Market News

Market News- Since intra-period Bitcoin returns peaked at 131% this past year.

- 70 crypto hedge funds used an industry-neutral investing strategy.

Based on PwC’s 2022 Global Crypto Hedge Fund Report, hedge money is purchasing cryptocurrencies in an all-time high regardless of the volatility.

Based on the report, the marketplace presently has around 300 hedge funds centered on cryptocurrencies. Data in the survey reveals the establishment of recent crypto hedge funds seems to become connected using the cost of Bitcoin.

All-time At the top of Huge Fund

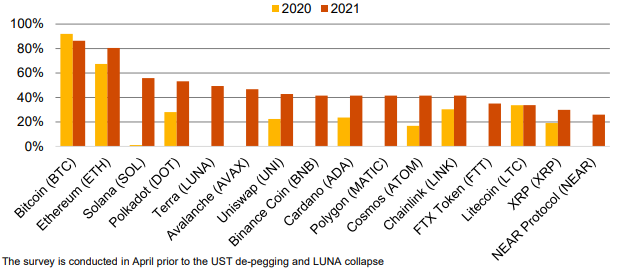

Cryptocurrencies traded by crypto hedge funds

Data says a number of other funds were launched in 2018, 2020, and 2021 all very bull years for bitcoin. However, nearly all brand-new cryptocurrency hedge funds typically use investment opportunities that do not rely on market growth.

PwC learned that more than a third from the greater than 70 crypto hedge funds it surveyed used an industry-neutral investing strategy. These funds frequently use derivatives to lessen risk and acquire focused contact with the actual asset simply because they try to benefit no matter market direction.

Based on the report, these funds were built with a median return of 199% in 2021, and also the discretionary lengthy-term funds with returns of 420% in 2021 are the most useful-performing ones, based on the average return.

By having an average return of just 37%, market-neutral funds considerably underperformed funds using other strategies, and also, since intra-period Bitcoin returns peaked at 131% this past year. Over $500 million in internet inflows happen to be silently chose to make this year to bitcoin investment funds.