Ethereum blockchain shifted from the proof-of-work (Bang) to some proof-of-stake (PoS) consensus mechanism on Sept. 15, 2022. In addition to this move, ETHPoW, a definite Bang blockchain (essentially that old pre-Merge Ethereum) forked from Ethereum’s Merge, grew to become live. This forked form of Ethereum aims to keep the proof-of-work mining process for ETH miners.

Any miner is allowed to include a block towards the Bang network using the obvious stipulation the first valid block printed is the most appropriate one. The truth is, several legitimate block is from time to time discovered through the network because of the latency of information propagation, creating numerous branches from the blockchain known as a fork.

This information will discuss the proof-of-work Ethereum fork, a brief history of Bang Ethereum and also the variations between ETH and ETHW.

What’s ETHPoW (ETHW)?

The lengthy-anticipated “The Merge” upgrade for Ethereum reduced the requirement of miners. It replaced all of them with validators who stake Ether (ETH) instead of using pricey and-intensive devices to secure the network, considerably growing the cryptocurrency’s energy-efficiency. However, in front of the Merge, a tough fork from the Ethereum network, known as ETHW, which still uses the Bang consensus mechanism, was produced, resulting in a triumph for ETH miners.

But who’s behind ETHW? Chinese miner Chandler Guo opposed the PoS consensus method and launched the Bang-based Ethereum blockchain. Although allowing the Bang Ethereum chain might be a victory for miners over stakers, ETHW users endured ease of access issues.

The chain ID that ETHPoW used is 10001, however it had been being used with a Bitcoin Cash testnet. Consequently, the MetaMask cryptocurrency wallet users faced issues because the Chain ID, serving as an identifier, couldn’t differentiate between two separate blockchains.

Chain IDs could be selected when needed because there’s no central repository or registry, but pre-hard fork testing might have found the contradiction, whereas they behind ETHW overlooked the problem. Regardless of this, crypto exchanges like Binance and Coinbase demonstrated support for ETHW. For example, Binance announced its ETHW mining pool, stating that it’ll be susceptible to exactly the same review process as other cryptocurrencies.

Related: Exactly what is a cryptocurrency mining pool?

So how exactly does Bang Ethereum (ETHW) work?

The first form of the Ethereum network (i.e., Ethereum Classic) took it’s origin from the Bang consensus method. However, this version was hard forked to secure the network because of the DAO hack. EthereumFair and EthereumPOW would be the other two hard forks of the initial Ethereum blockchain that continuously use proof-of-work mining.

Proof-of-work cryptocurrencies like Bitcoin (BTC) are promoted like a censorship-resistant, trustless kind of digital money produced after one individual or perhaps a small group solve a mathematical puzzle and propose a brand new block. However, to avoid any select few of miners from enacting rules that will weaken the potential to deal with censorship, many non-colluding miners should be processing transactions.

Similarly, to prevent anybody from mistreating the machine, ETHW miners may also still solve arbitrary mathematical challenges to validate transactions and mine new tokens. In exchange, they’ll be rewarded with ETHW, the native focal point in the ETHPoW chain.

Buying Bang Ethereum (ETHW)

Crypto buying and selling platforms like Crypto.com and exchanges for example Coinbase and Binance are types of a couple of places where ETHW supporters can purchase proof-of-work Ethereum tokens.

For example, Binance formally launched Binance Pool’s fee-free Ethereum ETHW mining service that provides ETHW withdrawals for any short time. However, please be aware that ETHW deposits aren’t possible. On Binance Convert, users can sell ETHW against BUSD and USDT.

The fundamental steps needed to purchase ETHW in your selected platform include:

- On line in your selected platform/exchange and verify your identity.

- Following the identity verification process is effective, deposit funds.

- Users can turn to the buying and selling section and purchase ETHW after their account continues to be funded.

Why do people use Bang Ethereum? Proof-of-stake critics prefer proof-of-work because they have committed to costly mining equipment, and also the shift to some PoS network will give them no revenue.

How you can store Bang Ethereum (ETHW)?

Software or hardware wallets may be used to keep ETHW. Hardware wallets offer more security than software wallets because the money is stored offline using wallets like Ledger Nano S. Crypto proprietors with software wallets retain child custody of the private keys instead of letting them take place through the exchange.

Related: Ethereum wallets: A beginner’s help guide to storing ETH

Users who’re mostly from their Computers may choose mobile wallets to keep ETHW or other cryptocurrency. However, the initial owner may lose funds when the system is have contracted adware and spyware. Alternatively, it’s possible to use paper wallets that store public and private keys and QR codes on certificates. Again, when the document that contains this post is lost or grouped into the hands of unauthorized users, the owner’s ETHW can’t be retrieved.

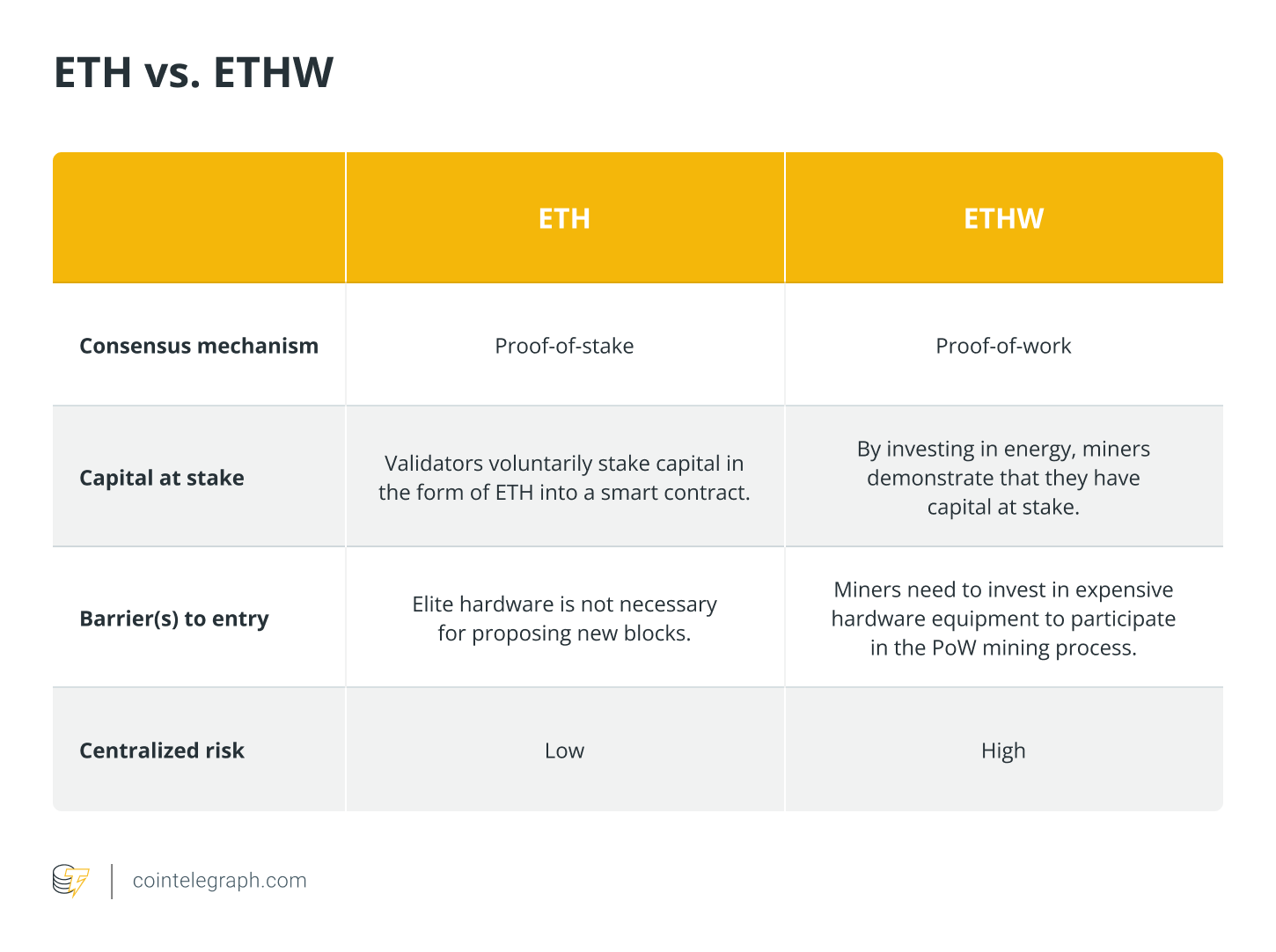

ETH versus. ETHW

Following the Merge, the Ethereum network was split up into two versions: ETH, which utilizes the PoS consensus formula, and ETHW, which utilizes the older Bang formula. That stated, ETHW miners receive rewards by means of Ethereum tokens by solving complicated mathematical puzzles, whereas validators will have to stake ETH for revenue purposes.

ETHW attracts miners because with no proof-of-work consensus mechanism, they might go under as new tokens will be included to the blockchain through the staking process. However, the proof-of-stake blockchain isn’t a substitute for that original Ethereum blockchain but instead a merge from the execution (mainnet) and consensus (Beacon chain) layers.

The variations between ETH and ETHW are mentioned within the table below:

Way forward for Bang Ethereum

The Bang consensus scheme’s incentive structure necessitates the network’s miners to do many hashes to get the first functional block hash, leading to unsustainable energy use. Furthermore, the consensus mechanism adjusts the block hash difficulty upward because the network’s processing power grows, resulting in a greater network-wide hash rate.

Furthermore, the power utilized by unsuccessful miners would go to waste, leading Ethereum to maneuver to some proof-of-stake consensus mechanism. Although ETHW attracts miners because they have committed to hardware mining equipment, the PoS consensus technique is less energy-intensive and enables systems to scale inexpensively.

Proof-of-stake continues to be in the infancy, potentially revolutionizing blockchain security and rendering mining obsolete. But it’s not yet been seen if PoS consensus algorithms can lead to the entire cessation of Bang mining.

Buy a licence with this article. Operated by SharpShark.