Governance tokens are a kind of cryptocurrency that permit tokenholders to election around the direction of the blockchain project. The main reason for governance tokens would be to decentralize decision-making and also to give holders a say in the way the project operates.

Governance tokenholders are often more committed to the project’s success because they are in position to gain or shed more pounds, with respect to the outcome. Community people may use tokens to help the direction featuring of the blockchain protocol directly. As a result, you’ll be able to implement changes associated with the consumer interface, election on charges and reward distribution, or perhaps customize the underlying code of the project.

Although most decentralized finance (DeFi) tokens are governance tokens, voting isn’t their only defining feature. People possessing these governance tokens may use them to get loans, stake them and make money through yield farming. Given all of this, their primary function continues to be to distribute power.

Governance tokens really are a relatively recent invention, and there’s still much debate regarding their effectiveness. Some believe those are the answer to true decentralization, while some worry that they’ll result in the centralization of power among a little number of tokenholders.

How can governance tokens work?

Governance tokens behave as the building blocks to determine decentralized governance in decentralized autonomous organizations (DAOs), DeFi projects and decentralized applications (DApps).

Users who’ve made significant contributions towards the community and have shown loyalty are often awarded governance tokens. Tokenholders then election on key issues to make sure that the projects progress effectively. Generally, people election by utilizing smart contracts so the answers are tabulated and enacted instantly.

Each project features its own group of governance token rules. They’re spread to stakeholders, such as the founding team, investors and users, using various calculation methods.

Some governance tokens only election on the small group of governance issues, while some election on from development updates to smart contract revisions. Similarly, some governance tokens have the choice of generating financial returns others don’t.

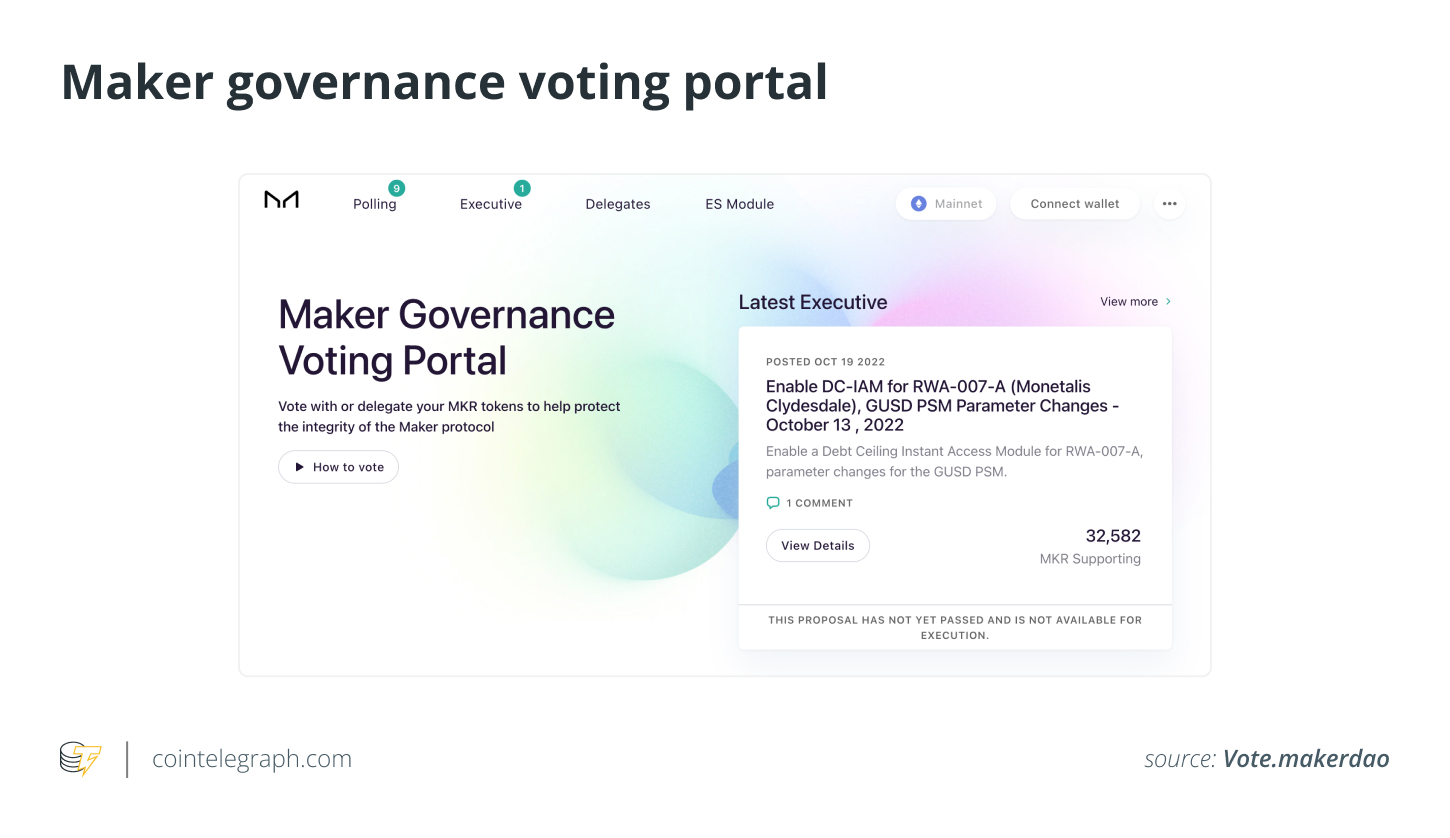

The Ethereum-based DAO, MakerDAO, was one of the primary issuers of governance tokens. MakerDAO’s stablecoin is known as Dai (DAI), while Maker (MKR) tokenholders govern the protocol itself. One token means one election, and decisions most abundant in votes are adopted.

Among the kinds of problems that MKR tokenholders election on are charges, rules and team member appointments. Ultimately, the aim would be to maintain DAI’s stability, transparency and efficiency.

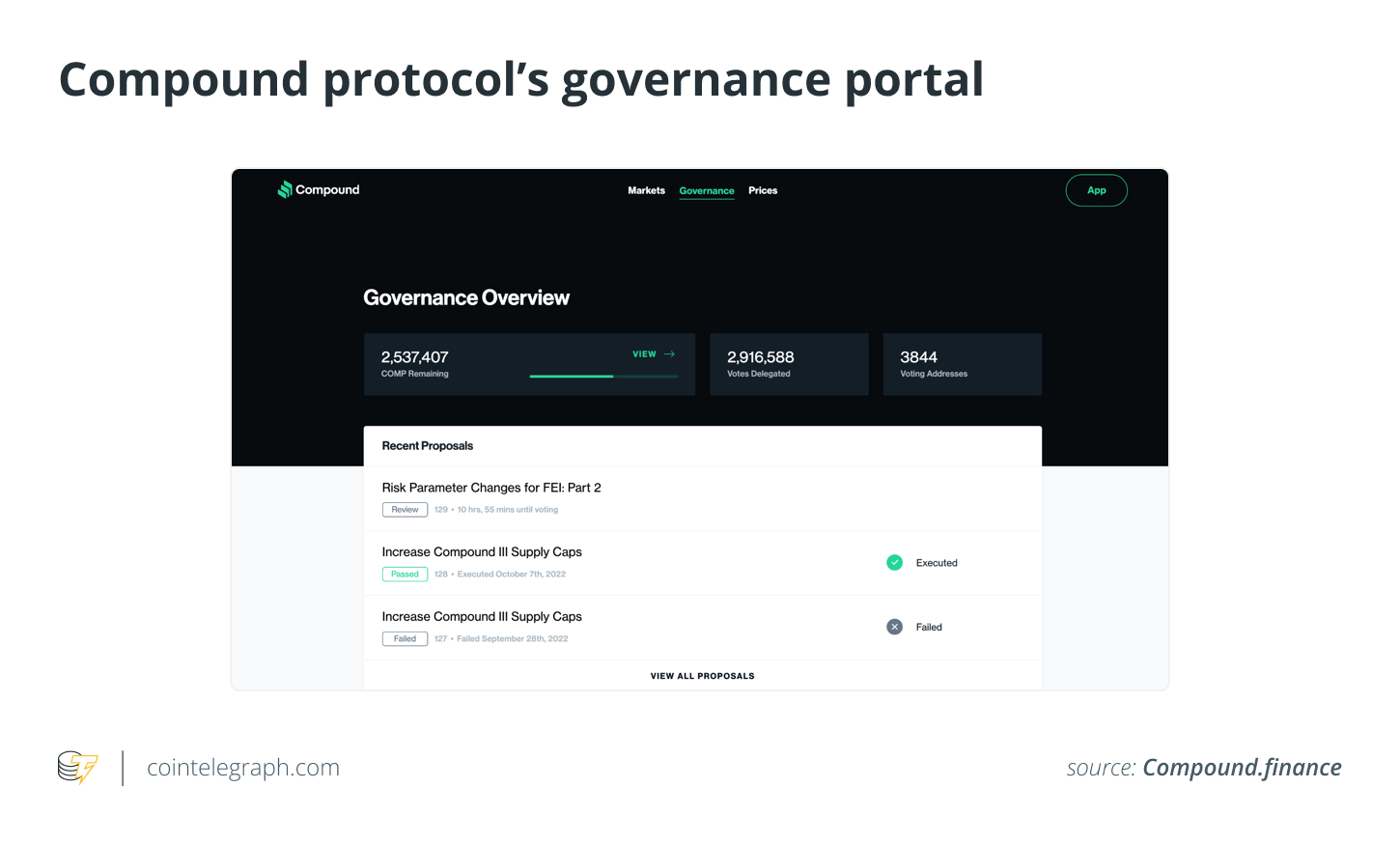

Another illustration of a protocol having a governance token is Compound, a DeFi protocol that enables users to gain access to or lend cryptocurrencies. The protocol includes a governance token known as Compound (COMP), which tokenholders may use to select important protocol-related matters.

The amount of COMP tokens users receive is dependant on their activity levels inside the Compound network. That stated, users who lend and borrow more frequently is going to be rewarded with increased COMP tokens. The COMP token is the same as one election on Compound. The tokens may also be delegated to other people to election in your account.

In 2020, Compound threw in the towel charge of the network’s admin key and also the project has become entirely controlled by its tokenholders with no other governance methods.

What’s the distinction between governance and utility tokens?

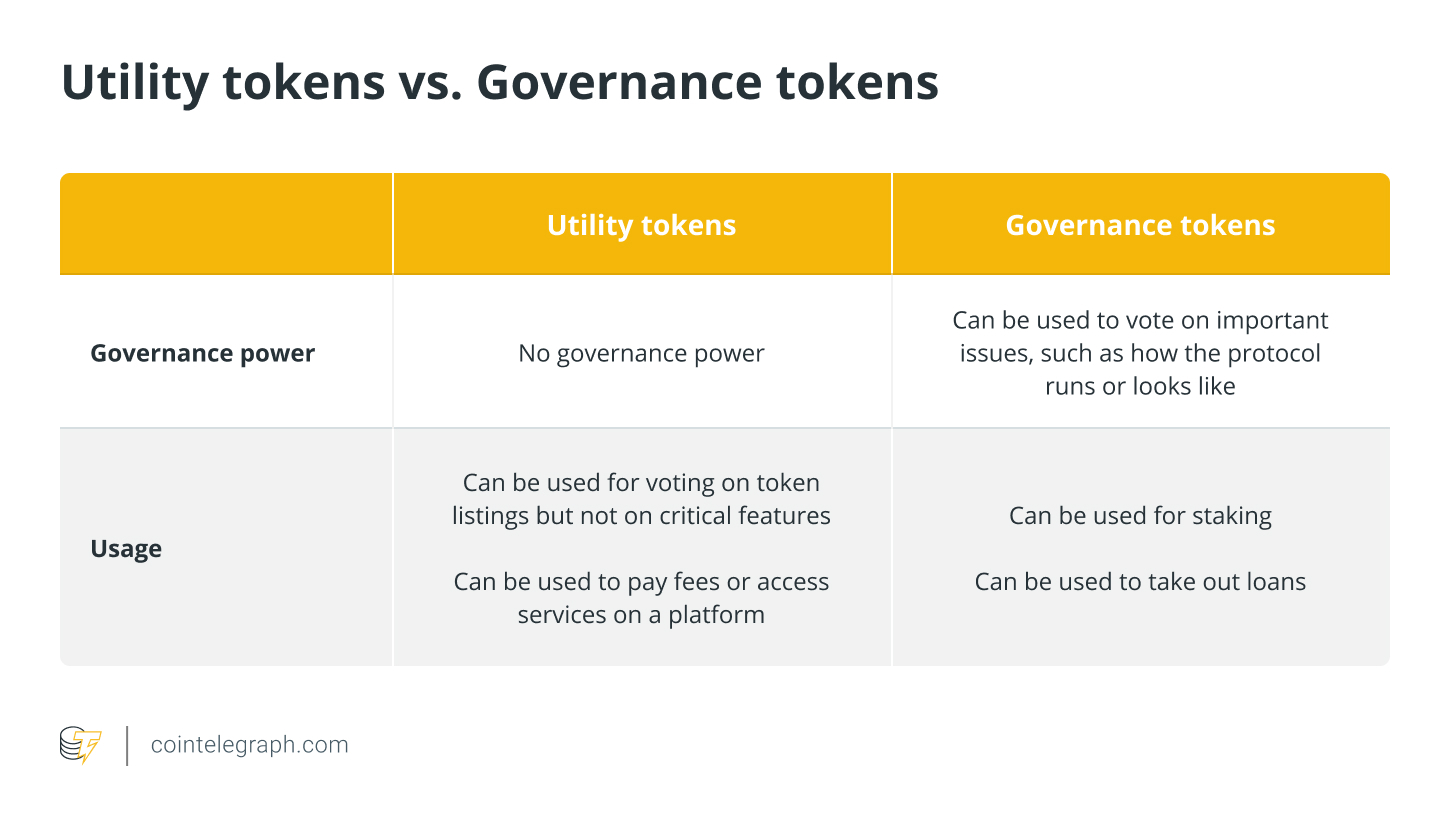

Utility tokens are digital assets you can use for any specific purpose, for example fee payment or use of a service or product. In comparison, governance tokens provide the holder a say in the way the project operates.

A software application token’s purpose is generally encompassed inside the native blockchain network or crypto platform where it had been purchased. BNB (BNB) is a great one of the utility token. It’s utilized on Binance to pay for charges, election on new token listings and pay tickets or “entrance fees” for features such as the Binance Launchpad.

The important thing distinction is the fact that utility tokens don’t carry any governance power. Utility tokens are a good choice for many purposes, but governance tokens could be the better option in some instances. As pointed out before, governance tokens may also be used for staking and getting loans. This will make them handier than utility tokens, mostly employed for transactions.

What exactly are the pros and cons of governance tokens?

Governance tokens are a way to decentralize a task and provide users a motivation to sign up, but they may be complex and available to abuse. Among the key benefits of governance tokens is decentralization. In reality, those are the best way developers can use decentralization within the DeFi ecosystem. Without one, there’d not be any method for users to possess a say in the way the project operates.

An additional advantage of governance tokens is they incentivize users to remain associated with the work. If your user holds COMP tokens, for instance, they may wish to carry on using the Compound platform to earn more COMP tokens. This results in a virtuous circle where users are incentivized to make use of the woking platform, growing the platform’s value.

Governance models also permit more effective development, as developers could work on features the community wants. In traditional development models, developers need to spend considerable time and sources on features that won’t be also used.

There’s also some risks and drawbacks connected with governance tokens. One is they could be complex, which makes it challenging for users to know the way they work. For instance, some protocols have multiple token types with various functions. This complexity can result in user indifference, as users might not want to concern yourself with voting in order to take part in governance when they don’t experience how it works.

Another disadvantage is the fact that many people may abuse their ability. If your user holds a lot of COMP tokens, they are able to easily sway the election within their favor. This can lead to decisions being made that aren’t within the needs from the platform in general. Could also be too little accountability, meaning when a choice happens to be bad, there’s no one that will take place responsible.

Are governance tokens valuable?

Governance tokens are effective simply because they give holders a say in the way the project develops. In addition, governance tokens can improve business efficiency. Consequently, the whole organization can become more effective and effective.

Additionally, governance tokens have value and could be traded, swapped, exchanged, staked, etc. They’re also an excellent chance to earn passive earnings. Stake governance tokens might also earn users additional benefits, for example elevated use of services or a bit of the protocol’s profits. If this sounds like the situation, aquiring a governance token resembles getting a be part of an income stream.

So, how can governance tokens gain value? There’s a couple of ways. One would be that the tokens will end up worth more because the project gets to be more effective. For example, new blockchain games usually offer early adopters an opportunity to later stake their governance tokens in return for game revenue. Within this situation, despite the fact that a governance token might not appear to possess much value initially, it might be worth much more later on.

A decentralized protocol may also greatly increase the need for its governance tokens by buying back tokens. This reduces the amount of tokens in circulation, making each worth more.

Buy a licence with this article. Operated by SharpShark.