America’s housing industry may soon be facing its next bubble as home values across the nation continue being fueled by demand, speculation and lavish spending that could cause a collapse. Furthermore, many householders are opting to stay there because of climbing home loan rates, developing a housing shortage.

Data in the Federal National Mortgage Association, generally referred to as Fannie Mae, found that 92% of house owners think their current house is affordable. Yet, findings further reveal that 69% from the general population, composed of both homeowners and renters, believe it’s becoming too difficult to get affordable housing.

Web3 and also the real-estate market

As the fate from the U . s . States housing industry remains unclear, the rise of Web3 business models based on nonfungible tokens (NFTs), blockchain technology and cryptocurrency try to solve most of the problems presently plaguing America’s trillion-dollar housing market.

Jerry Chu, Chief executive officer of tokenization platform High AI, told Cointelegraph that although property is among the best asset courses of instruction for wealth creation around the world, many people can’t can get on because of three primary reasons:

“Real estate, especially today, is costly. Even when someone might get a home loan, many occasions a lower payment requires an excessive amount of cash. Real estate process can also be frustrating, as mortgages have to be approved along with a title escrow process could require two months. Finally, there isn’t much liquidity in tangible estate, therefore sellers will probably generate losses if they would like to rapidly liquidate.”

To make property attainable for that masses, Chu made the decision to produce a platform that may fractionalize qualities. Referred to as High AI, Chu described the platform is made around the Algorand blockchain and includes various turnkey rental qualities that multiple investors can fractionally buy for less than $50. “You can consider every property since it’s own small blockchain around the Algorand network. Assets, or unique tokens, are produced for each property listed. The token supply differs for the way costly the qualities are,” stated Chu.

While the idea of tokenizing property is becoming rather common — for example, Cointelegraph research lately discovered that the property sector comprises 89% of traded security tokens — Chu noticed that High is definitely an active investing platform. “Similar platforms purchase property and switch qualities to customers, but we allow investors to handle these qualities and constantly earn rewards and earnings.”

Elaborating about this, Chu described that High is dependant on a co-possession model in which the deeds for every property on the marketplace are held and of a llc, or LLC. When investors purchase tokens, they immediately enroll in that entity, meaning they possess a number of that business.

Like other decentralized finance (DeFi) platforms, High includes a governance system that enables token holders to election regarding how to manage the qualities they own. “Token holders have to achieve a supermajority election of 60% for decisions to become applied. The winning election will be delivered to the home manager to handle. These decisions could include maintenance, rent changes, eviction decisions and much more.”

Chu added that investors may also earn servings of rental earnings produced by tenants, which could be either withdrawn to some banking account or donated to Whim Housing, an inexpensive housing organization. “Most High users worry about the appreciation of the tokens around the qualities they’re buying into, and, therefore, donate their earned earnings to affordable housing programs,” Chu pointed out.

While this can be, Chu emphasized the goal behind High would be to make real estate investment readily available simply. “This appears is the situation, because the platform launched this past year and already has near to 4,000 users,” he stated. Takahito Torimoto, a solutions architect and High user, further told Cointelegraph he is a property investor for any couple of years, but High continues to be a perfect solution because of the platform’s liquidity and returns. “There aren’t any charges for users, and because of the current housing market, High seems far better for any huge a part of my ‘early retirement’ strategy,” he remarked.

Additionally to High, mortgage loan provider LoanSnap launched a mortgage-backed stablecoin on their own Bacon Protocol in the finish of this past year. Karl Jacob, Chief executive officer of LoanSnap and co-founding father of Bacon Protocol, told Cointelegraph that although a home loan-backed token solves many issues connected with stablecoins, these digital assets also benefit current homeowners and buyers.

From a technical perspective, LoanSnap has minted NFTs associated with individual mortgage liens, that are property possession legal rights that collateralize home loans. Individuals NFTs will be accustomed to back LoanSnap’s stablecoin referred to as “bHome token.” Jacob described this product is advantageous for several reasons:

“Mortgage-backed stablecoins are beneficial to homeowners and buyers because speed is all things in a genuine-estate transaction. This method works rapidly because it leverages the Ethereum blockchain. You can observe financing getting closed and funded within 24-hrs or fewer, based on condition compliance.”

Quite simply, wrapping an NFT around a home loan lien and putting that asset on the blockchain network enables anybody use of individuals records. “We supply the minimal quantity of data, so individuals are only able to begin to see the address of the property, the lien size and property value,” stated Jacob.

Jacob claimed the bHome stablecoin also reveals accessibility U.S. housing industry. “Investors that subscribe to the bHome token are gaining contact with the housing industry without getting to possess a house. This is just a swimming pool of mortgages across the nation that provides a terrific way to participate with no costs connected with homeownership.” As the platform is rather new, Jacob shared that about 30 mortgages on LoanSnap are used because of its stablecoin pool, noting the platform has given out over $seven million against its $42 million home value around the platform.

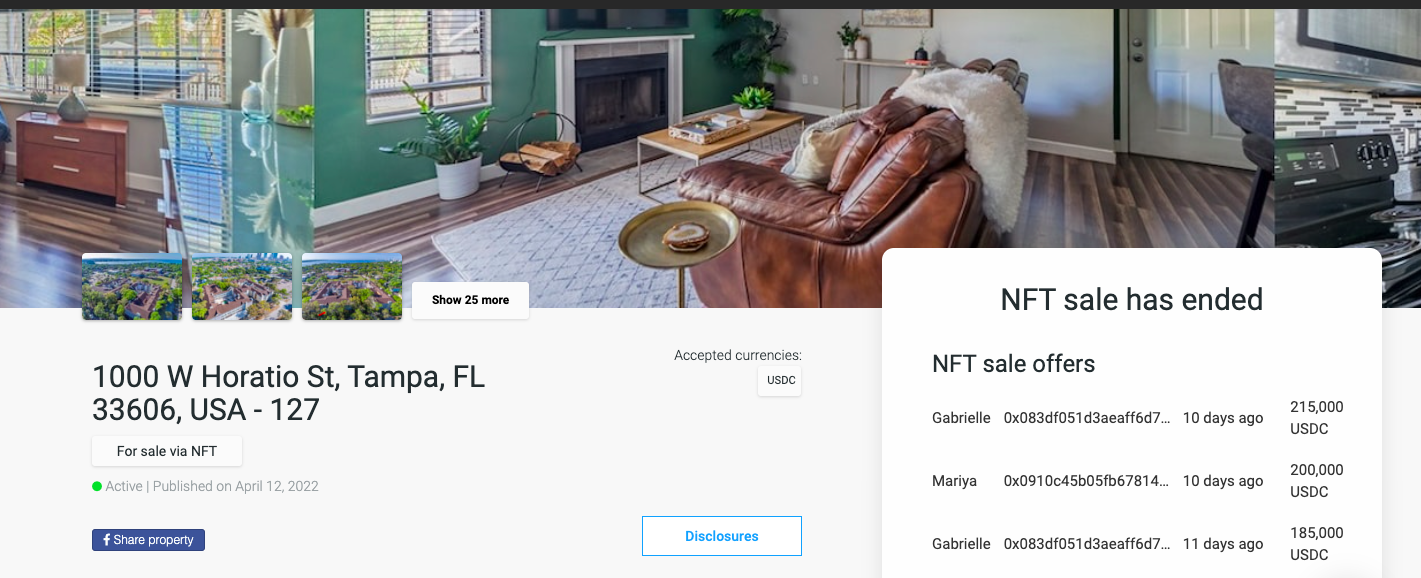

Some U.S. property qualities also have lately been offered as NFTs, an idea that appears to become attracting Generation-Z homebuyers. This will be significant, as data shows that Gen Z’s only composed 2% of home sales in 2020. Natalia Karayaneva, Chief executive officer and co-founding father of Propy — a blockchain-based property platform — told Cointelegraph that Propy has lately offered three NFT qualities: one out of Kyiv and 2 in Florida. “We are the initial platform to market property as NFTs, that has resulted in many benefits for first-time consumers,” stated Karayaneva.

On the technical level, Karayaneva described that Propy is capable of doing this by selling tokenized LLC qualities. The acquisition records for every property survive the Ethereum blockchain. When a property sells, the possession legal rights are transferred being an NFT towards the homebuyer’s wallet address. Karayaneva elaborated:

“The newest NFT property that offered in Tampa was purchased while using USD Gold coin stablecoin. Putting in a bid happened in tangible-some time and possession was transferred in fifteen minutes upon closing the purchase, which simplifies and accelerates the whole traditional real estate process. This will be significant since the U.S. housing industry is really competitive today that individuals do not have time for you to wait. NFT qualities will also be fully transparent, so prospective buyers could make informed decisions by seeing any appraisals, contingencies and other things in advance.”

Because of the transparency and fast-paced nature of NFT home sales, Karayaneva pointed out the concept is especially attractive to the more youthful generation. “The two qualities we offered in Florida attracted many Gen Z’s because you can now purchase a house using the mouse click,” she stated. Karayaneva added that older clients have expressed interest concerning how secure this method is since things are documented on an immutable blockchain ledger.

Giving homeowners use of their data with NFTs

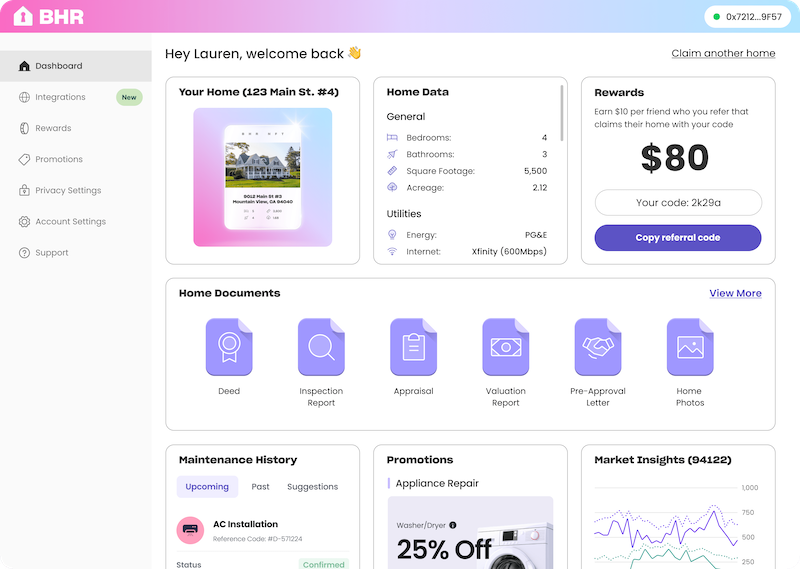

Blockchain Home Registry (BHR) is an additional Web3 project using NFTs to represent homeownership. BHR is really a DeFi platform built around the Ethereum blockchain that enables homeowners to assert a verified NFT of the property, providing them with use of a lasting, transferrable historic record of the home. James Rogers, Chief executive officer of Torii Homes — a genuine estate technology company that developed BHR — told Cointelegraph:

“While consumers own their houses, it normally won’t own the information connected by using it. For instance, a title company frequently knows much more about an owner’s home history compared to what they do.There’s an chance for the whole property industry to collaborate with homeowners to make certain individuals own the information connected using their homes.”

Rogers described that BHR enables homeowners to assert their house like a verified NFT when completed of the thorough Know Your Customer (KYC) process. Once verified, homeowners’ NFTs are put around the BHR platform, which in turn enables for organizations across real estate industry to construct services to eat data in the platform. This enables both organizations and homeowners the opportunity to monetize their data.

Zach Gorman, co-founding father of Torri Homes, told Cointelegraph that homeowners can see all of their home documents inside a dashboard around the BHR platform. “Homeowners can also add and keep their records with time and may then decide to monetize that data allowing other organizations can get on.” For instance, Gorman described that an insurer could more proficiently quote policies using data about homes for auction on BHR:

“At the same time frame, the information added would inform homeowners about risks for example fire or ton they could face. And, when another insurance provider builds an integration on the top from the data added, they’d compensate the very first company for his or her data. Whether or not the homeowner chooses to utilize the second company, the previous still wins, too.”

Gorman added that although BHR just launched on April 26, numerous homeowners and repair providers have expressed curiosity about while using platform. “The power data has not been put up for grabs before for house owners, making this an enormous chance to democratize might put power back to homeowners’ hands.”

Challenges may hamper adoption

While Web3 solutions might help solve most of the challenges presently facing homeowners and buyers, it remains questionable regarding the way the mainstream will respond to these innovations.

For example, Karayaneva shared that qualities offered as NFTs through Propy should be purchased while using USD Gold coin (USDC) stablecoin, yet this can be challenging for non-crypto natives. Despite the fact that Karayaneva pointed out that Propy helps facilitate the change in fiat to USDC, users who would like to buy an NFT home might also find it too difficult because of the fact that loans can’t be removed. “Currently, we’re only accepting full cash offers, but we’re focusing on incorporating a strategy to get crypto enabled mortgages around the place,” stated Karayaneva.

Furthermore, obtaining the mainstream to consider blockchain solutions can also be complicated. For example, Rogers described that BHR is initially launching with MetaMask. Although it’s notable that MetaMask’s monthly average users list keeps growing, MetaMask along with other popular crypto wallets are susceptible to adware and spyware attacks and hacks.

Theoretically speaking, it’s important to indicate that the majority of the Web3 solutions pointed out derive from the Ethereum blockchain, that is infamous for top gas charges. Jacob shared that, when using the Ethereum network continues to be advantageous for Bacon Protocol, they behind the work has labored difficult to hide high gas charges from bHome purchasers. However, Chu stated he made a decision to build High around the Algorand blockchain because of its low gas charges. “Lofty transmits small gets in user’s wallets regularly, therefore if it was built on another chain rich in gas charges that will cost a lot more,” he stated.

Finally, it’s important to indicate that legalities may arise when applying NFTs and DeFi standards to property transactions. With this thought, Jacob shared that LoanSnap conducted massive levels of research when thinking about the regulatory components connected having a mortgage-backed stablecoin. “LoanSnap is controlled and audited through the condition, so finances rules in position. The issue people ask is if this sounds like a burglar, however the interesting factor about mortgages is they aren’t securities.”

Challenges aside, Rogers stated that homeowners and buyers using Web3 solutions like BHR do not need to completely comprehend the components behind the platforms, they simply need to realize that they work. “When I explain BHR, individuals are interested even when it normally won’t know much about NFTs and blockchain. The concept here’s to onboard new users towards the Web3 space and transform the standard property industry. It is exactly what excites us.”