The cost of Ethereum’s native token ETH could drop to some low of USD 675 – and rise to some a lot of USD 2,673 – before ending the entire year at USD 1,711, based on a panel of crypto industry professionals surveyed in comparison website Finder.com.

Based on typically the responses given through the panelists, ETH is facing five several weeks of outstanding volatility, with a 57% drop and 68% profit from the present cost prone to happen, prior to the cost ends the entire year at USD 1,711 – around 7% greater compared to current cost.

During the time of writing (14:25 UTC), ETH traded at USD 1,604. The token expires 4% per day and nearly 54% per week.

Many panelists pointed to the Merge – Ethereum’s transition in the proof-of-work (Bang) towards the proof-of-stake (PoS) consensus mechanism – as crucial for the asset’s cost moving forward.

Ben Ritchie, md of Digital Capital Management, stated that,

“Since Ethereum’s correlation to bitcoin continues to be high, we are able to speculate when Merge happens prior to the year-finish, its cost may decouple [from the remainder of crypto]. However, the outdoors economic factor is essential, getting hurdles towards the short-term cost action.”

An identical sentiment was shared by Kevin He, chief operating officer of fintech firm CloudTech Group.

“If Ethereum effectively completes the merger this season, we predict the cost to increase because PoS and faster [transactions per second] result in greater interest in ETH from miners, investors and Dapp users, and when the marketplace woes are alleviated within the other half of the season, it’s possible for ETH cost to increase towards the previous high or break the prior high because of the rising demand,” he stated.

Others also agreed, with Frederick Raczynski, a technologist and futurist for Thomson Reuters, saying the Merge “is not priced into [ETH]” yet.

“[Ethereum] still supports countless vast amounts of dollars in transactions and cost, with a large number of tokens. At this time, Ethereum remains the blue bloodstream from the crypto world,” Raczynski opined.

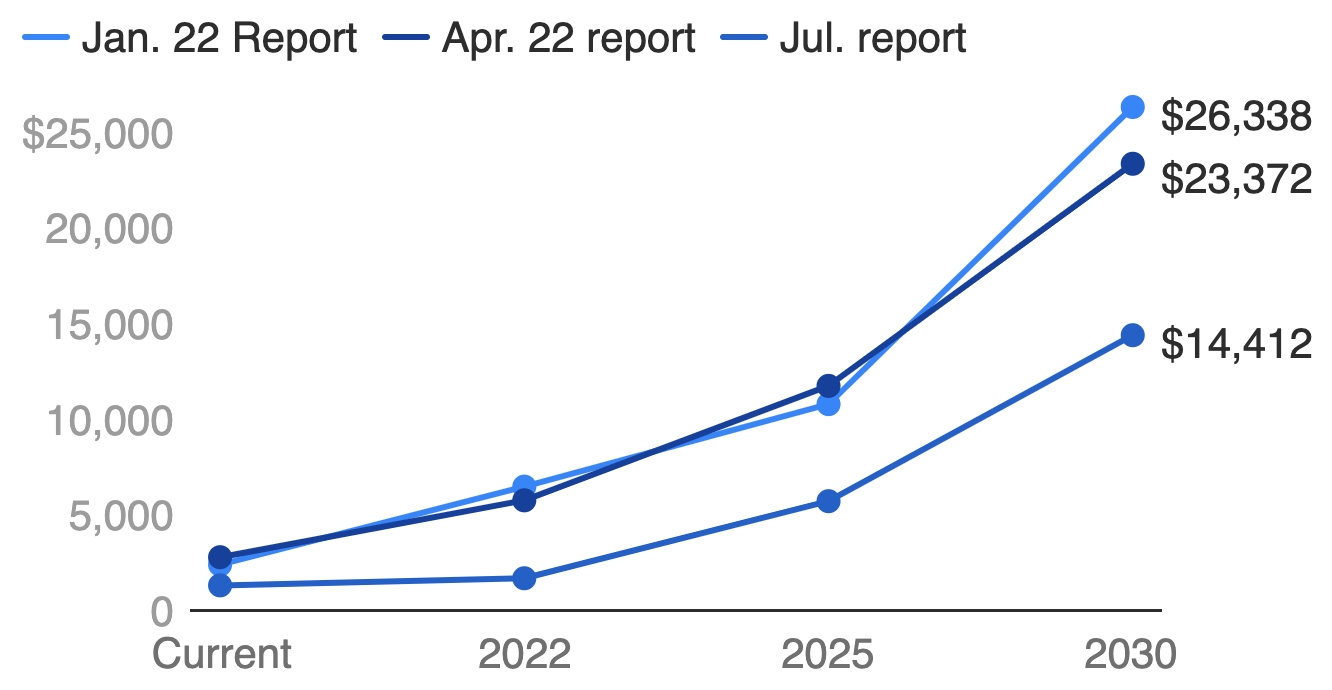

Searching further out, the typical from the panelists’ responses indicated a cost for year-finish 2025 of USD 5,739, as well as for 2030 of USD 14,412.

And even though that could seem bullish, still it marks a substantial downgrade within the cost predictions when compared with earlier surveys through the panel from The month of january and April this season.

In April, the panel predicted ETH would achieve USD 11,764 through the finish of 2025 and USD 23,372 through the finish of 2030. In The month of january, panelists were also bullish, predicting annually-finish cost for 2025 of USD 10,810 as well as for 2030 of USD 26,338.

As formerly as reported by Cryptonews.com, similar downgrades are also observed in Finder.com’s bitcoin cost predictions. As lately as April, Finder.com’s panel predicted BTC would finish the entire year at USD 65,185. Then, in This summer, the panel downgraded this conjecture, stating that annually-finish cost of USD 25,500 is much more likely.

Finder.com’s panel consists of various crypto industry players, including analysts, founders, CEOs, and academics within the field.

____

Find out more:

– Massive Liquidations Push Ethereum Greater because the Nearing Merge Boosts Sentiment

– Ethereum Merge Date Suggested for September

– Bitcoin and difficult Assets Will Win as Inflation Increases, Novogratz States and Sees BTC at USD 500K

– Bitcoin Could Fall to USD 13.6K This Season, Panel States After Modifying Predictions Once More

– Cardano Cost to Finish Year at USD .63, More and more Bearish Panel Predicts

– Crypto Winter Will Finish Before 2022 Has Gone Out – Korbit