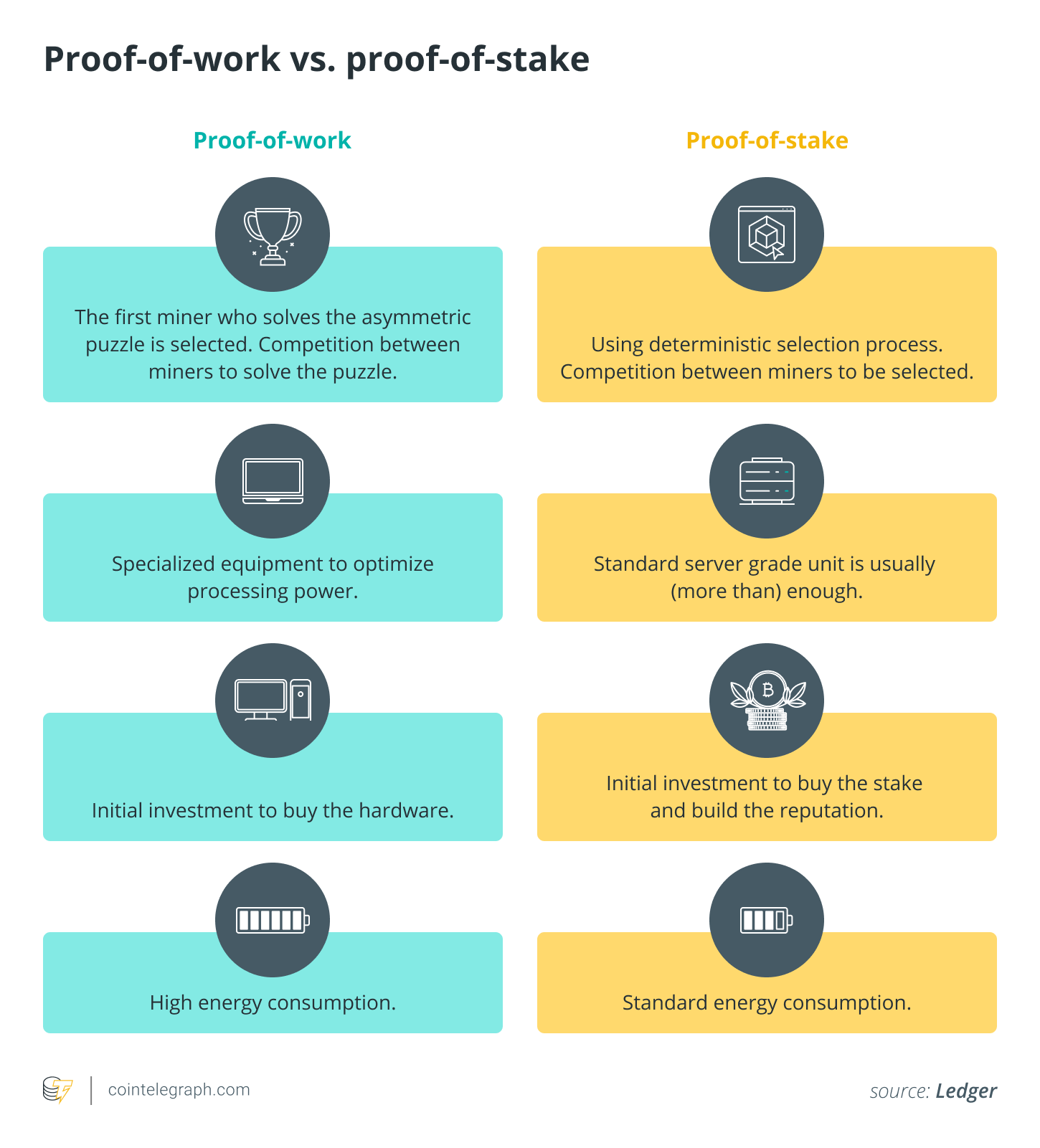

Blockchains have trusted proof-of-work (Bang) validation since their beginning. The Bang consensus demonstrated to become unsustainable using its high energy usage and it is requirement for fast, effective hardware creating high barriers to entry. That is why blockchains are adopting proof-of-stake consensus algorithms (PoS), where individuals attempting to earn rewards do not have to compete against other miners, but could simply stake a part of their crypto for an opportunity to become selected to become a validator — and reap the returns.

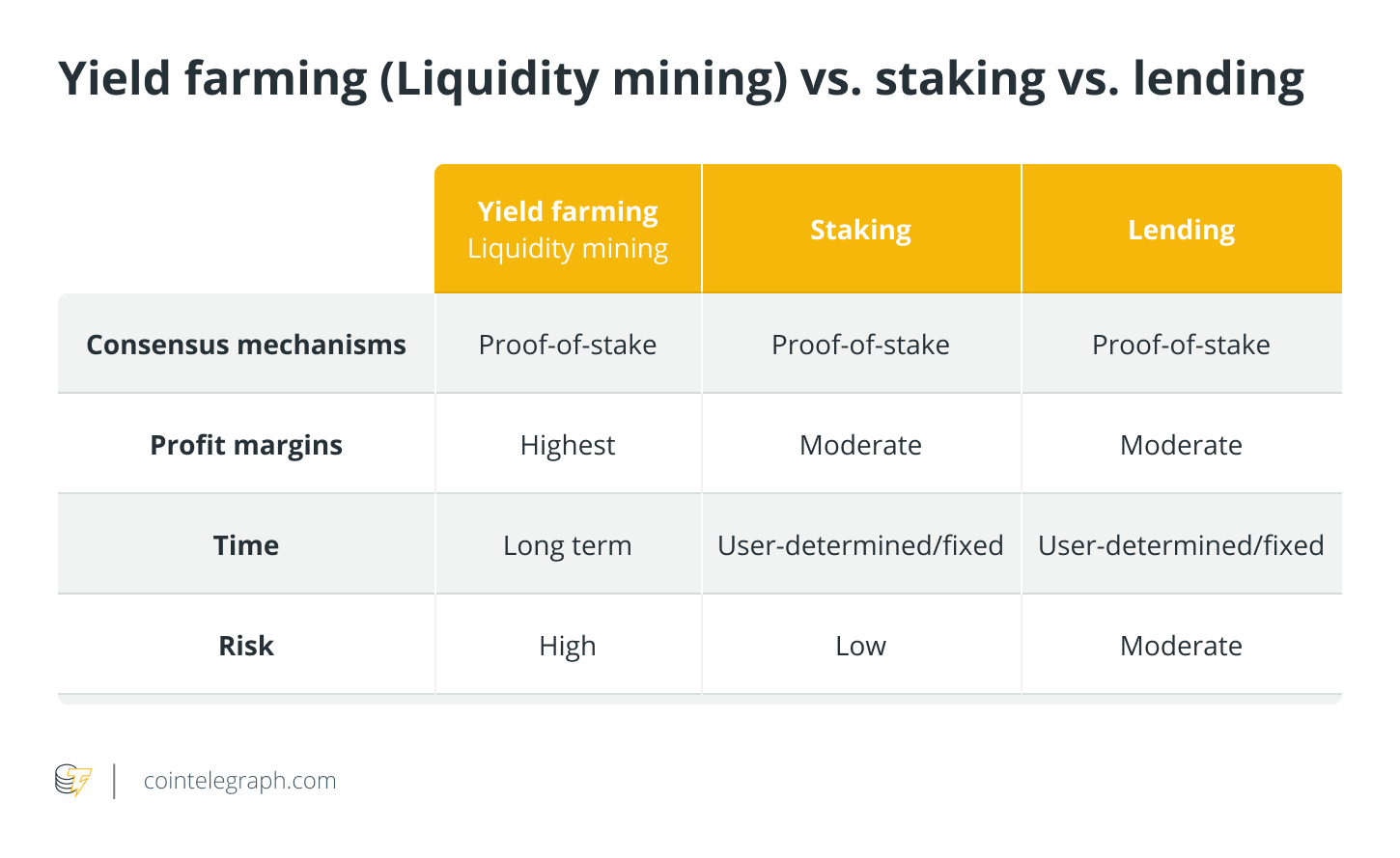

Everybody the master of crypto on PoS blockchains must want to benefit from the possibilities staking provides, right? Really, based on our report, while 56% of individuals surveyed had staked before, lots who hadn’t staked or wouldn’t stake again pointed toward exactly the same hesitation: It normally won’t want their assets secured in staking, not when individuals assets might be offer use elsewhere. For this reason liquid staking provides the very best of all possible worlds. It enables investors to stake their assets whilst letting them use individuals assets in other projects during lock-up.

Even though this innovation has the capacity to lower barriers to staking, there’s still confusion by what liquid staking is and just what it may offer towards the crypto community. Below are the misconceptions about liquid staking and just what the simple truth is relating to this new chance.

Related: The numerous layers of crypto staking within the DeFi ecosystem

What’s liquid staking?

Staking is altering the way in which blockchains function. It brings better energy-efficiency to blockchain validation, more versatility towards the hardware needed and faster transaction frequency. But despite its benefits, certainly one of its greatest challenges — and what’s holding many away from staking — may be the lock-up period. Assets are inaccessible towards the holder while being staked, and individuals proprietors can’t so something with them — like purchase decentralized finance (DeFi) — while they’re being staked. It’s due to this sacrifice that lots of are reluctant to stake.

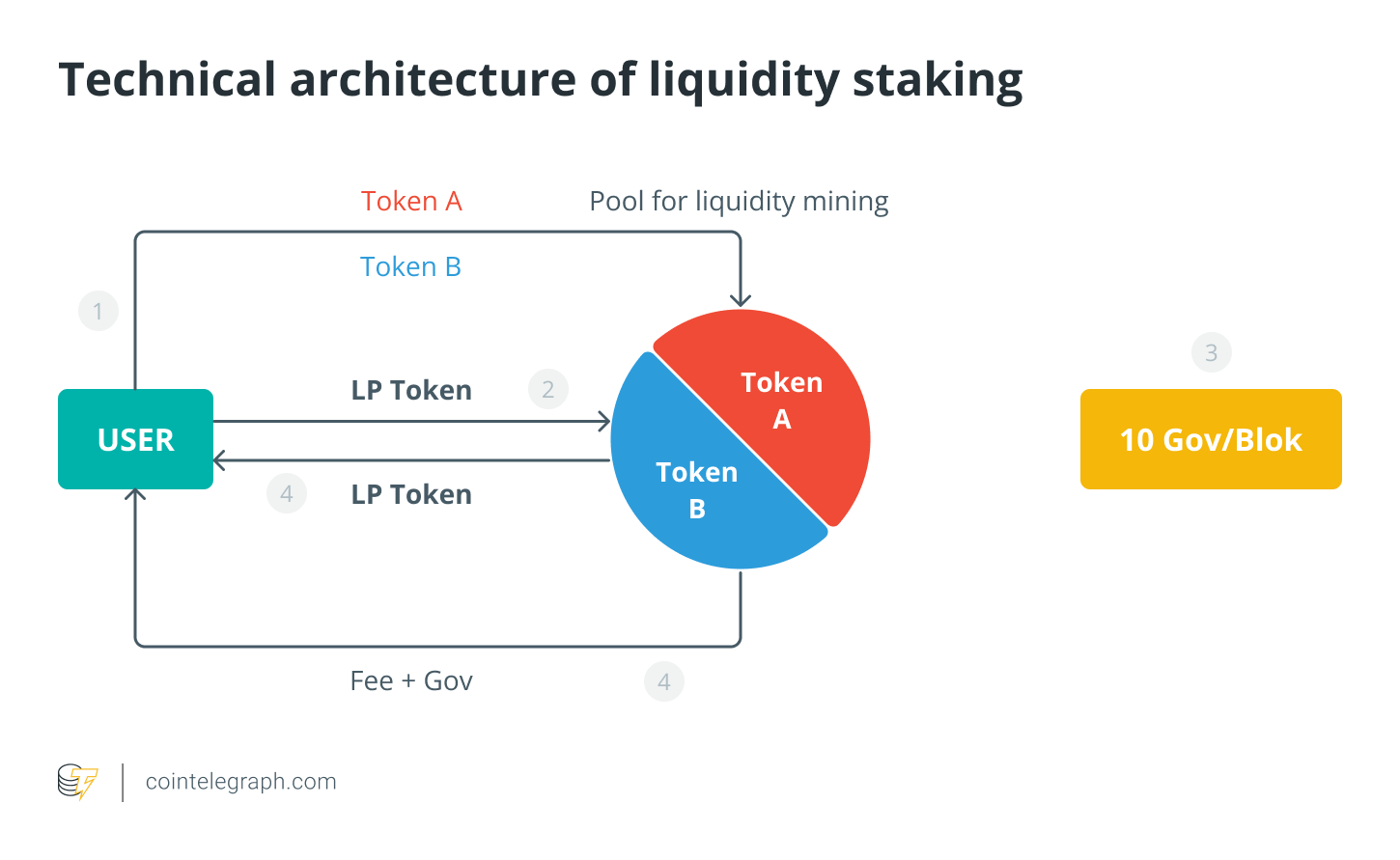

However, liquid staking solves this problem. Liquid staking protocols allow holders of staked assets to obtain liquidity by means of an offshoot token that they’ll then use within DeFi — all as the staked assets still earn rewards. It’s a method to maximize earning potential while getting the very best of all possible worlds.

PoS can also be quickly rising in recognition. PoS protocols account for more than 1 / 2 of crypto’s total market cap, as many as $594 billion. The possibilities is only going to increase as Ethereum moves fully to PoS within the coming several weeks. However, only 24% from the total market capital of staking platforms is locked in staking — meaning there are lots of who are able to stake but are not doing so.

Related: The benefits and drawbacks of staking cryptocurrency

Four misconceptions of liquid staking

Despite the advantages of liquid staking, there’s still confusion about how exactly it truely does work. Listed here are four common misconceptions, and just how you ought to be considering liquid staking rather.

Misconception 1: Just one player or protocol will exist. Among the misconceptions about liquid staking is the fact that just one player will exist by which investors can gain liquidity. It might appear this way since it’s still so at the start of the liquid staking space, but later on, multiple liquid staking protocols will exist together. Could also be no capping to the amount of liquid staking protocols that may exist together, either. Actually, the greater the amount of protocols, the greater it’s for that network, as it can certainly reduce cases of stake centralization and fears of merely one reason for failure.

Misconception 2: It’s only restricted to liquidity. Liquid staking isn’t just a method to get liquidity. While liquid staking helps PoS systems acquire staked capital that safeguards the network, it is not only restricted to that. It is also a method to get composability since you can make use of your derivative in multiple places, that you simply can’t use an exchange. The synthetic derivatives which are issued included in liquid staking and utilized in supported DeFi protocols for generating more yield really assist in constructing financial foundations over the ecosystem.

Misconception 3: Liquid staking is solved in the protocol level. People think liquid staking is going to be solved in the protocol level itself. But liquid staking isn’t nearly enabling functionality in a protocol level. Sturdy coordinating along with other protocols, getting more use cases, more features and much more usability. A liquid staking protocol is exclusively centered on developing the architecture which will facilitate the development of synthetic derivatives and making certain there are DeFi protocols that individuals derivatives could be integrated.

Misconception 4: Liquid staking defeats the objective of staking overall. Some say liquid staking defeats the objective of staking or locking up assets, but you’ve seen it is not true. Liquid staking not just increases network security but additionally helps acquire a crucial purpose of the PoS network, that is staking. If there’s an answer that issues derivatives for staked capital inside the network, then not just may be the staked capital making certain the PoS network is safe, but it’s also creating an improved experience for that user by enabling capital efficiency.

The way forward for PoS

Liquid staking not just solves an issue for crypto enthusiasts who wish to stake by issuing tokens they are able to use within DeFi while their assets are staked. A rise in individuals staking their assets — that is made simpler by looking into making liquid staking available — really helps make the blockchain safer. By learning the reality regarding common misconceptions, investors will enable staking to really become a cutting-edge new method for blockchains to attain consensus.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Mohak Agarwal may be the Chief executive officer of ClayStack. He’s a serial entrepreneur and investor on the pursuit to unlock the liquidity of staked assets.