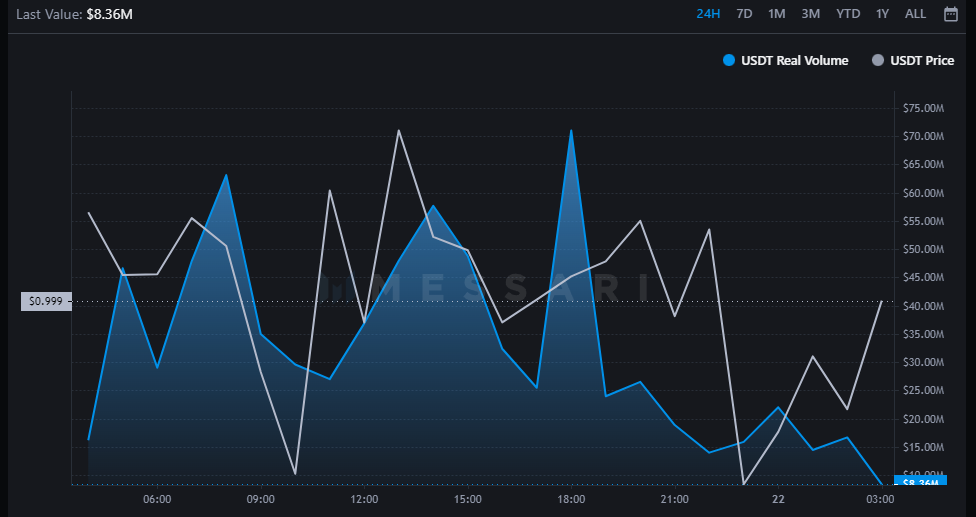

USD Gold coin (USDC) is going for a run in the title from the top stablecoin in crypto after its daily ‘real volume’ around the Ethereum network bending those of Tether’s (USDT) on Tuesday.

Based on crypto market data tool Messari, Circle’s USDC published $1.1 billion in daily real volume around the Ethereum network , that was double USDT’s real amount of $579 million.

Messari’s real volume metric is calculated by compiling data only from exchanges it believes have “significant and legit crypto buying and selling volumes” and therefore is different from the greater generally seen “total volume” metric.

Exchanges incorporated in Messari’s Real Volume metric include Binance, Bitfinex, Bitflyer, Bitstamp, Bittrex, Coinbase Pro, Gemini, itBit, Kraken, Poloniex and individuals tracked on OnChainFX.

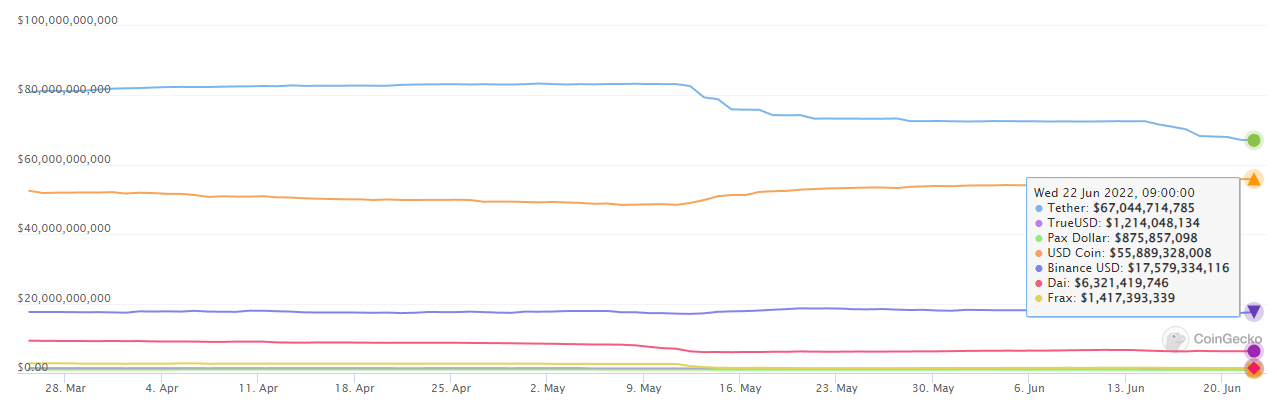

USDC supply gaining ground

Tether’s circulating supply has ongoing to fall since its all-time at the top of May 11, shedding nearly 20% from 83.1 billion coins in circulation for an eight-month low of 67.9 billion as of times of writing.

USDC, however, has witnessed its supply increase by 13% since May 11 to 55.9 billion. When the trends continue, it might spell the finish of Tether’s dominance within the stablecoin space.

The collapse of layer-1 blockchain Terra and possible contagion from nov crypto lending platform Celsius have caused doubt among investors, worsened with a market crash in recent days. Redemptions in Tether have elevated considerably as a direct consequence, resulting in a stop by supply.

Tether continues to be trying to shore up confidence in the stablecoin — including stating on June 13 the ongoing calamities within the crypto market involving Terra and Celsius won’t have any effect on its reserves. Regardless of this, investors seem to be moving to USDC.

Messari’s real volume metric doesn’t tell the entire story, obviously. Across all blockchains and exchanges, CoinGecko shows USDT daily volume still tops the charts at $44 billion when compared with USDC’s $5 billion.

However, it’s not known what amount of the volume is a result of USDT working in wash buying and selling either to inflate the figures for coins or exchanges, and that’s why the imperfect real volume metric was created.

Related: Record stablecoin share of the market suggests crypto upside: JPMorgan

In order to combat the continuing redemptions and doubts concerning the composition of their reserves, Tether chief technology officer Paolo Ardoino told Euromoney on June 15 that his firm intentions of obtaining a proper audit from the top-12 auditing firm. As they want to have among the top four firms carry out the audit, Ardoino stated, “The big four are a little more careful about supplying a complete suit once the rules aren’t obvious,” around stablecoins.