Cryptocurrencies will be in a bear trend since mid-August once they unsuccessful to interrupt over the $1.2 trillion market capital resistance. Despite the present bear trend along with a brutal 25% correction, it is not enough to interrupt the 3-month-lengthy climbing trend.

The crypto markets’ aggregate capital declined 7.2% to $920 billion within the 7 days resulting in Sept. 21. Investors desired to be cautious in front of the Federal Open Markets Committee meeting, which made the decision to improve the eye rate by .75%.

By growing the price of borrowing cash, the financial authority aims to curb inflationary pressure while growing the responsibility on consumer finance and company debt. This explains why investors moved from risk assets, including stock markets, foreign currency, goods and cryptocurrencies. For example, WTI oil prices ceded 6.8% from Sept. 14, and also the MSCI China stock exchange index dropped 5.1%.

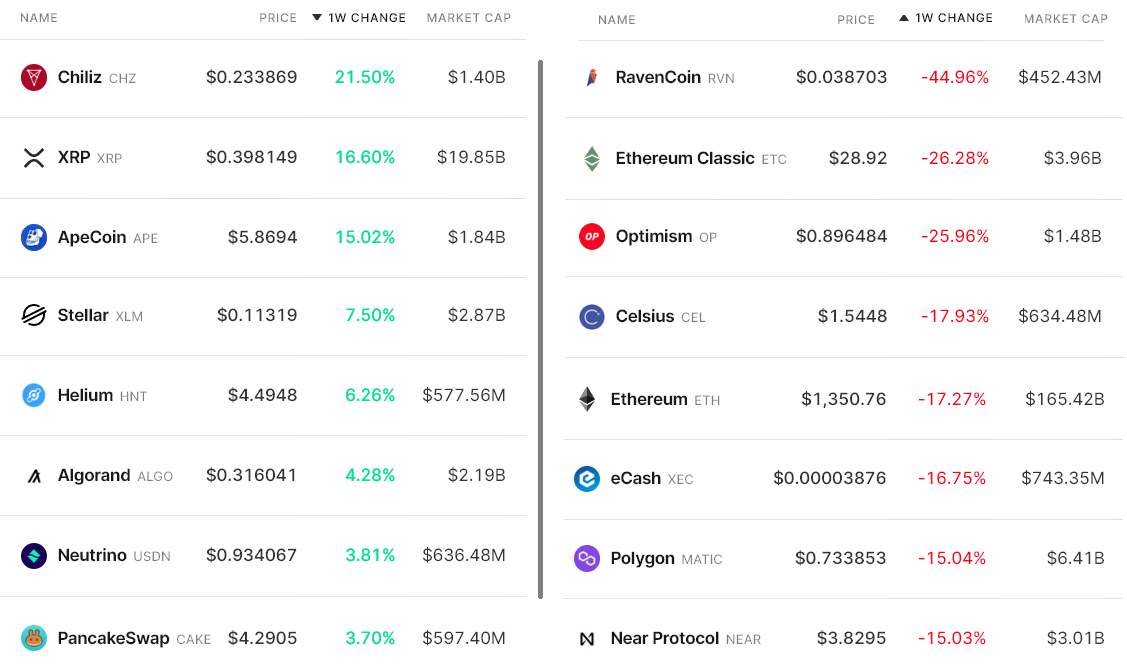

Ether (ETH) also saw a 17.3% retrace throughout the seven-day period and lots of altcoins performed a whole lot worse. The Ethereum network Merge and it is subsequent effect on other GPU-mineable coins caused some skewed results one of the worst weekly performers.

Chiliz (CHZ) rallied 21.5% following two effective fan token launches from MIBR esports team and also the VASCO team from South america.

XRP gained 16.6% after Ripple Labs known as for any federal judge to instantly rule if the company’s XRP token sales violated U.S. securities laws and regulations.

ApeCoin (APE) acquired 15% because the community expects the staking program to produce, which will be detailed by Horizen Labs on Sept. 22.

RavenCoin (RVN) and Ethereum Classic (ETC) retraced many of their gains in the previous week as investors recognized the hash rate gains from Ethereum miners didn’t always convert into greater adoption.

Traders’ appetite didn’t vanish regardless of the correction

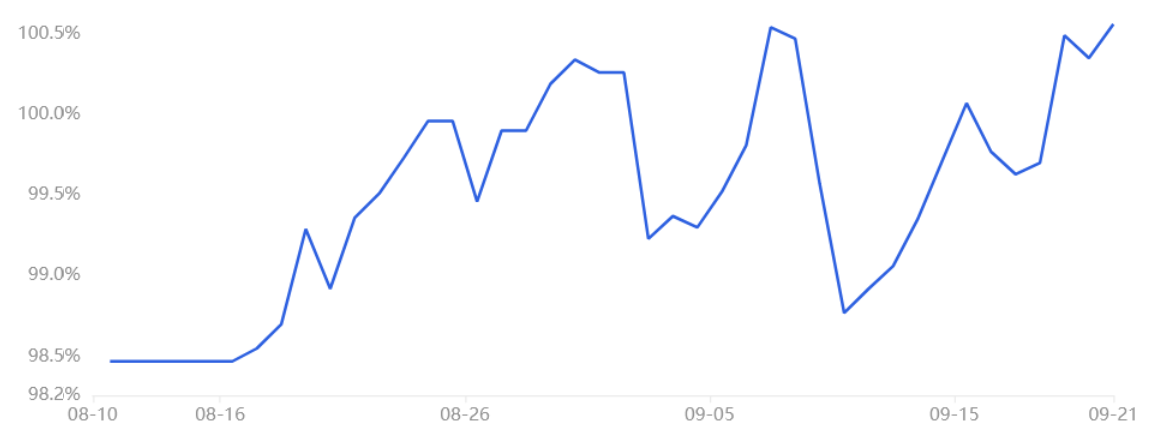

The OKX Tether (USDT) premium is a great gauge of China-based crypto retail trader demand. Its dimensions are the main difference between China-based peer-to-peer trades and also the U . s . States dollar.

Excessive buying demand has a tendency to pressure the indicator above fair value at 100%, and through bearish markets, Tether’s market offers are flooded, creating a 4% or greater discount.

The Tether premium presently is 100.7%, its greatest level since June 15. While still underneath the neutral area, the indicator demonstrated a modest improvement in the last week. Thinking about that crypto markets tanked by 7.2%, this data ought to be considered a victory.

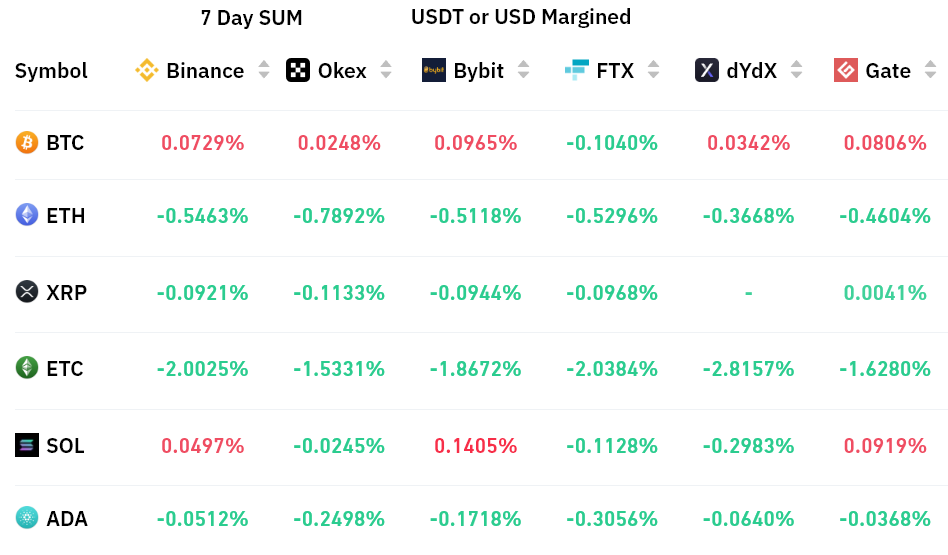

Perpetual contracts, also referred to as inverse swaps, come with an embedded rate that’s usually billed every eight hrs. Exchanges make use of this fee to prevent exchange risk imbalances.

An optimistic funding rate signifies that longs (buyers) require more leverage. However, the alternative situation takes place when shorts (sellers) require additional leverage, resulting in the funding rate to show negative.

As portrayed above, the accrued seve-day funding rate was negative for each altcoin. This data signifies excess interest in shorts (sellers), although it may be ignored in Ether’s situation because investors targeting the disposable fork coins throughout the Merge likely bought ETH and offered futures contracts to hedge the positioning.

More to the point, Bitcoin’s funding rate held slightly positive throughout a week of cost decline and potentially bearish news in the Given. Since this critical decision has been created, investors have a tendency to avoid placing new bets until newer and more effective data provides insights about how the economy adjusts.

Overall, the Tether premium and futures’ funding rate show no indications of stress, that is positive thinking about how badly crypto markets have performed.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.