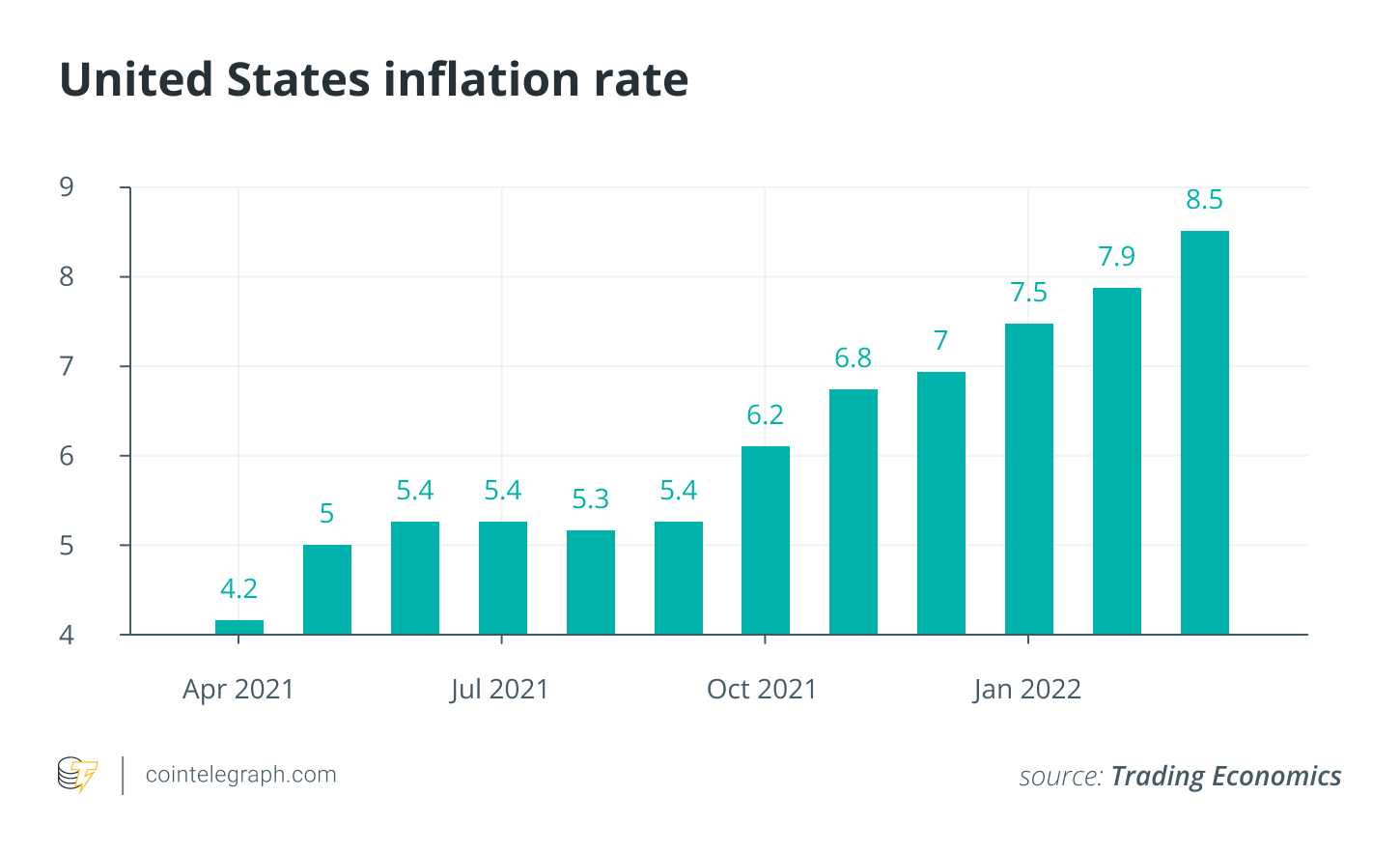

When occasions are tough — as with the pandemic — enterprising human instinct adopts overdrive. People look for other ways to earn money. That may be a primary reason why cryptocurrencies skyrocketed in recognition within the last couple of years, driven partly by large figures of individuals sitting in your own home wondering how you can beat low-rates of interest and rising inflation.

Where there’s cash, however, there’s also crooks. Bad actors are experts in human behavior and find out building momentum and elevated crypto traffic like a huge chance, understanding that many newer investors might not do their homework. Investors may not use the same degree of scrutiny to crypto because they would their pensions or any other investments, and there’s very little regulatory oversight globally. So, an easy splash page or message on the forum can rapidly lead lots of new investors to fall under scams.

We’ve also seen an elevated proliferation of scams attached to the pandemic for example pretending to market fraudulent medicines, vaccines or testing, or offer loans and grants, for example, possess a crypto element, and police force is getting to show on the cent to respond to these new threats. That, consequently, results in a growing headache for policymakers given the job of protecting consumers. We hear loud and obvious in the crypto industry that regulation frequently feels behind the bend and never fit for purpose.

What’s needed is much better education. Better education at each level, from teaching and educating police force to policymakers and regulators. Understanding discussing over the crypto ecosystem to aid investigations. And, the sources and appetite for creating smarter regulation which will both safeguard consumers and provide the the clearness it must still innovate and flourish.

Related: Mass adoption of blockchain tech can be done, and education is paramount

A brand new method of police force

Centuries-old investigative methods require more than adaptation to satisfy the requirements of the crime involving digital assets. As new kinds of crime emerge, the crypto industry includes a duty to teach every person in police force relating to this ” new world ” and fast. Crypto’s primary “players” are usually youthful digital natives when compared with police force. Worldwide, most officials might find crypto very foreign, intimidating or puzzling, which makes them somewhat up against the technology. It has its impacts, as police force is frequently first at crime scenes, collecting evidence on the search warrant. But, are they going to understand how to locate a Bitcoin wallet, for example? Should you not comprehend the crime, how will you police it?

After education, the greatest struggle is sources. Within the U . s . States, crypto crime can be regarded as a subset of cybercrimes like ransomware. By particularly resourcing crypto, investigators can engage in its benefits in uncovering the immutable evidence of transactions stored around the blockchain, but frequently the sources and understanding sit with Federal police force. Which means that local crypto-related crimes are removed from local law enforcement’s hands, developing a huge backlog in the Federal level.

Related: The United States intend to monitor illegal crypto activities more sufficiently

Within the Uk, police force is making up ground to crypto crime. One fourth of U.K. police forces have performed a component in appropriating $450 million, or around £322 during the time of writing, in cryptocurrency within the last 5 years. Diving much deeper in to the figures, we are able to observe that 99.9% of seizures are Bitcoin (BTC), suggesting that police can easily trace criminal activity using public blockchains but face problems tracking privacy coins like Monero (XMR) and Dash (DASH).

Greater Manchester Everybody that U.K. police forces are “just getting their heads around” we’ve got the technology behind crypto they’re recruiting civilian staff with relevant experience to coach detectives. And, forces face yet another legal hurdle when appropriating cryptocurrency as it is considered property, not cash, underneath the Proceeds of Crime Act.

Related: In defense of crypto: Why digital currencies deserve a much better status

Whenever we discuss crypto, police force is beginning to maneuver beyond rug pulls and Silk Route to grasp its huge potential in assisting to resolve a criminal offense by opening tools for investigators to follow the movement of cash globally. Within the U.K., Her Majesty’s Revenue and Customs (HMRC) grabbed three nonfungible tokens (NFTs) connected with suspected tax evasion, becoming an alert to individuals searching to hide money in the government bodies.

Lowering the “lag” in new regulation

Regulators are mainly worried about protecting consumers, and it is obvious that they’re battling to help keep pace having a rapidly evolving industry. Regulation exists but feels piecemeal. We will have more regulation coming this season from consultations and dealing groups, the U.K.’s Her Majesty’s Treasury announced financial promotions oversight just lately, but frequently we hear the industry sees emerging regulation as decidedly behind the bend.

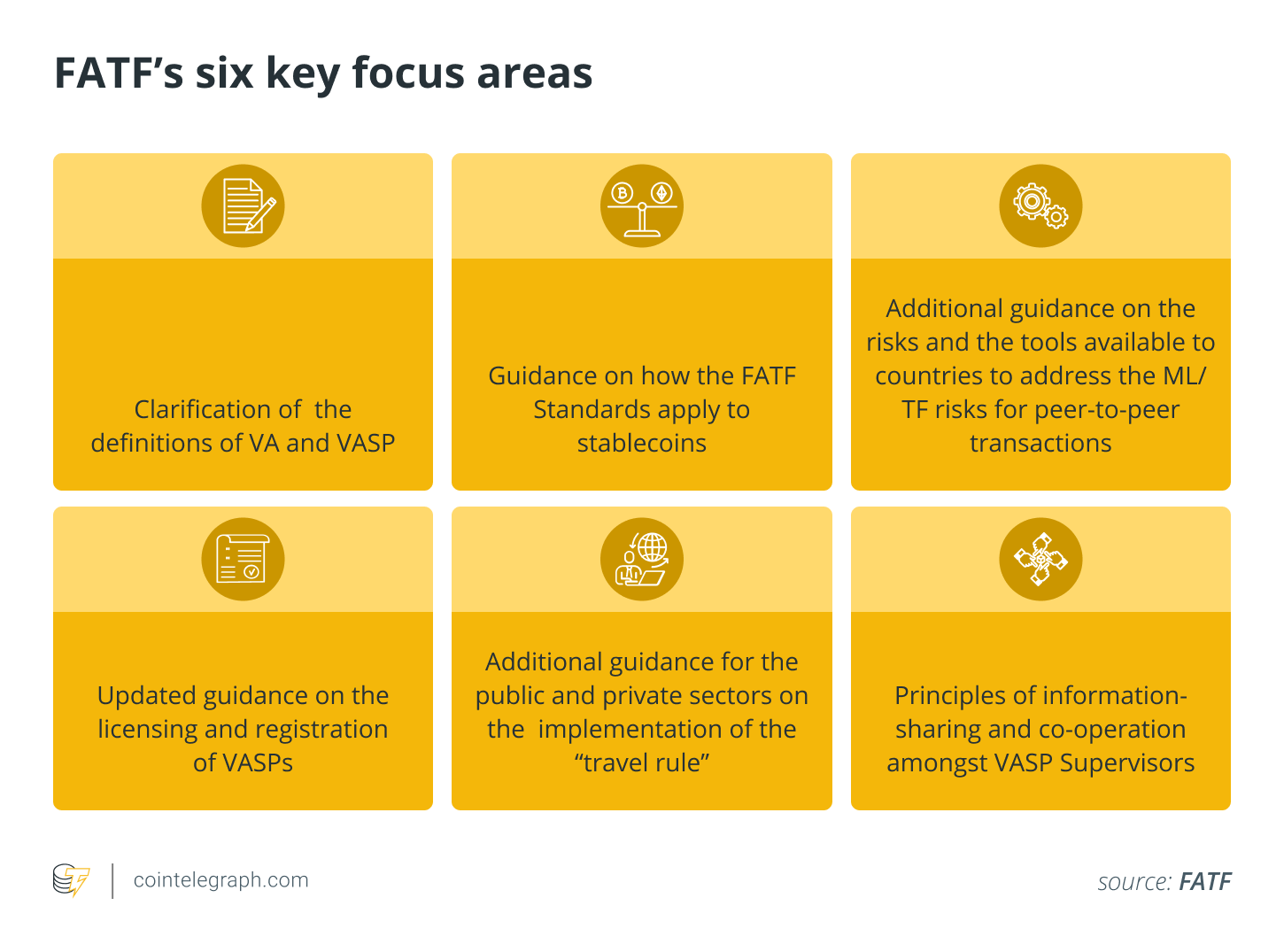

Regulators want to alter that perception. Within the Eu, for example, the Eu Council adopted Markets in Crypto Assets (MiCA) framework and also the Digital Operational Resilience Act (DORA), which might become law later this season. MiCA provides some clearness on controlling stablecoins, public choices of crypto assets and licensing virtual asset providers (VASPs). DORA covers digital operational resilience, making certain that companies can withstand all kinds of technological risks.

The U.K.’s Financial Conduct Authority (FCA) is spending so much time, promising to place more sources into crypto. Consequently, more firms are becoming approval. Jurisdictions like Europe and Singapore are the standard-bearers for regulatory frameworks which are obvious and mature, where crypto companies have clearness regarding their position, may change and can flourish.

Related: The brand new HM Treasury rules: The great, unhealthy and also the ugly

Blockchain and behavior monitoring tools are increasing in recognition because crypto firms see improving compliance processes (as well as their relationship with regulators) as answer to growing adoption. In general, where we have seen regulatory clearness, we have seen growing efforts produced by the to boost compliance and boost adoption, fuelling the economy for the reason that region and furthering innovation for the whole market. It may be tempting to determine the crypto industry as at war using its regulators, but I’d characterize it-not as adversarial but because symbiotic. Improving standards, if succeeded as well as in collaboration, stands to profit everybody.

Sit back while dining

There’s much to become acquired from inviting private blockchains, governments, exchanges and VASPs towards the same table. Understanding discussing over the ecosystem, particularly with regards to behavior data and new criminal typologies, could unlock criminal investigations in addition to enable better-created regulation and consumer protections. It’s a balanced exercise.

Related: FATF includes DeFi in guidance for crypto providers

An increasing number of companies are approaching us, thinking of doing the best factor beyond meeting the present regulatory needs. By enhancing compliance and applying guidelines, the sphere can mature, making certain that crypto companies operate securely, investors are safe and inching the doorway available to institutional investors.

Inside a world where one can create a large number of new addresses each day, blacklists simply can’t continue. This is where behavior analysis is available in to supplement classical resources so companies could make informed decisions on how to act.

Related: Bitcoin can not be considered an untraceable ‘crime coin’ any longer

Education can make crypto finally come old

Crypto can’t become conventional without wider awareness and understanding. The informs us that governments and regulators always appear six steps behind when attempting to revive control of chaos instead of taking an extended-term and fewer myopic take on policymaking. Which was a huge part of my role in the FBI, helping police force to possess a fundamental knowledge of crypto. And, we’re still battling for much better education. We’ve been lending our expertise to assist regulators and governments get up to date with that shifting and quickly innovating industry to produce relevant and efficient policy. Because without awareness, understanding and understanding, crypto might be broadly noted for crime over authenticity for a while in the future.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Mike Welsh is director of presidency matters at Merkle Science and accounts for relationships with worldwide government entities, supplying training, operational and technical insights to regulators and police force so that they may seamlessly fold cryptocurrency crimes into financial investigations and collaborate along with other agencies. Formerly, Mike spent eight years using the FBI, focusing on complex financial crimes and opioid diversion. Next, Mike brought Chainalysis’ early efforts in to the public sector, assisting in government liaison and processes.