Traders using the Ethereum network understand the ERC-20 technical standard and also have probably traded and committed to tokens that put it to use. In the end, its functionality, transparency and versatility make it the norm for Ethereum-based projects.

As a result, many decentralized applications (DApps), crypto wallets and exchanges natively support ERC-20 tokens. However, there’s one problem: Ether (ETH) and ERC-20 don’t exactly stick to the same rules, as Ether was produced way before ERC-20 was implemented like a technical standard.

So, how come wrapped ETH matter? Briefly put, ERC-20 tokens are only able to be traded along with other ERC-20 tokens, not Ether. To be able to bridge this gap and let the exchange of Ether for ERC-20 tokens (and the other way around), the Ethereum network introduced wrapped Ethereum (wETH). That stated, wETH may be the ERC-20 tradable form of ETH.

What’s wrapped Ether (wETH)?

As pointed out, wETH may be the wrapped form of Ether, and it is named as a result because wETH is basically Ether “wrapped” with ERC-20 token standards. Wrapped coins and tokens virtually have a similar value his or her underlying assets.

So, is wrapped Ethereum safe to trade and purchase? The reply is yes, so far as Ethereum is worried. wETH is pegged towards the cost of ETH in a 1:1 ratio, so they’re essentially exactly the same. The only real distinction between wrapped tokens as well as their underlying assets is the use cases, specifically for older coins like Bitcoin (BTC) and Ether.

Wrapped tokens are just like stablecoins, to some extent. Arrived at consider it, stablecoins may also be considered “wrapped USD,” given that they have a similar value his or her underlying asset, the U . s . States dollar. They may also be redeemed for fiat currencies anytime.

Bitcoin also offers a wrapped version known as Wrapped Bitcoin, that has exactly the same value as Bitcoin. The same applies to other blockchains like Fantom and Avalanche.

Wrapped Ethereum tokens could be unwrapped after they’ve been wrapped, and the operation is simple: Users have to send their wETH tokens to some smart contract around the Ethereum network, that will then return the same quantity of ETH.

Wrapped tokens solve interoperability problems that most blockchains have and permit for that easy exchange of 1 token for an additional. For instance, users cannot normally utilize Ether on the Bitcoin blockchain or Avalanche around the Ethereum blockchain. Through wrapping, underlying coins are tokenized and wrapped having a certain blockchain’s token standards, thus permitting their experience that network.

So how exactly does wrapped Ethereum (wETH) work?

Unlike Ether, wETH cannot be employed to pay gas charges around the network. Since it is ERC-20 compatible, however, you can use it to supply more investment and staking possibilities on DApps. wETH may also be used on platforms like OpenSea to purchase and sell through auctions.

Wrapping Ether tokens involves delivering ETH to some smart contract. The smart contract will generate wETH in exchange. Meanwhile, ETH is locked to make sure that the wETH is supported by a reserve.

Whenever wETH is exchanged back to ETH, the exchanged wETH is burned or taken off circulation. This is accomplished to make sure that wETH remains pegged to the need for ETH whatsoever occasions. wETH may also be acquired by swapping other tokens for this on the crypto exchange, for example SushiSwap or Uniswap.

So, what’s the reason for wrapped Ethereum? Based on WETH.io, the best goal would be to update Ethereum’s codebase making it ERC-20 compliant by itself, eventually eliminating the necessity to wrap Ether with regards to interoperability. But, for now, wETH remains as helpful in supplying liquidity to liquidity pools, and for crypto lending and NFT buying and selling, amongst others.

In a nutshell, it’s not just a few ETH versus. wETH since wrapping Ethereum is much more of the workaround than the usual permanent solution. With the amount of upgrades slated to happen around the Ethereum network through the years, Ethereum appears to become moving closer toward better interoperability each day.

How you can wrap Ether (ETH)?

There are many methods to wrap Ether. As pointed out, probably the most common ways to do this is as simple as delivering ETH to some smart contract. Another way is swapping wETH for an additional token using a crypto exchange.

Let’s take a look at 3 ways to create wETH within the sections below:

While using wETH smart contract on OpenSea

Within this example, we’ll be utilising the OpenSea platform to transform ETH to wETH while using wETH smart contract.

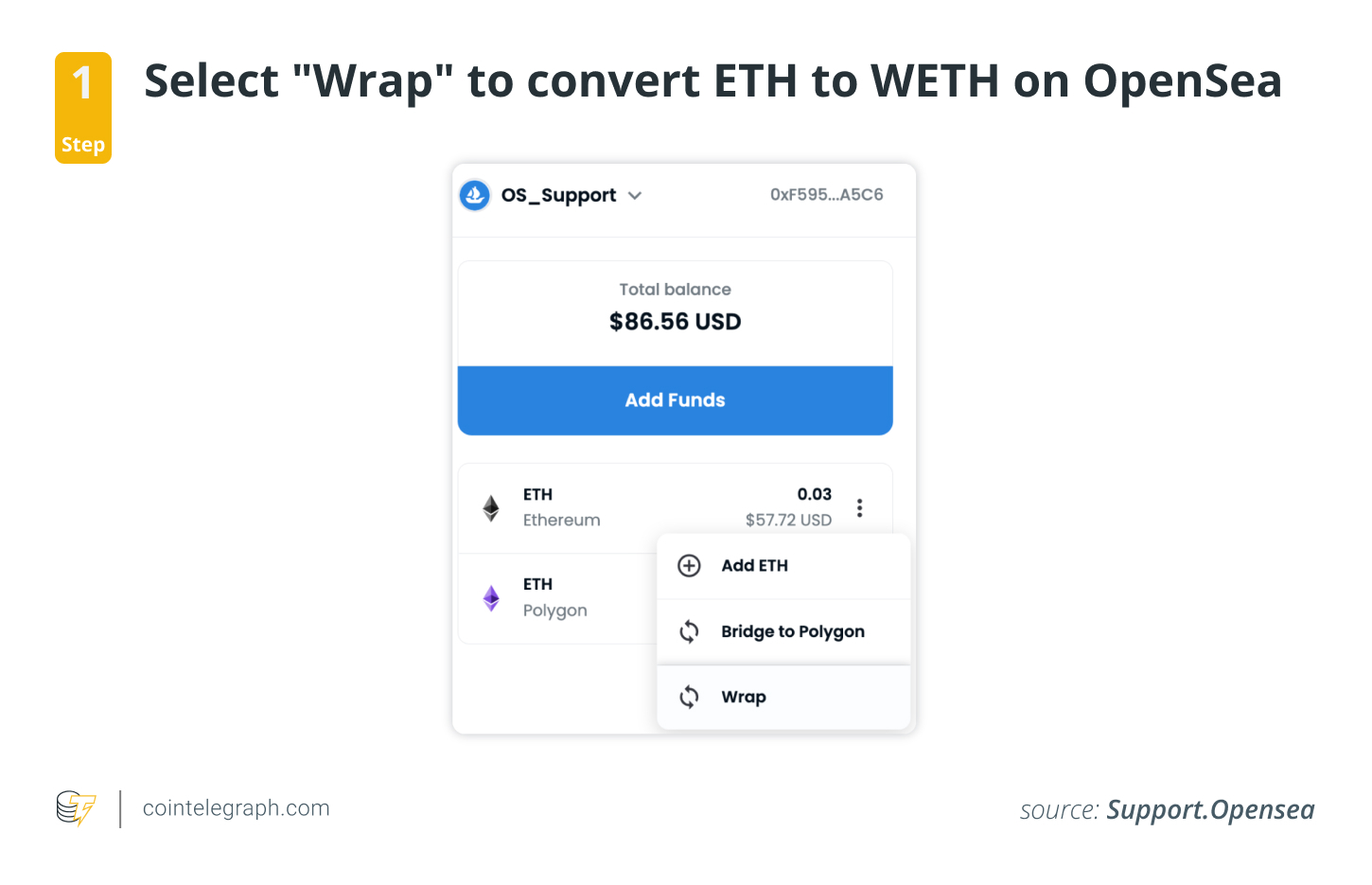

First, click “Wallet,” located at the very top-right corner of OpenSea. Then, click the three dots alongside Ethereum and choose “Wrap.”

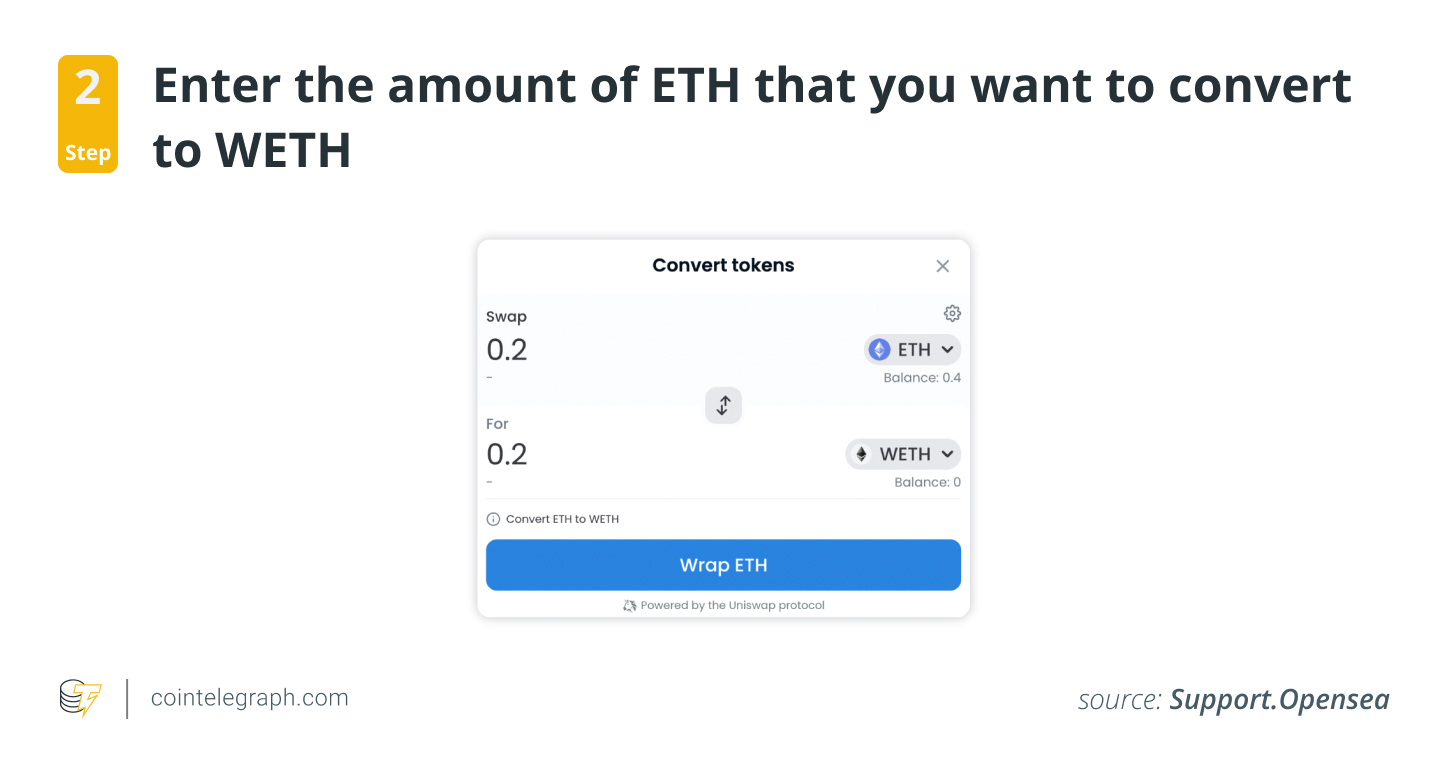

Next, go into the value for the quantity of ETH to become transformed into wETH. Then, click “Wrap ETH.” This can call the wETH smart contract to transform ETH into wETH.

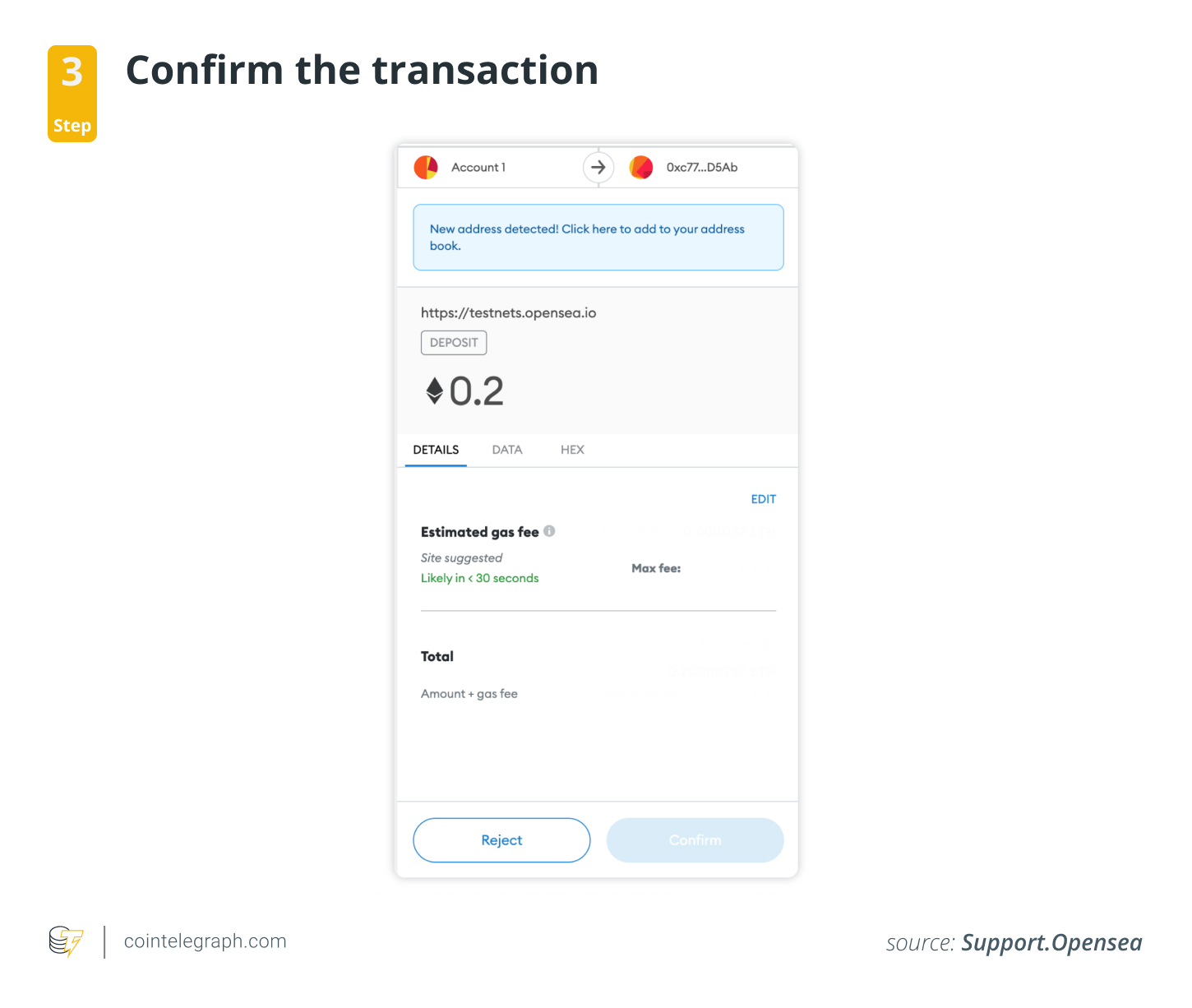

A MetaMask pop-up can look, prompting the consumer to sign the transaction.

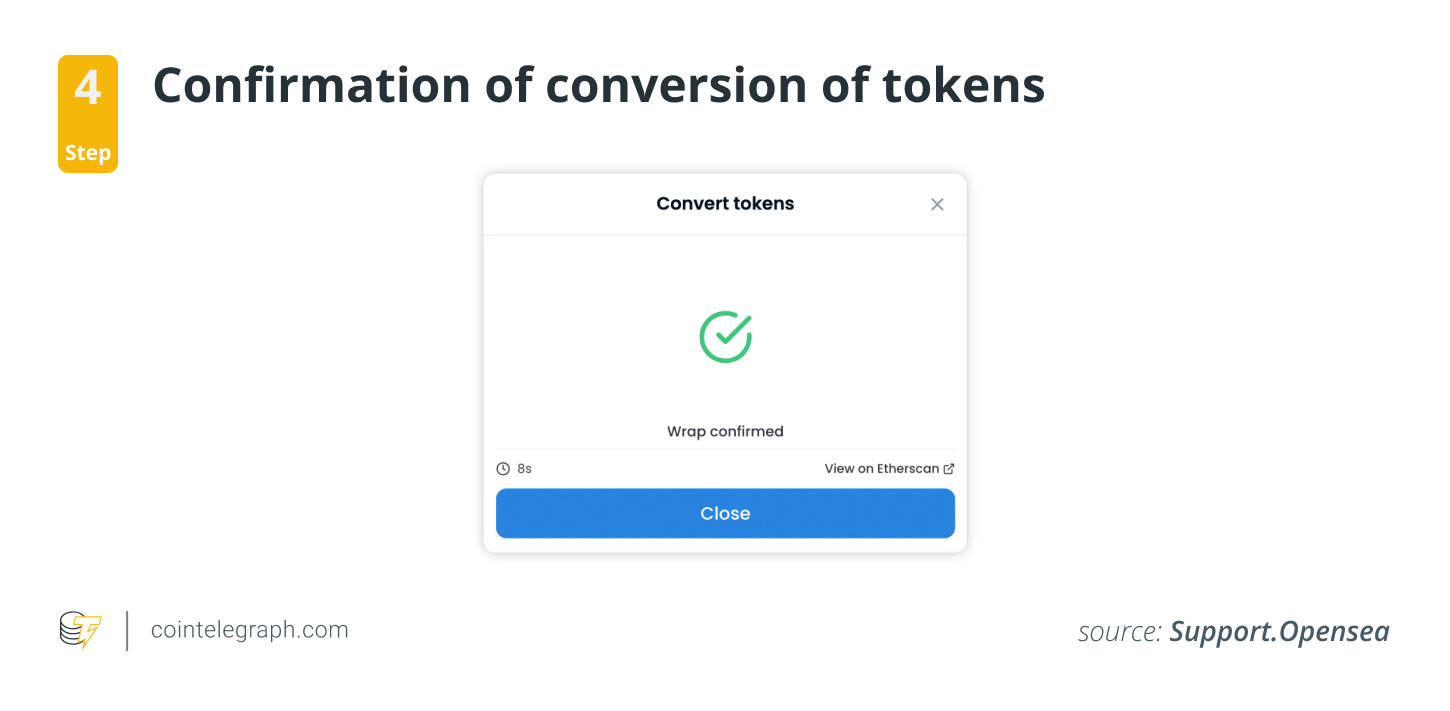

A confirmation message will appear when the wrap is finished.

The converted wETH will display in the wallet area of the user’s OpenSea account. The wETH will bear a pink Ethereum gemstone since it’s emblem, distinguishing it from ETH.

Generating wETH via Uniswap

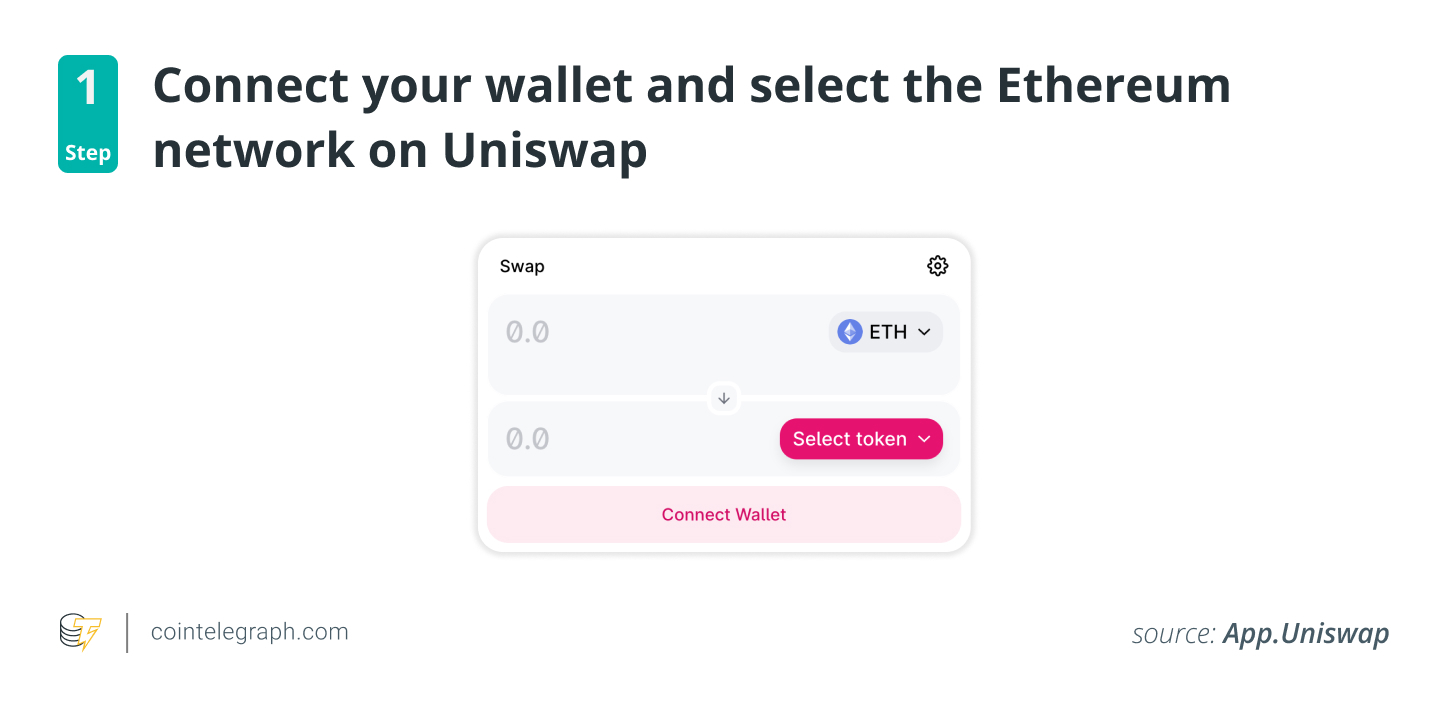

When utilizing Uniswap, a person first needs to connect their wallet and make sure the Ethereum network is chosen.

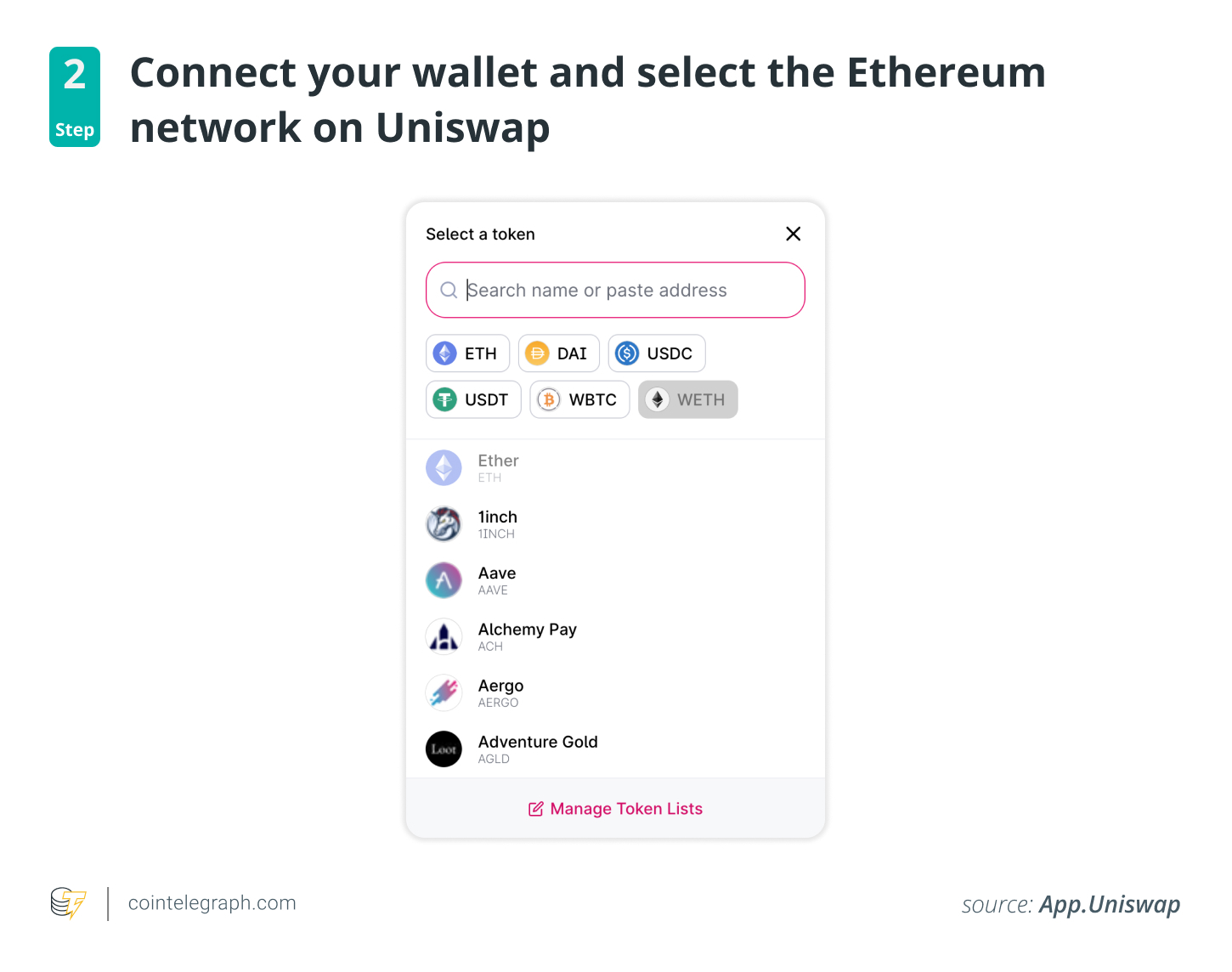

Then, click “Select Token,” located at the end field, and choose wETH in the listing of options.

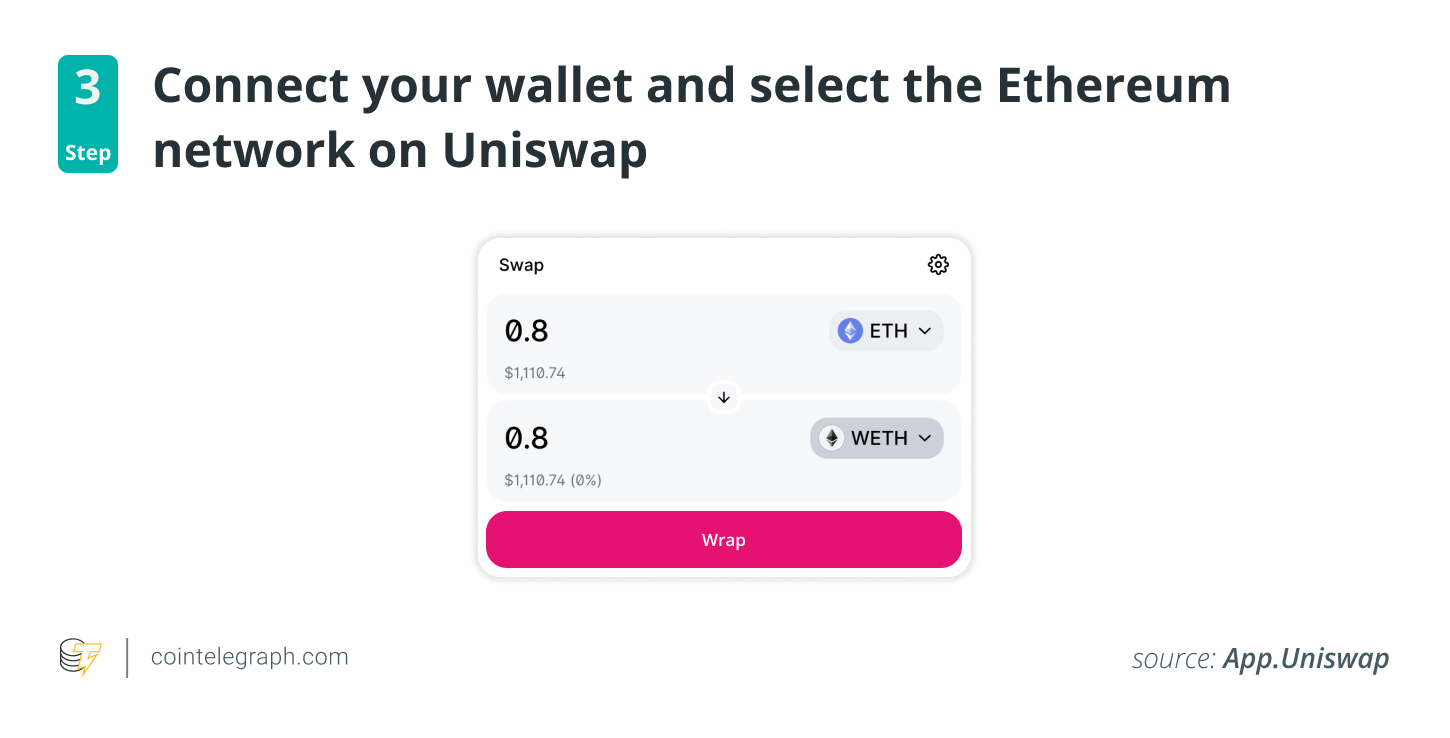

Now, input the quantity of ETH to become transformed into wETH and click on “Wrap.”

The transaction will have to be confirmed in the user’s crypto wallet. Gas charges in ETH must also be compensated at this time. Once every detail have been in order and also the transaction is proven in the user’s finish, all that’s left to complete would be to wait for a transaction to become confirmed within the blockchain.

Generating wETH with MetaMask

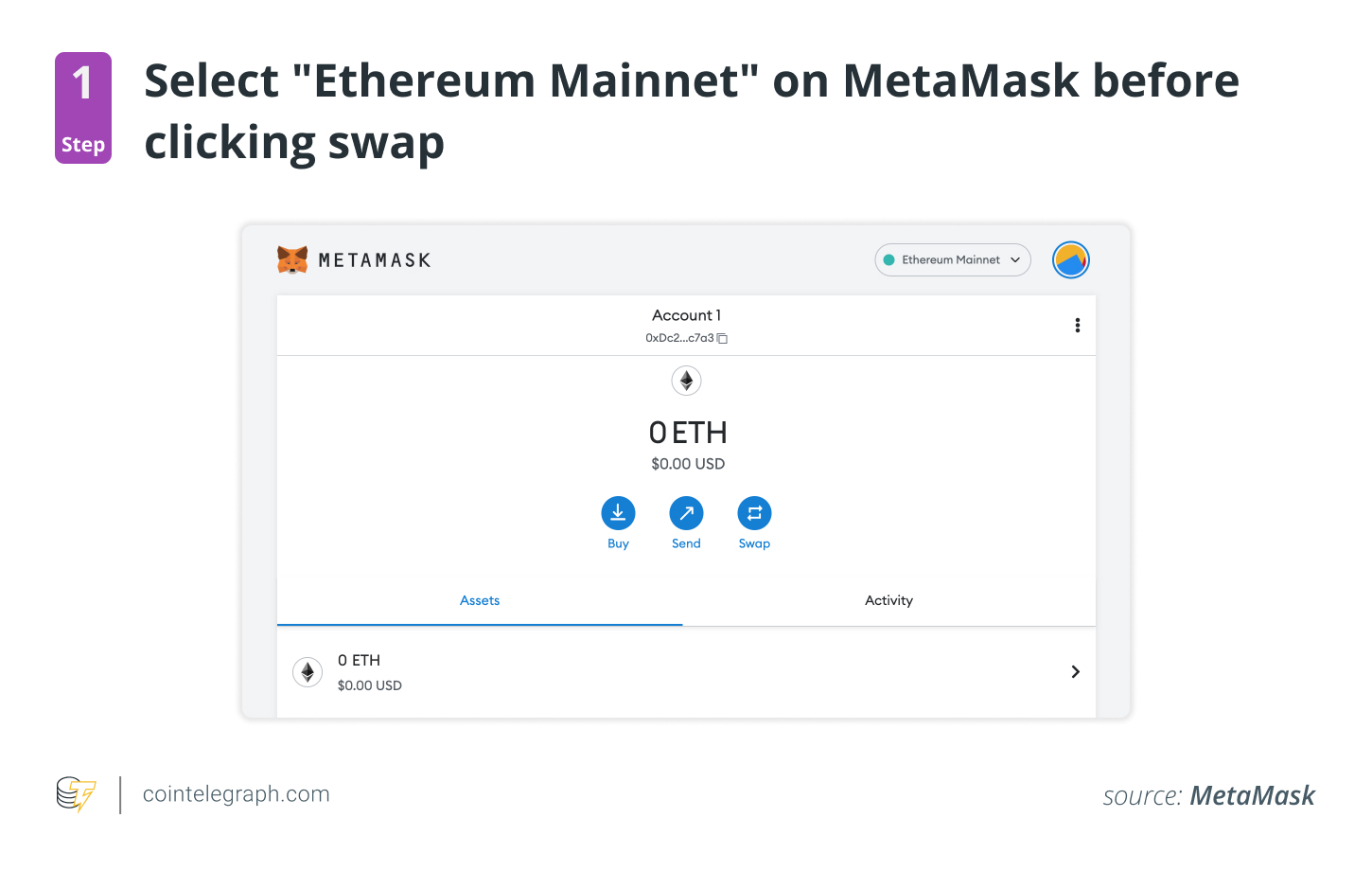

Upon opening the MetaMask wallet, start by making certain the selected network is “Ethereum Mainnet.” Then, click “Swap.”

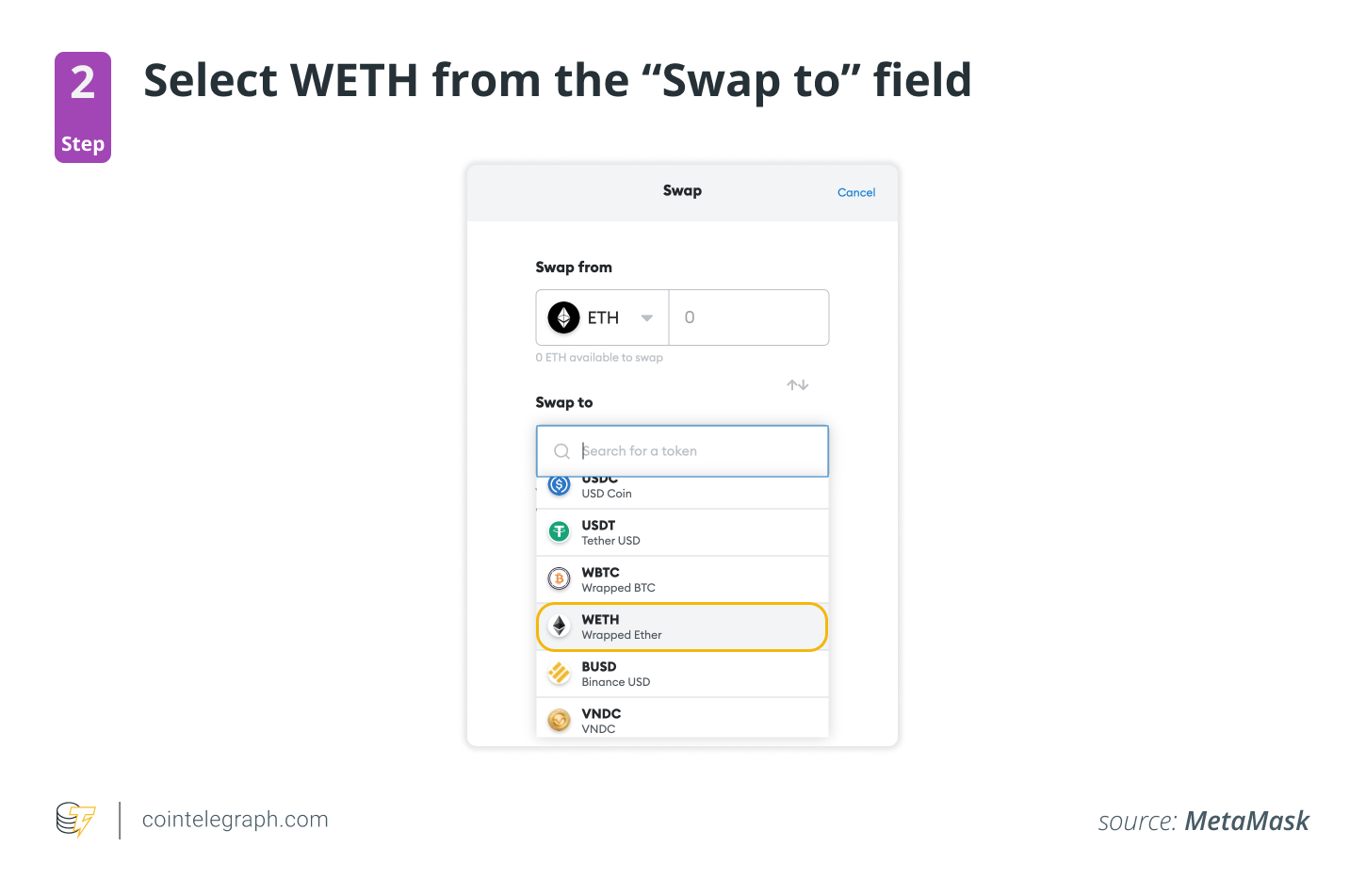

Then, select wETH in the “Swap to” field.

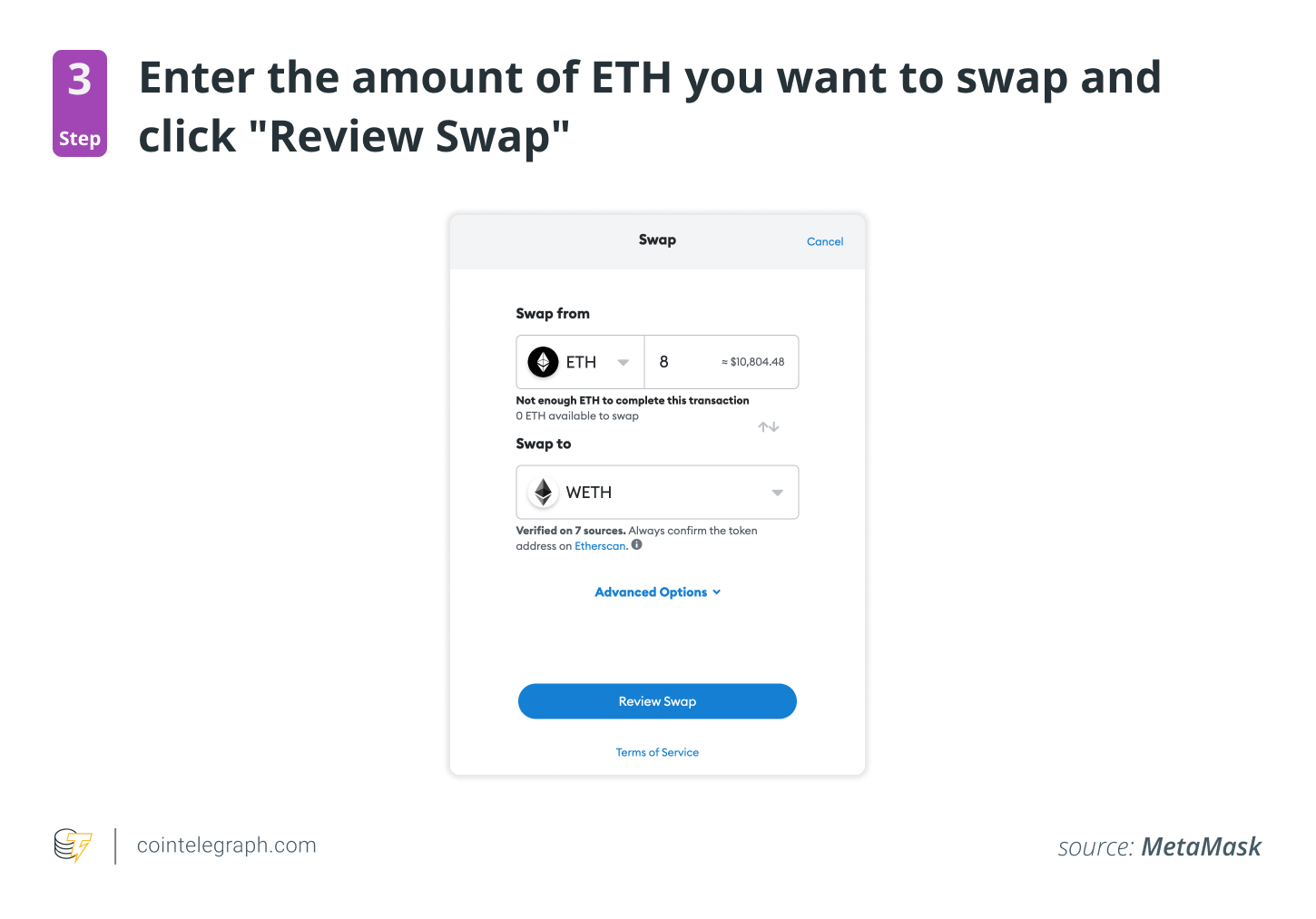

Next, input the quantity of ETH to become swapped. Then, click “Review Swap.”

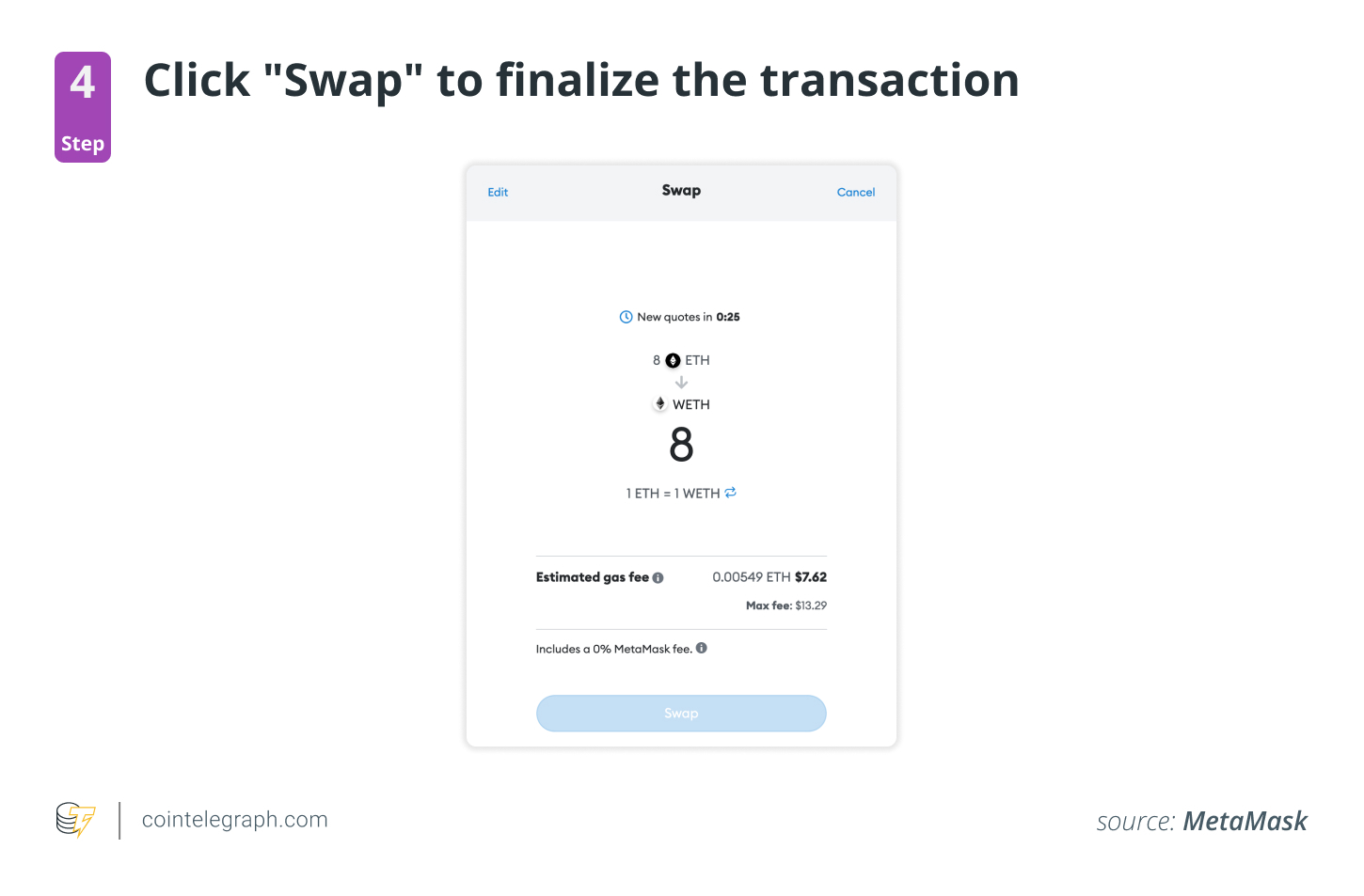

A window displaying an estimate from the rate of conversion can look. Because it requires the conversion of ETH to wETH, the speed ought to be 1:1. To finalize the transaction, click “Swap.”

How you can unwrap Ether (ETH)?

Unwrapping Ether may also be done by hand, for example by getting together with a good contract. For example, ETH may also be unwrapped in the same manner that it may be wrapped through the wETH smart contract on OpenSea. The only real difference is the fact that rather of clicking “Wrap ETH,” the consumer needs to click “Unwrap wETH.”

You have to swapping wETH to ETH, which may be made by using Uniswap or MetaMask. The procedure for unwrapping is basically identical to the process outlined above for wrapping ETH on platforms. The only real difference would be that the values ought to be altered (from wETH to ETH).

Do you know the perils of using wrapped tokens?

Ethereum co-creator Vitalik Buterin themself pinpointed among the primary disadvantages of wrapped assets. Based on Buterin, the primary problem with lots of these wrapped assets is the sensitivity to centralization.

Presently, wrapping assets aren’t Turing-complete and can’t be automated through the Ethereum blockchain. As discussed, wrapping is generally only transported out using central programs, thus the priority for possible manipulation and abuse.

Issued wrapped tokens rely on the 3rd-party platforms that issue them, inevitably submitting decisions relating to wrapped assets to central entities. Buterin voiced his concerns about the potential of this type of mechanism undermining the main concepts of decentralization and transparency the blockchain industry means.

Way forward for wrapped tokens

Presently, wrapped tokens make it easy for blockchains to have interaction with each other. This enables for an infinitely more decentralized ecosystem, where tokens can be simply traded or exchanged between different platforms.

Better interoperability solutions are coming, for example updating blockchains’ codebases to become suitable for one another or using bridge chains. For Ethereum, a minimum of, the program would be to eventually phase out using wrapped tokens like wETH alongside network developments.

It doesn’t mean that wrapped tokens ‘re going away in the near future. They continuously play a huge role, supplying valuable plan to individuals who require it. For just one, wrapped tokens may serve as a stabilizing pressure between different blockchains, because they maintain consistent prices together.

They may also help facilitate mix-chain atomic swaps, that are becoming more and more popular. Over time, however, wrapped tokens will probably become much less necessary as blockchains be interoperable.

Buy a licence with this article. Operated by SharpShark