Investors tend to be more bullish on Bitcoin compared to what they take presctiption Ether (ETH) within the next couple of several weeks, based on various option market gauges of sentiment supplied by crypto analytics website The Block. That may mean downside for that ETH/BTC exchange rate within the next couple of days and several weeks.

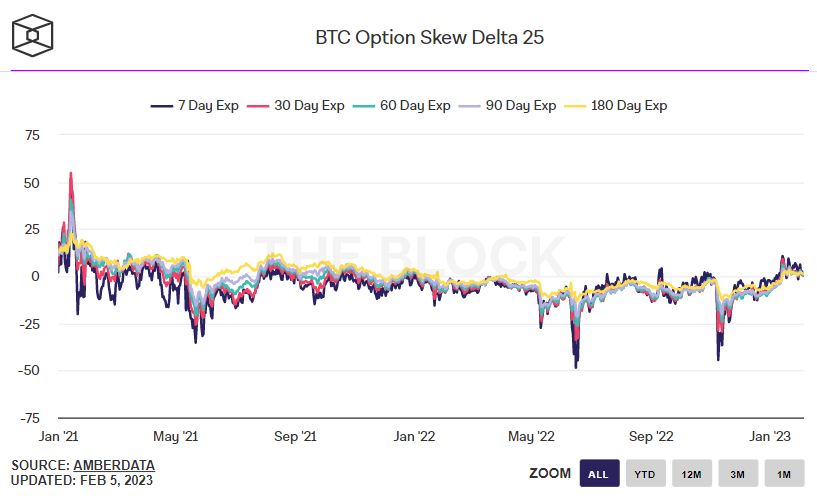

Based on a chart supplied by The Block, the broadly followed 25% delta skew of Bitcoin options expiring in 180 days continued to be was 1.32 around the 5th of Feb, not very far below recent one-year highs hit recently within the 3.3 area. The 25% delta skew of Bitcoin options expiring in 7, 30, 60, 3 months counseled me just a little lower, but nonetheless above zero, hence indicating the market includes a modestly positive bias.

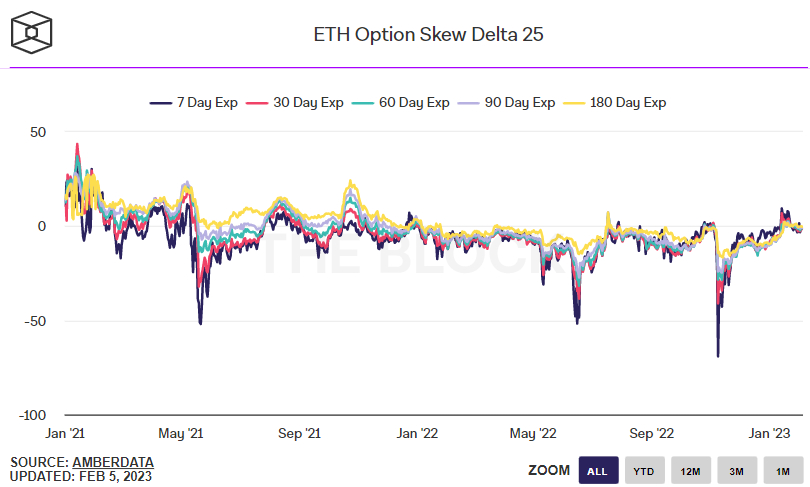

The 25% delta options skew is really a popularly monitored proxy for that degree that buying and selling desks are gone or undercharging for upside or downside protection through the put and call options they’re supplying investors. Put options give a trader the best although not the duty to market a good thing in a predetermined cost, while a phone call option gives a trader the best although not the duty to purchase a good thing in a predetermined cost.

A 25% delta options skew above shows that desks are charging more for equivalent call options versus puts. This means there’s greater interest in calls versus puts, which may be construed like a bullish sign as investors tend to be more wanting to secure protection against (or bet on) a boost in prices.

The 25% delta skew of Ether options expiring in 180 days, meanwhile, was -.3 around the 5th of Feb, as the 25% delta skew of Ether options expiring in 7, 30, 60, 3 months counseled me just a little lower at between -.8 and -1.5. Options markets thus indicate that investors presently possess a modestly negative bias on ETH.

Put/Call Ratio Also Concerning For Ethereum Bulls

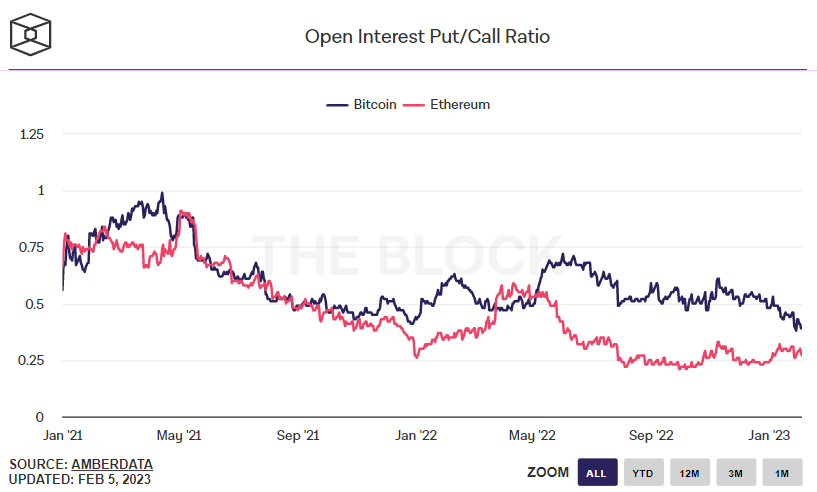

The ratio between your open interest of Bitcoin put and call options was .39 around the 4th of Feb, near to its cheapest in over 2 yrs. A ratio below 1 implies that investors favor owning call options (bets around the cost rising) over put options (bets around the cost shedding).

As the Ethereum Open Interest Put/Call ratio was last lower at .27, it remains substantially above its recent lows hit at the outset of last October around .2. Ether bulls will thus be disappointed to determine how, as the Bitcoin Open Interest Put/Call ratio has dropped substantially in 2023 as prices have risen, exactly the same can’t be stated for that Ether Open Interest Put/Call ratio.

Options financial markets are delivering a obvious signal that, regardless of this year’s impressive cost performance (ETH expires nearly 40%), investors are yet to warm to ETH around they’ve been to Bitcoin as recently. Further indications of this apparently better sentiment towards Bitcoin was apparent in CoinShare’s latest weekly fund flows report, which demonstrated Bitcoin once more dominating inflows.

Some Ether investors are perplexed. The Ethereum blockchain will undergo a significant upgrade in only under two several weeks – the so-known as Shanghai hard fork will release staked ETH withdrawals the very first time, that is likely to lure significant investment in to the Ethereum ecosystem within the lengthy-run.

Meanwhile, Ether is presently experiencing deflation, using the cryptocurrency’s annualized burn rate (because of Ethereum Improvement Proposal 1559) presently outstripping the cryptocurrency’s issuance rate. When a good thing it deflationary, that typically means greater prices with time.

ETH/BTC to interrupt Lower?

Options financial markets are thus delivering an indication that ETH/BTC will continue to mind lower, using the pair lower around 1% this season at .0715 and also over 16% versus last year’s highs within the .085 area. ETH/BTC did lately fund support within the .068 area, largely because of a lengthy-term upward trend that’s been supplying support since late 2020. But technicians are warning when this upward trend would be to break, that may open the doorway to some longer-term move reduced ETH/BTC for the 2022 lows under .05.