OpenSea includes a security and fraud problem and when one account holder around the NFT marketplace is appropriate, it’s negligent in protecting its customers and responsible for extortion.

As prominent NFT creator, collector and venture capitalist Kevin Rose would without doubt attest, thievery within the NFT space is really a serious issue. He lost part of his personal collection worth $1.a million inside a recent phishing attack, although which was nothing related to OpenSea.

Robert Acres, once we detail below, also fell victim for an NFT phishing attack. Less high-profile a person of OpenSea as Rose, Acres had two NFTs stolen inside a phishing attack.

He alleges that not even close to quickly attempting to help him retrieve his property and stop resale through the thieves, as OpenSea is reported to possess completed with Rose, the key NFT marketplace wound up locking Acres from his take into account three several weeks.

In that time Acres alleges he endured large losses around the 58 NFTs in the account while he was not able to trade them.

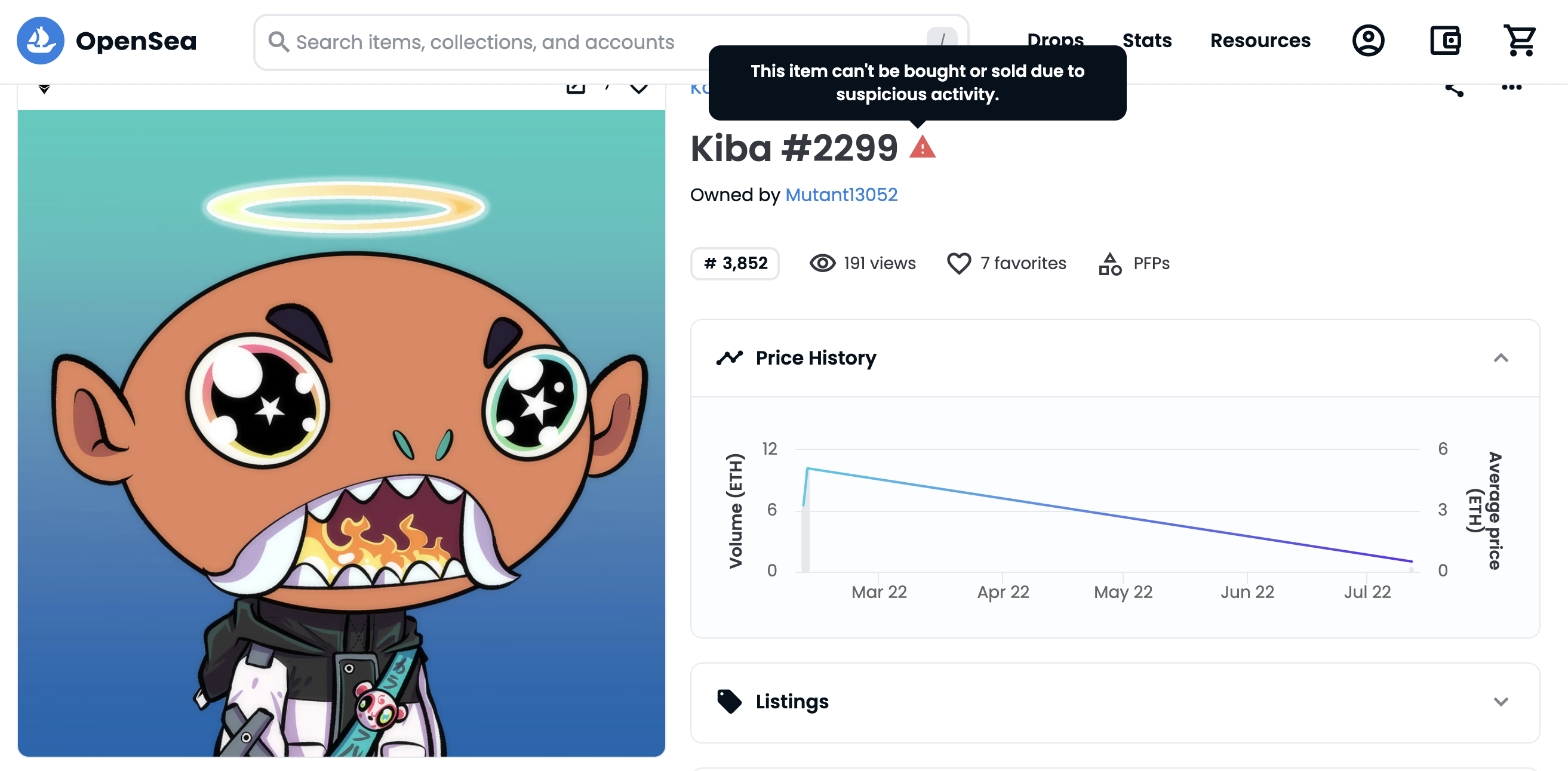

The 2 now blacklisted stolen NFTs is visible for auction on OpenSea, having a warning the products can’t be bought or offered because of suspicious activity:

https://opensea.io/assets/ethereum/0xd2f668a8461d6761115daf8aeb3cdf5f40c532c6/2299

https://opensea.io/assets/ethereum/0x4db1f25d3d98600140dfc18deb7515be5bd293af/5297

Acres’s stolen NFTs were offered through the crook for .5 and .7 WETH.

However, Acres estimates his loss caused by the inability to trade his remaining NFTs on OpenSea at around $500,000 and it is suing the NFT marketplace – OpenSea is really a buying and selling name of Ozone Systems Corporation – to create good individuals losses.

He’s hired the expertise of Traverse Legal, with managing partner and trial attorney focusing on blockchain and web3, Enrico Schaefer, heading in the team.

Image caption: among the stolen NFTs: https://opensea.io/assets/ethereum/0xd2f668a8461d6761115daf8aeb3cdf5f40c532c6/2299

OpenSea user states he was locked from his account after complaining

Acres alleges that whenever he were not impressed with the slow response by OpenSea towards the thievery, it had been then the marketplace locked him from his account.

Based on the timestamped support communications with OpenSea seen by Cryptonews, dated This summer twelfth 2021, your day the thievery required place, Acres informed OpenSea from the thievery before the purchase from the stolen NFTs around the marketplace.

The transaction hash from the thievery is proven on etherscan and timestamped at 01:38 PM UTC: https://etherscan.io/texas/0xa6bc538181d79b342cd69042eac74b9a64a1aeb99ed05d98d3f5c09a6f7bf59d

The purchase required place 1 hour later at 02:38 PM UTC: https://etherscan.io/texas/0xd2327c65e66d0ac94282580f0a8d64d1cd155faa53d7613565d55c6ed9862b25

The e-mail reporting the thievery to OpenSea support is timestamped at 02:11 PM UTC.

The texas hashes reveal that there is 30 minutes between OpenSea being alerted towards the thievery and also the subsequent purchase around the marketplace.

Admittedly it may be contended the half-hour window didn’t give OpenSea enough time to react, but when it was legacy finance, where automated surveillance systems have been in operation, processes could be in position to rapidly suspend suspect activity.

But, given its insufficient action to avoid the resale, it may be reasonable to summarize that OpenSea doesn’t have the symptoms of had sufficiently robust systems in position so that you can react to such alerts from users in due time.

OpenSea’s initial response seems to become deliberately disingenuous

Partly, in the only public statement made around the matter up to now, an OpenSea spokesperson, mentioned: “The thievery under consideration required place outdoors of OpenSea and also the products were offered before OpenSea grew to become conscious of the reported thievery. Right after i was notified and grew to become aware, we disabled the products and also the user’s account has since been unlocked.”

The very first clause from the first sentence is true – it had been a phishing attack which had nothing related to OpenSea. But, if Mr Acres is true, the remainder of that snippet in the statement is wrong. OpenSea, as proven above, was informed from the thievery prior to the purchase required place.

The 2nd sentence is disingenuous as you would expect as it may automatically get to infer the user’s account was unlocked right after the 2 NFTs were disabled, that was and not the situation – Acres’s account was locked for 3 and half several weeks.

Indeed, it seems it had been when Acres required problem with OpenSea’s failure to avoid the purchase from the stolen NFTs, that his account was locked.

Within an email to Cryptonews.com, Acres writes:

“Frustrated and believing OS bore some responsibility for which had happened, I noted that OS ought to be responsible for financial damages. In reaction, OS locked my account without warning, request, or permission.”

Acres procedes to allege that “OS required which i swear under oath that my wallet is not compromised (meaning OS wouldn’t be liable)”.

Based on Acres’s account, as he declined to conform using the alleged demands from OpenSea, he was locked from his account. Acre further claims that OpenSea, because of the lock-out, avoided him from buying and selling his 58 NFTs around the OpenSea marketplace.

OpenSea user claims the NFT marketplace “can seize your NFT assets”

Acres writes in the email to Cryptonews.com: “OS represents that it is users’ NFTs are away from the child custody of OpenSea. Yet, most OpenSea people are not aware that OS can seize your NFT assets and preclude you against moving or buying and selling your NFTs for several days, days, several weeks, or presumably forever, even though you didn’t do anything wrong.”

The OpenSea help center page, clearly states the alternative is the situation:

“While we are able to stop your products from being bought or offered using OpenSea’s services, your products stick to the blockchain and aren’t within the child custody of OpenSea.”

OpenSea wouldn’t obviously have the ability to prevent a person from the platform from buying and selling their NFTs on the competing marketplace. Which means it might not be the situation that, as it happens, OpenSea “can seize your NFTs”, as Acres claims

However, used, the majority of the liquidity obtainable in the NFT market will be available on OpenSea. Ideas see writ large the limitations of crypto decentralization used instead of its theoretical intended outcomes.

Inside a defense from the accusation he levels against OpenSea concerning the lock on his account, Acres told Cryptonews: “Once your bank account is ‘locked’ or ‘blocked’ all of the products in the bank are flagged as suspicious and therefore regardless of what wallet they’re used in they should never be in a position to trade on OpenSea until they take away the flag upon your account.

“Currently, OpenSea instructions over 60% of NFT buying and selling volume and when this incident happened it had been much better.

“The buying and selling volume left being split by competitors means that you’re not capable of getting probably the most competitive prices and therefore again builds in to the financial losses being accrued on my own for any wallet lock which was put on me against my will.

“Most people who trade on any OS competitor marketplace frequently finish up using OS because the resale market once they purchase on the competitor’s marketplace.

“So again, within this situation, my NFTs would carry this ‘suspicious’ tag when proven on [the] OS marketplace[] the brand new buyer also cannot market it and therefore when they’re doing their research throughout the shopping process they would not get them as re-purchase options could be limited.”

How’s that type of argument prone to engage in inside a court?

OpenSea stands charged with attempted extortion

We place the same question, concerning the complainant being liberated to trade his NFTs elsewhere, to Acres’s lead lawyer, Enrico Schaefer, managing partner at Traverse Legal.

It was his response.

“OpenSea acquired Mr. Acres’ assets by presuming charge of his account, which constitutes the tort of conversion [lawyer-speak for a kind of thievery]. This provides people who are the sufferers of thievery the right to consider law suit to recuperate their damages.

“In essence, conversion provides one having the ability to file a suit to acquire damages for that conversion over their home. Conversion takes place when an individual, using the intention and without correct authorization, takes charge of someone else’s property or funds, therefore restricting remarkable ability to gain access to it.

“The control doesn’t need to be exclusive. The possible lack of response from OpenSea and also the attempted extortion to unlock the account would have been a surprise along with a reason to be concerned, as it might be for anybody inside a similar situation.”

Why didn’t OpenSea respond in due time once alerted towards the NFT thievery?

In addition, Traverse Legal with respect to Acres claims that OpenSeas had three hrs to do something prior to the purchase from the stolen NFTs required put on its platform.

“If OpenSea hadn’t anxiously waited over three hrs to positively engage, the NFT might have been locked and potentially came back to his wallet,” writes Traverse Legal.

Actually the lapse of your time between being alerted towards the thievery as well as their subsequent purchase was really only 30 minutes, once we pointed out earlier, based on Cryptonews analysis.

Nonetheless, in the end from the well-documented issues on the website faced by its users, from insider-dealing to thievery, OpenSea should surely right now have implemented systems and procedures, automated and human, to instantly pause suspicious activity when it’s flagged.

Departing the timings aside, surely OpenSea could defend themselves because that Acres could have been liberated to trade his 58 NFTs for auction on OpenSea at another venue?

“This matter is better forwarded to Robbie, who experienced the problem firsthand,” authored Schaefer within an email to Cryptonews.

He ongoing: “However, I’ve formerly symbolized clients facing similar issues. The assertion that ‘a lesser platform with less buyers and sellers’ might have been used rather isn’t a valid excuse for OpenSea to shirk its responsibilities to the platform people.

“OpenSea may be the preferred platform for people trying to maximize demand and prices pressure on the market. Utilizing a platform having a considerably lower product sales might have led to a liquidation purchase instead of substantive buying and selling activity.”

The 3 questions for OpenSea that remain unanswered

Exactly what does OpenSea are saying about all of this, beyond their initial statement distributed to media outlets?

We sent OpenSea the next questions:

- Why was Mr Acres locked from his account against his will?

- Why was Mr Acres needed to perjure themself, out of the box alleged, to get his account unlocked?

- Will Mr Acres receive compensation for losses allegedly incurred within the time he was not able to gain access to his account?

Not much later and we’re still yet to listen to away from OpenSea.

It certainly is the peak of irony that the marketplace that trades products with different technology whose use value is grounded in being able to safely assign unique identities to digital and non-digital assets along with other property, can’t avoid the proliferation of fraudulent listings and also the purchase of stated stolen assets.

Does OpenSea place the gathering of buying and selling charges revenue over the interests of their users?

We gave Acres the ultimate word. On telephone, inside a conversation by which he agreed the correct timing is 30 minutes in regards to the report from the thievery and also the purchase from the stolen property, he nonetheless was adamant: “The major [of his complaint] part is always that they locked my take into account 3 . 5 several weeks and requested me to perjure myself.

“I understand fully that it’s a phishing scam which acting within forty-five minutes for an hour of me being notified myself after which notifying OpenSea – which half-an-hour stretch when it comes to me notifying them that it’s been stolen and wishing they might take some kind of action – is fairly slim, I actually do completely stick to that.

“But exactly what follows on from that transaction is negligence 101.”

Have you ever had your bank account locked by OpenSea previously been the victim of attacks by fraudsters but found OpenSea slow to assist or really are a creator of NFTs for auction on OpenSea battling with scammers persistently posting fraudulent versions of the products? If that’s the case, make contact with Cryptonews at [email protected].