Most of us have had the experience. The thing is something, hear something, or feel something, and wish to share that feeling or observation with another person. Would you get the telephone? Send more than a text? Record a voice note?

Humans thrive within our shared encounters: an attractive concert, the winning objective of a sports match, getting out of bed to look at the sunrise. There is something fulfilling about getting an event or being able to share it with someone instantly. These types of technology, are going to that, even when someone else, give them a call our counterpart, is midway around the globe.

Why wouldn’t we predict exactly the same degree of seamless communication and collaboration across a business built around that thought — total interconnectivity along with a global achieve? Crypto was created to democratize use of finance, community and technology. But, in the present regulatory climate, as government departments tighten their grasp about how customers transact through the Coinbases and Binances around the globe, we’re experiencing growing delays among quickly expanding sanctions which are creating a major enter crypto’s connectivity.

Consequently, crypto exchanges have a harmful roadblock when attemping to conform (and process compliant transactions between one another) among global regulation. What’s holding our industry back currently whenever we need obvious compliant solutions? Satisfy the Sunrise Issue.

The present condition of VASPs — and also the Travel Rule

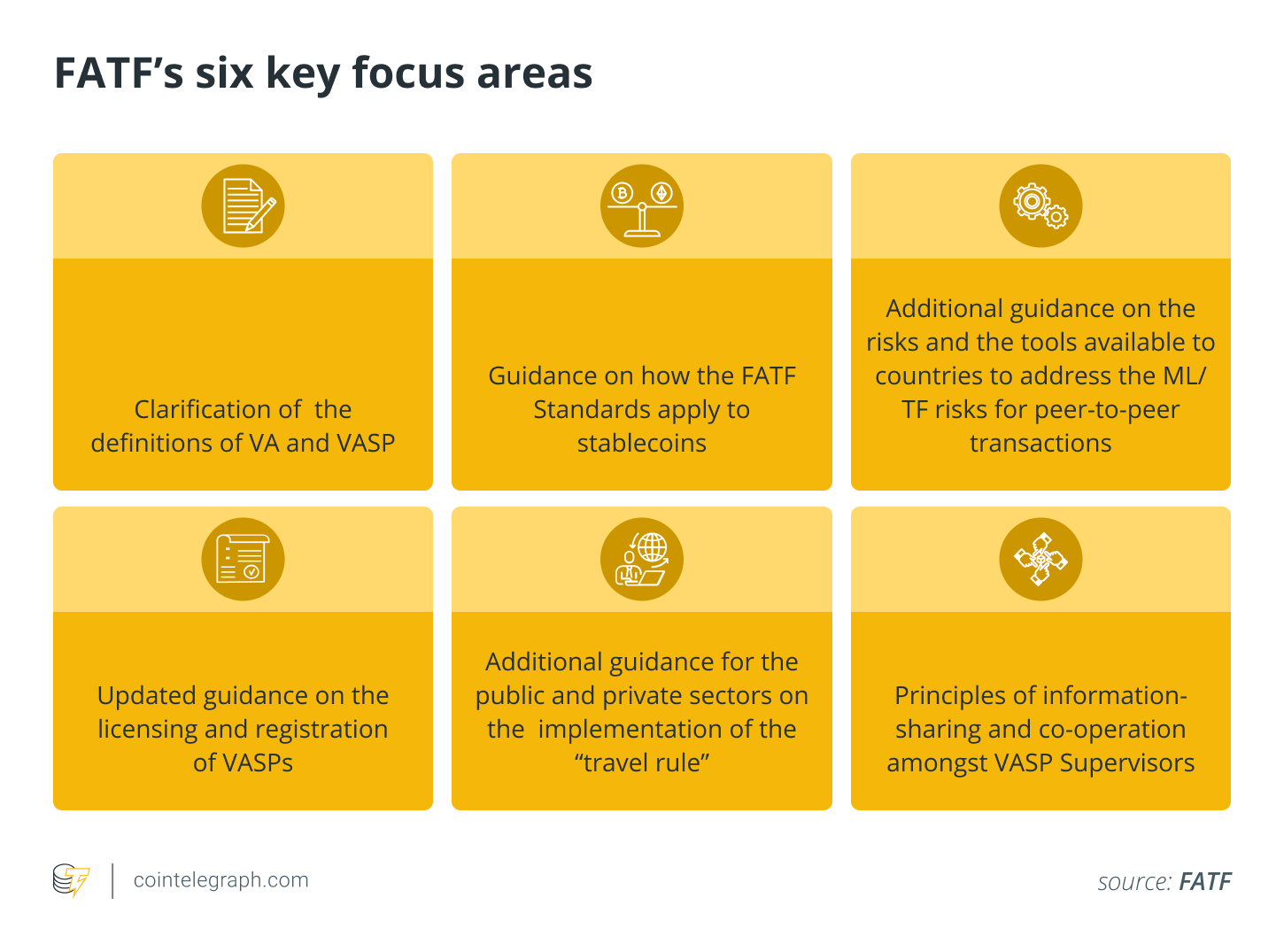

If you’ve been following crypto’s regulatory landscape within the last 3 years, you’ve likely encounter the word “VASP,” which means Virtual Asset Company, a phrase born in the FATF (Financial Action Task Pressure).

Beyond crafting acronyms, the FATF functions like a global watchdog agency for stopping money washing in financial transactions. The FATF accounts for the Travel Rule, an economic regulation that needs banks, crypto exchanges along with other crypto players, by 2020, to talk about data on participants (customers) in financial exchanges exceeding 1,000 USD/EUR. Some countries have reduced the brink to zero. What is really a VASP? Generally speaking, a VASP is really a cryptocurrency exchange, liquidity provider or custodian that may be centralized or decentralized.

Related: FATF includes DeFi in guidance for crypto providers

The sunrise is perfect for everybody, right?

So here’s the problem and why it is so harmful to advance. Compliance must be seamless and synchronised. From the crypto compliance perspective, let us break lower what which means, and just how whenever a VASP posts a request info on transacting people to another VASP, issues can arise. VASP “A” (a crypto exchange) are operating in a jurisdiction where Travel Rule compliance is needed. Based on the “Sunrise Issue” example, VASP A can easily see the sunrise within their location and desires the opportunity to discuss it (exchange customer details) having a counterpart who resides in another place, in which the sun has not yet show up (VASP B). VASP “B” is situated in which the Travel Rule is not yet a regulatory obligation. VASP B isn’t just inside a different “time zone,” it’s different rules altogether. How you can solve the dilemma when there’s one compliant and something non-compliant VASP?

VASP A (a crypto exchange where cash is being deposited or sent) transmits an “information request” to VASP B. To go back to the Sunrise example again, VASP A wants to speak to VASP B regarding their experience watching the sunrise. VASP A posts a request these details from VASP B, who doesn’t respond since the sun hasn’t yet show up where they’re. It may be tomorrow, maybe it’s a year, until then, there’s a imbalance that’s resulting in potential non-compliance for VASP A, which it’s still attributed to the specific regulators. The Sunrise Issue strikes.

Related: DeFi: Who, how and what to manage inside a borderless, code-governed world?

Getting real about regulation

In the last couple of years, platforms across crypto and DeFi happen to be working hard building compliant methods to government rules such as the Travel Rule. Ideally, these solutions allow VASPs to function without any interruption to how their clients would normally transact.

The fact is that regulation is not an “if” in crypto. It’s here — and it is growing. Despite the fact that the knee-jerk reaction among some within our market is to villainize regulation, compliance protects customers and exchanges and it is set up to safeguard against malicious intent and bad actors who set the in our journey towards global mass adoption. This require is real: based on TechCrunch, crypto losses have spiked 695% on year following massive hacks, like last month’s $625 million Axie Infinity/Ronin Network exploit. The secret is, how can we remain compliant, safeguard ourselves and never quit the amount of pseudo-anonymity and identity that lots of us switched to crypto to see to begin with?

Related: Losing privacy: Why we have to fight for any decentralized future

How you can solve the Sunrise Issue

The reply is compliant solutions that solve the Travel Rule and the Sunrise Issue. If we will be considered a compliant industry, we have to make sure that regulation can be done (and frictionless) for those involved parties. For your to become possible, VASPs must have the ability to process transactions — and transmit the required customer data — between one another, whether or not one VASP is Travel Rule-compliant and yet another isn’t quite yet sticking to rules of the jurisdiction due to staggered implementation.

How can we make it happen? Solutions like Verisope, a Travel Rule solution and decentralized discovery P2P data transmission network just launched by Shyft Network permit a “historic lookback” on any crypto transaction involving a VASP broadcast. This selection enables VASPs to acquire info on any transaction no matter if this happened, before the receiving VASP signed up with Veriscope or any other Travel Rule solution. Like a new VASP joins, they receive these historic data demands and may respond using the information you need, stopping the roadblock (also known as the Sunrise Issue) between compliant and non-compliant VASPs.

Crypto deserves better

If there’s have you been a necessity to democratize use of compliance while protecting customer identity on-chain, that point has become. At the end of March, we automobile to the news the European Parliament had voted on applying new sanctions that will require KYC (know-your-customer) compliance on private, unhosted crypto wallets. Regulation will quickly touch every jurisdiction around the world and each person within each jurisdiction. If exchanges and customers wish to transact (and host process transactions) legally, we will have to be in a position to share key information for current, past and continuing transactions.

Shared encounters and the opportunity to communicate are ultimately what make us human. If crypto is here now to assist improve finance and humanity, we deserve the very best methods to probably the most challenging problems. Let’s prepare yourself.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Frederick Weinberg was an earlier investor in Bitcoin this year and director at Coinsetter until its acquisition by Kraken in 2016. They know his way round the cryptocurrency world. Presently, Weinberg may be the co-founding father of Shyft Network, the blockchain-based trust network that reclaims trust, credibility and identity. Enthusiastic about evolving the mass adoption of crypto and blockchain, also, he can serve as an consultant towards the OECD and also the Financial Stability Board in addition to governments and regulatory physiques globally.