The Ethereum Merge came and went, departing investors to ponder exactly what the next trending development on the market could seem like. Inside a Cointelegraph Twitter Space with Capriole Fund founder Charles Edwards, the analyst pointed out that excitement within the Ethereum Merge and it is bullish cost action had somewhat been supporting hope over the market. Since the big event originates and gone, the crypto market continues to be selling off, with Bitcoin’s (BTC) cost buying and selling below $20,000 and Ether’s (ETH) under $1,500.

Eventually, new narratives and market trends will emerge, and when the basic principles are right, traders will rotate funds because these new leaders emerge.

Let’s check out a couple of potential trends.

Which side the previous ETH miners go?

The Ethereum network effectively now use an evidence-of-stake (PoS) model, meaning miners are up front but nonetheless possibly owning their GPUs and ASICs mining infrastructure. It’s entirely possible that some miners might want to mine on the different chain rather of promoting their gear.

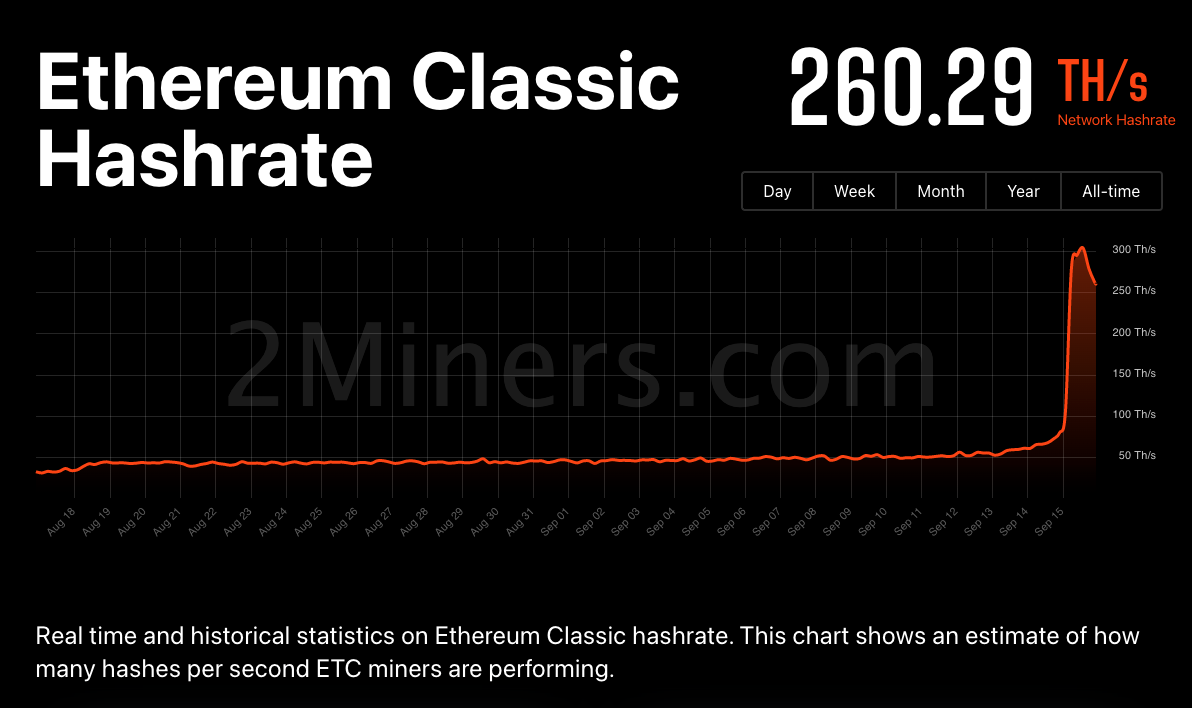

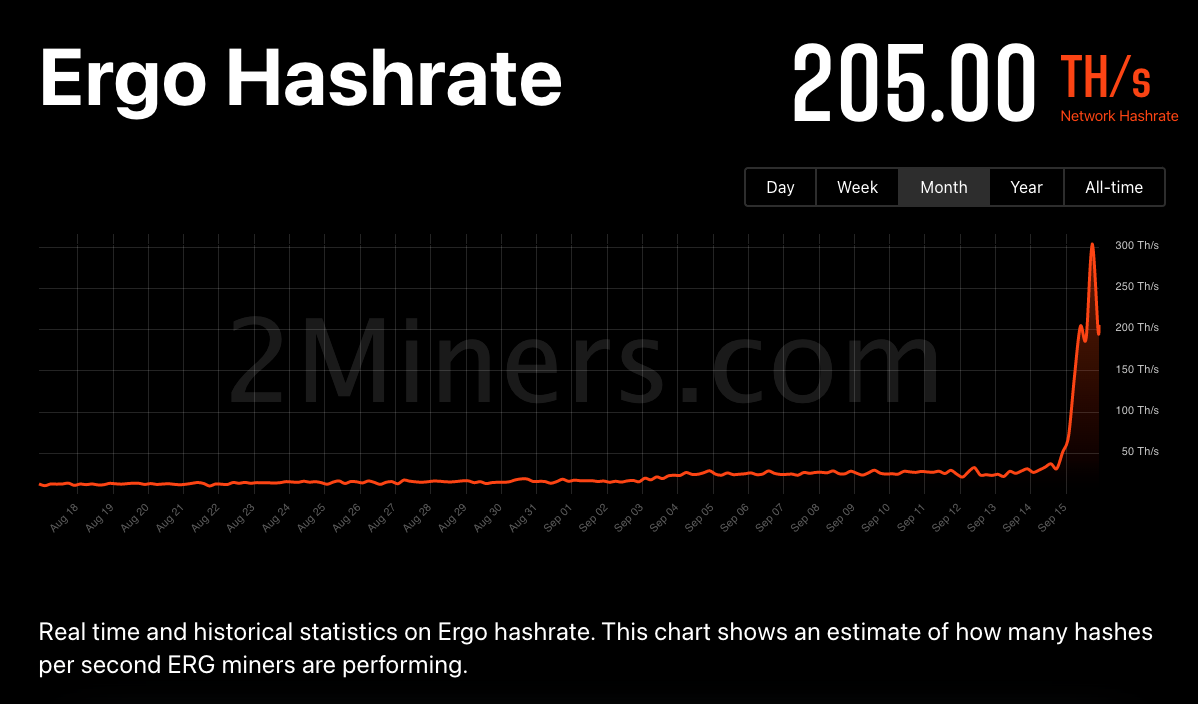

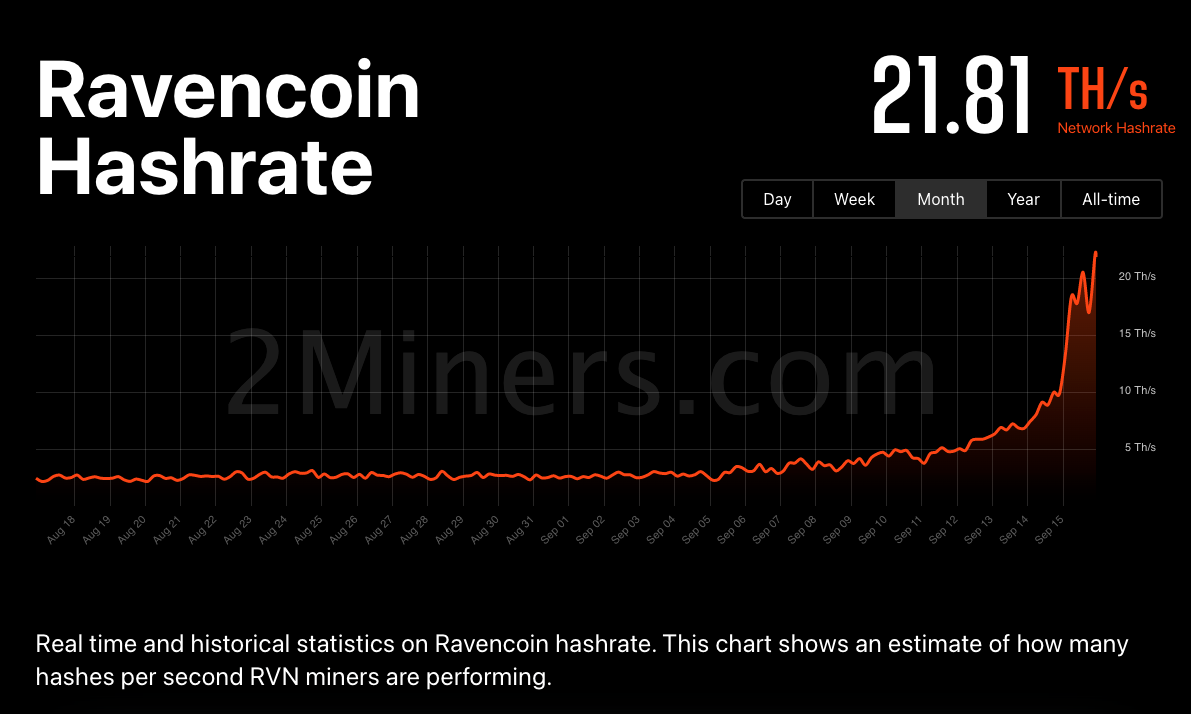

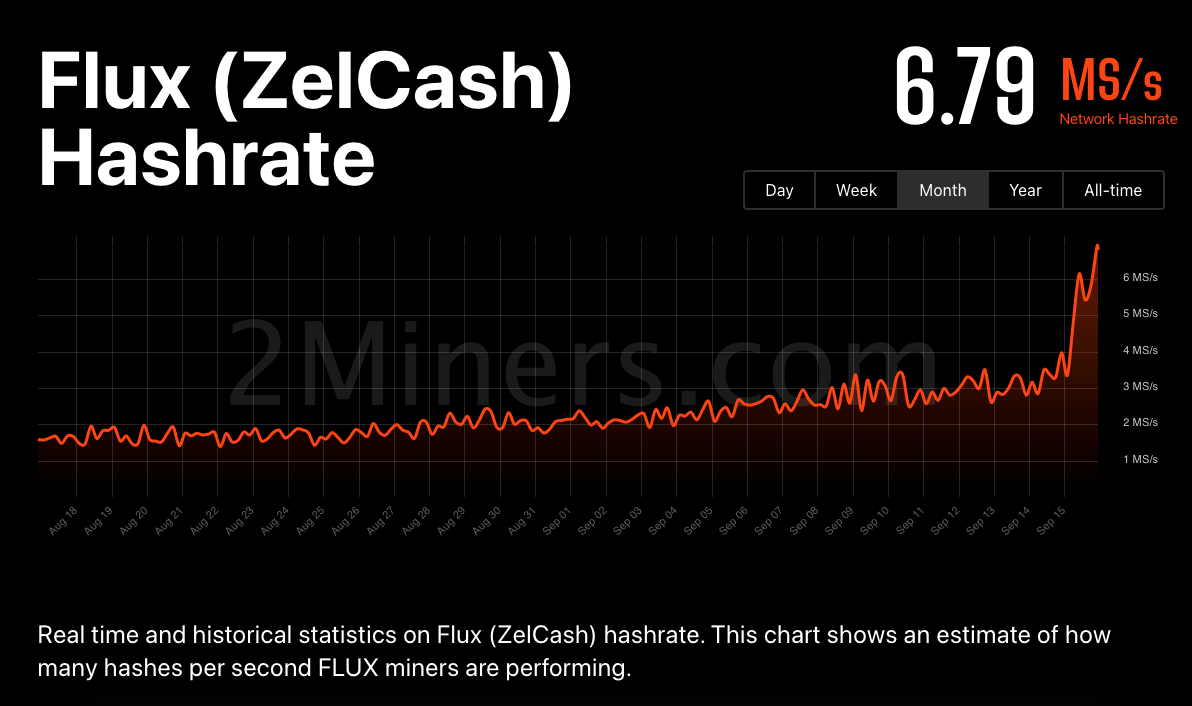

When they haven’t chosen any particular chain at this time, Ravencoin, Flux, Ethereum Classic and Ergo appear is the frontrunners. Leading in to the Merge, each network saw its hash rate rise to new all-time highs, as proven below.

Prices of every altcoin also rallied in the last month, with Ravencoin’s RVN up 169%, Ergo’s ERG added 132%, Flux acquired 156%, and Ethereum Classic’s ETC rallied 135% previously 90-days.

Interestingly, the hash rate and cost dropped dramatically on Sept.15, and during the time of writing, just Flux and RVN seem to be rebounding. Within the coming days and several weeks, it will likely be interesting to determine what network miners possibly select his or her new house and also the impact it has around the cryptocurrency’s cost.

The Cosmos is constantly on the expand

The Cosmos ecosystem is constantly on the expand, which seems to become attracting buyers to ATOM. Since bottoming at $5.50 on June 18, ATOM’s cost has acquired 137.5% and, presently, is buying and selling above $16. Analysis shows that investors see the soon-to-launch liquid staking, ATOM getting used as collateral for stablecoin minting, the launch of Cosmos Hub 2. and also the eventual recovery of decentralized finance generally as bullish lengthy-term factors for ATOM cost.

Purchase the rumor then sell this news, or purchase the dip?

While ETH’s current cost action is less bullish than Merge supporters and ETH bulls may have wished, the particular shift to PoS seems to possess been successful, and possibly with time, the advantages of PoS will mean bullish cost action from ETH. Based on Jarvis Labs co-founder Ben Lilly, the “Joe Awesome move” for ETH investors isn’t to “get distracted by the the future. The primary player that will probably do any kind of crazy activity is the miner. And that’s a 1-off event that will be short-resided.”

Lilly described that:

“The Joe Awesome move would be to wallow in it and purchase any kind of excessively emotional movement. Then relax and relax.”

Later on, Ether could notice a supply shock and perhaps become deflationary. Staking further safeguards the network whilst supplying guaranteed returns on deposited assets. Inside a market that’s stuck inside a downtrend, sourcing a secure, foreseeable yield turn into more appealing.

Basically, Lilly is suggesting that it’ll take some time for that fervor all around the Merge to stay as well as for investors to start taking advantage of the advantages the PoS Ethereum network could offer.

How about Bitcoin?

Within this week’s Bitcoin analysis I discussed how very little has truly altered with Bitcoin’s cost. Its cost has continued to be range-bound within the $17,600–$24,400 range within the last three several weeks, and all sorts of rallies from each range-high since March 29 happen to be capped through the 200-day moving average as well as an overhead resistance trendline that extends from Bitcoin’s November 2021 all-time high at $69,400.

While ongoing consolidation inside the current range could (and would typically) be great for altcoins, macro tensions will continue to weigh on crypto and equities markets. The new consumer cost index print from Sept. 12 can lead to more aggressive rate hikes in the U . s . States Fed, and also the potential knock-on impact on stock values might have a level sharper spillover impact on crypto prices.

Because of this, investors remain largely risk-averse to many cryptocurrencies, which is entirely possible that repeat rejections in the lengthy-term climbing down trendline and additional retests from the $19,000 support may ultimately create a breakdown underneath the yearly swing low.

This e-newsletter was compiled by Big Smokey, the writer of The Standard Pontificator Substack and resident e-newsletter author at Cointelegraph. Each Friday, Big Smokey will write market insights, trending how-tos, analyses and early-bird research on potential emerging trends inside the crypto market.

Disclaimer. Cointelegraph doesn’t endorse any content of product in this article. Basically we are designed for supplying all of you information that people could obtain, readers must do their very own research when considering actions associated with the organization and bear full responsibility for his or her decisions, nor this short article can be viewed as being an investment recommendations.