Ether (ETH) is lower 25% in a month as well as the current upgrade to some proof-of-stake (PoS) consensus around the Ropsten testnet unsuccessful to maneuver the altcoin’s cost.

The merge is supposed to address energy-use issues and open a way for greater transaction output, however the actual full transition for that Ethereum network isn’t expected until later around. Ethereum developer Parithosh Jayanthi also noted that some bugs around the PoS implementation emerged, but individuals ought to be fixed within the coming days.

Fortunately for Ethereum, a couple of its top competitors lately faced challenges that belongs to them. The Solana (SOL) network faced the 5th outage in 2022 after no new blocks were created for four hrs on June 1. Every decentralized application was stopped before the validators could address the issue and re-sync the network.

More lately, Binance’s native BNB token dropped 7% on June 7 after news the U . s . States Registration announced it had opened up an analysis in to the initial gold coin offer (ICO) from 2017. Based on Bloomberg, a minumum of one U.S. resident claimed to possess played within the ICO, that could be crucial to have an SEC situation.

Regulatory uncertainty might be partly accountable for Ether’s sharp correction. On June 6, Hong Kong’s Securities and Futures Commission (SFC) released an email warning concerning the investment perils of nonfungible tokens. The regulatory agency highlighted the sectors’ opaque prices, illiquid markets and frauds.

Options traders continue to be very risk-averse

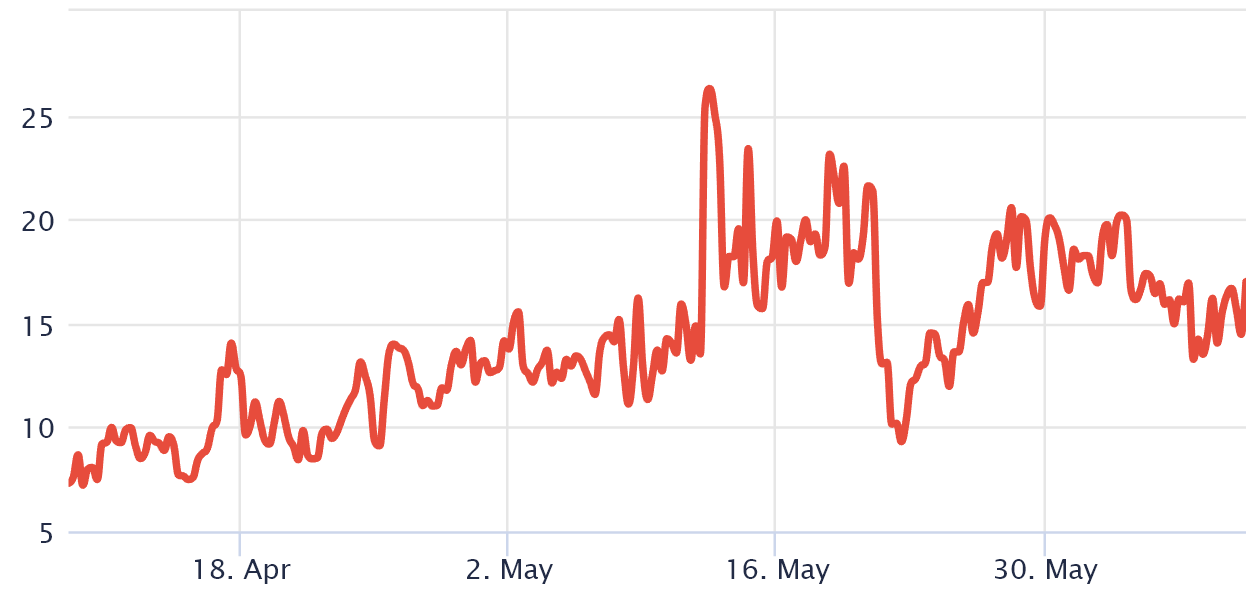

Traders need to look at Ether’s derivatives markets data to know how bigger-sized traders are situated. The 25% delta skew is really a telling sign whenever whales and arbitrage desks overcharge for upside or downside protection.

If individuals traders fear an Ether cost crash, the skew indicator will move above 10%. However, generalized excitement reflects an adverse 10% skew. That’s the key reason why the metric is called the professional traders’ fear and avarice metric.

The skew indicator continues to be above 10% since May 22, also it lately peaked at 20% on June 3. Individuals levels signal extreme fear from options traders, and regardless of the modest improvement, the present 17% delta skew shows whales and arbitrage desks reluctant to consider downside risk.

Lengthy-to-short information is showing a couple of positives

The very best traders’ lengthy-to-short internet ratio excludes externalities that may have exclusively impacted the choices markets. By analyzing the high clients’ positions around the place, perpetual and quarterly futures contracts, it’s possible to better understand whether professional traders are leaning bullish or bearish.

You will find periodic methodological discrepancies between different exchanges, so viewers should monitor changes rather of absolute figures.

Despite the fact that Ether has battled to sustain $1,800 like a support, professional traders didn’t change their positions between June 5 and 9, based on the lengthy-to-short indicator.

Binance displayed a modest reduction in its lengthy-to-short ratio, because the indicator moved from .99 to the present .96 in four days. Thus, individuals traders slightly internet elevated their bearish bets.

Huobi data shows an identical pattern and also the indicator moved from 1.02 to .98 on June 9, that was a little change favoring shorts. At OKX exchange, the metric oscillated drastically inside the period but finished nearly unchanged at 1.35.

Related: DeFi contagion? Analysts warn of ‘Staked Ether’ de-pegging from Ethereum by 50%

Mixed derivatives data provides expect bulls

Overall, there has not been a substantial alternation in whales and market makers’ leverage positions despite Ether’s failure to interrupt the $1,900 resistance on June 6.

In one side, options traders fear that the much deeper Ether cost correction is probably within the making, but simultaneously, futures market players don’t have any conviction to improve bearish bets.

This studying is probably a “glass half full” scenario because the top traders’ unwillingness to short below $1,900 could possibly produce a support level.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.