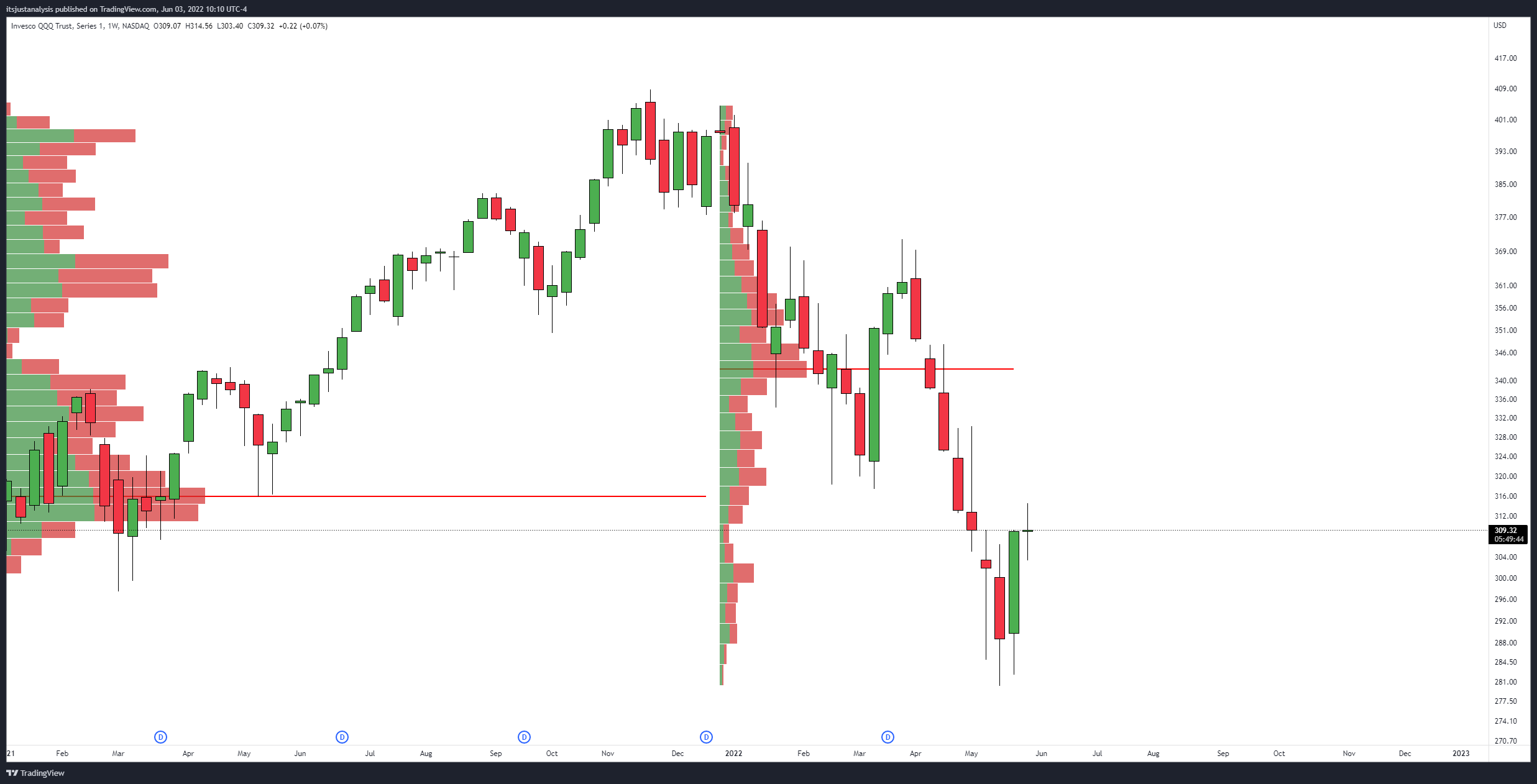

Between May 23 and 27, the equities markets had a remarkable run, using the tech-heavy NASDAQ (NASDAQ: QQQ) ETF up over 7% and also the S&P 500 (New york stock exchange: SPY) up over 6.50%. However, this week’ whipsaws in cost action happened through the week even though the J trade session isn’t yet over, the weekly candlesticks advise a close near last week’s open.

Presently, all major indexes face significant technical resistance levels above their present traded levels. Toss in thegrowing economic uncertainty and fears of the recession the bounce might be limited.

Cryptocurrencies lower again

The crypto market may close relatively flat but lower for that week, extending its losing streak for an all-time a lot of nine consecutive weekly losses. Some altcoins now were within the eco-friendly, Cardano (ADA) and Stellar (XLM), for instance, but both saw 50% to 70% of individuals gains easily wiped out.

The total market capital for that cryptocurrency market stands just over the $1.20 trillion level, that is getting uncomfortably near to the critical $1 trillion zone.

Oil keeps rising

Light crude futures (NYMEX: CL) still rise and may complete an implied close near 14-year highs, levels not seen since late This summer 2008. From April 11 to June 3, oil has acquired greater than 20% and rests just beneath the $120 level.

The weekly oil inventory data on June 1 demonstrated a massively bigger drop of -5 million barrels in comparison to the believed -1.35 million. The recent agreement from OPEC+ to almost double production has unsuccessful to stymy oil’s rise.

Food goods tank

Wheat futures (CBOT: ZW) and corn futures (CBOT: ZC) are lower now, -10% and -6%, correspondingly. However, the stop by these markets is probably because of seriously extended overbought conditions, producing a technical pullback. Global fears and uncertainty about food security and scarcity still plague the forex market.

Dollar recovery might be going ahead

Like wheat and corn, the greenback is originating from a technical pullback from extended overbought conditions. Consequently, inside the Ichimoku Kinko Hyo system, the united states Dollar Index (TVC: DXY) comes with an implied close for that week that’s greater having a marginal gain of .3%.

A powerful technical bounce from the weekly Tenkan-Sen saw the DXY bounce greater than +1%, but many of individuals gains happen to be lost. The DXY could drop lower towards the critical 100 level close to the weekly Kijun-Sen, however the hidden bullish divergence between your chart and also the composite index prevents further downside pressure.

For traders and investors of cryptocurrencies, the DXY may also be considered a non-correlated market. Quite simply, once the DXY rises, Bitcoin (BTC) and altcoins move lower.

That isn’t always the situation, however the DXY ought to be considered a flight ticket to safety. When money moves in to the dollar, the assumption is that market participants are scared and unsure.

Along with ongoing economic uncertainty and a few shakiness within the labor market, the DXY may continue its steady rise greater.

Major economic data in a few days to look at

- June 7: Canadian balance of trade and Ivey PMI data. US API Oil stock change.

- June 9: Eu Central Bank rate of interest decision. US initial unemployed claims.

- June 10: Canadian unemployment rate. US core inflation (Mother), real inflation rate, core inflation (YoY) and Michigan consumer sentiment.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.