Yesteryear couple of days happen to be intriguing and have surfaced what we should within the financial services industry call matters requiring attention, or MRAs. An MRA describes an exercise that deviates from seem governance, internal controls and risk management concepts. These things that need attention have the possibility to adversely modify the industry while increasing the danger profile.

I’ve always centered on technology and innovation-brought business models — systems and interconnected aspects of blockchain-powered business systems — redefining the transaction systems that power many industries, including financial services. An increasing number of naysayers have grown to be vocal about recent occasions, that have revealed extensive mismanagement, ill-defined and misgoverned systems, and general misrepresentation of the profession. Consequently, I wish to have a systemic view of the profession to understand brought up to now, dissect the failings, and become prescriptive about how we are able to study from failures and make upon successes.

Let’s first comprehend the market structure and just what this means. That can help reveal inefficiency in the present crypto market structure and let me result in the situation for any better-defined structure targeted at systemic fairness, robust information flow for risk profiles, along with a convincing innovation narrative to bring back the and instill confidence.

Comprehending the current financial market structure

The current financial market structure is basically a series of interconnected market participants that help with accumulating capital and developing investment sources. These market participants have specific functions, for example asset child custody, central bookkeeping, liquidity provisioning, clearing and settlement. Due to function, capital constraints or regulation, a number of these entities aren’t vertically integrated, which prevents collusion or unilateral investment decisions. So, various products might be controlled by different markets, however the fundamental financial primitives remain universal. For instance, products for example stocks, bonds, futures, options and currencies all have to be traded, removed and settled, along with other functions for example collateralization, lending and borrowing ensue.

Markets work only where there’s a way to obtain and interest in capital, which is important. Today, the data between these interconnected participants is really a purpose of consecutive batched relay systems, which uneven distribution of knowledge not just creates opacity but additionally inefficiency when it comes to liquidity needs, system trust costs by means of charges and chance costs.

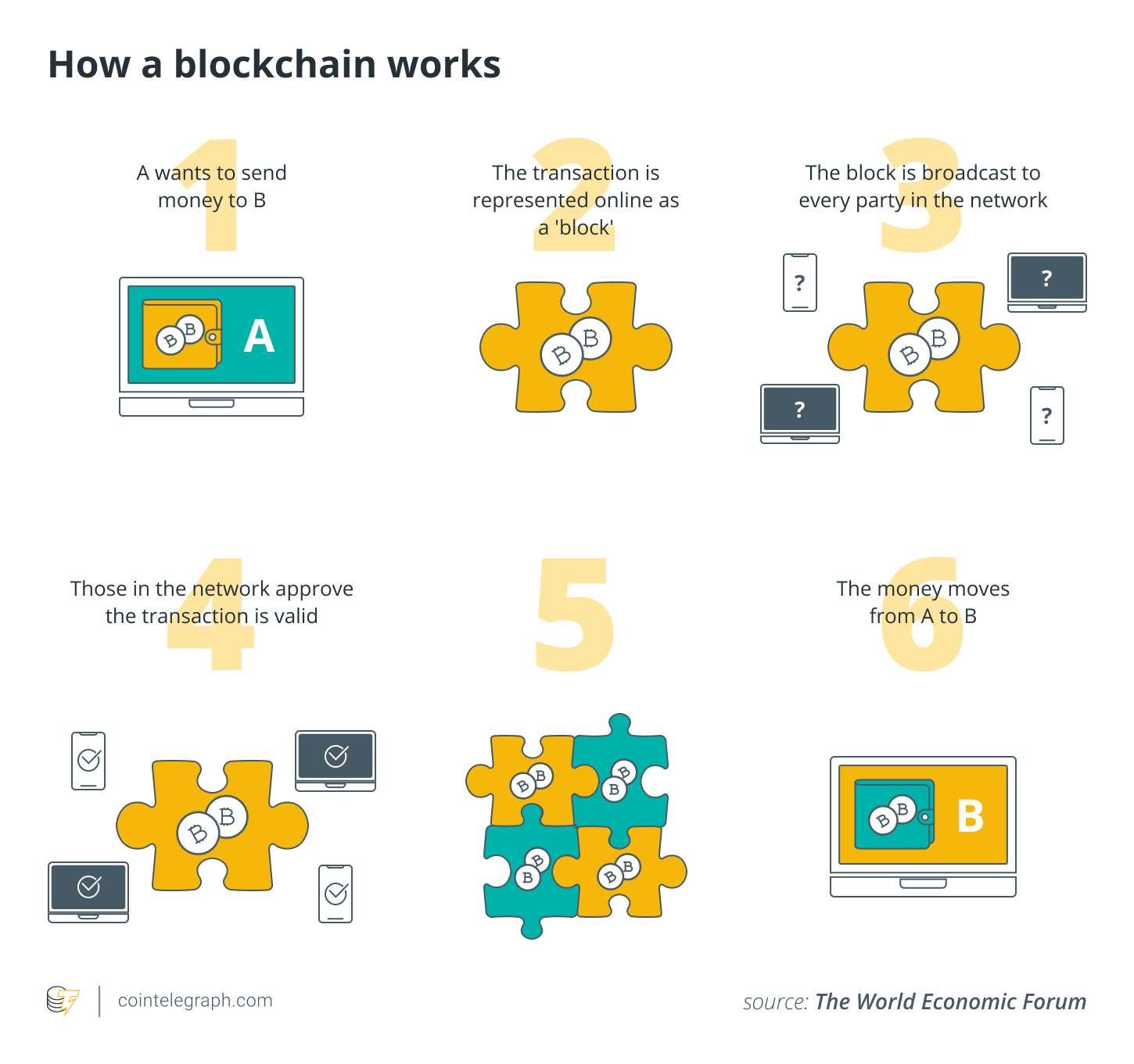

Blockchain and distributed ledger technology systems try to solve these problems of your time and trust using the characteristics of immutability and uneven distribution of consistent information, which leads to trust and instant transaction processing. So, where did this fail? Why is the issue i was attempting to solve becoming tremendously more complicated and prevalent in crypto capital markets?

Related: Comprehending the systemic shift from digitization to tokenization of monetary services

The present condition of market (united nations)structure — A brief history from the commitment of crypto

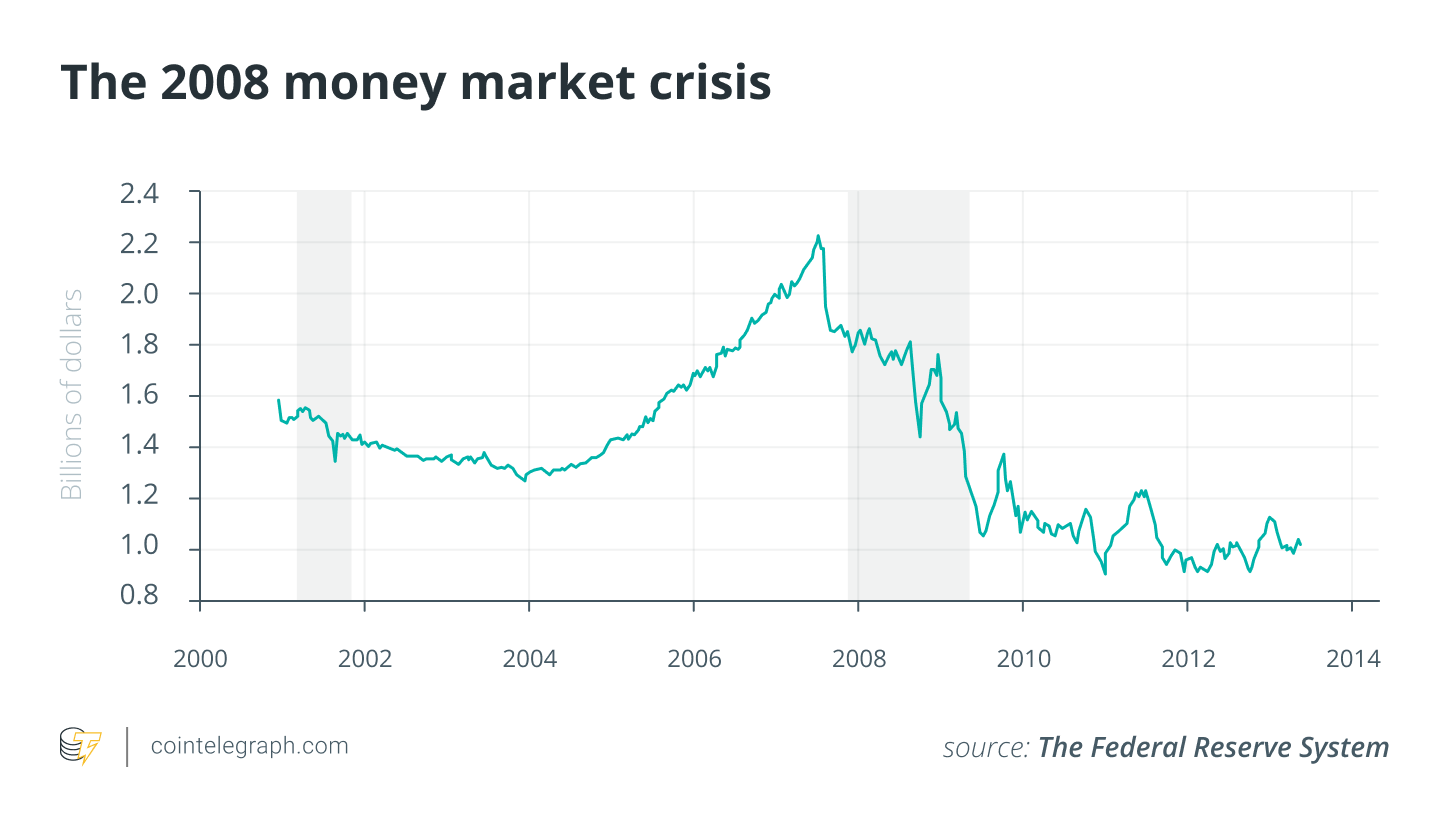

The Bitcoin (BTC) system was suggested being an experiment born from the global financial trouble like a prescriptive method of rethinking our economic climate, a reimagined to organize the planet community and lower reliance on a couple of large hegemonic economies.

This technique was suggested with tenets of decentralization to distribute power and trustless protocols to make sure that not one entity had absolute charge of a financial system. It trusted participation within the global creation, acceptance and recognition of the currency, in which the rules of supply and demand put on egalitarian concepts.

Related: A brand new intro to Bitcoin: The 9-minute read that may improve your existence

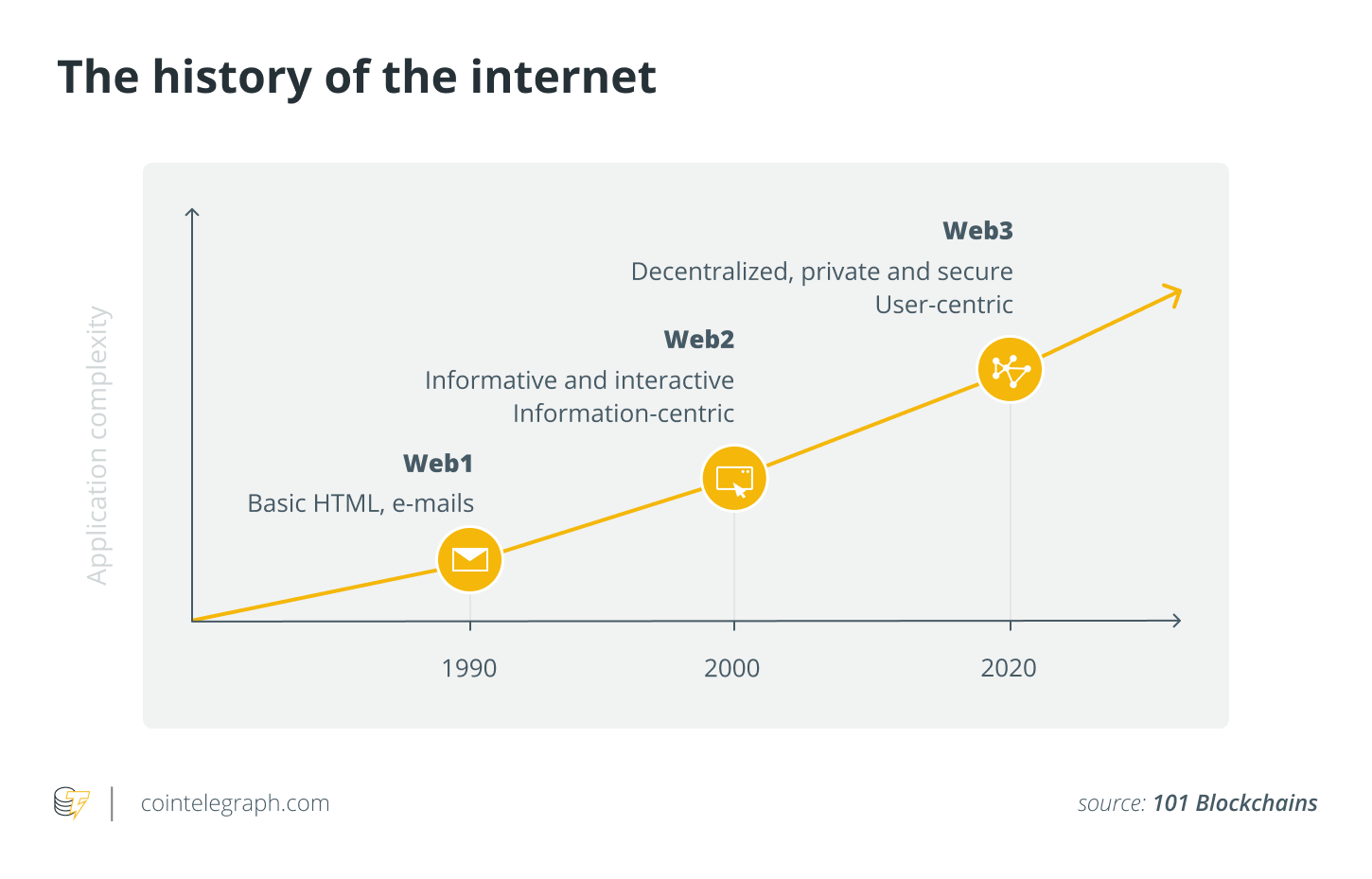

Bitcoin helped picture a couple of economic climates to deal with the inefficiencies of the present system discussed formerly. Ethereum introduced programmability to some simple asset transfer that Bitcoin introduced, adding business rules along with other complex financial primitives for application to otherwise simple rules for moving value.

This started a reinvention from the internet, that was never made to move value only information. Subsequently, evolved layers of innovation, for example provisioning scalability and privacy (layer 2), were added, and also the industry was humming combined with the commitment of a vibrant future. Basically we had naysayers, the crypto industry introduced innovation without any apologies and started to shape a brand new wave of technological development to empower an possession economy — greatly using the participative and global egalitarian economic climate guaranteed by Bitcoin.

Many interesting projects evolved to resolve problems because they sprang up, so we often see lots of innovative energy spread with the ecosystem with new use cases, applications and solutions for a lot of problems caused by insufficient trust, costs and also the exploitive opacity of information and data only monetizable with a couple of.

Related: Bitcoin’s Velvet Revolution: The overthrow of crony capitalism

This revolution also started to draw in new talent from many industries, and lots of projects started to become socialized, which neither stuck to original envisioned concepts nor put into technology. They used the vernacular and also the enthusiasm from the community, however in their structure would be a centralized layer with challenges getting the pitfalls of the present system however with the utility of the distributed ledger techonology-based transaction system. A few of these projects did offer financial product innovation by employing the same financial primitives, solving the problems of opacity, time, trust, liquidity, capital efficiency and risk, and promising egalitarian access, however they lacked the marketplace structure and guardrails the present system provides.

Devising a brand new crypto capital market structure and convincing innovation narrative

In the past, crypto industry market changes happen to be grassroots, and so the changes are impelled by entrepreneurs and also the community. The will once more pivot and shift with these forces and emerge having a more powerful foundation. With this to happen, however, the requires a seem market structure and systemic independence from current transactional systems. One industry imperative isn’t just to exist together with market structures but additionally to supply a bridging vehicle to current asset classes. Listed here are a couple of imperatives I consider essential MRAs for more powerful and much more resilient markets.

Rethinking stablecoins

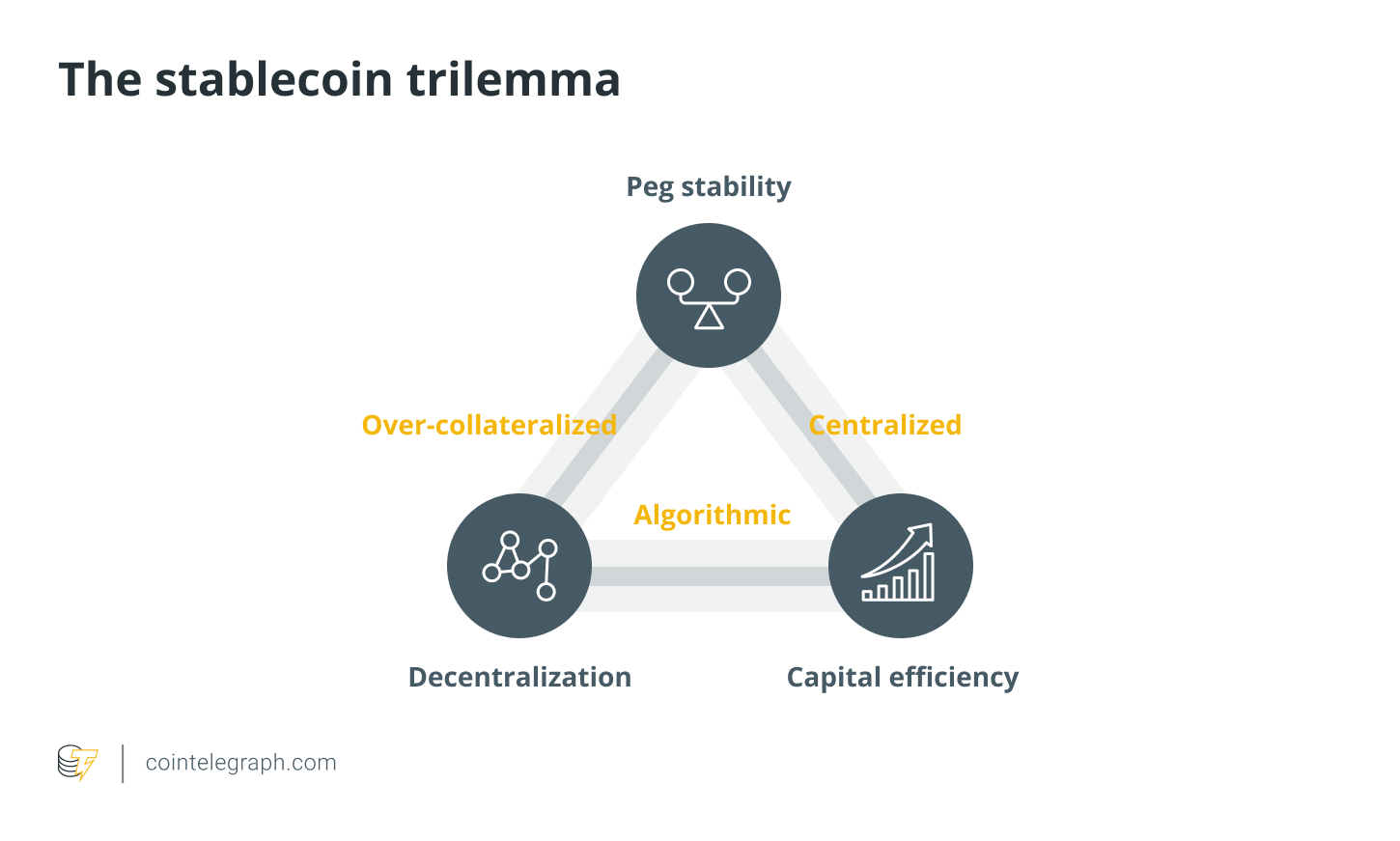

“Stablecoin” has numerous definitions and lots of types, therefore the industry should devote significant energy to rethinking stablecoins, or perhaps a truly fungible asset like a medium of exchange. Stablecoins have facilitated a sizable amount of digital asset buying and selling and permitted for traditional fiat, or fungible sovereign, currency to become digital assets, including crypto assets, and introduced much-needed liquidity in to the market. However, they likewise have inherited the difficulties of fiat (like a reserve) and started to provide linkages to and inherit the difficulties (and possibilities) of traditional markets.

Aside from the regulatory and compliance burden of fiat inside a largely unregulated crypto economic climate, the complexness of worth systems can frequently cause issues in asset valuation and also the risk matrix, which makes it challenging for a growing asset class to flourish and achieve its full potential. I believe the must view native crypto assets, for example BTC, Ether (ETH) along with other ubiquitous crypto assets or perhaps a currency basket as fungible assets like a store of worth, unit of account and medium of exchange — the 3 fundamental characteristics of the currency.

Provisioning robust crypto market data

Market information is an extensive term that describes the financial information essential for transporting out research, analyzing, buying and selling and comprising financial instruments of asset classes on world markets. Crypto adds a brand new vector of challenge like a 24/7, 365-day operation having a velocity and veracity of information never witnessed before. This velocity and knowledge capacity have brought to analytic challenges in data collection, aggregation, modeling and insights. So, information is information which adopts the cost/value/risk calculus and thought on other macro factors for example inflation, money supply and global occasions that impact goods, and basically constitutes a market efficient or aims to.

Regulatory moats exist to avoid some participants from benefiting from information asymmetry, for example insider buying and selling. Crypto market data will bridge the space between cost (that which you pay) and cost (what you’ll get). This will not just be crucial for those new layer-1 projects but in addition for all projects supplying financialization of token like a service.

Related: The significant shift from Bitcoin maximalism to Bitcoin realism

Development of a crypto self-regulatory organization

You should produce a self-regulatory organization (SRO) involving dominant industry players and major layer-1 protocols, which has the ability to produce industry standards, professional conduct guidelines and rules to influence the within the right direction.

SROs are usually effective because of domain expertise and preserving the eye and status of the profession by supplying guidelines and guardrails for brand new entrants and existing participants alike. Enforcement and breach may come through broader education and attracts the city that supports a task, which is especially effective around robust crypto market data that gives insights into transparent data and also the correlation of activities over the industry on related projects and related markets. This may also help the (by segments) to teach itself, use regulators and policymakers, and forge partnerships.

Decoupling crypto

Decoupling is important for that crypto industry to supply both diversity within the investment landscape along with a model for efficient and resilient asset classes, transaction systems as well as an effective market structure. As we view with stablecoins, which inherit aspects of global macro strategy and elevated correlation, rethinking the industry’s capability to create value by itself merits along with a new fundamental model that won’t only produce a convincing innovation narrative but additionally supply the markets a brand new independent asset class with seem fundamentals. This is aligned using the fundamental principle that brought towards the genesis of Bitcoin-brought crypto innovations. Decoupling in scientific terms also describes reducing the amount of sources accustomed to generate economic growth while decreasing ecological degeneration and environmental scarcity.

Related: The decoupling manifesto: Mapping the next thing from the crypto journey

Searching forward

A contemporary financial market structure is basically a series of interconnected market participants that help with accumulating capital and developing investment sources. The requires a seem market structure and systemic independence from current transactional systems. Among the industry imperatives isn’t just to exist together with market structures but additionally to supply a bridging vehicle to current asset classes.

Earlier, I discussed several MRAs which are required for more powerful and much more resilient markets. The alterations suggested to repair the volatile and runaway nature of the profession include (but aren’t restricted to): a) rethinking stablecoins and liquidity, b) robust crypto market data for efficient market functioning, c) development of a crypto self-controlled organization and enforcement via community actions, and d) decoupling crypto — basically rethinking the industry’s capability to create value by itself merits along with a new fundamental model that won’t only produce a convincing innovation narrative but additionally supply the markets a brand new independent asset class with seem fundamentals.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Nitin Gaur has lately became a member of Condition Street Digital since it’s md, where he leads digital asset and technology design, with aspirations to transition area of the company’s financial market infrastructure and it is clients towards the new digital economy. Inside a previous role, Nitin, offered because the founder and director of IBM Digital Asset Labs — dedicated to devising industry standards, use cases and dealing toward making blockchain for enterprise a real possibility. In parallel, Nitin also offered as chief technology officer of IBM World Wire — a mix-border payment solution utilizing digital assets. Nitin also founded IBM Blockchain Labs and brought your time and effort in creating blockchain practice for that enterprise.