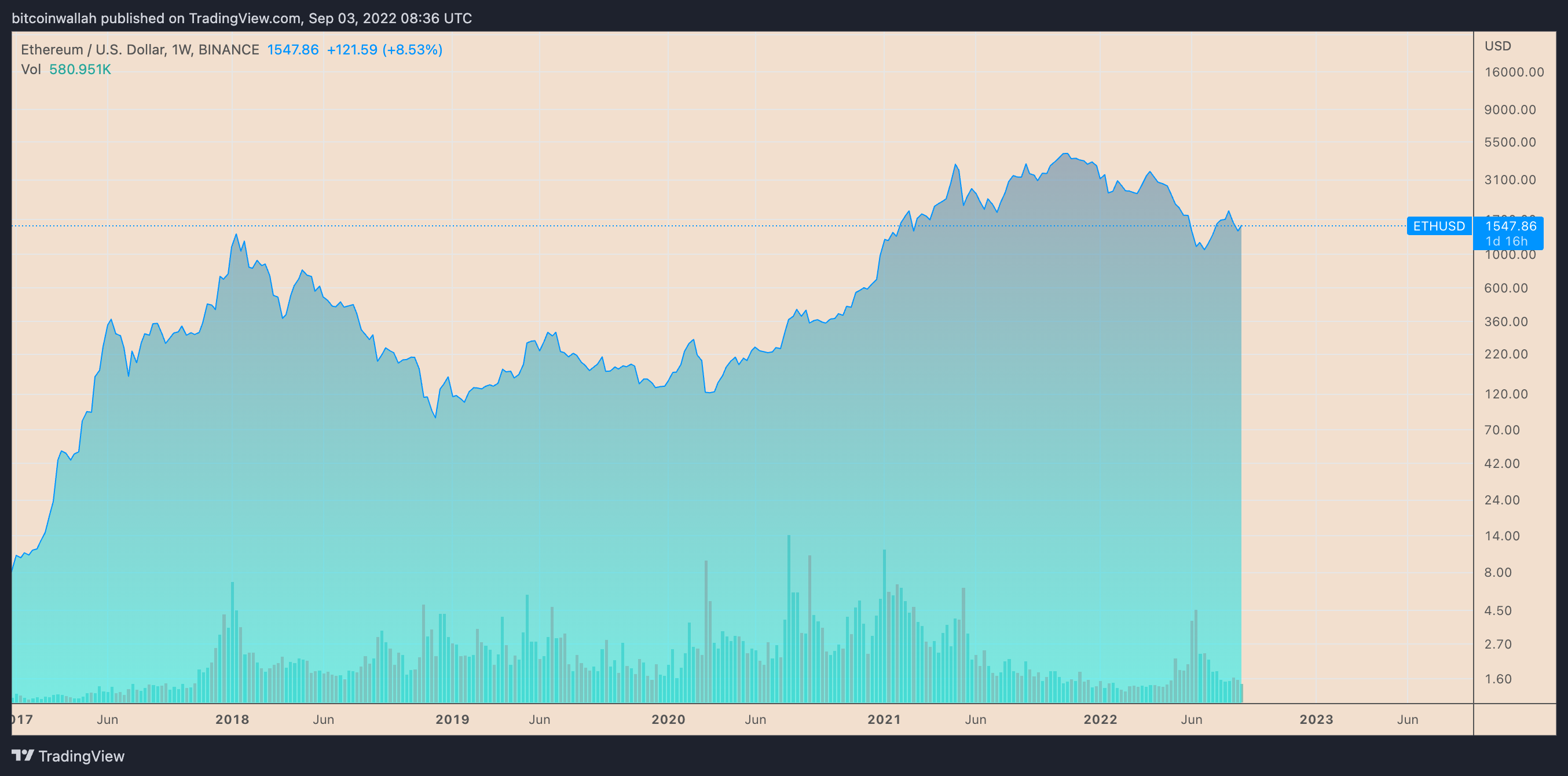

Ethereum’s native token, Ether (ETH), isn’t safe from downside risk in September after rallying roughly 90% from the bottom close to $880 in June.

A lot of the token’s upside move is related to the Merge, a technical upgrade that will make Ethereum an evidence-of-stake (PoS) protocol, slated for Sep. 15.

But despite logging impressive gains between June and September, Ether still trades almost 70% below its record a lot of around $4,950 from November 2021. Therefore, its chance of heading lower remains around the cards.

Listed here are three Ethereum bearish market indicators that demonstrate why more bad thing is likely.

Sell the Ethereum Merge news

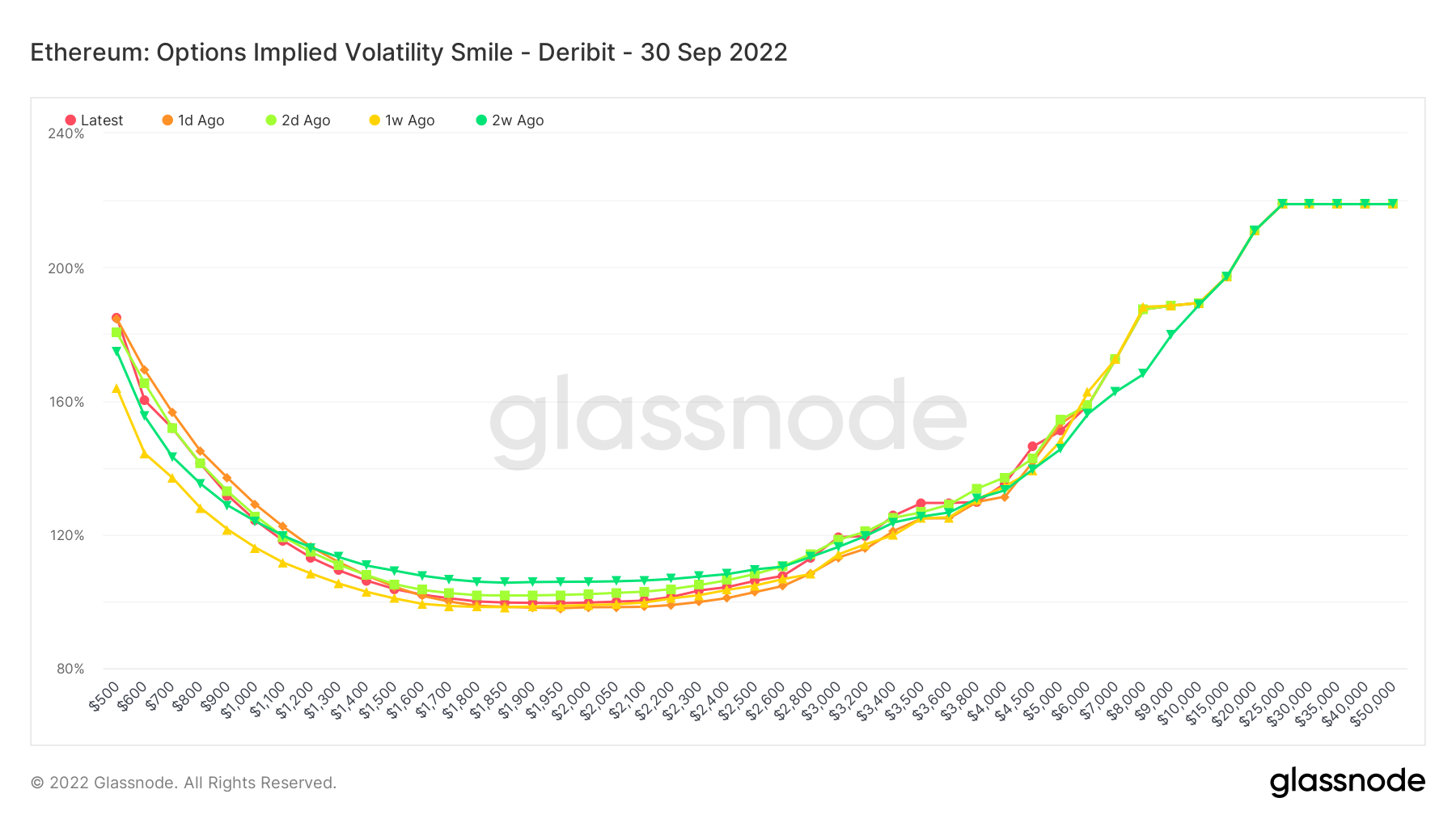

Ethereum options traders anticipate Ether’s cost to achieve $2,200 from the current $1,540 level in front of the Merge, based on Deribit data published by Glassnode. Incidents where begin to see the cost hitting $5,000, but enthusiasm looks flat publish the PoS switch.

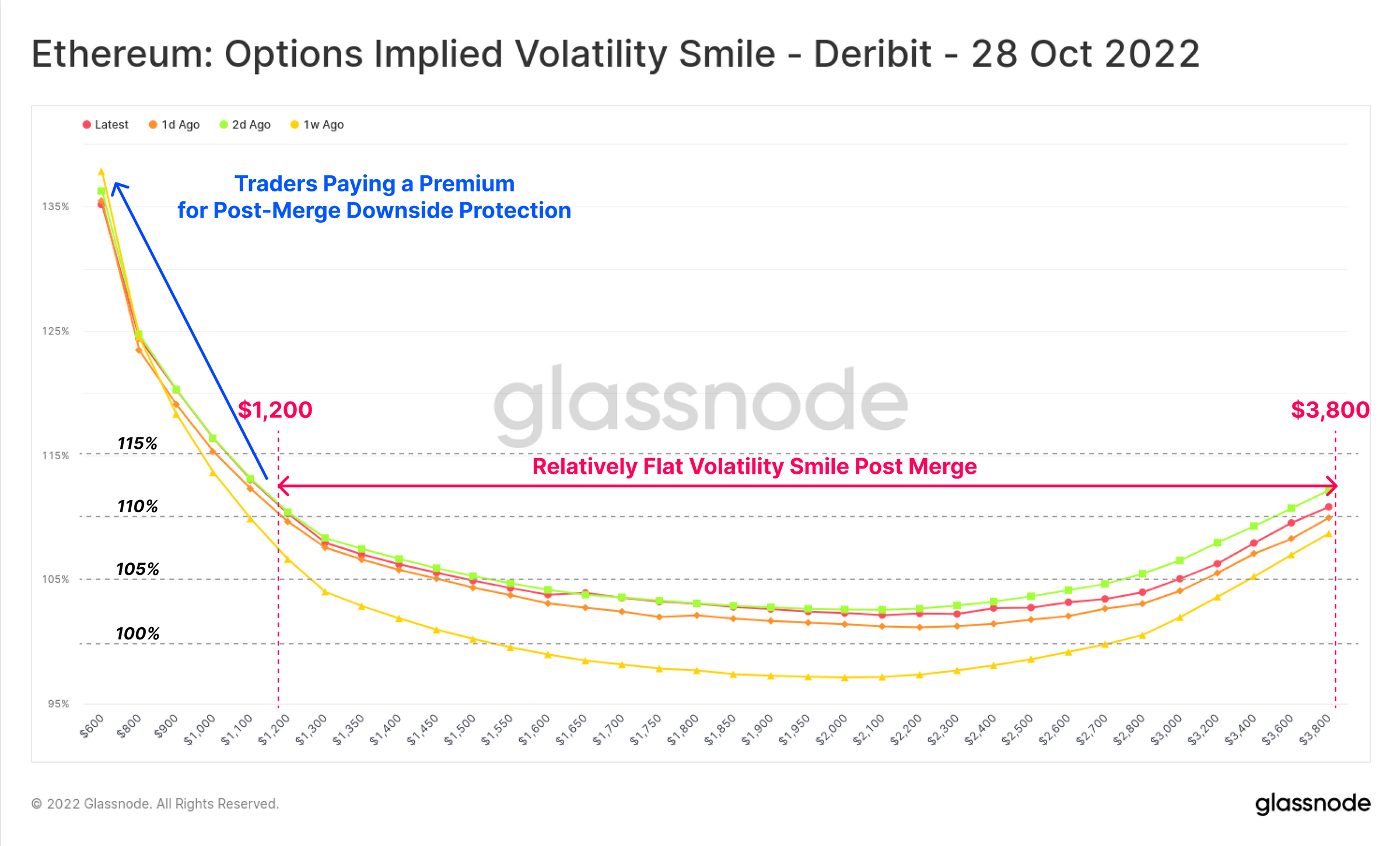

There seems to become interest in downside protection among traders following the Merge, shown by a so-known as “options implied volatility smile” metric (OIVS).

OIVS illustrates the options’ implied volatilities with various strikes for that specific expiration date. So, contracts from capital typically show greater implied volatility, and the other way around.

For example, within the Ethereum’s Sept. 30 options expiry chart below, the smile’s steepness and shape help traders measure the relative expensiveness of options and gauge what sort of tail risks the marketplace is prices in.

Thus, it shows a sizable buy-side interest in ETH call options expiring in September, shown by the volatility smile’s upward slope, showing traders are prepared to pay reasonably limited for any lengthy exposure.

“Post Merge, the left tail is prices in considerably greater implied volatility, indicating traders are having to pay reasonably limited for ‘sell-the-news’ put-option protection publish-Merge,” Glassnode analysts authored, citing the OIVS chart below which features Call and set open interests at different strike rates.

Quite simply, ETH traders are hedging their bets in situation of the sell-the-news event.

Hawkish Fed

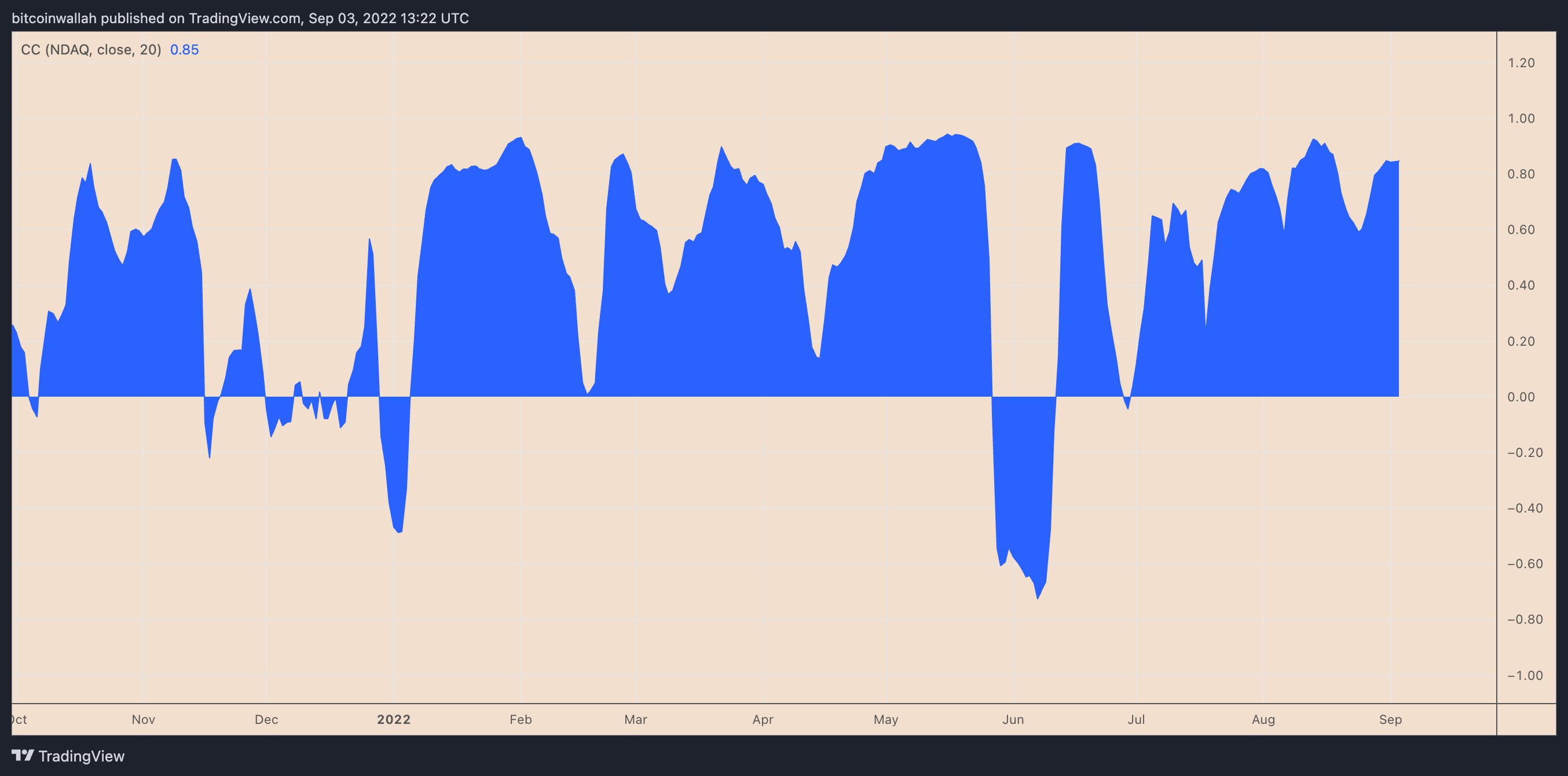

More downside cues from Ethereum originate from its contact with macroeconomic occasions, mainly quantitative tightening through the Fed.

A week ago, Given Chairman Jerome Powell reiterated the central bank’s dedication to curbing inflation, noting they “must keep going with it before the job is performed.” Quite simply, Powell and the associates may likely raise rates of interest by .5%-.75% within their next policy meeting in September.

Rate hikes have lately been not so good news for that ETH/USD pair, because of the growing positive correlation from a broader crypto sector and traditional risk-on indices from the prospects of declining cash liquidity. For example, the daily correlation coefficient between ETH and Nasdaq by Sep. 3 was .85.

Therefore, the potential of Ether declining alongside riskier assets is high, specifically if the Given hikes by .75%.

That giant Ether “bear flag”

Theoretically speaking, Ether is painting what seems just like a bear flag on its weekly chart.

Bear flags appear once the cost consolidates greater in a climbing parallel funnel following a strong move downward. They resolve following the cost breaks from the funnel towards the downside and, usually of technical analysis, falls up to the prior downtrend’s length (flagpole).

Ether tested the bear flag’s lower trendline as support now. Came from here, the Ethereum token could either rebound to retest the flag’s upper trendline (~$2,500) as resistance or break underneath the lower trendline to carry on its prevailing bearish trend.

Related: ETH cost outlook for that Merge: Bullish or bearish? TheChartGuys interview

Because of the factors discussed above, the ETH/USD pair risks entering the bear flag breakdown stage in September, as highlighted within the chart below.

Therefore, ETH’s bear flag profit target involves be near $540 in 2022, lower roughly 65% from today’s cost.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.