There’s valid reason to become afraid. Previous lower markets have experienced declines more than 80%. While tightfisted hodling might hold knowledge among many Bitcoin (BTC) maximalists, speculators in altcoins realize that gemstone handing often means near (or total) annihilation.

No matter one’s investment philosophy, in risk-off environments, participation flees the area with haste. The purest in our midst might visit a silver lining because the devastation clears the forest floor of weeds, departing room for that most powerful projects to flourish. Though, doubtlessly, there are lots of saplings lost who’d grow to great heights themselves when they were built with a chance.

Investment and curiosity about digital asset space are water and sunlight towards the fertile ground of ideas and entrepreneurship. More gentle declines better serve the marketplace better an outdoor than the usual desert.

A history of crypto bear markets

To be able to solve an issue, we have to first understand its catalyst. Bitcoin and also the wider digital asset space have survived numerous bear markets since its beginning. By a few accounts, based on one’s definition, we’re presently in # 5.

The very first 1 / 2 of 2012 was fraught with regulatory uncertainty culminating within the closure of TradeHill, the 2nd-largest Bitcoin exchange. It was adopted through the hacks of both Bitcoinica and Linode, leading to thousands of Bitcoin lost and shedding the marketplace by a few 40%.¹ But, the cost rebounded, although briefly, finding new heights above $16 until further hacks, regulatory fears and defaults in the Bitcoin Savings and Trust Ponzi Plan collapsed the cost all over again, lower 37%.¹

The passion for that new digital currency didn’t stay lengthy covered up, as BTC rose again to locate equilibrium around $120 for that better area of the the coming year before rocketing to in excess of $1,100 within the last quarter of 2013. And, just like dramatically, the seizure from the Silk Road through the DEA, China’s Central Bank ban and also the scandal round the Mt. Gox closure sank the marketplace right into a viciously protracted retracement of 415 days. This phase lasted until early 2015, and also the cost withered to some mere 17% from the previous market highs.¹

After that, growth was steady until the center of 2017, when enthusiasm and market mania launched Bitcoin cost in to the stratos, peaking in December at nearly $20,000. Eager profit-taking, further hacks and rumors of nations banning the asset, again, crashed the marketplace and BTC languished within the doldrums for more than a year. 2019 introduced an encouraging escalation to almost $14,000 and ranged largely above $10,000 until pandemic fears dropped BTC below $4,000 in March 2020. It had been an astounding 1,089 days — nearly three full years — prior to the crypto market obtained its 2017 high.²

But, then, as numerous within the space have memed, the cash printer went “brrrrrr.” Global expansionist financial policy and fears of fiat inflation given an unparalleled increase in asset values.

Bitcoin and also the greater crypto market found new heights, topping out at nearly $69,000 per BTC and also over $3 trillion within the total asset class market capital at the end of 2021.²

By June 20, the pandemic liquidity has dried out. Central banks are hiking rates as a result of worrying inflation figures, and also the greater crypto market has a total investment of the relatively meager $845 billion.² More worrying still, the popularity signifies much deeper and longer crypto winters, not shorter, suitable for a far more mature market. Doubtless, this really is mainly brought on by the inclusion of and speculative mania round the high-risk start-ups define some 50% to 60% from the total digital market cap.²

However, altcoins aren’t entirely responsible. The 2018 crash saw the Bitcoin cost drop 65%.⁴ Growth and adoption of crypto’s apex asset have elevated regulatory alarms in lots of countries and questions regarding the sovereignty of national currencies have adopted.

How you can mitigate risk on the market?

So, it’s risk, obviously, that drives this undue downward volatility. And, we’re inside a risk-off atmosphere. Thus, our youthful and fragile garden wilts first one of the much deeper-rooted asset classes of convention.

Portfolio managers are really conscious of this and therefore are needed to balance a sliver of crypto investment having a bigger slice of safe-haven assets. Retail investors and professionals alike frequently drop their bags entirely in the first manifestation of a bear, coming back to traditional markets in order to cash. This reactionary strategy is viewed as an essential evil, frequently at the fee for incurring short-term capital gains tax, and vulnerable to missing significant unpredictable reversals, that is chosen over the devastating and protracted declines of crypto winter.

Must it’s so?

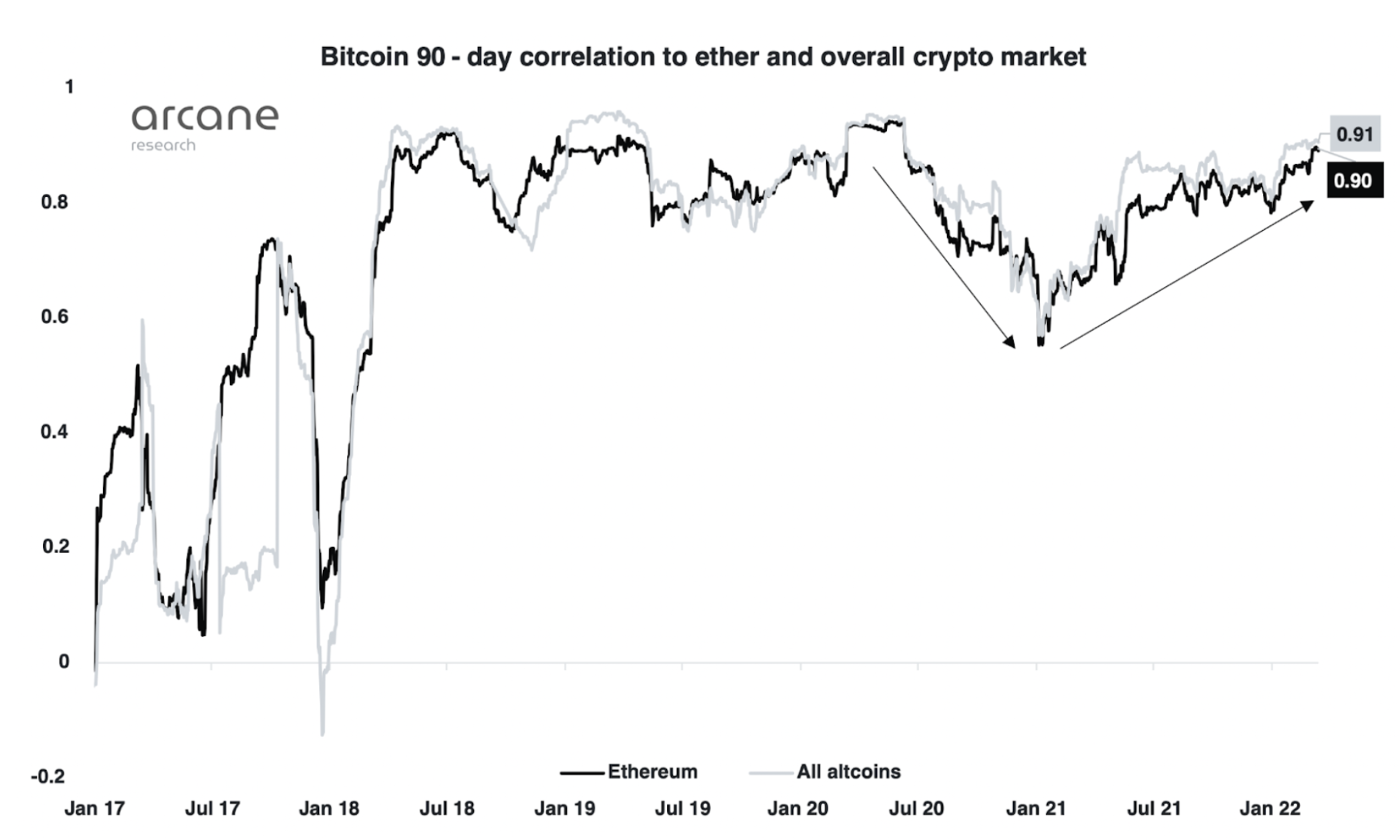

So how exactly does a good thing class so driven by speculative promise de-risk enough to help keep interest and investment alive within the worst of occasions? Bitcoin-heavy crypto portfolios fare better, comprising a greater number of minimal volatile from the major assets. Nevertheless, having a .90+ correlation of Bitcoin towards the altcoin market, the wake of crypto’s most dominant currency frequently works as a churn to smaller sized assets caught within the same storm.

Many flee to stablecoins in dire occasions, but, as evidenced through the recent Terra disaster, they essentially hold more risk than their fiat peg. And, commodity-paired tokens are burdened with similar concerns natural holiday to a digital asset: trust — whether it is inside a marketplace or its business entity — regulatory uncertainty and technological vulnerabilities.

No, just tokenizing safe-haven assets won’t supply the stable yang towards the volatile yin from the crypto market. When fear reaches an optimum, an inverse cost relationship, not just neutrality, should be achieved to retain purchase of crypto and also at coming back that justifies the adoption of the natural risk.

For individuals ready, inclusion from the inverse Bitcoin exchange-traded funds (ETFs) provided by BetaPro and Proshares provides a hedge. Similar to engaging short positions, however, ease of access hurdles and charges make these solutions even more unlikely to sustain the typical investor with the bear market.

Further, more and more controlled and compliant centralized exchanges are earning leveraged accounts and crypto derivatives unreachable to a lot of within the bigger retail markets.⁵

Decentralized exchanges (DEXs) are afflicted by the constraints of anonymity and solutions offered for shorting mechanisms on such have largely needed a centralized exchange to operate in collaboration. And, moreover, both solutions functionally don’t support value retention within the crypto market directly.

Are crypto safe-haven assets enough?

The reply to the mass exodus of purchase of the crypto bear market should be based in the assets themselves, not within their derivatives. Getting away the natural risks pointed out above may be, within the medium-term, impossible. But, regulatory clarification is guaranteed and debated around the world. Centralization and technical risks have found new mitigations through decentralized autonomous strategies and also the engagement of the ever-more discerning crypto-savvy investor.

Through many experiments and trials, crypto entrepreneurs continuously bring real methods to the forefront. Applying blockchain technology that find substantial adoption in lower-market “defensive” industries for example healthcare, utilities and also the purchase or manufacture of consumer staples provides an alternative choice to flight. Such development ought to be encouraged during these uncertain occasions. Rather, through the knowledge from the market, such uncertain occasions should encourage this development.

However, resourcefulness shouldn’t be restricted to just tokenizing the feeble solutions from the conventional markets. This can be a ” new world ” with new rules and options. Programmatically incentivized inverse mechanisms are achievable, in the end.

Synthetix’s Inverse Synths desire to just do that, however the protocol sets both a ceiling and floor cost, as well as in this kind of event, the exchange rates are frozen and just exchangeable on their own platform.³ A fascinating tool without a doubt but unlikely to be employed through the greater crypto market. True solutions is going to be broadly accessible both geographically and conceptually. Instead of supplying just a dry spot to wait the lower-market storm, crypto solutions must give a go back to justify the danger still natural to the developing asset class.

What is the silver lining towards the bear market? Will the survivors of crypto-winter emerge inside a market more rewarding for application and adoption than speculation? Healthy pruning might be precisely what our youthful garden requires a protracted drought is surely unnecessary. Lower financial markets are just a problem and, using the clever use of blockchain technology, hopefully, a soluble one.

Disclaimer. Cointelegraph doesn’t endorse any content of product in this article. Basically we are designed for supplying all of you information that people could obtain, readers must do their very own research when considering actions associated with the organization and bear full responsibility for his or her decisions, nor this short article can be viewed as being an investment recommendations.

Trevor is really a technology consultant, entrepreneur and principal at Positron Market Instruments LLC. He’s consulted for corporate planning teams within the U . s . States, Canada and Europe and believes that blockchain technology supports the commitment of a far more efficient, just and egalitarian future.

¹A Brief Good reputation for Bitcoin Bear Markets by Mosaic – Medium

² Crypto Total Market Cap (Ticker: CRYPTOCAP): Calculated by TradingView

³ Travers, Garth (This summer 19, 2019). “Inverse Synths have returned”

⁵ Newbery, Emma (August 3, 2021). “Why a multitude of crypto exchanges unavailable in america?”