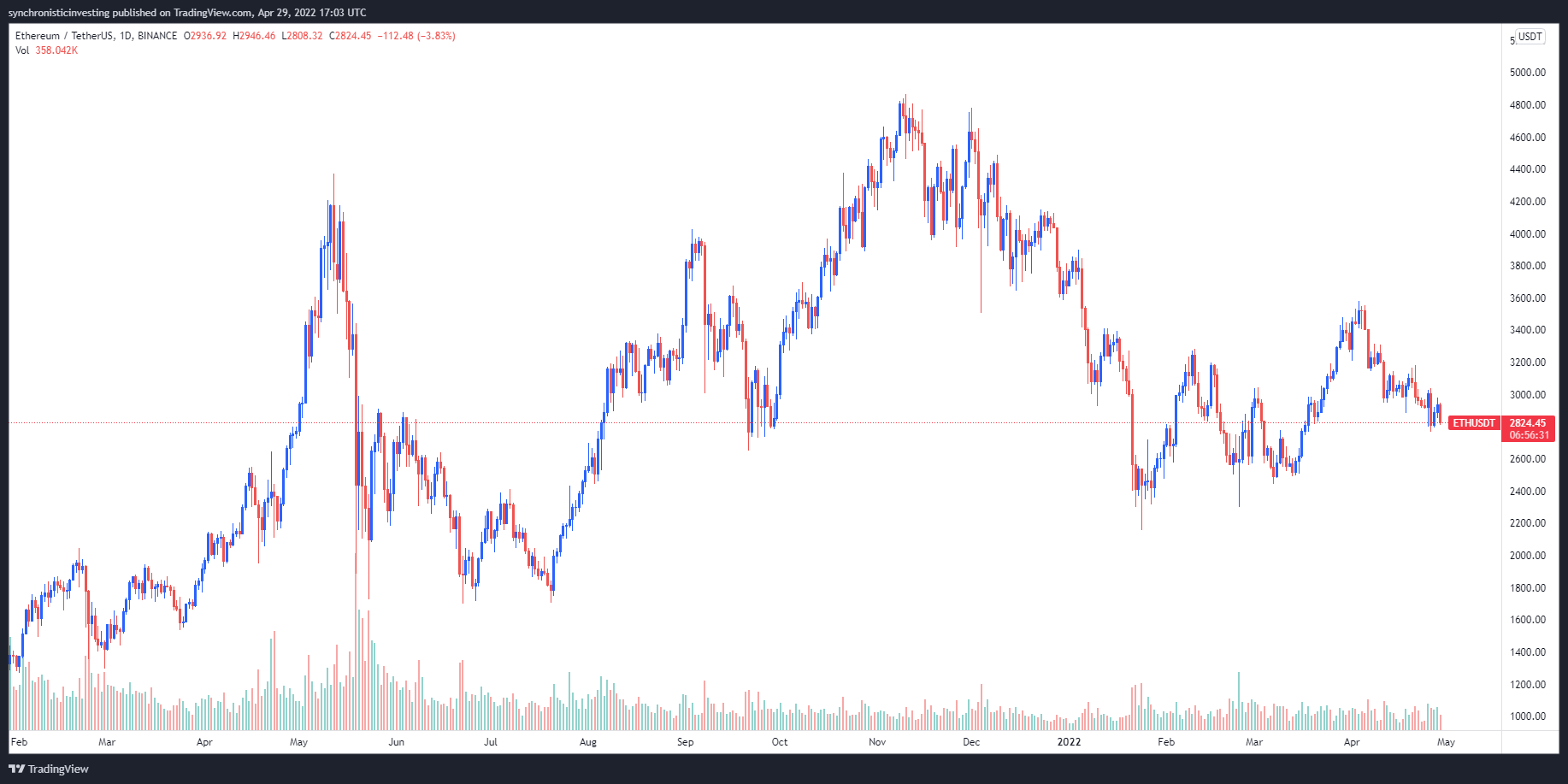

The approaching Ethereum merge is among the most broadly discussed topics within the crypto sector and analysts have a diverse range of perspectives about how the transition to evidence of stake could impact Ether’s cost.

Whales accumulate in front of the merge

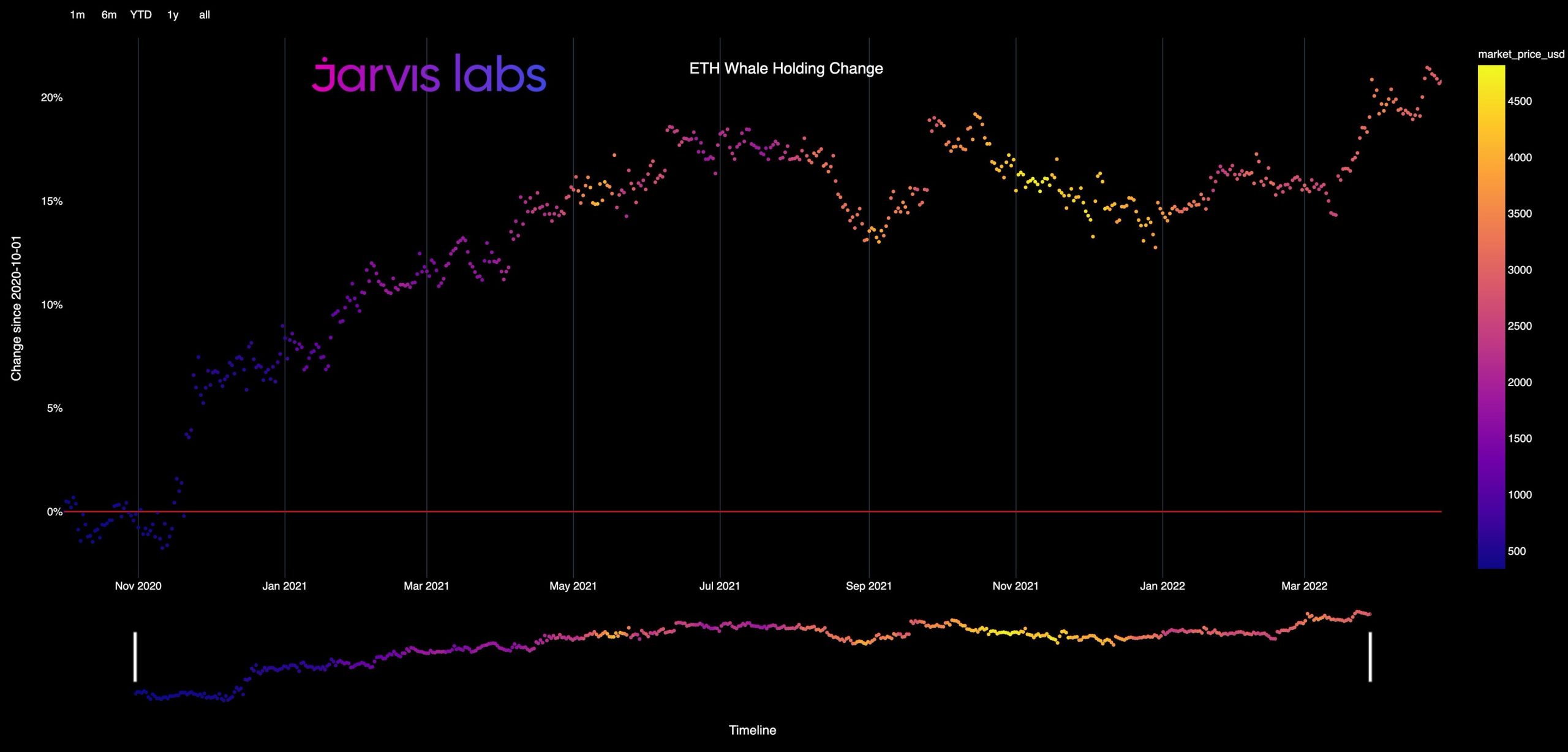

A much deeper dive in to the ongoing accumulation of Ether by whale wallets was supplied by cryptocurrency intelligence firm Jarvis Labs, which published the next chart searching in the percentage alternation in whale wallet holdings versus ET cost.

The colour from the dots pertains to the cost of Ether, using the chart showing that whale wallets started decreasing their holdings once the cost was above $4,000 plus they did not begin to reaccumulate until following the cost dropped below $2,300.

Jarvis Labs stated,

“Whales are ongoing to amass Ether, their accumulation remains in sideways-to-upward trend.”

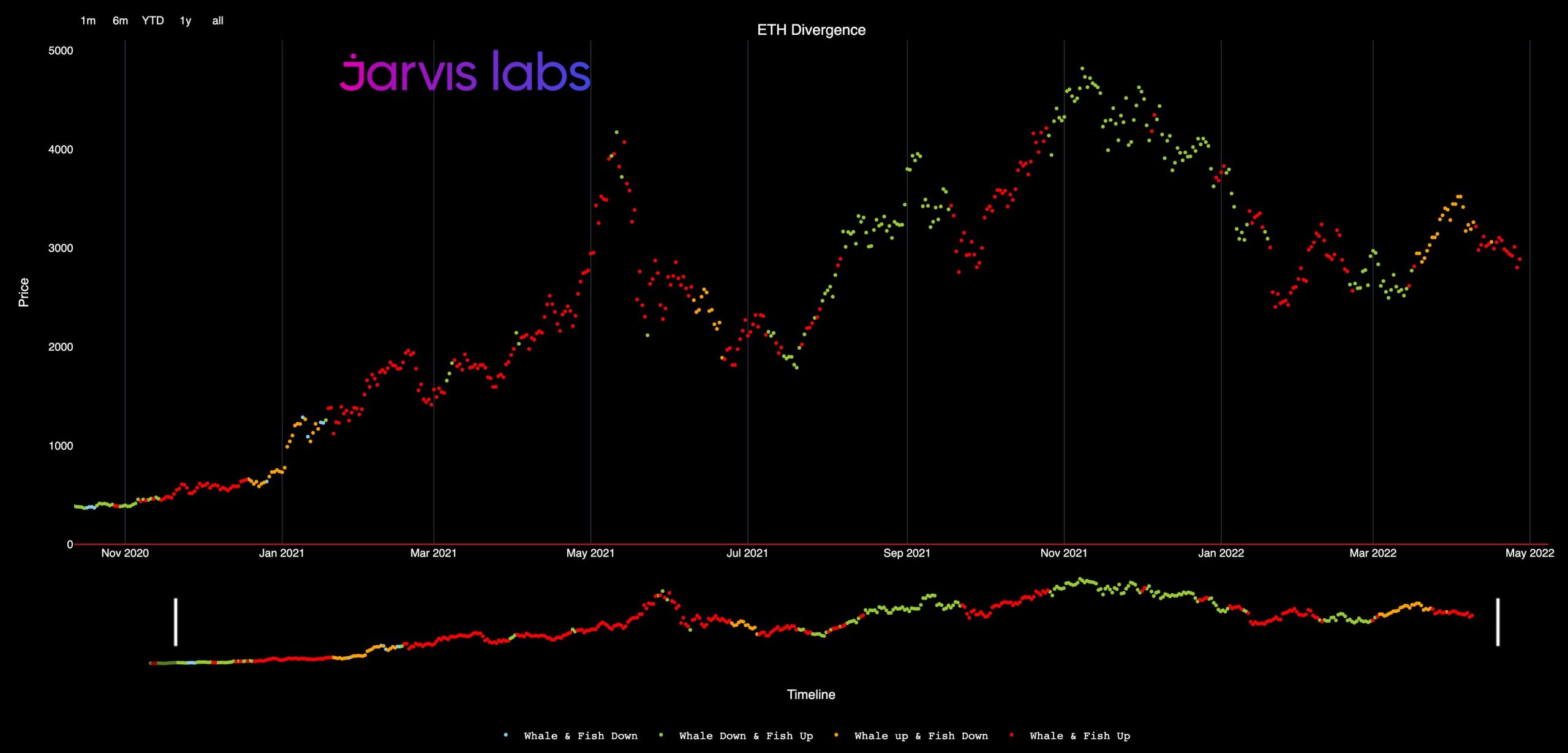

And it’s not only the whales who’re searching to scoop up Ether around the dip as shown in the next chart where red dots indicate that both whale wallets and smaller sized wallets have experienced a rise in accumulation.

Analysts at Jarvis Labs stated,

“Looking just the Ether wallets distributions, it may be deduced that Whales UP + Fishes UP (Both whales and Fishes appear to become accumulating). Merge narrative?”

Is definitely an Ethereum decoupling coming?

Analysts at Delphi Digital considered whether Ethereum cost could decouple from BTC leading into or following the merge. The analysts also predict the altcoin is “likely to determine more consolidation for ETH/BTC within the short term.”

Among the primary questions this chart elicits is exactly what does it require Ether to interrupt free of “the invisible chain” which has stored it tethered to Bitcoin for such a long time.

Based on Delphi Digital, the present bullish “ultrasound money” and “Merge” narratives surrounding Ether may be only the factor to assist Ether liberate from the correlation to Bitcoin cost action.

Delphi Digital stated,

“The curiosity about “post-Merge” Ether will simply get more powerful came from here, especially as increasing numbers of people recognize the chance to earn greater real yields denominated inside a deflationary asset.”

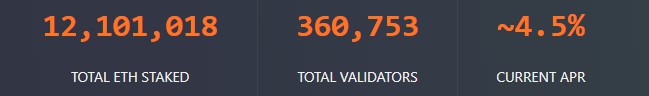

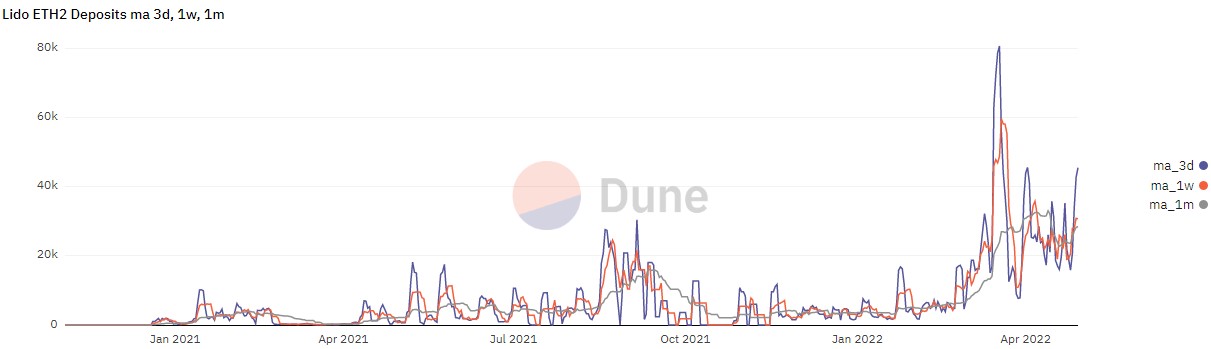

Ether staking gains momentum

Despite Ether cost ongoing to say no, data implies that the amount of ETH staked around the beacon chain is constantly on the increase. Data from Dune Analytics also shows growing deposits to Eth2 and multiple analysts have shared their take on how institutional investors and whales might trade Ether within the pre and publish Merge phase.

Overall, the information implies that despite Ether cost buying and selling 42.5% from its all-time high, the smart money is constantly on the accumulate because of the expected increase in the staking reward percentage and anticipation that cost will turn bullish once Ethereum turns into a deflationary asset.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.