Most buyers from the hotly-anticipated Otherdeed non-fungible tokens (NFTs) drop aren’t able to sell their digital land deeds in a profit, because of the high Ethereum (ETH) gas charges they compensated during minting, along with the decreasing demand.

According to NFT data aggregator CryptoSlam, Otherdeed NFTs sales are lower by 24.6% in the last 24 hrs, with nearly a 45% loss of the amount of new buyers.

The ground cost from the collection, the tiniest amount of cash the different options are to buy an Otherdeed NFT, has additionally taken a success, shedding by 9.46% from ETH 3.7 (USD 10,532) to ETH 3.35 (USD 9,536).

Given that almost all users compensated exorbitant gas charges throughout the mint, the decreasing demand further pushes them underwater.

According to Etherscan data, users compensated between ETH 2.6 (USD 7,356) to ETH 5 (USD 14,147) in gas charges. The NFTs were minted at APE 305 each, meaning each Otherdeed cost about USD 5,800 (ETH 2) given Apecoin’s cost (USD 19) at mint time.

Subtracting the minting cost of ETH 2 in the current floor cost of ETH 3.38, apparently , any buyer who compensated greater than ETH 1.38 in gas charges is presently at a negative balance.

Particularly, some have switched to wash buying and selling to be able to artificially increase prices and paint a misleading picture of the NFTs’ value. Based on CryptoSlam, Otherdeed wash sales have elevated with a whopping 13,203,094% in the last 24 hrs.

Launched by Yuga Labs, the startup behind the most popular NFT collection Bored Ape Yacht Club (BAYC), Otherdeed NFTs went survive Saturday night. The NFTs should be “the answer to claiming land in Otherside,” Yuga Labs’ approaching metaverse game.

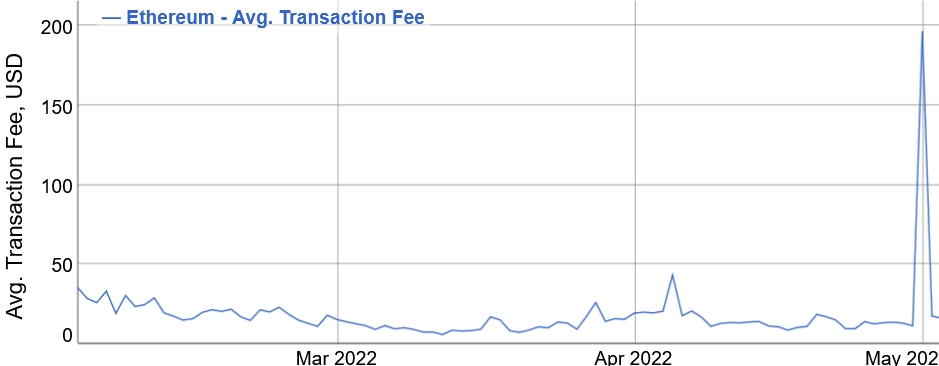

The Otherdeed mint attracted huge attention, clogging the Ethereum mainnet and leading gas prices to skyrocket. The typical gwei, or cost of Ethereum gas, surged to greater than 6,200 during the period of the mint night.

“It has been the biggest NFT mint ever by a number of multiples, but the gas used throughout the mint implies that demand far exceeded anyone’s wildest expectations,” Yuga Labs stated. “The size of the mint am large that Etherscan crashed.”

Yuga Labs also promised they would refund the unsuccessful transactions, as well as stated the requirement for their very own blockchain. “It appears abundantly obvious that ApeCoin will have to migrate to the own chain to be able to correctly scale,” the organization stated.

Meanwhile, scammers also have were able to steal millions price of NFTs through phishing attacks impersonating Yuga Labs among the hype behind the Otherside NFT drop.

There has been several phishing attempts, varying from fake websites to forged Twitter accounts impersonating the organization and it is metaverse initiative.

____

Find out more:

– Apecoin hitting USD 27 by Finish 2022 – Survey

– ApeCoin Smart Contract Exploited, ‘Well-Prepared Claimer’ Walks Away With USD 380K

– Kraken Enters NFT Game with Waitlist for brand new Multi-Chain Marketplace

– Elon Musk NFT First to go in Ukrainian Hall of Fame and also you Can’t Purchase It

– DeFi Transactions at One-Year Low, NFTs and Games Standing Strong

– NFTs in 2022: From Word of the season to Mainstream Adoption & New Use Cases