You can’t really determine if Bitcoin has hit its peak instantly, but dead easy to decipher it in hindsight. This is exactly why there are plenty of analysts evaluating current cost charts to original copies and invoking a famous Mark Twain quote.

On Wednesday morning in Europe, Bitcoin was buying and selling for approximately $42,560. This is a 2.3% drop from the same time frame yesterday, but 6% greater compared to BTC cost the other day, based on CoinGecko data.

The narrative around prices at the beginning of a few days was that Bitcoin was beginning to achieve on expectations that U.S. Fed Chairman Jerome Powell might drop hints about lowering rates of interest later this season as he announces the Fed’s rates later today. Investors overwhelmingly expect him to keep rates because they are, based on the FedWatch tool.

That optimism evaporated, and costs slid by using it. But to listen to some analysts tell it, Bitcoin continues to be making exactly the same types of movements it’s in front of other bull market runs.

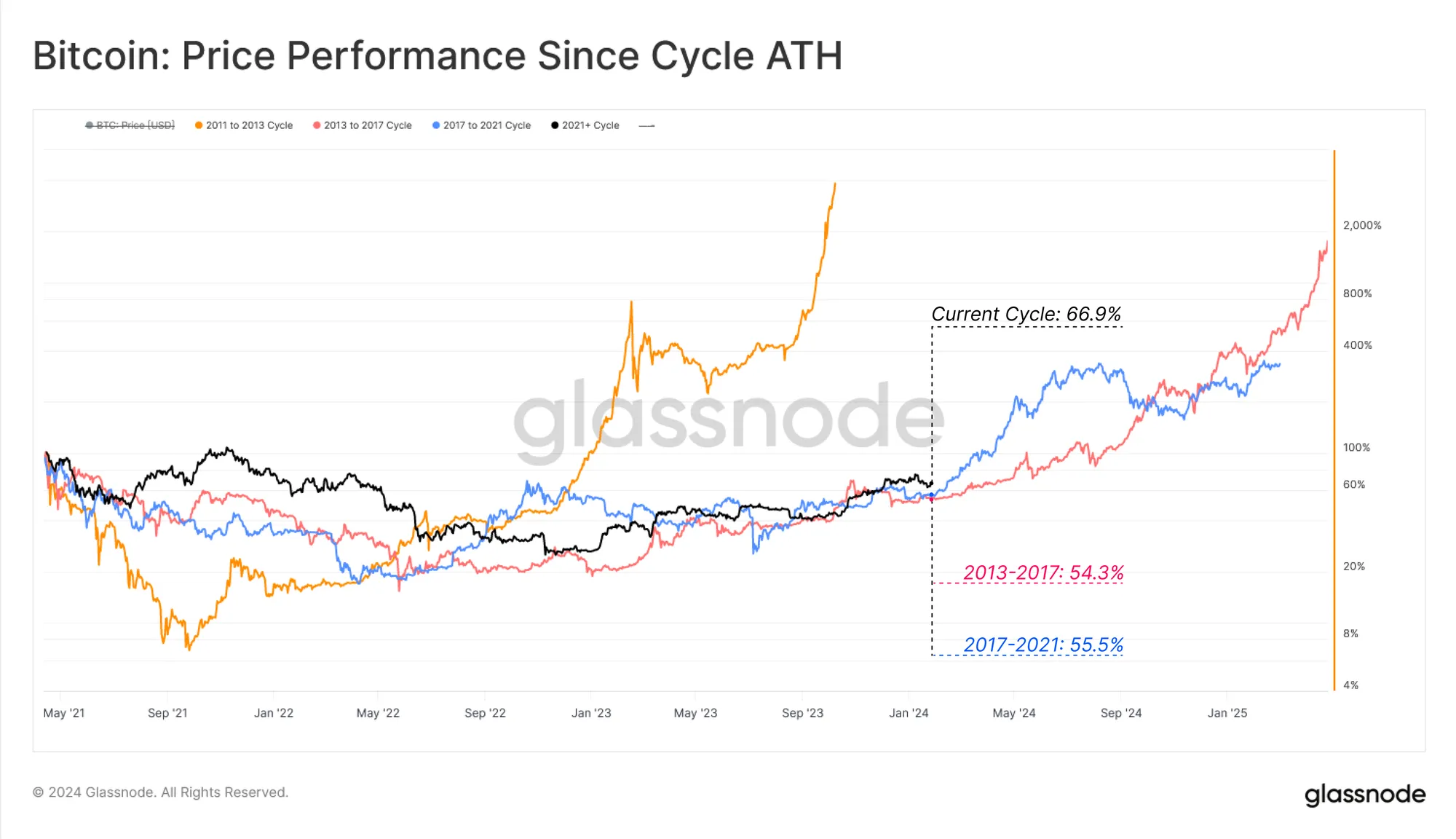

“The idea in history rhyming rings strikingly true, using the last three cycles experiencing eerily similar performance,” writes Glassnode in the latest Insights blog publish. “Our current cycle remains marginally in front of both 2016-17 and 2019-20 periods, due partly for an very strong year in 2023.”

The saying “history rhyming” is probably a mention of the an estimate in the American novelist: “History does not repeat itself, however it frequently rhymes.”

Poor markets, including Bitcoin prices, which means that as the specific information on market movements and types of conditions won’t exactly repeat, they are able to exhibit patterns or trends which are similar to past occurrences.

This is exactly why a lot of analysts are taking out old cost charts to state that Bitcoin’s cost is moving much like the actual way it just before past bull runs.

The primary headwinds came from Grayscale Bitcoin Trust (GBTC) redemptions.

“Like a closed finish trust fund, GBTC accumulated an remarkable 661.7k BTC at the begining of 2021, as traders searched for to shut the NAV premium arbitrage,” Glassnode analysts authored. “After a period of buying and selling in a severe NAV discount (having a high 2% fee), conversion to some place ETF has triggered significant a re-balancing event. Around ~115.6k BTC happen to be redeemed in the GBTC ETF since conversion, creating significant market headwinds.”