Get the daily, bite-sized digest of cryptoasset and blockchain-related news – investigating the tales flying individually distinct of today’s crypto news.

__________

NFTs news

- Mark Zuckerberg, the Chief executive officer of Meta, parents company of social systems Facebook and Instagram, announced this week they’re beginning to check digital collectibles on Instagram so creators and collectors can show their NFTs on their own profiles. Zuckerberg added that similar functionality is due Facebook “soon”.

Tokenization news

- Prominent crypto skeptic, US economist Nouriel Roubini is focusing on a tokenized substitute for that US Dollar, dubbed USG, which is supposed to stand against greater inflation, global warming, and riots, per Bloomberg. Roubini added the USG would first be a catalog, then an exchange-traded fund (ETF), and lastly a burglar token supported by “real/[financial] assets with AML/KYC [Anti-Money Washing / Know Your Customer] features.”

Investments news

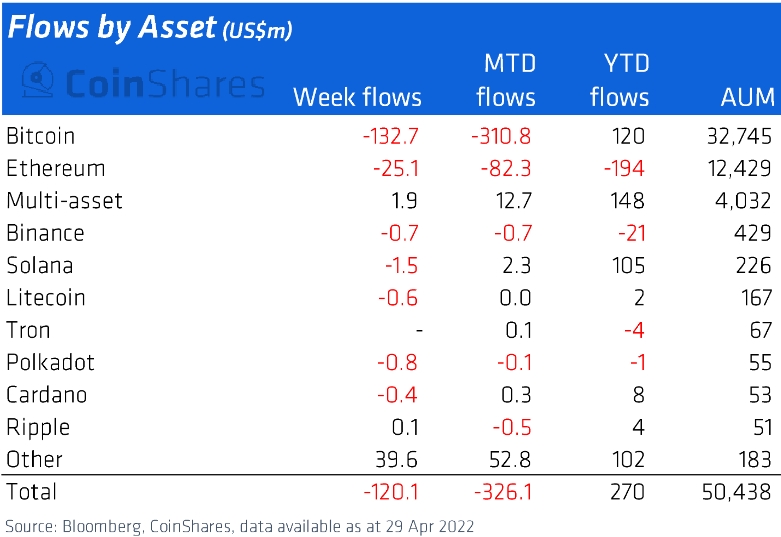

- Digital asset investment products surprisingly saw inflows totaling USD 40m a week ago, per CoinShares data. “We feel [that] investors [are] benefiting from the substantive cost weakness to increase positions,” per the firm. However, they stressed that there wasn’t any spike in investment product buying and selling activity as typically happens during extreme cost weakness periods, and it is too soon to inform if the marks the finish from the 4-week run of negative sentiment. Bitcoin (BTC) saw inflows of USD 45m (in contrast to USD 133m outflows a week ago), while ethereum (ETH) saw outflows of USD 12.5m or 50% under per week earlier.

- Institutional crypto-powered management solution Compound Treasury announced it’s received a b — grade from credit score agency S&P Global Ratings. They include that “S&P’s outlook is stable, reflecting an expectation of limited loan losses around the Compound Treasury platform.”

- Asset manager Universe Digital announced a internet comprehensive lack of USD 111.7m for that first quarter of 2022, over a USD 858.2m grow in the last-year period. They mentioned that “[t]he decrease was mainly associated with unrealized losses on digital assets as well as on investments within our Buying and selling and Principal Investment companies, partly offset by profitability within our Investment Banking and Mining companies minimizing operating expenses.”

- Blockchain gaming firm Irreverent Labs elevated USD 40m to help its efforts to produce a robot cock fighting NFT game known as MechaFightClub, per GamesBeat.

Career news

- Crypto exchange Bitstamp announced it has hired JB Graftieaux, their Europe Chief executive officer, since it’s Global Chief executive officer. Graftieaux was formerly the Md of e-commerce giant eBay Europe, where he brought their regulatory operations for payments and offered around the board of company directors for many eBay entities. Graftieaux succeeds Julian Sawyer “that has made the decision to pursue other possibilities.”

Legal news

- The United kingdom High Court has recognized non-fungible tokens (NFTs) as property inside a situation introduced by Lavinia Osbourne, the founding father of the informative show Women in Blockchain Talks, who claimed that two digital works in the Boss Special gems collection, an NFT-based initiative made to “create opportunities” and lift funds for women, have been stolen from her online wallet, according towards the Art Newspaper.

- Luiz Capuci Junior, the Chief executive officer of purported crypto mining and investment platform Mining Capital Gold coin, was indicted for allegedly orchestrating a USD 62m global investment fraud plan, the united states Department of Justice stated. Capuci operated a dishonest investment plan and didn’t use investors’ funds to mine new cryptocurrency, as guaranteed, but rather diverted the funds to crypto wallets under his control, they claimed.

Mining news

- Alborz LLC, some pot venture affiliate of Bitcoin mining company Cipher Mining and company WindHQ, announced it has joined right into a two-year USD 46.9m guaranteed credit facility with crypto loan provider BlockFi. The borrowed funds proceeds will finance Bitmain S19J Pro mining rigs in the Alborz data center.