Ether’s (ETH) market structure remains bearish regardless of the unsuccessful make an effort to break the climbing down funnel resistance at $2,000 on May 31. This three-week-lengthy cost formation would mean that an eventual retest from the $1,700 support is going ahead.

Around the non-crypto side, numerous equities-related factors are converting to negative sentiment within the crypto market. This week Microsoft (MSFT) decreased its profit and revenue outlook, citing challenging macroeconomic conditions. The U.S. Fed signalled in the periodic “Beige Book” that business activities might have cooled in certain areas and also the Given is going to reduce its $9 trillion asset portfolio to combat persistent inflation.

Around the vibrant side, an institutional investor survey printed through the Economist magazine demonstrated that 85% from the respondents agreed that open-source cryptocurrencies like Bitcoin (BTC) or Ether (ETH) are helpful as diversifiers in portfolio or treasury accounts.

In the macroeconomic perspective, investors continue to be risk-averse, that could mean a lower appetite for cryptocurrencies.

Ethereum continues to have a mountain to climb

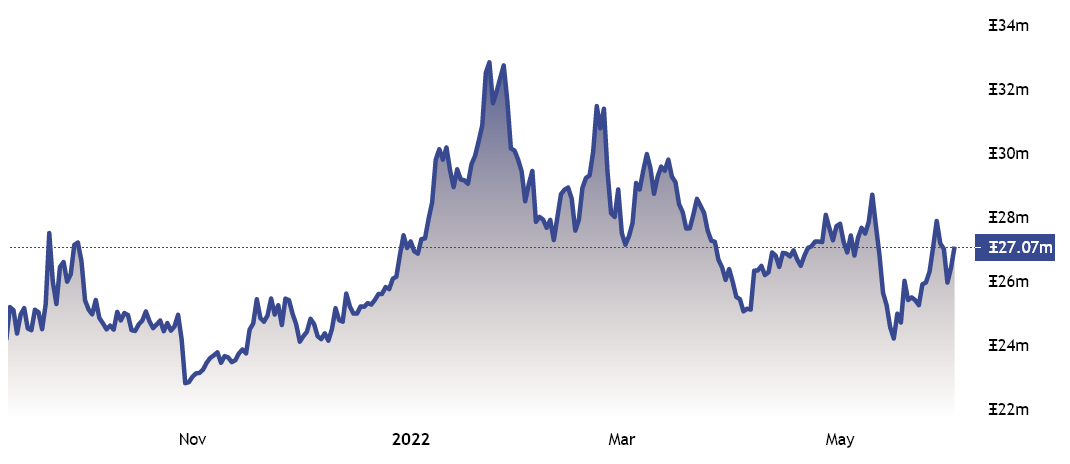

The Ethereum network’s total value locked (TVL), the quantity of assets deposited towards the network, has came by 5.5% since Ether started its downtrend three days ago.

The network’s TVL peaked at 28.7 billion Ether on May 10 and presently is 27.a million. Decentralized finance (DeFi) deposits were deeply influenced by the USD Terra (UST) — now referred to as TerraUSD Classic (USTC) — stablecoin collapse on May 10. With that said, the indicator shows an average decrease, that is somewhat expected after this kind of unparalleled event.

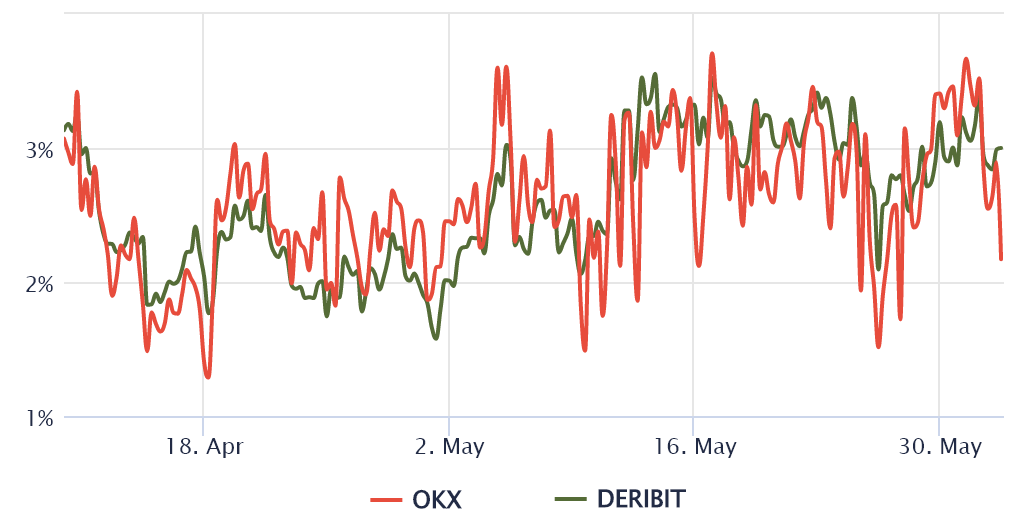

To know how professional traders are situated, let us take a look at Ether’s futures market data. Quarterly futures are whales and arbitrage desks’ preferred instruments because of their insufficient a fluctuating funding rate.

These fixed-month contracts usually trade in a 5% to 12% premium to place markets, indicating that sellers request more income to withhold settlement longer. This case can also be common in traditional assets for example stocks and goods.

In the last month, Ether’s futures contracts premium has continued to be near 3%, that is underneath the 5% neutral-market threshold. The possible lack of leverage demand from buyers is apparent because the current 2.5% basis indicator remains depressed despite Ether’s 24% negative performance in three days.

Fear a worldwide downturn is constantly on the impact crypto prices

Ether’s crash to $1,700 on May 27 drained any leftover bullish sentiment and, more to the point, caused $235 million in leverage lengthy futures contract liquidations. Despite the fact that Ether cost tested the $2,000 resistance on May 31, there’s no proof of strength from derivatives or DeFi deposits, based on the TVL metric.

As investors’ focus remains on traditional markets and also the impacts of worldwide macroeconomic worsening conditions, there’s little expect a sustainable Ether cost decoupling towards the upside.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.