Just lately, Yuga Labs, they behind the planet-famous bored nonfungible token (NFT) primates, nabbed some $300 million using its purchase of Otherdeed NFTs, an accumulation of land plots inside a soon-to-be metaverse. Indeed, NFTs, the blockchain industry’s primary approach to creating digital asset scarcity, emerged because the preferred method to handle virtual land possession for many metaverse projects, including Decentraland and also the Sandbox. All this has motivated a fascinating question locally: Within the metaverse, an enormous, near-endless digital space, just how can digital land be scarce? Well, let’s dig in.

First of all, let’s address the elephant within the room: The metaverse isn’t real. I am talking about, the Ready Player One-style metaverse, a seamless virtual reality-based rendition from the internet as you may know it. So, when you may don your VR helmet for any rave in Decentraland, the unit will hardly remain on for the daily dose of Instagram or perhaps a news feed surf.

Quite simply, what we should have at this time is an increasing number of relatively siloed metaverse projects, that offer users a range of project-specific encounters and processes instead of the browse-whatever from the bigger web. This by itself hints that scarcity is really a valid concept to think about because their lands go, even when we consider their value using it . prism just as real-world land.

Related: Sci-fi or blockchain reality? The ‘Ready Player One’ Oasis could be built

The laws and regulations from the land

Within the real life, the need for a stretch of land is really a product of the couple of quite obvious-cut variables — i.e., natural sources, from oil or nutrients to forestry and renewables, use of infrastructure, urban and logistical centers, and fertile soil. All this can come up based on what you are wanting to use this land. Purpose defines value, however the value continues to be quantifiable.

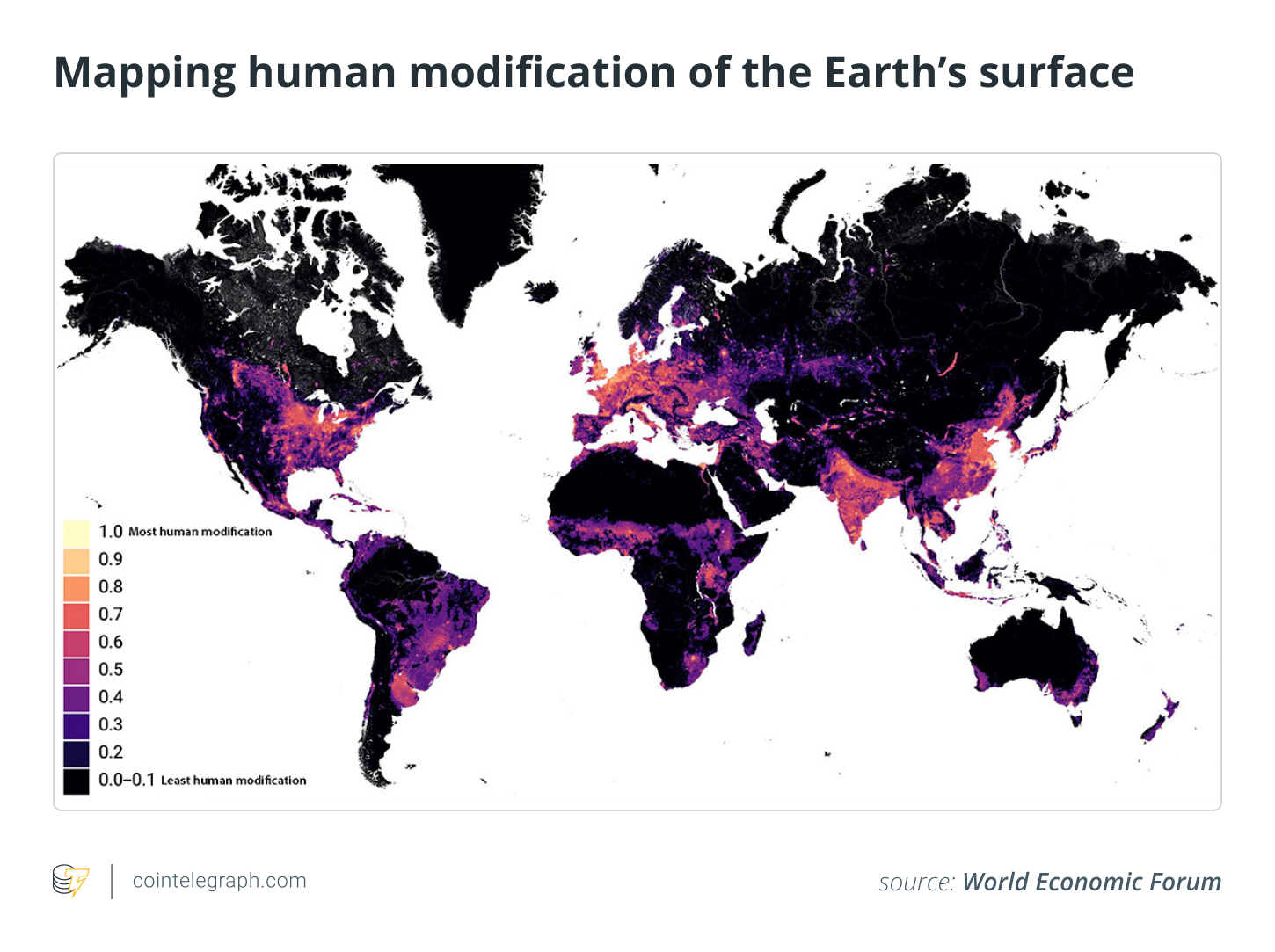

Value, because of its part, frequently goes hands in hands with scarcity, and land isn’t any exception. The planet’s total area is 510.a million square km, but over fifty percent of this is under water, which fits for gas and oil pipelines and submarine cable lines, but very little else. To date, we’ve modified about 15% from the available land area, but, in the finish during the day, land is finite. Element in the worth and financial practicality factors (a good investment needs to be worthwhile), and also the pool of land that really is sensible to get goes even slimmer.

Let’s go ahead and take Sandbox for example. What’s the need for getting there? Again, value originates from purpose. If you’re a fashion brand, for instance, you’d most likely take advantage of finding yourself in an identical digital space as Gucci. In addition to this, if you’re searching to contend with this brand, you’d would like your plot located as near to the own as you possibly can to reduce its footfall using the stunning exterior of your outlet.

Related: The metaverse is booming, getting revolution to property

This is when scarcity returns into play. There are just a lot of NFT plots available near the Gucci store. Inside a digital realm, distance as a result may appear arbitrary, but it isn’t entirely correct. Distance comes lower to how this unique metaverse handles space, objects and movement — the important, foundational aspects of its design. In the end, you most likely would like your own metaverse store to become a real 3D store a purchaser can explore, which requires a 3D spatial grid and a minimum of a fundamental physics engine. Sure, it’s most likely easy to have fun with non-Euclidian geometry along with other smart design features to help make the space bigger inside than you are on the outdoors, however this would amp the workload around the backend and modify the consumer experience.

With, technological constraints and business logic dictate the basic principles of digital realms and also the activities these realms can host. Digital world might be endless, however the processing abilities and memory on its backend servers aren’t. There’s only a lot digital space you are able to host and process without your server stack catching fire, and there’s only a lot creative leeway you could have in those ramifications while still maintaining your business afloat. These frameworks produce a system of coordinates informing the way in which its users and investors interpret value — and along the way, they’ve created scarcity, too.

The truly amazing wide world available

While many of the valuation and scarcity mechanisms range from intrinsic options that come with a particular metaverse as based on its code, the actual-world factors have as much, or even more, weight for the reason that. And also the metaverse proliferation will hardly change them or water the scarcity lower.

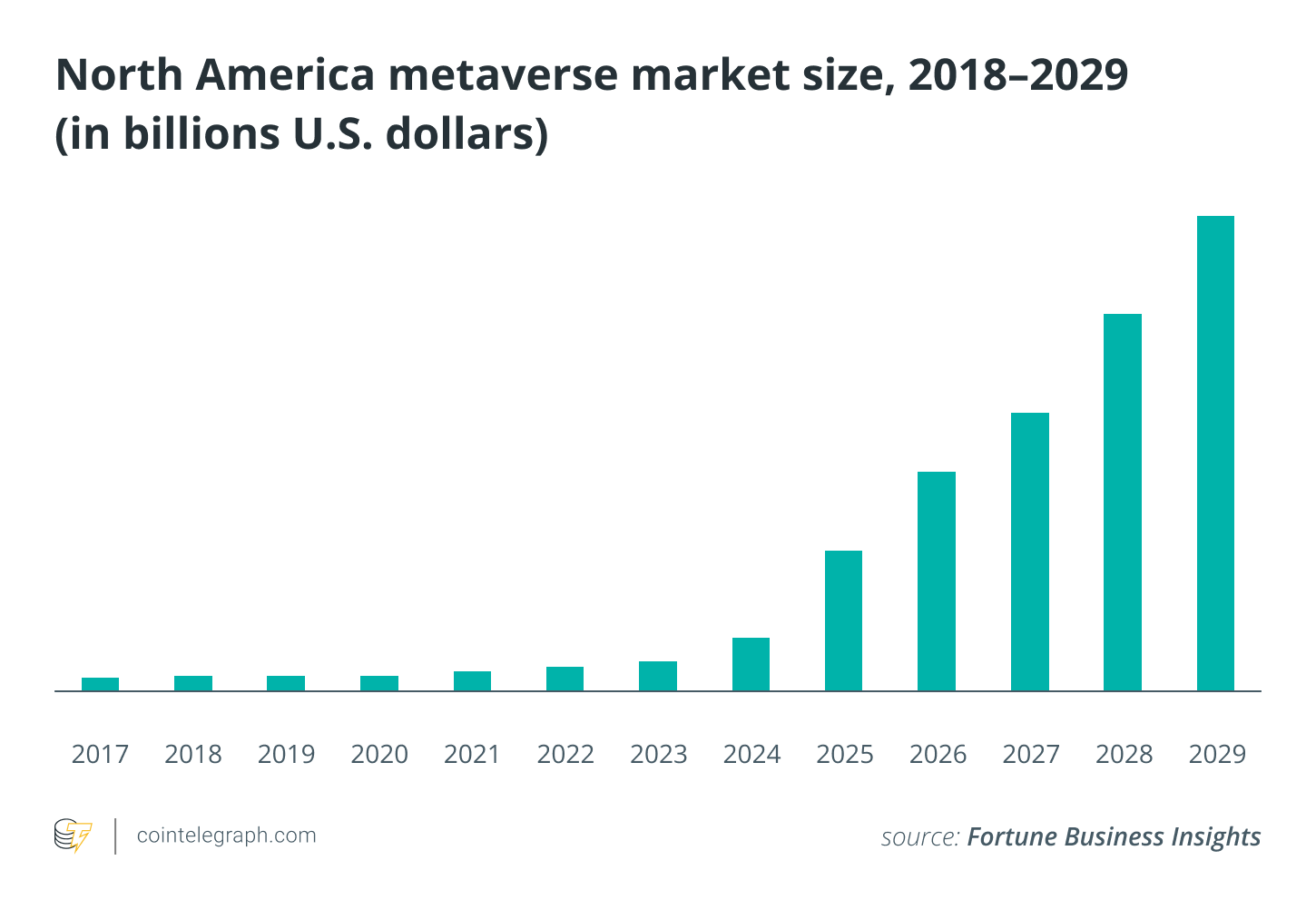

We begin using the user bases. The Sandbox reports 300,000 monthly active users, as well as for Decentraland, the figure is roughly exactly the same. When it comes to pure math, this is actually the cap for the monthly footfall at whatever metaverse outlet you’re running. So, even if they’re not very impressive, they will probably be unequalled for many newer metaverse projects, which, again, requires a toll on the need for their land. Through the same account, for those who have one AAA metaverse and 10 projects with zero users, investors would choose the AAA one and it is lands, as scarce as they might be. This results in a value-driven meta-scarcity: Sure, there’s lots of land generally, only a restricted part of it can make a achievable investment.

Related: How blockchain technology might bring triple-A games to metaverses

An evaluation with on-page ads is going to be useful here. Advertisers prefer websites with increased traffic, and the amount of ad spots on the page is restricted through the constraints of reasonable UX. You could make another dozen websites, but when it normally won’t generate exactly the same traffic, the ad spots there’ll hardly be as valuable, and those on top site are scarce.

Moving past the user bases, there’s even the intangible wow-factor. A primary reason why brands buy lands in metaverses is they be aware of media will talk about it. It is true the greatest companies generate traction regardless of what metaverse they’d enter through their very own sway. Still, they’d rather roll with something that’s developed some traction by itself, in the same manner they’d prefer coverage on Bloomberg to some small newspaper. Brands like partners who participate in the same league, or punch above how much they weigh, or at best appear like they’re doing any one of that. And individuals are often scarce.

Related: Fundamental and peculiar: Exactly what the metaverse is much like at this time

Eventually, we might indeed finish track of just one coherent metaverse, but there, the guidelines binding it’ll likely act as an all natural — or artificial — foundation for conceptualizing value, that will likely element in scarcity in certain form. Now, in an enormous amount of scattered metaverses that users cannot seamlessly bounce between, competition and, by extension, scarcity are extremely much part of the process.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Adrian Krion may be the founding father of the Berlin-based blockchain gaming startup Spielworks and it has experience in information technology and mathematics. Getting began programming at seven, he’s been effectively bridging companies and tech in excess of fifteen years, presently focusing on projects that connect the emerging DeFi ecosystem towards the gaming world.