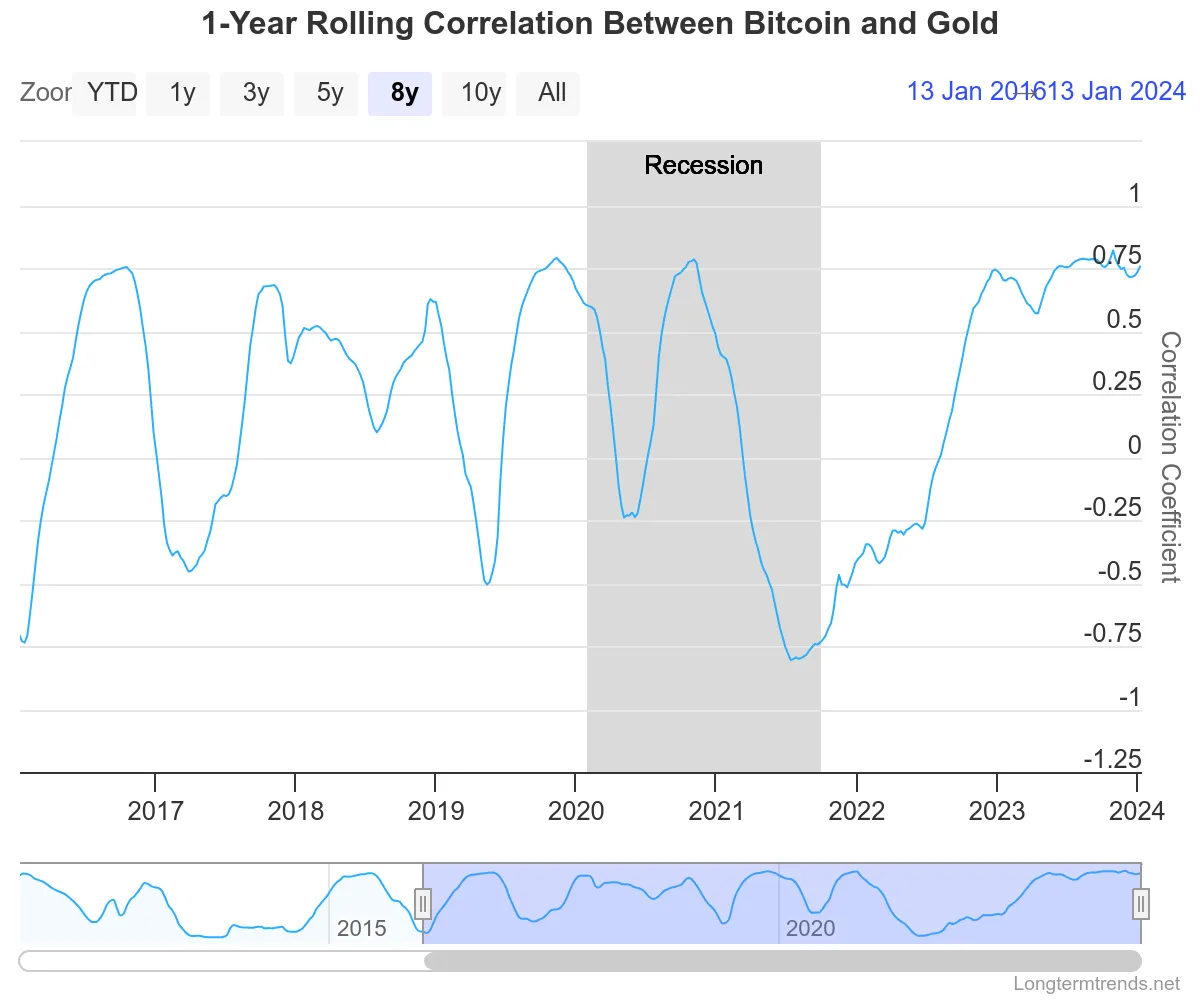

The correlation between Bitcoin and gold prices has rose to new heights in recent several weeks following a bullish near to 2023 and also the approval of the place Bitcoin ETF.

Bitcoin’s correlation to gold has fluctuated during a lot of digital asset’s history. What this means is the 2 assets’ prices have moved mostly independently—when one rose, another did not always follow. However the correlation increased tighter following the market crash in 2020 at the beginning of the COVID-19 crisis, and it is now once more approaching historic levels.

The Bitcoin to gold correlation presently is .76 (or 76%). A correlation of just one means there’s an ideal, positive correlation between two variables, within this situation the cost of Bitcoin and gold (-1 means an ideal, negative correlation). Even though the Bitcoin-gold correlation isn’t yet whatsoever-time levels, it’s now getting closer.

“Bitcoin’s relationship with [traditional finance] markets continues to be consistently evolving,” cryptocurrency exchange Binance noted inside a report printed earlier this year. “Currently, Bitcoin’s correlation using the S&P 500 reaches its cheapest in additional than 3 years.” Bitcoin correlation to gold observed a notable surge, sitting at roughly 75% through the finish of 2023, based on Lengthy Term Trends. This peak coincided with global central banks adopting rate of interest hikes, signaling a brief transfer of stock exchange behaviors.

The development of Bitcoin ETFs within the U.S. market a week ago also marked a watershed moment, heralding Bitcoin’s transition to some stock-like asset.

Regardless of this, Bitcoin’s kinship with gold only has strengthened, and also the bitcoin-gold correlation today sits at 76%, merely a couple of points behind the all-time a lot of 79%. That implies a tightening relationship backward and forward assets (both considered a powerful storage of worth by their proponents), even while Bitcoin inhabits more facets of mainstream finance.

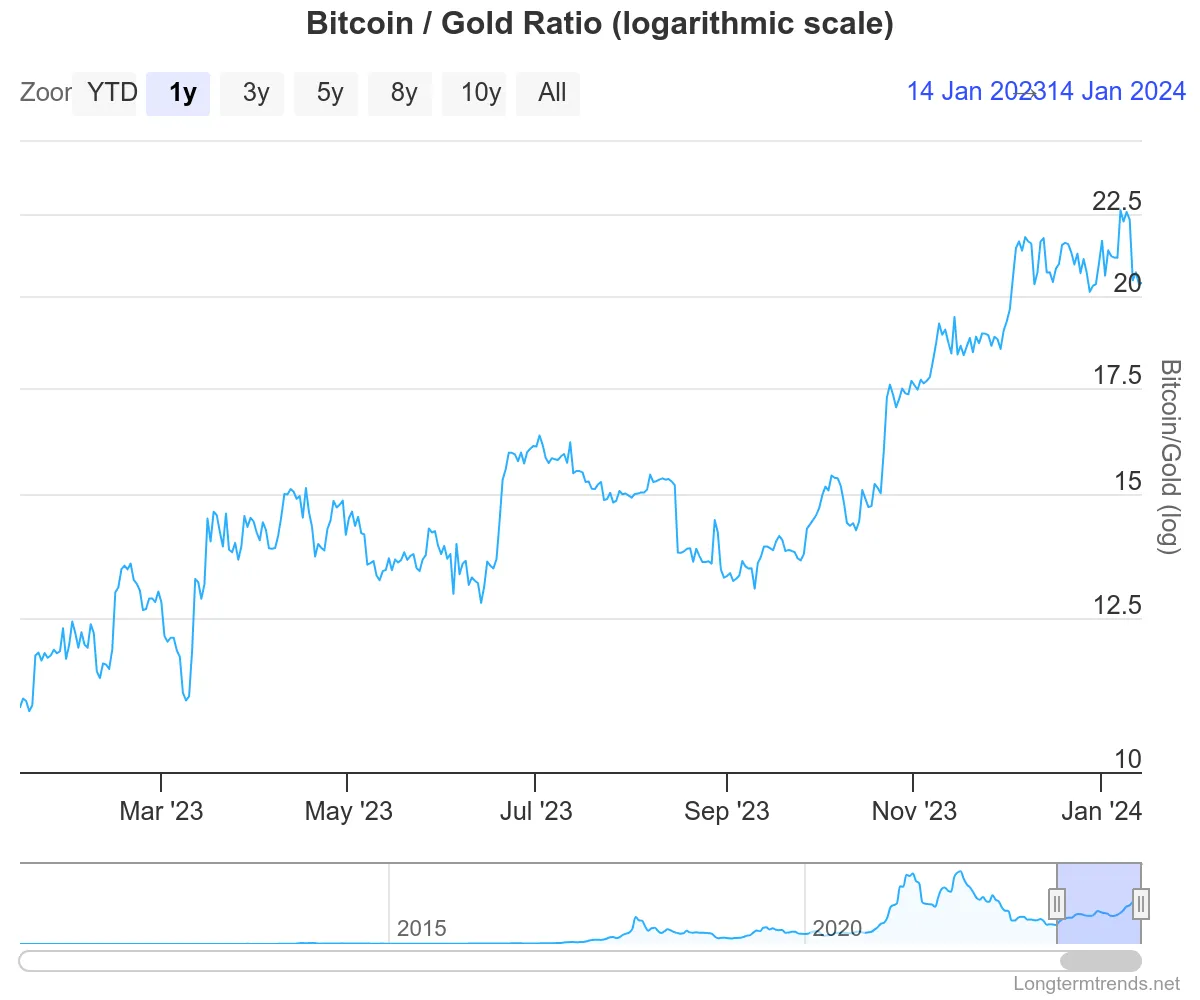

The charts also show Bitcoin’s ratio to gold climbing steeply throughout 2023, peaking for the year’s finish before a small retracement earlier this year, likely because the hype around ETFs faded. The Bitcoin to gold ratio is really a metric that is a result of dividing the cost of Bitcoin with that of gold, which informs us roughly the number of ounces of gold can be bought having a single Bitcoin.

At its zenith, the ratio touched a remarkable 22.5, meaning 22.5 ounces of gold might be purchased with 1 BTC. The figure demonstrates the purchasing power Bitcoin in accordance with gold, reaffirming the idea one of the Bitcoin faithful that BTC supplies a reliable store of worth.

Why would Bitcoin gain greater alignment with gold, specially when Bitcoin’s entry into the stock exchange via ETFs recommended a shift perfectly into a correlation with equities? It seems that despite these stock-like characteristics, investors can always be seeking solace in Bitcoin’s gold-like characteristics.

Using the U.S. inflation rate lingering over the preferred Fed target of three.35%, and Bitcoin’s stellar 155% spike in 2023, the narrative appears obvious. Investors are not only chasing growth they’re also seeking stability when confronted with economic uncertainty. Bitcoin, using its gold-like performance, provides a semblance of the stability.

The Bitcoin-gold kinship highlights the complex, shifting nature of Bitcoin as both an electronic currency as well as an asset class. Because it matures, Bitcoin seems to become retaining select characteristics of gold whilst absorbing traits of stocks and goods.