On Friday, August 19, the entire crypto market capital came by 9.1%, but more to the point, the all-important $1 trillion mental support was drawn on. The market’s latest venture below this just three days ago, meaning investors were pretty certain that the $780 billion total market-cap have less June 18 would be a mere distant memory.

Regulatory uncertainty elevated on August. 17 following the U . s . States House Committee on Energy and Commerce announced that they are “deeply concerned” that proof-of-work mining could increase interest in non-renewable fuels. Consequently, U.S. lawmakers requested the crypto mining companies to showcase energy consumption and average costs.

Typically, sell-offs possess a greater effect on cryptocurrencies outdoors of the top five assets by market capital, but today’s correction presented losses varying from 7% to 14% overall. Bitcoin (BTC) saw a 9.7% loss because it tested $21,260 and Ether (ETH) presented a ten.6% drop at its $1,675 intraday low.

Some analysts might claim that harsh daily corrections such as the one seen today is really a norm instead of the best thinking about the asset’s 67% annualized volatility. Situation in point, today’s intraday stop by the entire market capital exceeded 9% in 19 days in the last 365, however, many aggravants are causing this current correction to stick out.

The BTC Futures premium disappeared

The fixed-month futures contracts usually trade in a slight premium to regular place markets because sellers require more money to withhold settlement for extended. Technically referred to as “contango,” this case isn’t only at crypto assets.

In healthy markets, futures should trade in a 4% to eightPercent annualized premium, which is sufficient to make amends for the potential risks plus the price of capital.

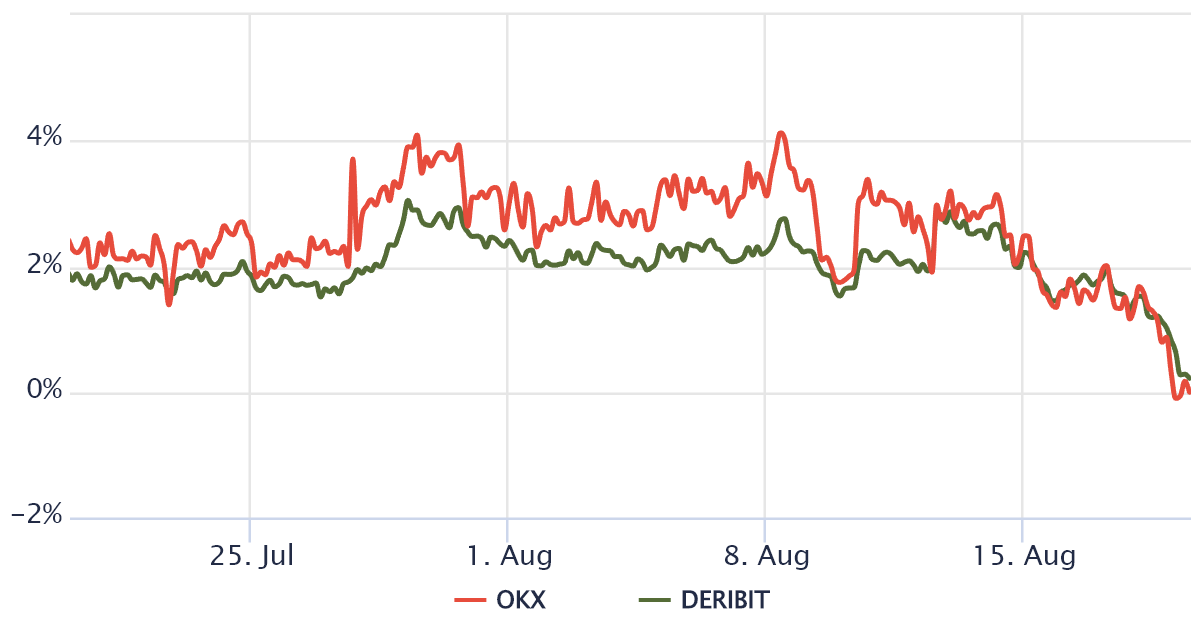

Based on the OKX and Deribit Bitcoin futures premium, the 9.7% negative swing on BTC caused investors to get rid of any optimism using derivatives instruments. Once the indicator flips towards the negative area, buying and selling in “backwardation,” it typically means there’s much greater demand from leveraged shorts who’re betting on further downside.

Leverage buyers’ liquidations exceeded $470 million

Futures contracts really are a relatively low-cost and simple instrument that enables using leverage. The possibility of with them is based on liquidation, meaning the investor’s margin deposit becomes inadequate to pay for their positions. In these instances, the exchange’s automatic deleveraging mechanism takes over and sells the crypto utilized as collateral to lessen the exposure.

An investor might improve their gains by 10x using leverage, however, if the asset drops 9% using their access point, the positioning is ended. The derivatives exchange will go to sell the collateral, developing a negative loop referred to as a cascading liquidation. As portrayed above, the August. 19 sell-off presented the greatest quantity of buyers having into selling since June 12.

Margin traders were excessively bullish and destroyed

Margin buying and selling enables investors to gain access to cryptocurrency to leverage their buying and selling position and potentially improve their returns. For example, an investor could buy Bitcoin by borrowing Tether (USDT), thus growing their crypto exposure. However, borrowing Bitcoin are only able to be employed to short it.

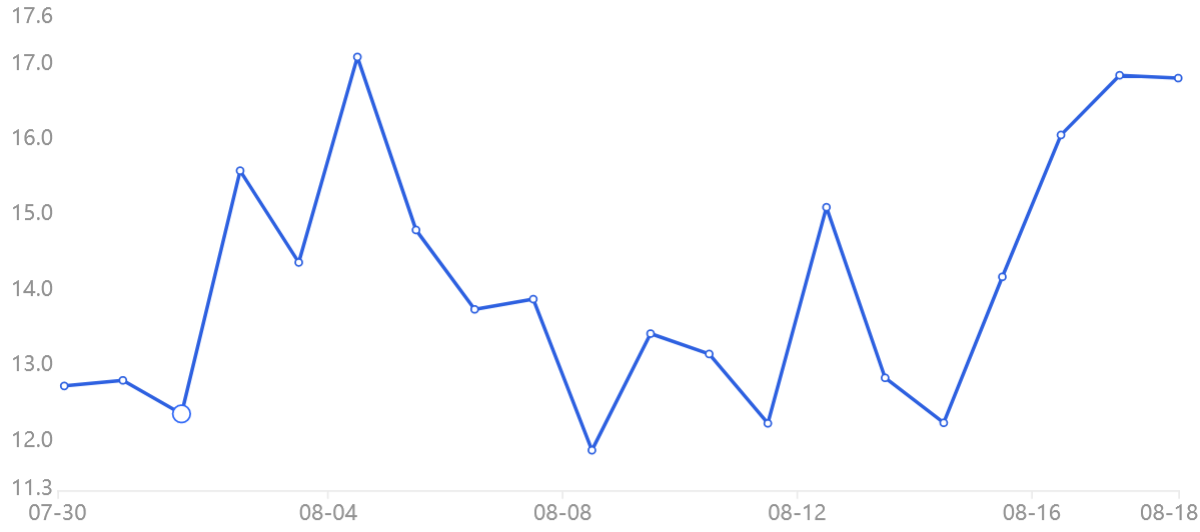

Unlike futures contracts, the total amount between margin longs and shorts is not always matched. Once the margin lending ratio is high, it signifies the marketplace is bullish—the opposite, a minimal ratio, signals the marketplace is bearish.

Crypto traders are recognized for being bullish, that is understandable thinking about the adoption potential and fast-growing use cases like decentralized finance (DeFi) and also the perception that particular cryptocurrencies shield you against USD inflation. A margin lending rate of 17x greater favors stablecoins isn’t normal and signifies excessive confidence from leverage buyers.

These 3 derivatives metrics show traders were certainly not expecting the whole crypto sell to correct as dramatically as today, nor for that total market capital to retest the $1 trillion support. This restored lack of confidence could potentially cause bulls to help reduce their leverage positions and perhaps trigger new lows within the coming days..

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.