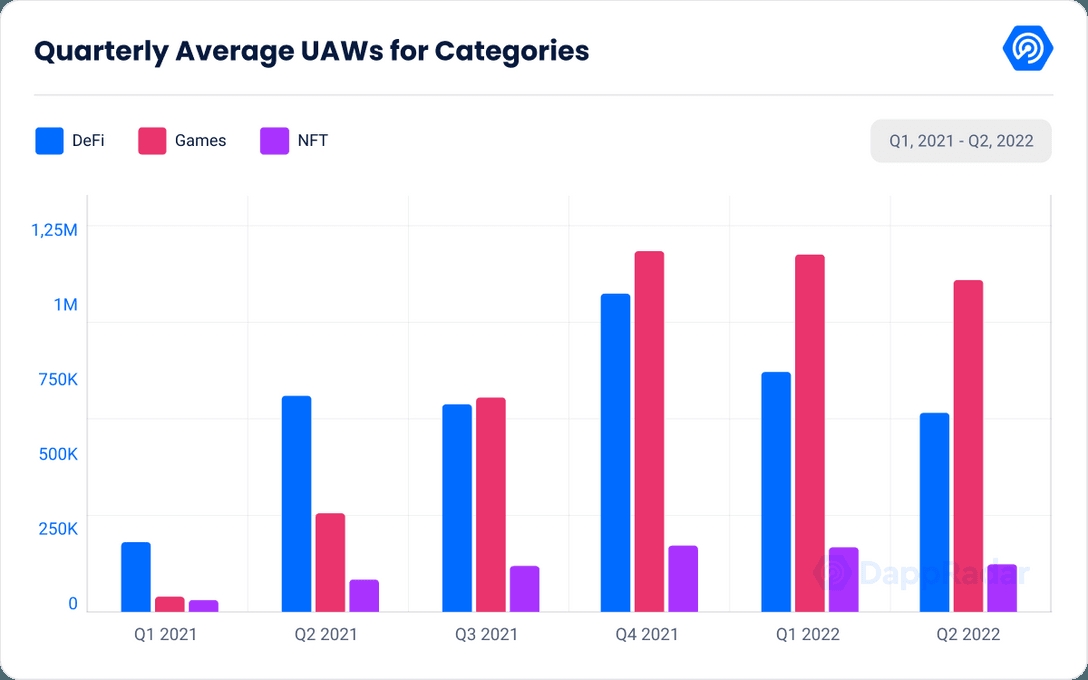

Crypto-based play-to-earn games and game-related non-fungible tokens (NFTs) comprise minimal affected sector throughout crypto throughout the current bear market, with investment capital investments ongoing to circulate in to the sector, a brand new report in the decentralized application tracking site DappRadar finds.

Based on the report, the gaming sector in crypto arrived at an optimum as lately as June this season, if this finally possessed a slowdown as measured by the amount of unique active wallets (United auto workers leader).

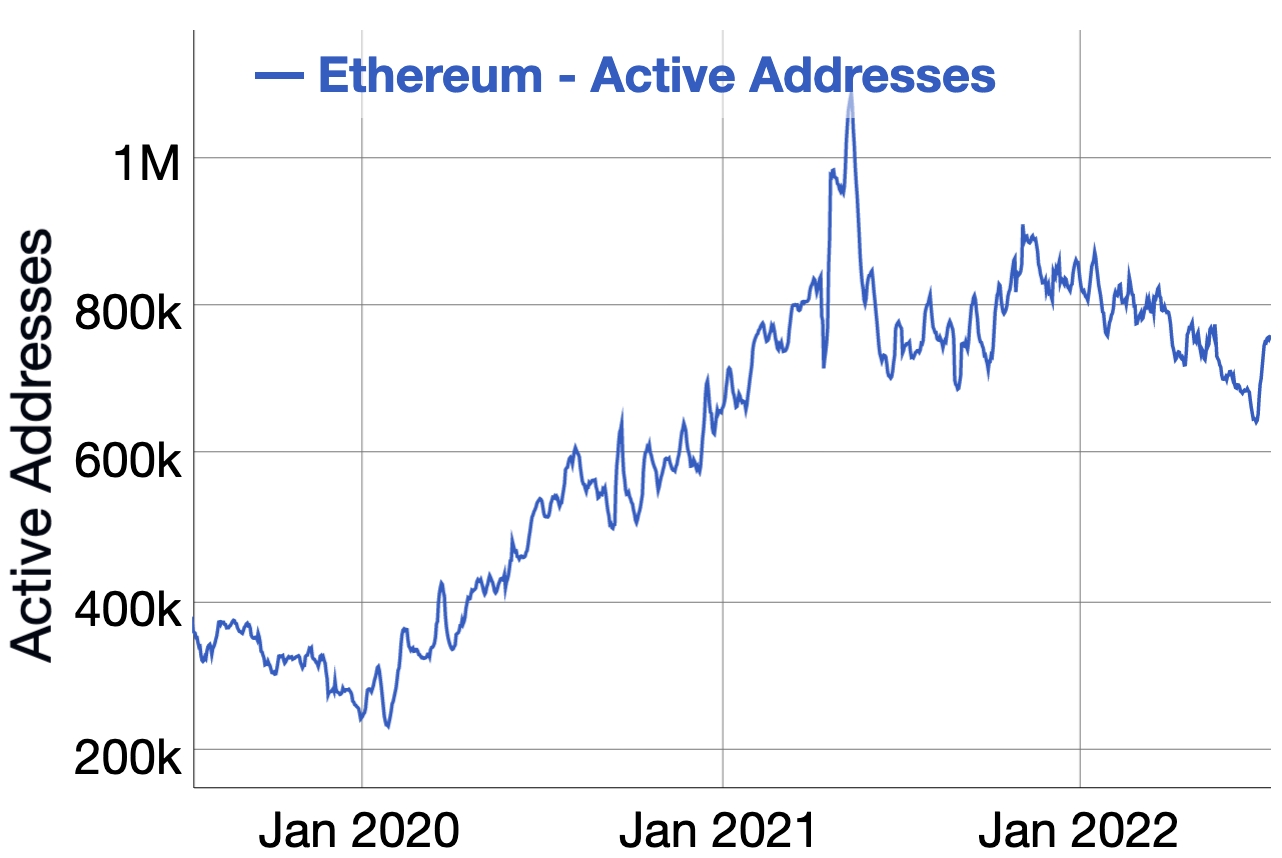

In comparison, the amount of daily active wallets around the Ethereum (ETH) network in general arrived at an optimum of more than 1m in May 2021, so it has yet to exceed.

Our prime usage implied by the amount of active wallets was construed by investors as “a bullish signal to help keep purchasing blockchain games,” DappRadar authored.

It further noted the second quarter this season saw investment capital investments of USD 2.5bn flowing in to the sector, so it stated maintained the interest rate occur the very first quarter, and “already surpassed the annual milestone of [USD] 4 billion occur 2021.”

Pointing to a different USD 4.5bn crypto-focused fund by VC giant Andreesen Horowitz like a major supply of future investments in to the space, the report contended that,

“At this pace, we’re forecasted to possess a amount of 12 billion invested through the finish of the season.”

One of the areas within the gaming sector that was the most were virtual world-related NFTs, which saw their buying and selling volume rise by 97% because the last quarter.

Meanwhile, typically the most popular game within the sector was Splinterlands, having a daily average of 283,729 unique active wallets throughout the quarter, based on DappRadar.

Another vibrant place pointed to within the report was Alien Worlds, the 2nd-greatest-rated game by unique active wallets. The game’s player base continued to be “more or fewer stable” within the quarter, with the amount of active wallets falling just 4% within the second quarter when compared to previous one.

With regards to the stuff that haven’t gone very well for that sector, the report pointed towards the play-to-earn game Axie Infinity (AXS). The sport has lost 40% of their players because the first quarter, largely because of the major Ronin bridge hack and also the depreciation from the game’s SLP token.

The Ronin bridge is really a mix-chain bridge accustomed to transfer assets in the Ethereum blockchain to Axie Infinity’s custom-built blockchain Ronin.

That stated, commenting around the findings within the report, Pedro Herrera, Mind of Research at DappRadar, stated that blockchain games have grown to be “one of the very most promising sectors of Web3.”

He added that the quantity of capital elevated, with an “exodus of talent shifting in the leading traditional gaming companies to web3 game startups,” are also positive signs for that sector moving forward.

“We are progressively seeing how Immutable-X, Gala Games, along with other systems are positioning themselves to guide the increasing category in a long time with impressive partnerships already in position,” Herrera stated.

____

Find out more:

– Blockchain Games Most powerful Category Among Crypto Market Downturn

– Axie Infinity Shows New Indications of Existence, Despite Still-Falling NFT Sales

– VC Play-to-Earn Investors Now ‘More Cautious’, Game Engagement Still Strong – Animoca Brands

– Japanese VC Firm Mistletoe Strengthens Crypto Focus, States Web3 Will Spread to any or all Industries

– Blockchain Games Visit a Stop by Users and Volume After Strong Performance in May

– 5 Best Play-to-Earn Games on Ethereum