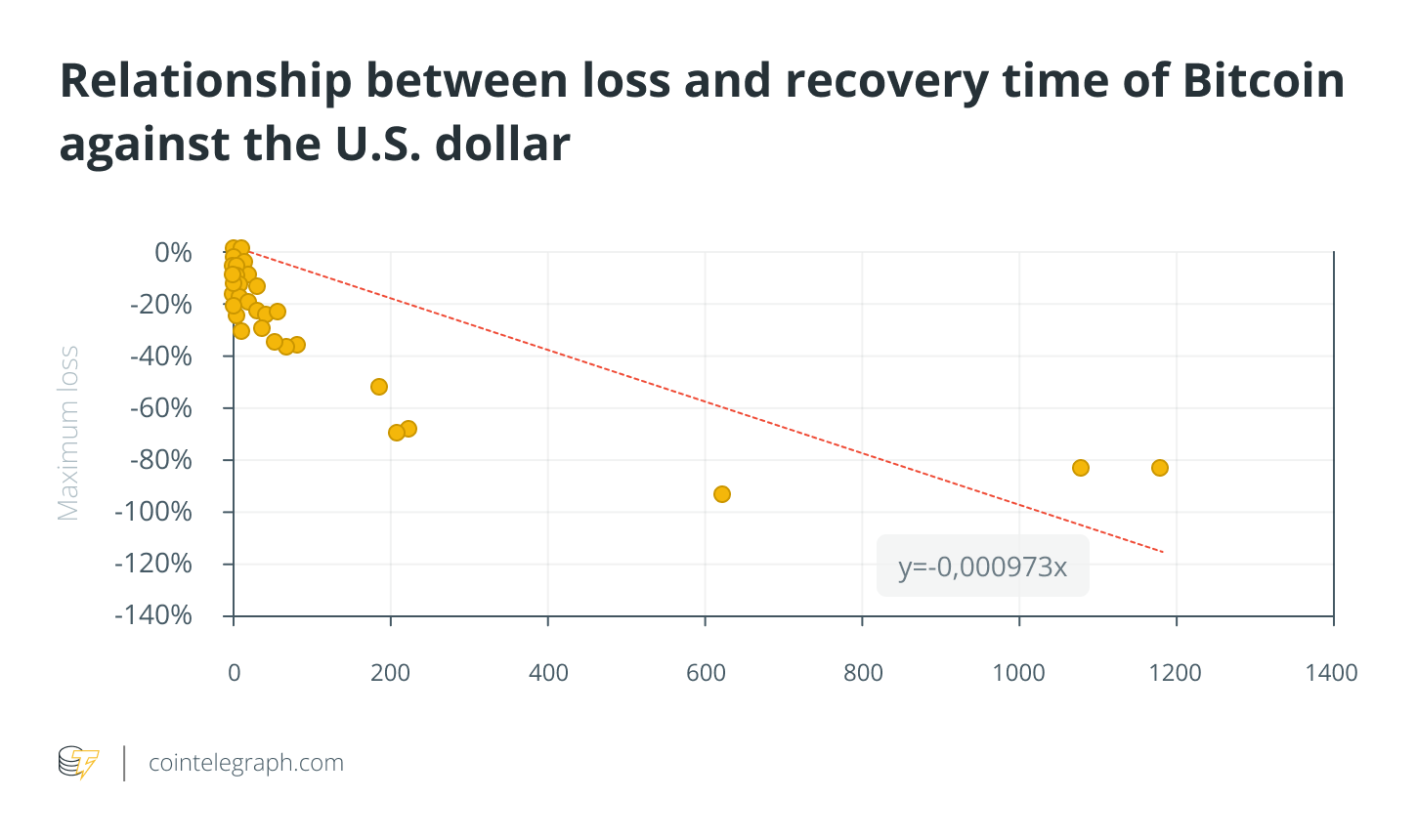

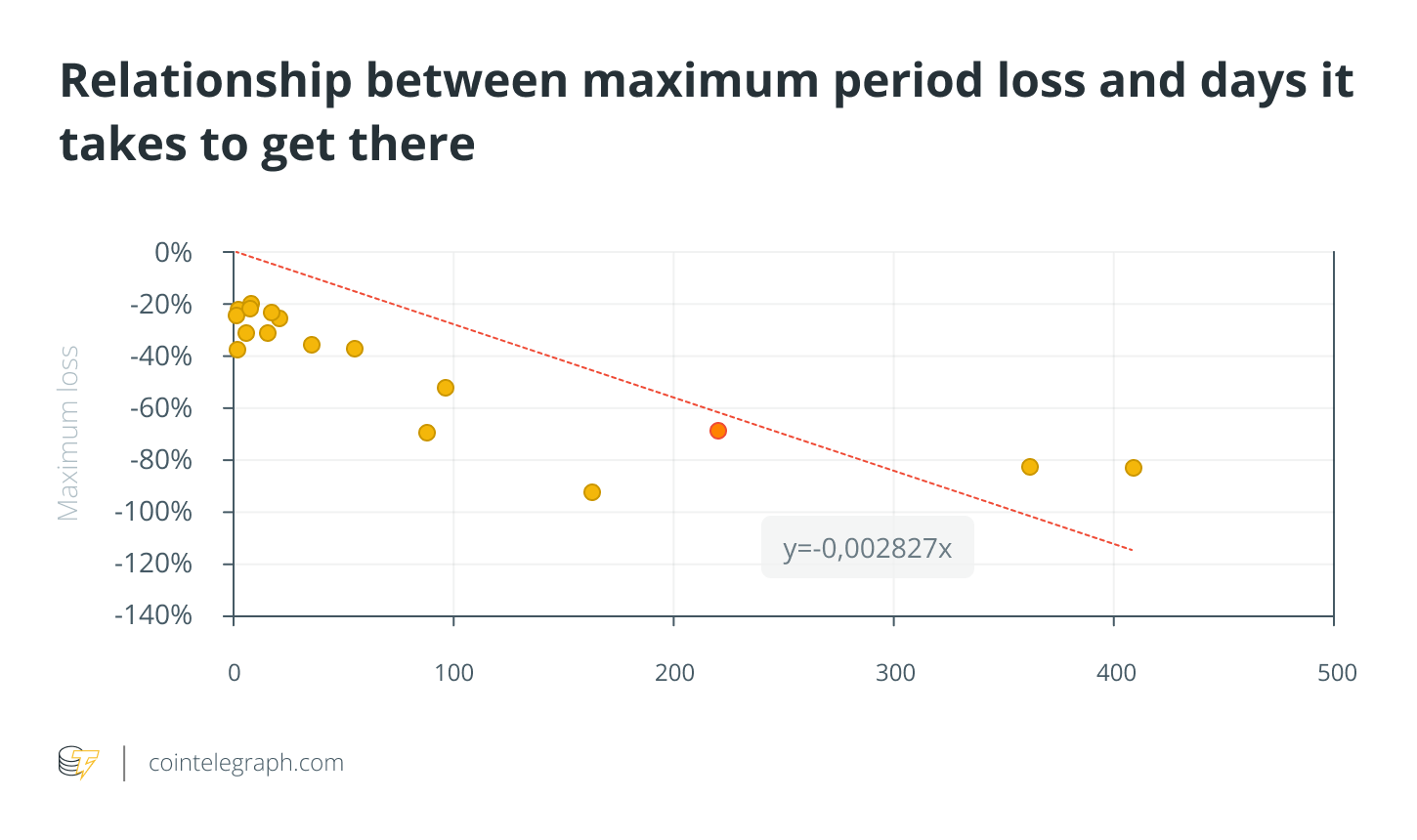

As possible seen, the times it requires to possess a 40% or greater loss frequently number under three several weeks. The more dark us dot may be the current drawdown endured by Bitcoin because the November highs, or about 220 days to date, which makes it using the regression line that determines (to simplify) a typical worth of the connection between losses and also the time for you to make it happen.

While a good thing getting short times to get towards the low point implies that it’s a lot of volatility, additionally, it means that it’s able to recovering. Otherwise, it wouldn’t have retrieved from that low and, indeed, there’d not really be considered a bottom by which to rise.

Rather, shrewd investors who have been initially dubious of Bitcoin until it demonstrated to increase again within the COVID-19 onset period (that’s, March-April 2020) recognized this asset has unique and fascinating characteristics, and not the least being being able to get over the lows.

What this means is not just that there’s an industry, however that there’s an industry that views (although still with imperfect models) that Bitcoin includes a fair value cost and thus, at certain values, it’s a bargain to purchase.

Understanding, therefore, the effectiveness of the recoveries that Bitcoin has had the ability to make can provide us a quote regarding how lengthy it might take it to recuperate to new highs — to not delude ourselves into thinking that it may achieve this inside a couple of several weeks (although, on the couple of occasions, it’s surprised everybody), but to provide us the reassurance to hold back if already invested, in order to comprehend the chance ahead if, to date, we’ve been reluctant toward investing.

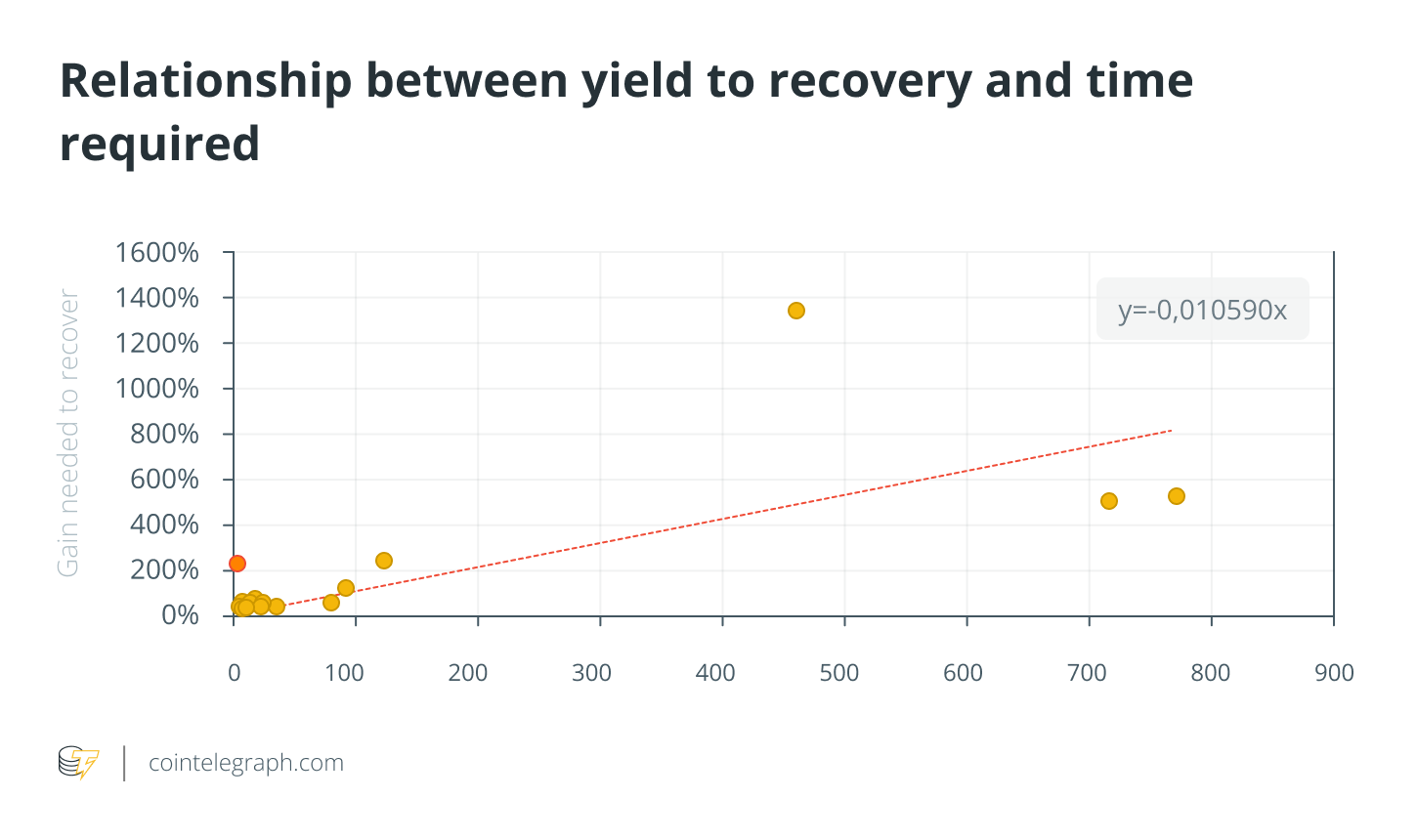

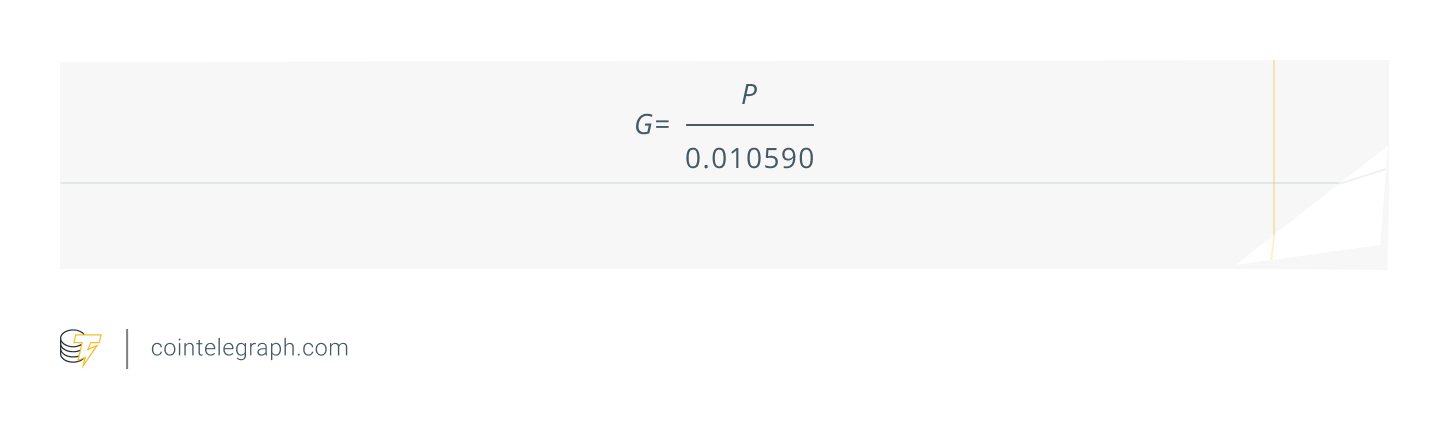

In the graph above, a regression could be extracted that explains Bitcoin’s relationship towards the time that it required to recuperate a brand new high in the relative low. To provide a good example, presuming and never granting that Bitcoin has hit lows of approximately $17,000, the recovery it must make to return to the highs is 227%. So, the next the formula could be produced from the regression line described within the graph:

Where G may be the expected days to recuperate losing and P may be the recovery percentage needed, it may be deduced that it requires 214 days in the low of the other day to go back to a brand new high.

Obviously, presuming the low was already hit is really a stretch as no-one can truly know. However, it may be assumed that it’s could be most unlikely to determine the brand new highs again before The month of january 2023, so people can take their hearts resting should they have invested and therefore are suffering losing, while possibly individuals who haven’t yet invested can realize they have a really interesting chance before these to consider, and rapidly.

Related: Forecasting Bitcoin cost using quantitative models, Part 3

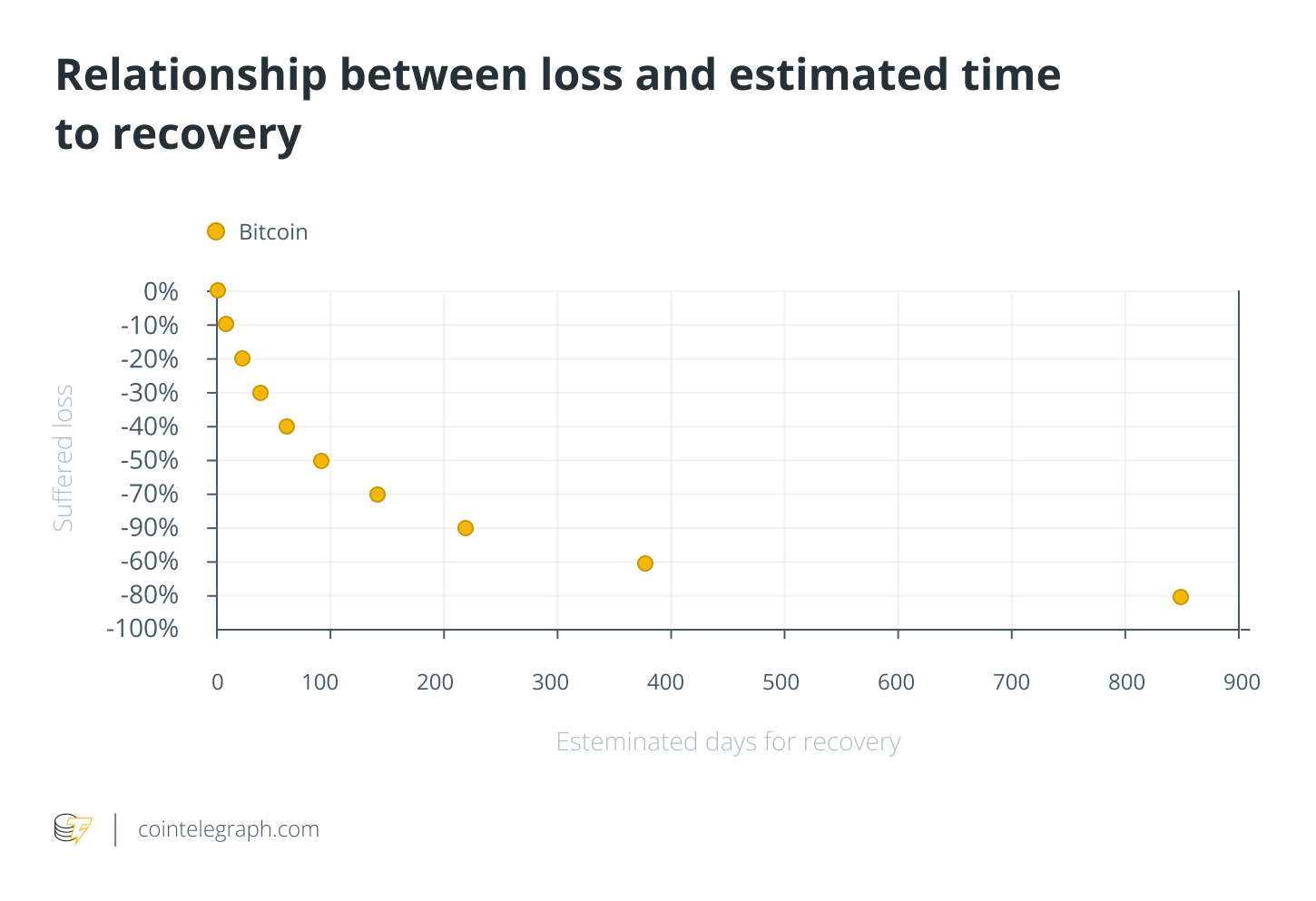

I recognize these statements are strong. They aren’t intended to be a forecast, only an research into the market and it is structure, attempting to give just as much information as you possibly can towards the investor. Clearly, it’s important to infer the worse losing will get, the more I must be prepared to wait to recuperate it, as possible seen in the graph below, the derivative from the regression within the graph above (recovery occasions according to loss) associated with losses incurred.

Some factors:

- Case study reported here represents a quote according to historic data there’s no be certain that the marketplace will recover within or round the believed values.

- There’s no assumption that will establish the present loss like a period low.

- Not selling does not necessarily mean the loss isn’t real losing is really whether or not the underlying asset isn’t offered. It’s not recognized but it’s still real, and also the market will need to result in the recovery akin to the graph at the beginning of this analysis to recuperate the first value.

Unlike the 2 asset classes equities and bonds, within the situation of Bitcoin at this time of loss, escaping . represents much more of a danger than an chance, because Bitcoin has proven that it may recover considerably faster than individuals other two asset classes. It could have been essential to exit earlier, once we did using the alternative Digital Asset Fund, that is losing under 20% YTD and therefore will require a absurd 25% to return to new highs for that year, when compared to 227% required by Bitcoin to climb support, evidence that using trend-following logic reduces volatility and time to recover.

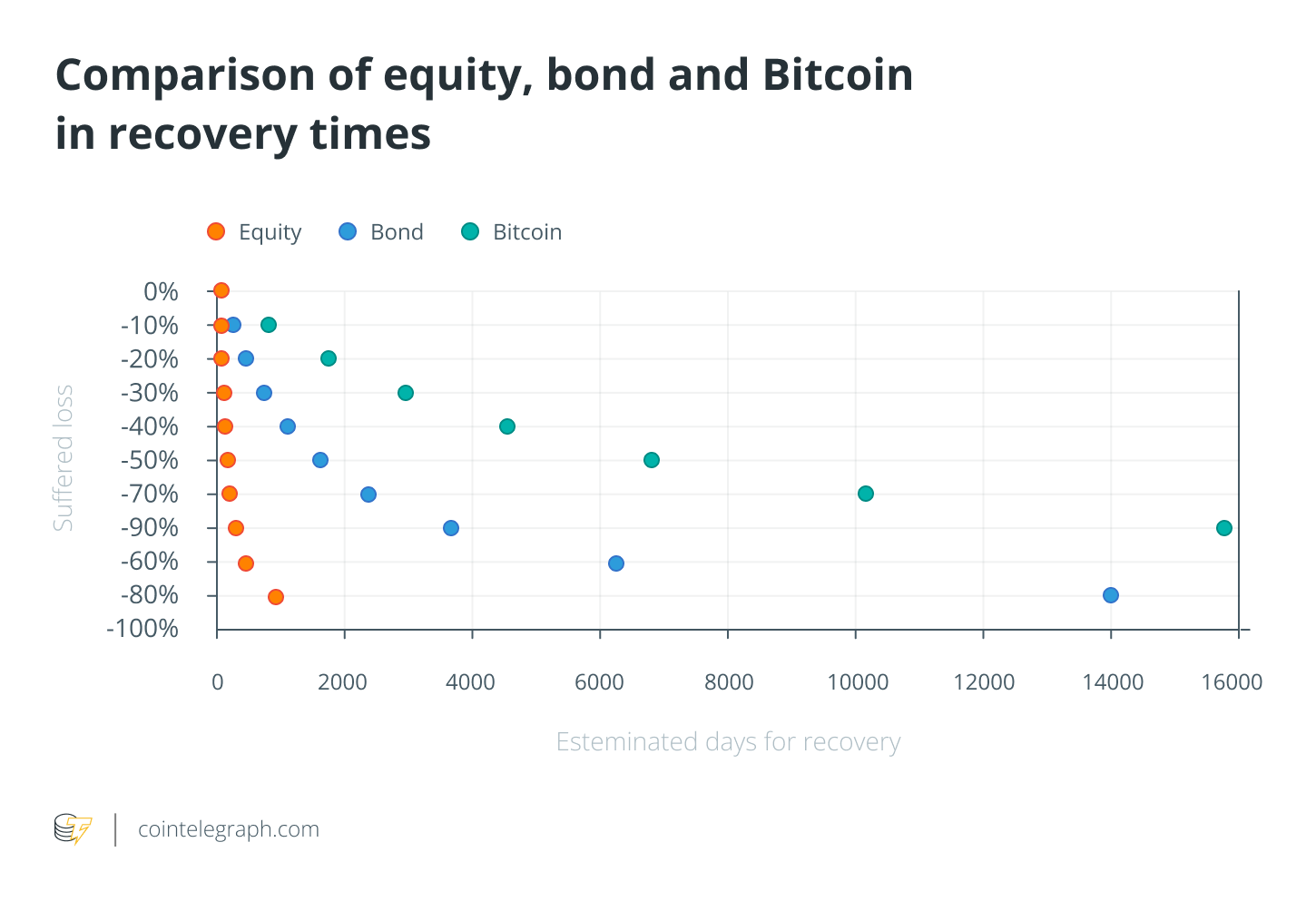

To reiterate, however, the main difference between Bitcoin and yet another two asset classes (equities and bonds), I’ve compared the 3 about this graph of relationship between loss and time to recover:

It’s obvious out of this chart that Bitcoin comes with an impressive recovery characteristic when compared with equities and bonds, so getting a portion, even a small %, of Bitcoin inside a portfolio can accelerate the time to recover from the entire portfolio.

This really is most likely the very best reason to possess a number of digital assets inside a portfolio, preferably with an positively managed quantitative fund, obviously, but you know this since i have am incompatible of great interest.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Daniele Bernardi is really a serial entrepreneur constantly trying to find innovation. He’s the founding father of Diaman, an organization focused on the introduction of lucrative investment opportunities that lately effectively issued the PHI Token, an electronic currency with the aim of merging traditional finance with crypto assets. Bernardi’s jobs are oriented toward mathematical models development which simplifies investors’ and family offices’ decision-making approaches for risk reduction. Bernardi can also be the chairman of investors’ magazine Italia SRL and Diaman Tech SRL and it is the Chief executive officer of asset management firm Diaman Partners. Additionally, he’s the manager of the crypto hedge fund. He’s the writer of The Genesis of Crypto Assets, a magazine about crypto assets. He was acknowledged as an “inventor” through the European Patent Office for his European and Russian patent associated with the mobile payments field.