For a long time, various blockchain projects were rumored to become future “Ethereum killers,” projects that will unseat Ether from the throne and usurp its title because the top digital asset. On that day appears to possess come, although it seems it had been an internal job. Lido-staked Ethereum (stETH) along with other liquid staking derivatives are primed to render Ether (ETH), being an asset, obsolete.

The transition from proof-of-work (Bang) to proof-of-stake (Bang) enables everyday decentralized finance (DeFi) users to profit from rewards formerly restricted to miners by simply holding stETH or other ETH liquid-staking derivative. It has given method to a wave of great interest over the industry, from visitors to institutions across centralized finance (CeFi) and DeFi. Previously month, the ETH liquid staking derivatives have obtained a lot of attention, and titans of the profession — including Coinbase and Frax — have released ETH liquid staking derivatives.

Liquid staking derivatives offer all the advantages of regular ETH whilst as being a yield-generating asset. Which means holders can gain contact with ETH’s cost action and keep liquidity while harnessing staking benefits. Wallets holding stETH might find their holdings progressively increase as staking yields are regularly put into the first sum.

Related: The marketplace isn’t surging in the near future — so get accustomed to dark occasions

Some staking strategies require locking up funds inside a validator, liquid staking derivatives allow users to keep liquidity while still taking advantage of the staking yield. ETH secured in staking validators isn’t readily available for withdrawal until an ambiguous time later on, likely using the Shanghai update. While stETH still trades in a slight discount when compared with ETH, this gap is anticipated to shut permanently once withdrawals are enabled. To put it simply, ETH liquid staking tokens are simply more capital efficient than standard ETH or even more traditional staking practices.

From the user perspective, there’s little need to hold regular ETH, in which the only potential upside could be a rise in cost once they could hold a liquid staking derivative that will grow their prospective profits via staking yield. Project founders now utilize an identical mentality. From DeFi to nonfungible token (NFT) projects, teams across Web3 have integrated stETH to their protocols, with behemoths for example Curve and Aave which makes it even simpler for DeFi users to integrate stETH to their investment opportunities.

For lending protocols, stETH offers the opportunity to increase yield collateral without getting to create dangerous investment decisions to help keep users satisfied. NFT projects can establish an origin of revenue through their mint proceeds instead of being playing a finite lump sum payment. By looking into making it simpler for Web3 projects to remain afloat and their community happy, ETH liquid staking derivatives release project leaders to maneuver beyond money worries and shepherd true innovation.

Related: Biden is hiring 87,000 new IRS agents — and they’re coming for you personally

Beyond being much more capital efficient, ETH liquid staking derivatives assist in maintaining the Ethereum network. stETH along with other derivatives represent Ether, that has been deposited into an Ethereum validator to assist provide network security.

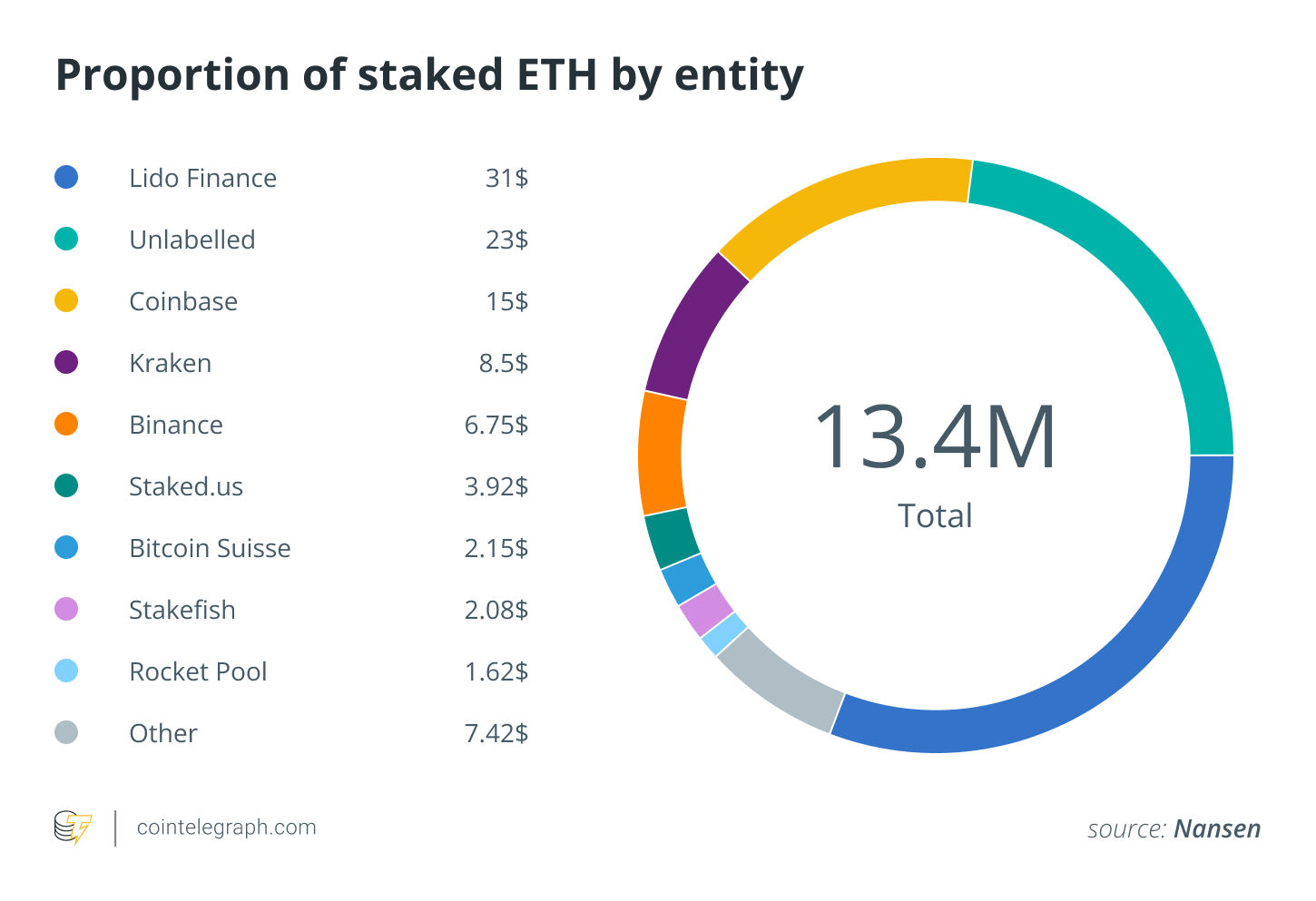

The centralization from the staked ETH is a major critique from the PoS consensus model, with Lido accounting in excess of 80% from the share of the market of liquid staking derivatives while controlling over 30% of staked ETH. However, the current proliferation of alternatives is poised to quell such worries because the share of the market becomes spread between various organizations. Swapping ETH for liquid staking derivatives is really a method for users to aid decentralization while padding their bags.

Related: What’s going to the cryptocurrency market seem like in 2027? Listed here are 5 predictions

As the advantages of staking continue being covered within the press, liquid staking derivatives are certain to be a central a part of the simplest of DeFi strategies. Coinbase supplying “cbETH” means even retail investors will know about the process. We’re prone to visit a steep upshoot in protocols accepting liquid staking derivatives as users start to flock towards the basically free yield. Soon, many DeFi users may hold ETH to pay for their gas charges.

The proliferation of liquid staking derivatives will assist you to bolster the quantity of ETH deposited into various validator systems, enhancing network security while supplying yield to supply financial benefits for supporters. The times of ETH appear to become numbered. Beyond a nominal gas allowance, any ETH not transformed into a liquid staking derivative will undoubtedly be money left up for grabs. The lengthy foretold ETH killer seems to possess finally emerged, though it appears as though it’ll only boost Ethereum’s security and it is supporters’ bags.

Mike Forman may be the founding father of Sturdy, a DeFi lending protocol. He grew to become enthusiastic about cryptography in senior high school before studying math and information technology at Stanford. When he is not focusing on Sturdy, Mike practices Brazilian Jiu-Jitsu and rooting for that New You are able to Giants.

This information is for general information purposes and isn’t supposed to have been and cannot be used as legal or investment recommendations. The views, ideas, and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.