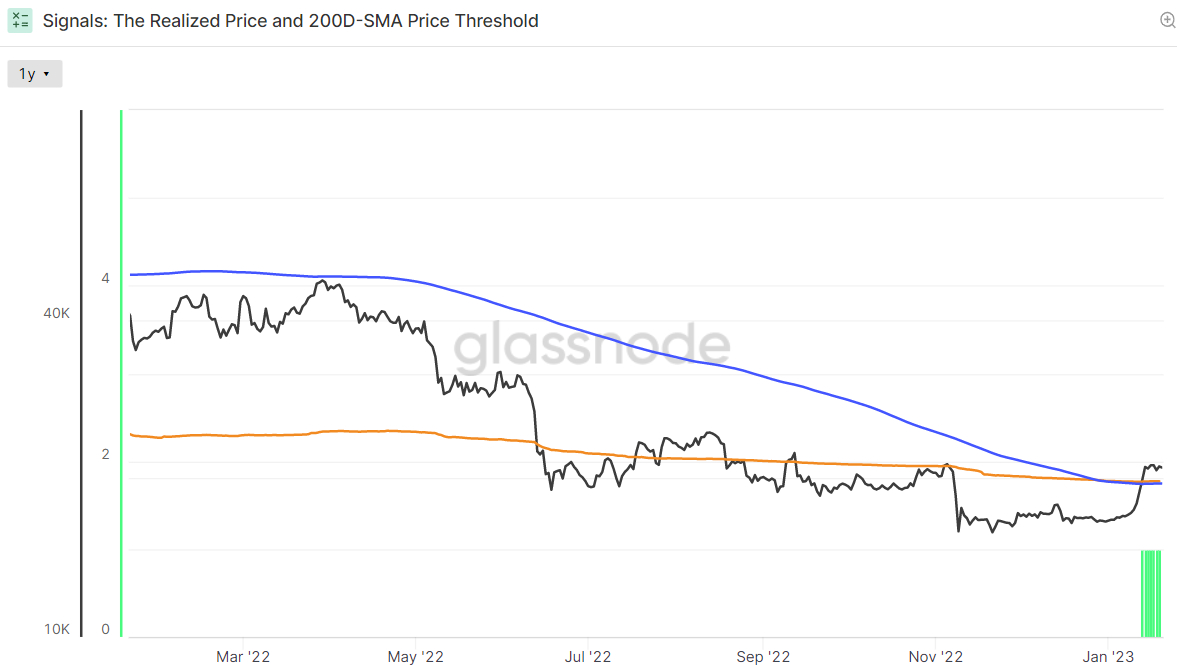

In wake from the impressive rally in Bitcoin’s cost since the beginning of the entire year, multiple technical as well as on-chain indicators have began flashing eco-friendly the bear market of 2022 may be over. For instance, Bitcoin’s latest push greater which has seen it recover above $21,000 from the finish of 2022 levels around $17,000 has witnessed the world’s largest cryptocurrency by market capital break to northern its 200-Day Moving Average and Recognized Cost, each of which sit just below $20,000.

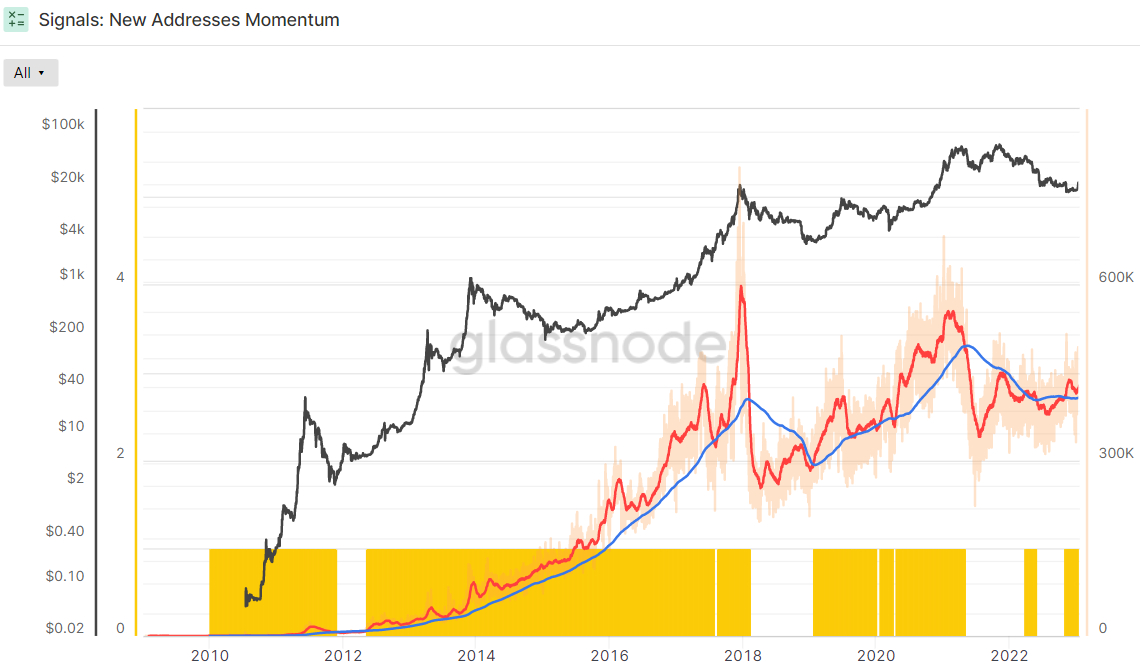

Momentum in new addresses also lately required a turn for that better, using the 30-day simple moving average (SMA) lately jumping over the 200-day SMA, a shift which frequently occurs at the beginning of a Bitcoin bull market.

Meanwhile, based on analysis from pseudonymous Twitter account @CryptoHornHairs, Bitcoin seems to become tracking almost exactly consistent with a lengthy-term market cycle that repeats itself roughly every 4 years. Based on @CryptoHornHairs, Bitcoin is at the outset of the bullish stage from the cycle, getting just come via a 364-day downturn.

However This Key Indicator Not Flashing Eco-friendly At This Time

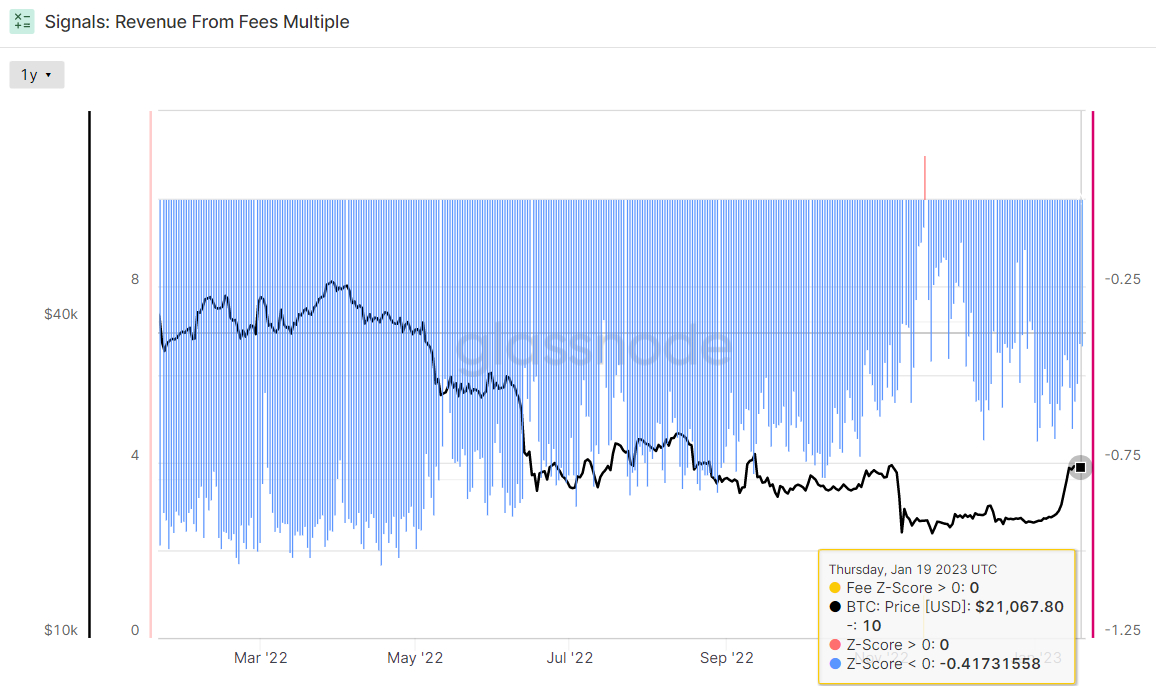

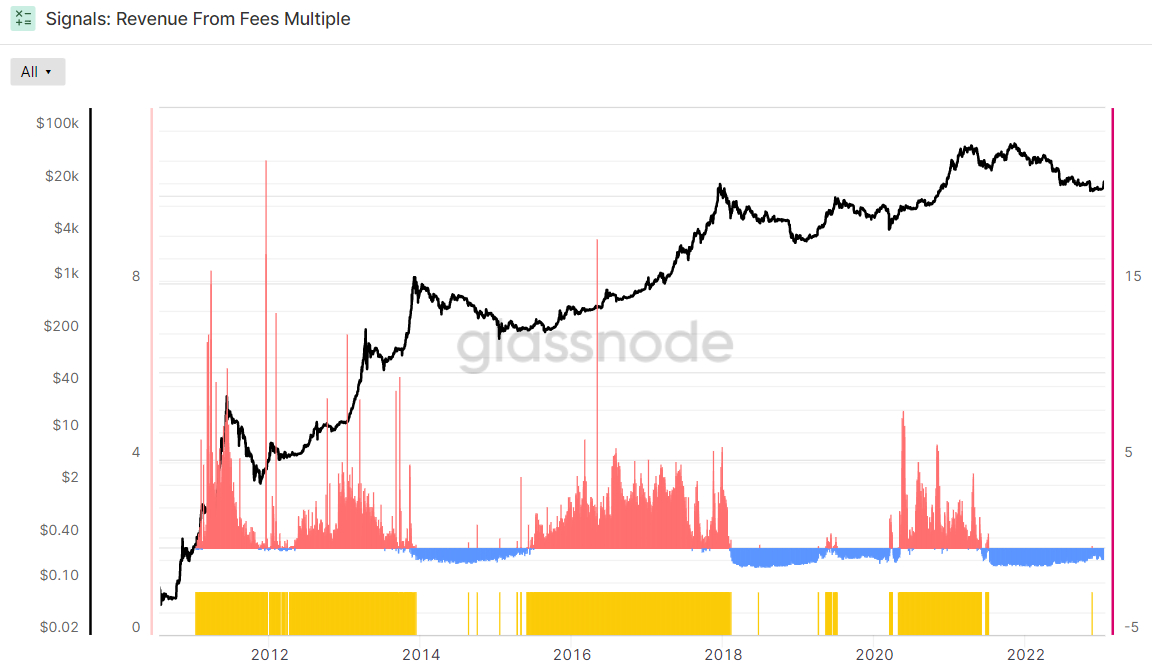

However, investors should observe that one key on-chain indicator isn’t delivering bullish signs. Glassnode’s Revenue From Charges Multiple continues to have an adverse 2-year Z-score close to -.41. The Z-score is the amount of standard deviations below or above the mean of the data sample. In cases like this, Glassnode’s Z-score is the amount of standard deviations below or above the mean Bitcoin Fee Revenue from the last 2-years.

“A sustained uptick in fee revenue like a proportion from the total reward signifies that Bitcoin blocks are full, and there’s growing interest in transaction activity,” the crypto analytics firm states. “Given the restricted blocksize of Bitcoin, it has in the past provided an invaluable early indicator of the macro trend transfer of the network demand profile”.

Thus, Bitcoin’s weak Fee Revenue momentum ought to be a warning sign for that bulls, because it implies weak on-chain activity. However, as history has proven, this indicator can rapidly swing inside a positive direction. All it could take is perfect for a ongoing grind greater in Bitcoin within the coming days and several weeks to trigger a little bit of FOMO among the retail crowd and institutions, as well as on-chain activity might begin to show strong indications of a pick-up.