Despite some touting crypto like a hedge against traditional markets, digital assets today share an identical risk profile to goods for example gas and oil, and tech and pharmaceutical stocks, based on an analysis from Coinbase’s chief economist.

The observation develops from a blog publish from Coinbase chief economist Cesare Fracassi on Wednesday, noting the “correlation between your stock and crypto-asset prices has risen significantly” because the 2020 pandemic.

“While for that first decade of their existence, Bitcoin returns were typically uncorrelated using the performance of the stock exchange, the connection elevated rapidly because the COVID pandemic began,” mentioned Fracassi:

“In particular, crypto assets today share similar risk profiles to grease commodity prices and technology stocks.”

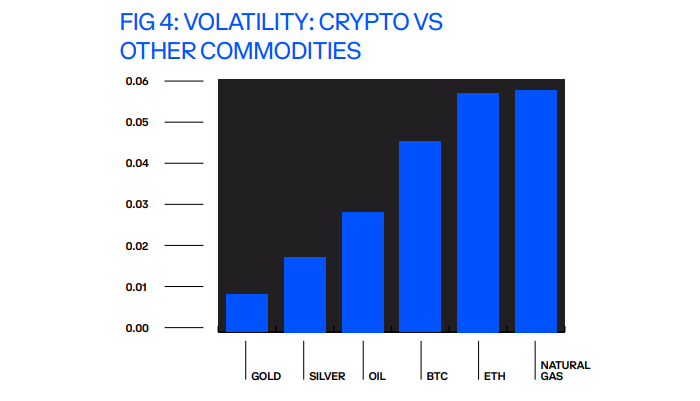

The economist referred to his institute’s monthly insights report in May, which discovered that Bitcoin (BTC) and Ether (ETH) have similar volatility to goods for example gas and oil, fluctuating between 4% and 5% every day.

Since 2020, the correlation between crypto and the stock exchange has risen with recent market movements we have seen the way the market expects crypto assets to get increasingly more intertwined with all of those other economic climate later on. (4/5)

— Cesare Fracassi (@CesareFracassi) This summer 5, 2022

Bitcoin, that is frequently known as the digital gold, includes a far riskier profile when compared with its real-world rare metal counterparts for example silver and gold, which see daily volatility nearer to 1% and a pair ofPercent, based on the research.

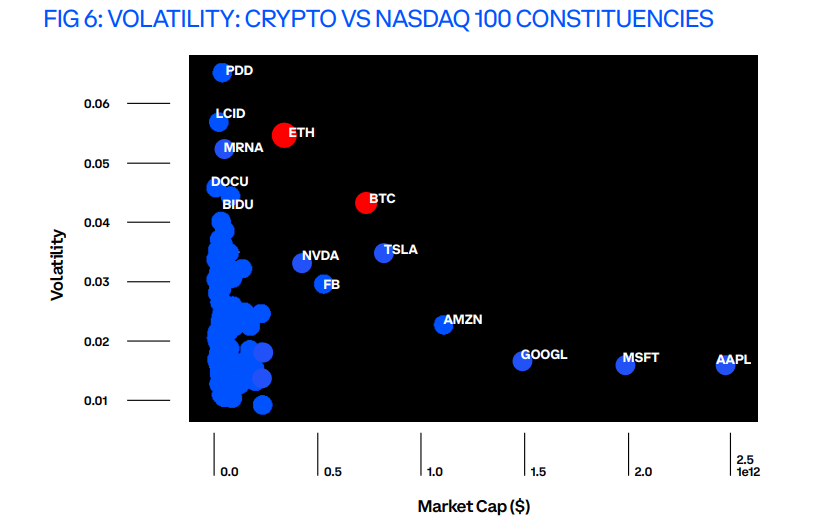

The best stock comparison to Bitcoin when it comes to volatility and market cap was the electrical vehicle manufacturer Tesla, the economist stated.

Ether, however, is much more similar to electric vehicle manufacturer Lucid and pharmaceutical company Moderna, according to market cap and volatility.

Fracassi stated this puts crypto assets in an exceedingly similar risk profile to traditional asset classes for example technology stocks:

“This shows that the marketplace expects crypto assets to get increasingly more intertwined with all of those other economic climate, and therefore to become uncovered towards the same macro-economic forces that slowly move the world economy.”

Fracassi added that roughly two-thirds from the recent loss of crypto prices are caused by macro factors for example inflation along with a looming recession. One-third from the crypto decline could be related to an ordinary-old weakening outlook “solely” for cryptocurrencies.

Related: The crypto industry requires a crypto capital market structure

Crypto pundits have viewed the truth that the crypto crash had been brought by macro factors like a positive sign for that industry.

Erik Voorhees, co-founding father of Coinapult and Chief executive officer and founding father of ShapeShift, authored on Twitter a week ago the current crash was minimal worrisome to him, because it was the very first crypto crash which was clearly “the consequence of macro factors outdoors of crypto.”

Alliance DAO core contributor Qiao Wang made similar comments on his Twitter, explaining that previous cycles were brought on by “endogenous” factors like the fall of Mt. Gox in 2014 and also the bursting from the initial gold coin offering (ICO) bubble in 2018.