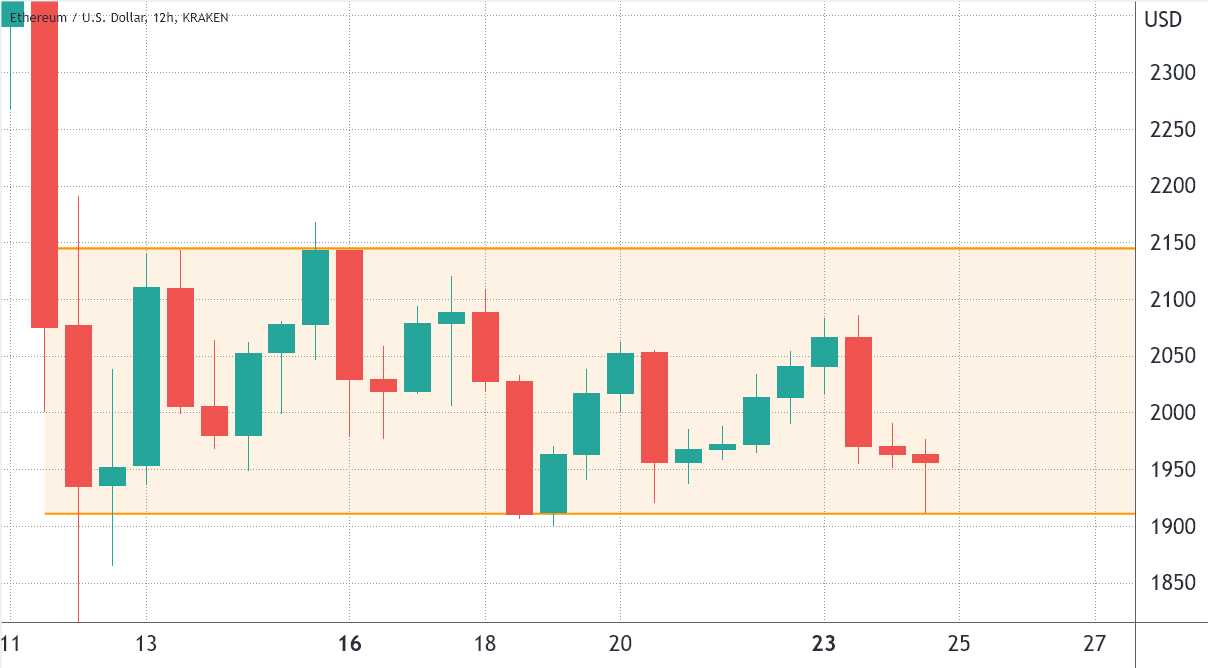

Ether’s (ETH) 12-hour closing cost continues to be respecting a good $1,910 to $2,150 range for twelve days, but strangely enough, these 13% oscillations happen to be enough to liquidate an aggregate of $495 million in futures contracts since May 13, according to data from Coinglass.

The worsening market conditions were also reflected in digital asset investment products. Based on the latest edition of CoinShare’s weekly Digital Asset Fund Flows report, crypto funds and investment products saw a $141 million output throughout the week ending on May 20. In cases like this, Bitcoin (BTC) was the investors’ focus after experiencing a $154 weekly internet redemption.

Russian regulation and crumbling U.S. tech stocks escalate the problem

Regulatory uncertainty considered on investor sentiment after an up-to-date form of the Russian mining law proposal been revealed on May 20. The document within the lower chamber from the Russian parliament no more contained the duty for any crypto mining operators registry nor the main one-year tax amnesty. As reported by local media, the legal department from the Duma mentioned these measures could “possibly incur costs around the federal budget.”

Additional pressure on Ether cost originated from the Nasdaq Composite Index’s 2.5% downturn on May 24. Additionally, the heavily-tech stock-driven indicator was pressured after social networking platform Snap (SNAP) tumbled 40%, citing rising inflation, logistics constraints and labor disruptions. Consequently, Meta Platforms (Facebook) shares fell by 10%.

On-chain data and derivatives are in support of bears

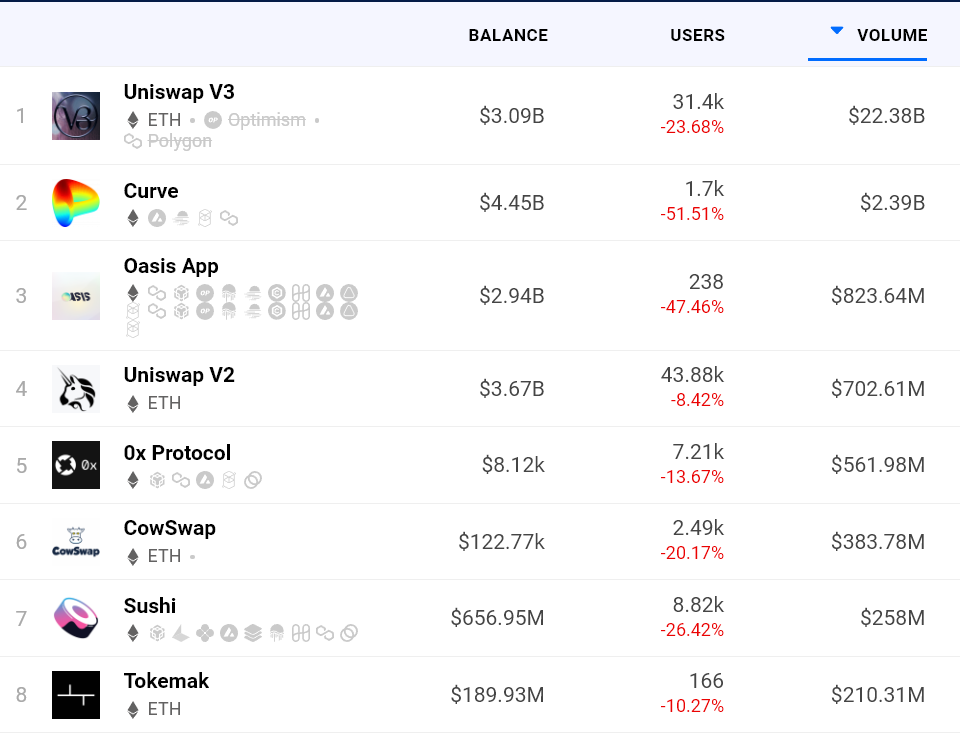

The amount of active addresses around the largest Ethereum network’s decentralized applications (DApps) has came by 27% in the previous week.

The network’s most active decentralized applications saw a considerable decrease in users. For example, Uniswap (UNI) V3 weekly addresses decreased by 24%, while Curve (CRV) faced 52% less users.

To know how professional traders, whales and market makers are situated, let us take a look at Ether’s futures market data.

Quarterly futures are utilized by whales and arbitrage desks due, mainly, for their insufficient a fluctuating funding rate. These fixed-month contracts usually trade in a slight premium to place markets, indicating that sellers request more income to withhold settlement longer.

These futures should trade in a 5% to 12% annualized premium in healthy markets. This case is technically understood to be “contango” and isn’t only at crypto markets.

Related: Bitcoin cost returns to weekly lows under $29K as Nasdaq leads fresh U.S. stocks dive

Ether’s futures contracts premium went underneath the 5% neutral-market threshold on April 6. Likely to apparent insufficient conviction from leverage buyers since the current 3% basis indicator remains depressed.

Ether may have acquired 2% after testing the $1,910 funnel resistance on May 24, but on-chain data shows too little user growth, while derivatives data point toward bearish sentiment.

Until there’s some morale improvement that reinforces using decentralized applications and also the Ether futures premium regains the fivePercent neutral level, the chances from the cost breaking over the $2,150 resistance appears low.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.