Although nonfungible tokens (NFTs) happen to be an element of the cryptocurrency market since 2014, interest and adoption has risen quickly during the last 2 yrs. In their height in August 2021, the entire buying and selling amount of NFTs rose to in excess of $5 billion, kickstarting what briefly came into existence to referred to as “NFT Summer time.”

Based on a study by CoinGecko, the NFT marketplace is now likely to exercise than $800 billion within the coming 2 yrs. The report, which mostly utilized investors from Asia and also the Off-shore, highlighted those of 871 respondents, around 72% of these already own a minumum of one NFT, using more than 50% of these declaring that they five or even more.

For investors, the report indicated an account balance between your generations, suggesting 43.6% of NFT investors surveyed were between 18-3 decades old and 45.2% were between 30-fifty years old.

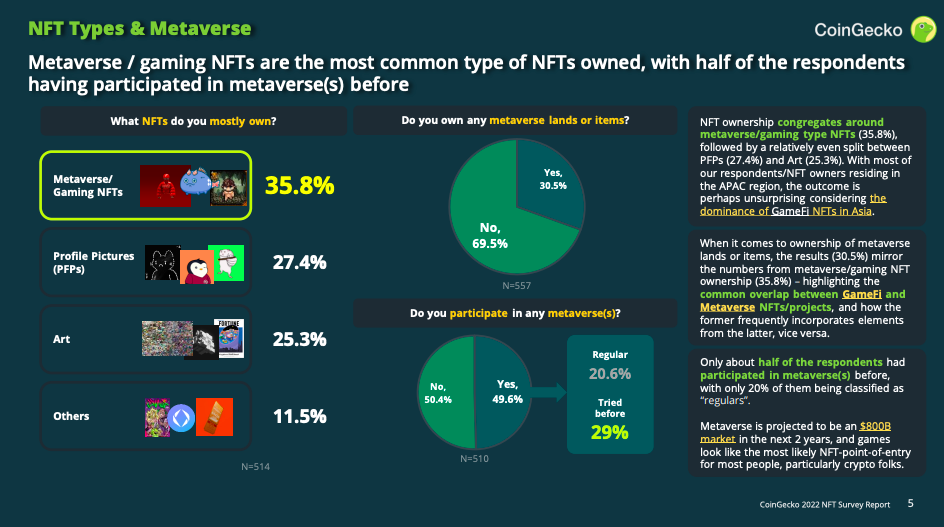

While the majority of the NFT market made an appearance to become concentrated in popular collections like the Bored Ape Yacht Club (BAYC) and CryptoPunks, 35.8% of respondents stated these were thinking about NFTs associated with play-to-earn and metaverse games and 25% mentioned they prefer art NFTs.

“The metaverse sector is forecasted to maneuver $800 billion within the next 24 months, and gaming seems is the probably access point in to the NFTs market,” the report highlighted.

“Our respondents have established that ‘flip & earn’ was the main motivation behind their NFT purchases, though 2/3 of respondents established that NFTs only composed

Although data from TeleGeography mentioned there were already greater than 7.1 billion active cellular devices worldwide, the pc continues to be the preferred option for NFT buying and selling and minting, with 60% of investors doing this. Mobile lags behind having a mere 21% of responses. “This could be related to the simplicity of utilizing a PC to navigate time-sensitive NFT mints/trades,” the report highlighted.

With regards to tracking new or approaching NFT projects, 60% of respondents stated they like to make use of Discord and Twitter. The minimum cost also made an appearance to become essential for the thought of value. The report says with regards to evaluating NFTs before choosing, nearly all respondents, 38.5%, were thinking about the ground cost and just 23% and 21.8% selected “strong community” and “artistic value/attachment,” correspondingly.

However, most market investors stated they weren’t thinking about selling their NFTs. Greater than 50% of respondents highlighted they have a HODL mentality and find out the next where nonfungible tokens might be important products in games. Even with the hype, NFTs only constitute a small sector on most cryptocurrency portfolios, with 70% of respondents reporting they only represent -25% of the cryptocurrency portfolios.

Ethereum continues to be the dominant chain for NFTs among respondents at 46.3%, based on the report. In second place was Polygon with 13.8%, adopted by Solana with 13.5%. Other smart contract platforms together taken into account 26.4% of NFTs traded by CoinGecko respondents.

If this found marketplaces, the information confirmed the dominance of OpenSea, that was accountable for 58.7% of buying and selling activity. Runner-up Solanart held approximately 10% share of the market, while and LooksRare had under 4%.

“Interestingly, Crypto.com, VEVE Official and Immutable X are the most reported examples parked under ‘Others’ through the respondents, possibly alluding for their rising prominence. LooksRare and X2Y2 however, despite their generous incentive programs, unsuccessful to construct stickiness despite early success,” pointed CoinGecko.