Previously year, Polygon (MATIC) has centered on growing a list of high-profile partners including luminaries like Disney, Starbucks and Robinhood. The current bulletins of partnerships with Instagram and JPMorgan have speculators pushing the token cost up nearly 200%.

In accessory for partnerships, blockchain adoption through network usage is essential to evaluate. Blockchain adoption could be examined by searching into daily active people that use the blockchain, protocols while using technology, quantity of transactions and total locked value.

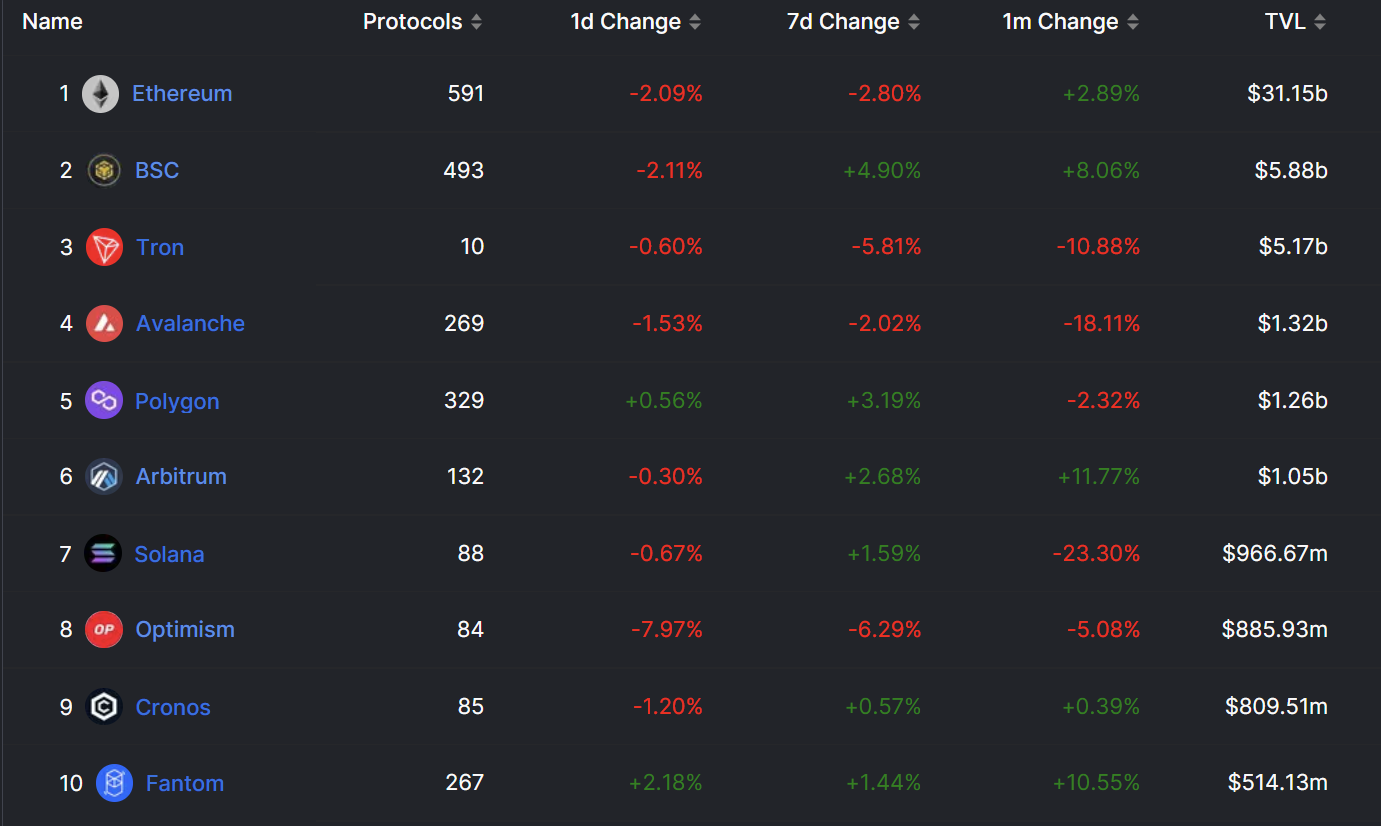

Total value locked on Polygon increases above $1B

Total value locked (TVL) is a cryptocurrency indicator accustomed to measure the market’s sentiment perfectly into a particular blockchain. TVL on Polygon requires using the MATIC blockchain and locking funds within the various DeFi platforms available over the network.

Rising TVL is an indication of growth, or new liquidity entering the ecosystem but it doesn’t always imply that the network and connected assets are “turning bullish.”

As the best three protocols, Ethereum (ETH), Binance Gold coin (BNB) and Tron (TRX) have the ability to a TVL over $5 billion, MATIC, Avalanche (AVAX) and Arbitrum would be the only others with more than $1 billion in TVL.

Based on data from Token Terminal, Polygon and Fantom (FTM) would be the only blockchains to publish positive TVL figures both in one day and seven day metrics.

Best Three protocol blockchain for developers

Protocols are basically decentralized applications (dApps) built using smart contracts on the top of public blockchains. The lately announced partnerships have be tested but haven’t yet fully launched.

Whether or not the new partnerships don’t fully materialize, the network has already been a high contender for developers to construct their smart contracts.

Polygon is really a newcomer in comparison with Ethereum. So although Ethereum has more protocols than Polygon, Ethereum launched mainnet having a 5 year jump.

Polygon’s astronomical development in protocols launching on their own blockchain is notable because based on TokenTerminal’s data, Ether’s market cap dominates MATIC 90% to 10%.

Related: JP Morgan executes first DeFi trade on public blockchain

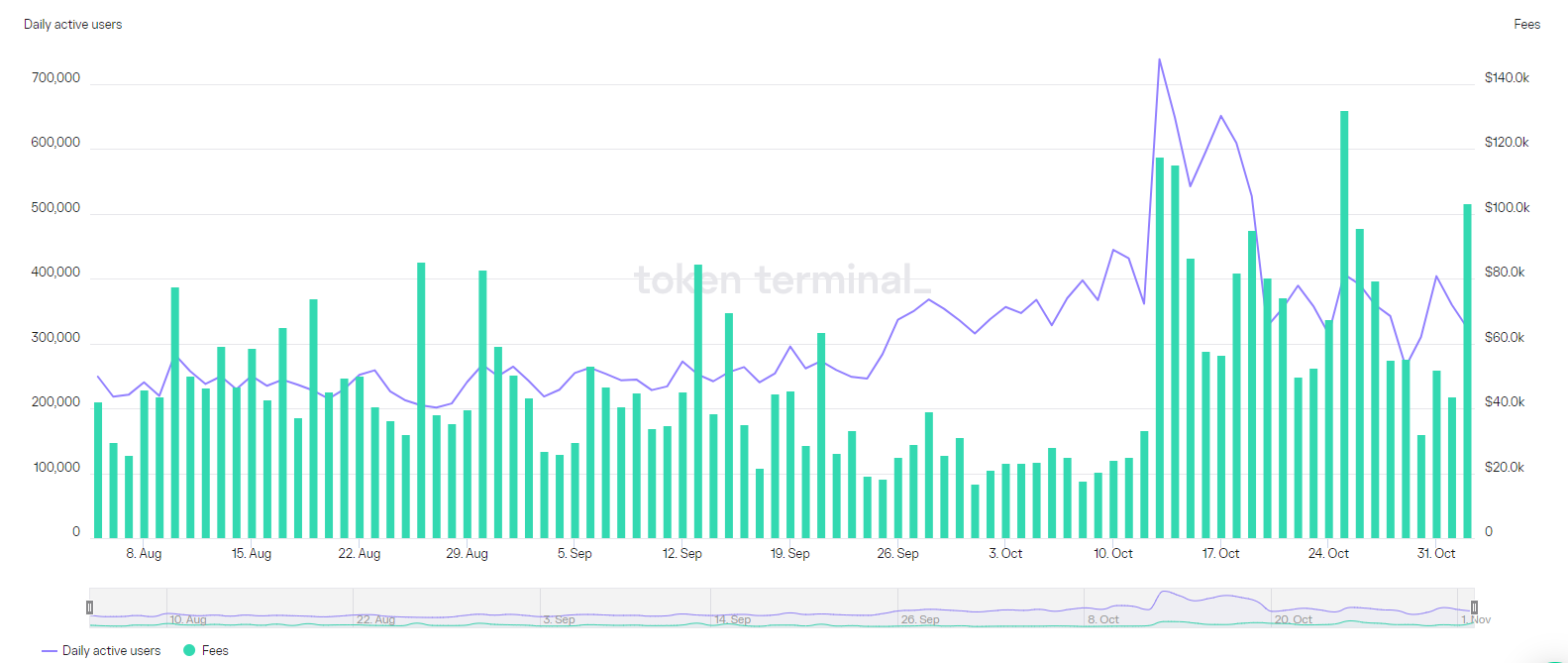

Polygon sees an uptick in charges and daily active users

Additionally to Polygon’s cost growing 12% previously month, the network’s daily charges and daily active users have become by 200% since August 5 lending credence towards the Cointelegraph conjecture.

On August 5, Polygon collected $42,093 in charges coupled with 248,853 daily network users. By October 13, the network’s daily active users peaked at 737,815 following a success from the Reddit NFT avatar launch. Following on October 25 the network hit a 90-day peak of $131,940 in daily charges.

When evaluating the on-chain activity and analysis using the recent MATIC rally, the information shows that speculation around the partnership news matches the basic principles.

Even though it is a stretch to forecast a 200% potential grow in MATIC growth by using only technical analysis, Polygon’s network growth and daily active user stats are encouraging.

The amount of transactions and TVL might be a sign that network fundamentals align using the expectations of technical analysts. MATIC’s strength versus competing chains, yet still be only a small fraction of Ether and BNB’s market cap is very bullish because of its lengthy-term growth prospects.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.