Recently, nonfungible tokens (NFTs), cryptocurrencies along with other modern investment options have grown to be trendy. However, physical goods for example gold continue to be very popular. In 2021, the worldwide market capital for cryptocurrency surpassed $2 trillion. Now, investors must ask themselves: which option must i choose — crypto or gold?

Gold is really a commodity that goes back 1000’s of years like a store of worth and as a way of exchange and it is still effective today. Despite the invention of decentralized digital cryptocurrency, gold has continued to be just like prominent. Although, for many individual investors, owning gold can be challenging and from achieve. There’s one crypto company, PAX Gold (PAXG), whose goal would be to make gold possession more democratic and open to everyday investors by letting them trade it like every other cryptocurrency.

PAX Gold has discovered a means to combine cryptocurrency with physical gold assets, which makes it appealing to investors familiar with conventional alternatives. This information will discuss PAX Gold (PAXG) and evaluate the way the cryptocurrency works.

What’s PAX Gold?

Paxos Gold is really a cryptocurrency that’s supported by real gold reserves held by Paxos, a for-profit company in New You are able to. Each PAXG token is related to some 1:1 ratio to 1 troy ounce (t oz) of the 400-ounce London Good Delivery gold bar stored at Brinks Security vaults working in london. The Paxos-backed cryptocurrency, PAXG, is supported by the London Bullion Market Association (LBMA) certified gold bars and could be redeemed for actual bullion.

Related: Exactly what is a gold-backed token and just how do you use it?

PAX Gold investors are able to escape the problem of storing and securing physical gold, in addition to transporting it. Also, shares can be purchased fractionally, that makes it readily available for retail investors who otherwise could be hindered by the cost of gold. PAX Gold boasts a mix of characteristics from both physical gold possession and cryptocurrency that offer methods to many modern-day challenges within the gold market for example expense, storage concerns and the possible lack of liquidity.

Who’s Behind PAX Gold?

The Paxos Trust Company, an economic institution and tech company located in New You are able to City that are experts in blockchain technology, produced PAX Gold. Charles Cascarilla and Richard Teo, both former analysts at different firms (Cascarilla at Goldman Sachs and Teo at Cedar plank Hill Capital Partners), founded Paxos this year.

PAX Gold isn’t the only crypto project that Paxos has carried out. Additionally to PAX Gold, they also have produced PAX Dollar (USDP), an electronic U . s . States dollar and stablecoin. They’ve received strong institutional support and also have elevated over $500 million as a whole funding from investors like OakHC/Foot, Mithril Partners and PayPal Ventures.

So how exactly does PAXG work?

The PAX Gold token is made around the Ethereum blockchain, which provides it portability among wallets, exchanges, decentralized finance (DeFi) platforms, along with other apps which use Ethereum. PAX Gold enables users to trade, stake or redeem their tokens for top-quality gold bars. These gold bars are accredited through the London Bullion Market Association and kept in secure vaults all over the world. Despite the high-notch safety measures and-quality gold, PAX Gold doesn’t charge any custodial or storage charges — merely a .02% transaction fee.

Is Pax Gold safe? PAX Gold isn’t just accredited having a defacto standard, it functions dependably and transparently. Both PAX Gold and it is holding company, Paxos Trust, they are under the legal jurisdiction from the New You are able to Department of monetary Services (NYDFS). In addition, PAX Gold protects the customer and also the company’s assets individually, making certain the consumer is safe in case of personal bankruptcy.

PAXG undergoes monthly audits from the third-party auditing firm to make sure that its gold reserves match the availability of PAXG tokens. The reports from all of these attestations are freed on Paxos’ official website. Additionally, PAXG’s developers run regular smart contract audits to look for any potential bugs or vulnerabilities within the network.

Is Pax Gold real gold?

As pointed out earlier, Pax gold is tokenized gold that runs using a blockchain network. Tokenization may be the digital transformation of both physical and intangible assets into cryptocurrency. The PAXG token particularly represents physical gold in the Paxos trust company. Gold is a great store of worth since it keeps its value with time. As a result, it’s frequently utilized as a hedge against inflation. Once the USD loses value, gold gets to be more costly in USD and the other way around. This will make gold a well known option for investors searching to safeguard their wealth from inflation.

The PAXG tokens have serial figures that match individuals of person gold bars. The serial number, value along with other characteristics of the holder’s physical gold might be discovered by inputting a person’s Ethereum wallet address around the PAXG lookup tool. Additionally they can convert their PAXG into fiat money, another cryptocurrency or allotted and unallocated gold bullion bars in the market cost of gold.

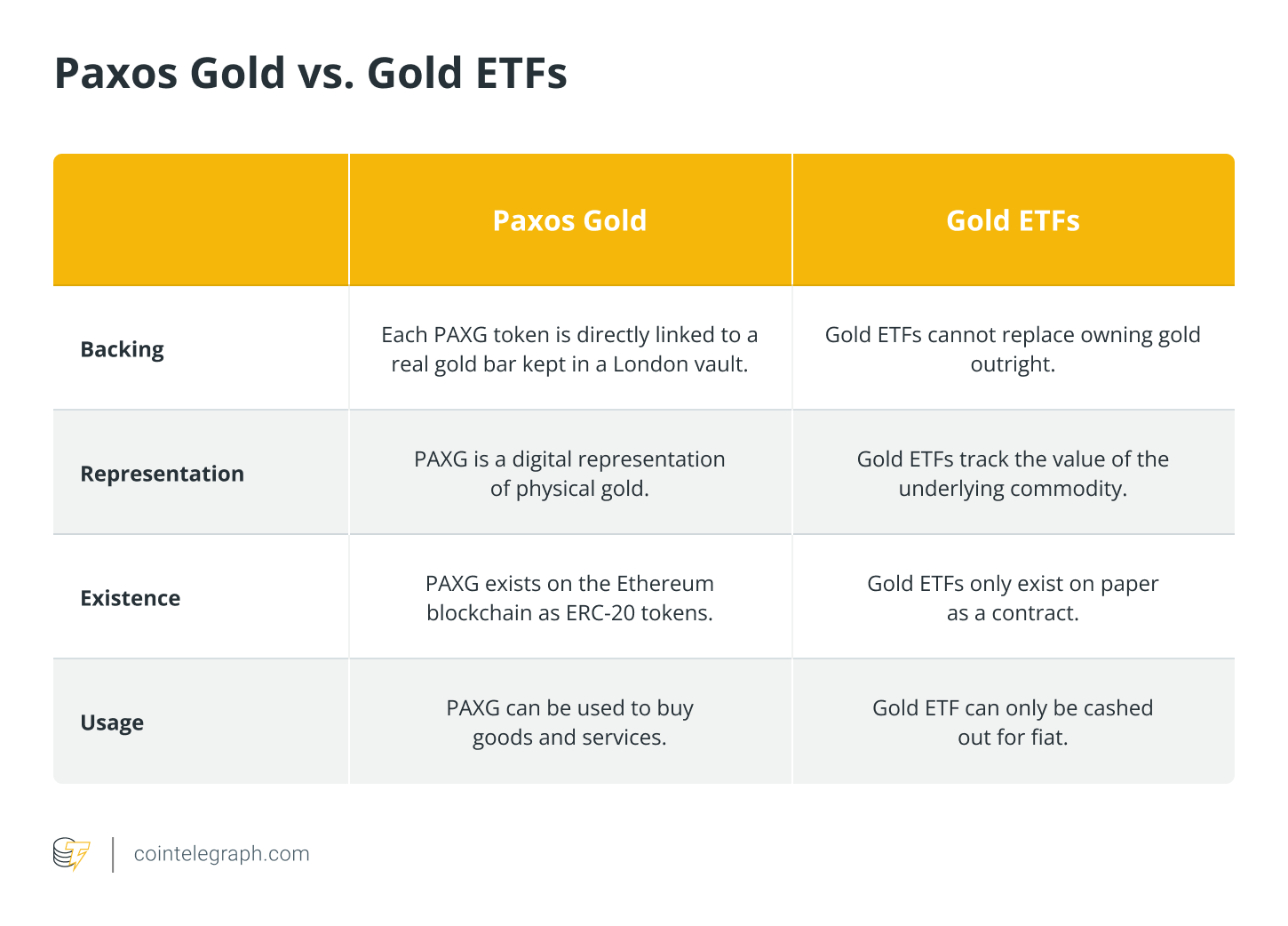

What’s the main difference between PAXG and gold ETFs?

The primary web site gold ETF and Pax Gold is the fact that an ETF purchases an agreement that mimics the cost of gold, however the user doesn’t own the actual asset. Each PAXG token is directly associated with a genuine gold bar stored inside a London vault, with every PAXG token being equal to one.

Gold exchange-traded funds (ETFs) track the need for the actual commodity. They simply give investors accessibility cost of gold, although not possession. A trader the master of a gold ETF is really a party within an agreement that provides her or him a particular fraction from the pooled gold. Gold ETFs can’t rival full possession from the metal. For instance, when settlement occurs, anything value might be less than what you will get should you simply owned the gold outright.

In comparison, a PAXG is really a digital representation of physical gold. Each PAXG token represents one troy ounce of gold working in london vaults that may be recognized by consecutive figures. Buying and selling PAXG doesn’t take days to stay as physical gold bar buying and selling might do since it is handled on Ethereum being an ERC-20 token.

PAX Gold is the best investment for modern and traditional investors who wish to remain on trend without compromising their personal goals. With actual gold assets reflected in crypto tokens, you are able to purchase both physical and digital sources having a single investment, benefiting from the very best facets of each.

So how exactly does PAX gold earn money?

PAX Gold will earn revenue in 2 ways: a little premium around the gold along with a tokenization fee during the time of initial purchase. The proportion for that tokenization fee depends upon the quantity purchased initially it’s 1% for purchases of 1 ounce or fewer but considerably lower for bigger purchases. Paxos won’t charge child custody charges, but it’ll impose a fee of .02% each time a customer really wants to purchase or sell an expression on the blockchain network.

Related: What’s tokenized property? A beginner’s help guide to digital property possession

Are you able to stake PAXG? You can generate interest in your PAXG by lending it to some custodian, but rates will differ with respect to the loan provider. Staking your PAXG also enables you to definitely earn interest, however, you must secure your tokens for any specific time period. Buying PAXG? The token is available to buy on several exchanges, including Binance, Kraken, KuCoin and Coinbase. Listed here are the steps to purchase PAXG tokens around the Coinbase crypto exchange:

-

Download a self-child custody wallet that supports PAXG such as the Coinbase wallet.

-

Safely store your recovery phrase.

-

Understand and get ready for Ethereum network charges.

-

Buy and transfer Ether (ETH) for your self-child custody wallet.

-

Within the trade section, make use of the ETH to buy PAX Gold.

The way forward for asset-backed tokens

Asset-backed tokens are digital representations of physical assets that may be redeemed for that underlying asset. That asset might be gold, oil, property, equity, soybeans or almost any other commodity.

Asset-backed tokens are opening markets which were once inaccessible and pricey by looking into making transactions that do not require a character. Using this method, we’re making certain both security and transparency running a business relationships. This really is altering the way you conduct business for future years and just how we consider possession and wealth creation.

Asset-backed tokens also may help to deal with issues brought on by inflated or depreciated currencies, along with the unpredictable stock exchange. People have a practical new financial choice that mixes digital liquidity with real asset values if needed, because of asset-backed tokens’ potential. We’ve already seen how asset-backed tokens are used in several applications.

The way forward for asset tokenization is just as limited because the imagination. With new use cases being discovered every single day, it’s exciting to consider all of the options for the way asset-backed tokens might help people and companies around the world.

Buy a licence with this article. Operated by SharpShark.