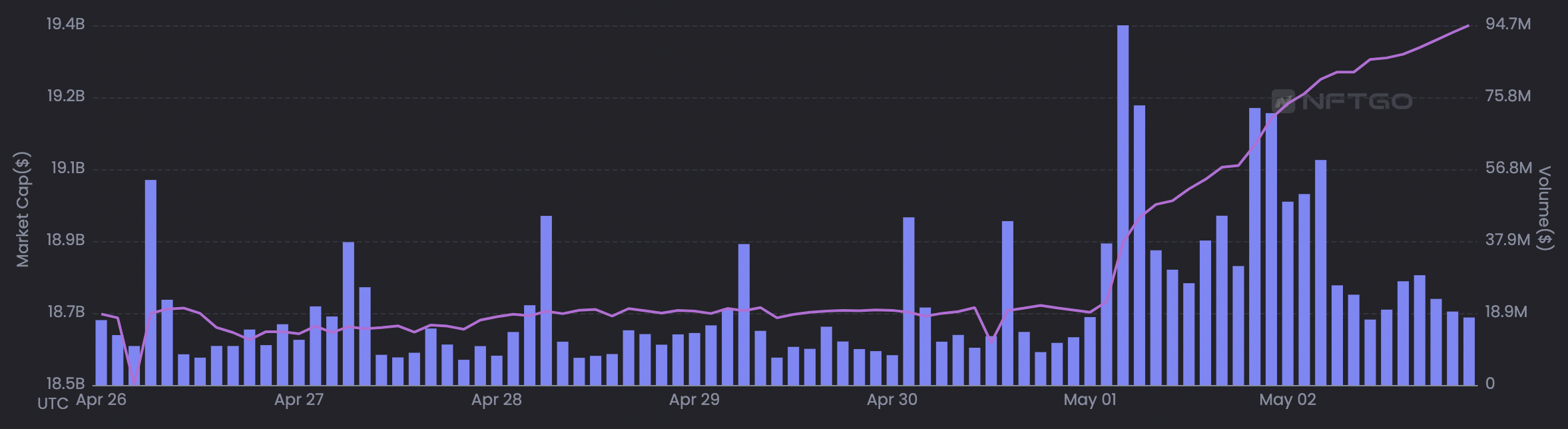

In May 2021, OpenSea closed out nearly $140 million as a whole volume. Go forward annually and also the most dominant nonfungible token (NFT) marketplace closed over $880 million in under per week partly due to the Yuga Labs’ The Otherside mint. Because of this mint, a brand new rush of liquidity was injected in to the NFT ecosystem so that as it stands the present NFT total market capital has ended $19.4 billion.

Within the last two days, the majority of the market saw little action, however this altered after the Otherside mint closed over $317 million in only three hrs.

These broadly unique, at random sorted parcels of land have accumulated over 194,000 Ether (ETH) ($536,137,000) and also to the surprise of numerous, Yuga Labs has started refunding individuals lost towards the foreseeable gas wars that burned over $100 million price of Ether. Some holders also touted airdropped assets worth over $930,000.

The cost of NFTs may take a small slumber, with lots of NFT traders charting impending disaster for projects with low volume, however the liquidity produced through the Otherside purchase seems to become getting the alternative effect.

Investors aren’t fading blue-nick NFTs

Outdoors from the Bored Ape Yacht Club (BAYC) and also the Mutant Ape Yacht Club (MAYC), blue-nick tier NFTs like Doodles, Azuki, CloneX and Meebits have experienced some notable increases in volume within the last 7 days.

Meebits saw a virtually 167% rise in total product sales along with a 19% rise in the typical purchase cost after Yuga Labs announced intends to get the Metaverse utility for Meebits.

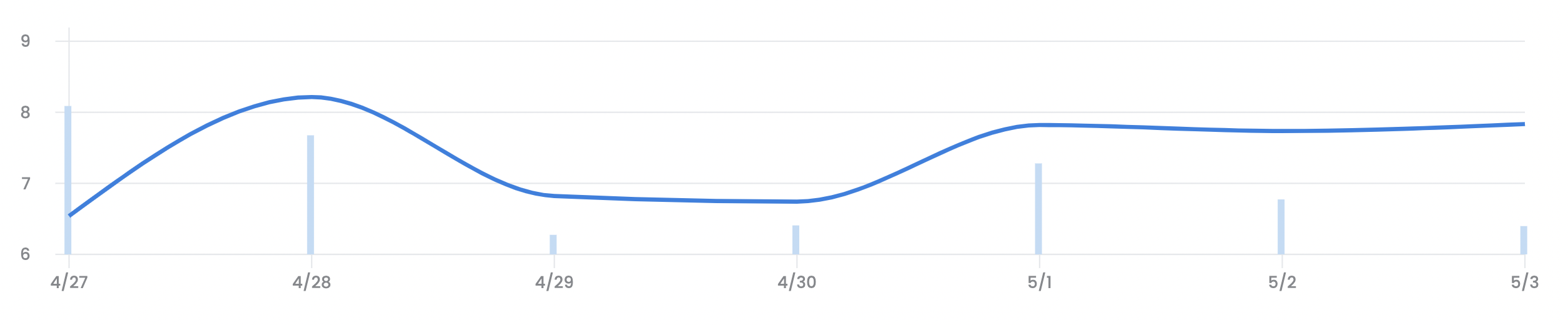

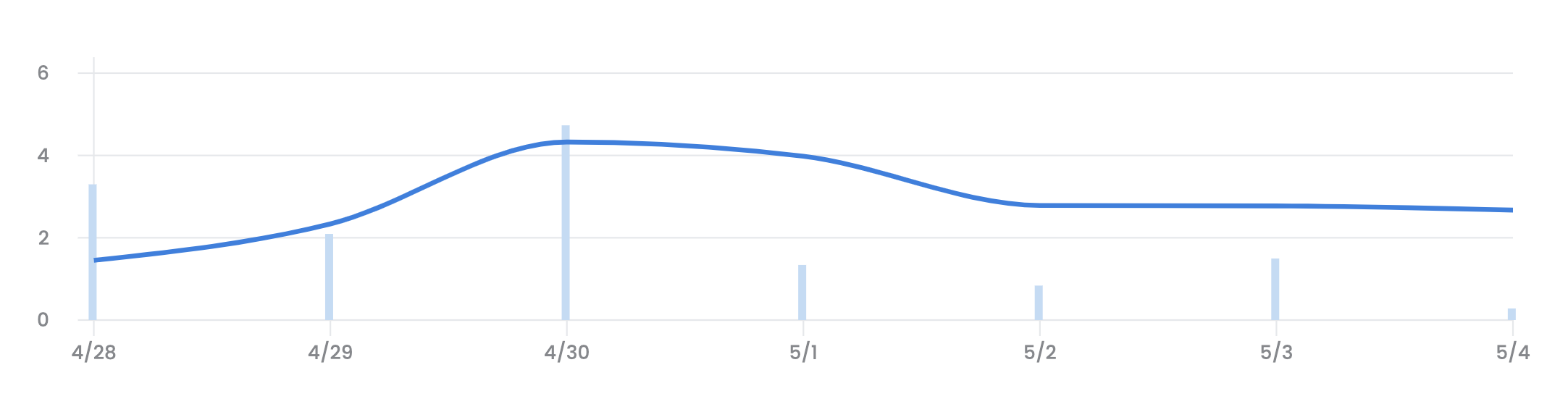

Meebits’ volume started to simmer in the finish of April and saw an outburst since the beginning of May. The typical sales cost has elevated by 15% and volume elevated over 65% within the last 7 days.

It seems NFT traders who’ve left certain NFT environments take their profits and investing back to upgrading their collection with blue-nick status NFTs.

Carrying out a similar trajectory as Azuki, Doodles NFT has witnessed nearly a 250% rise in volume during the last 7 days. The ground cost has additionally been continuously growing since the beginning of May and it is presently at 23 Ether ($65,458).

A obvious trend would be that the newest capital infusion is lifting blue-nick NFT prices, departing all of those other PFP-dominated sell to fall. Could this be the start of Gary Vee’s speculation that 99% of collections will go to zero, departing just the top 1% with value?

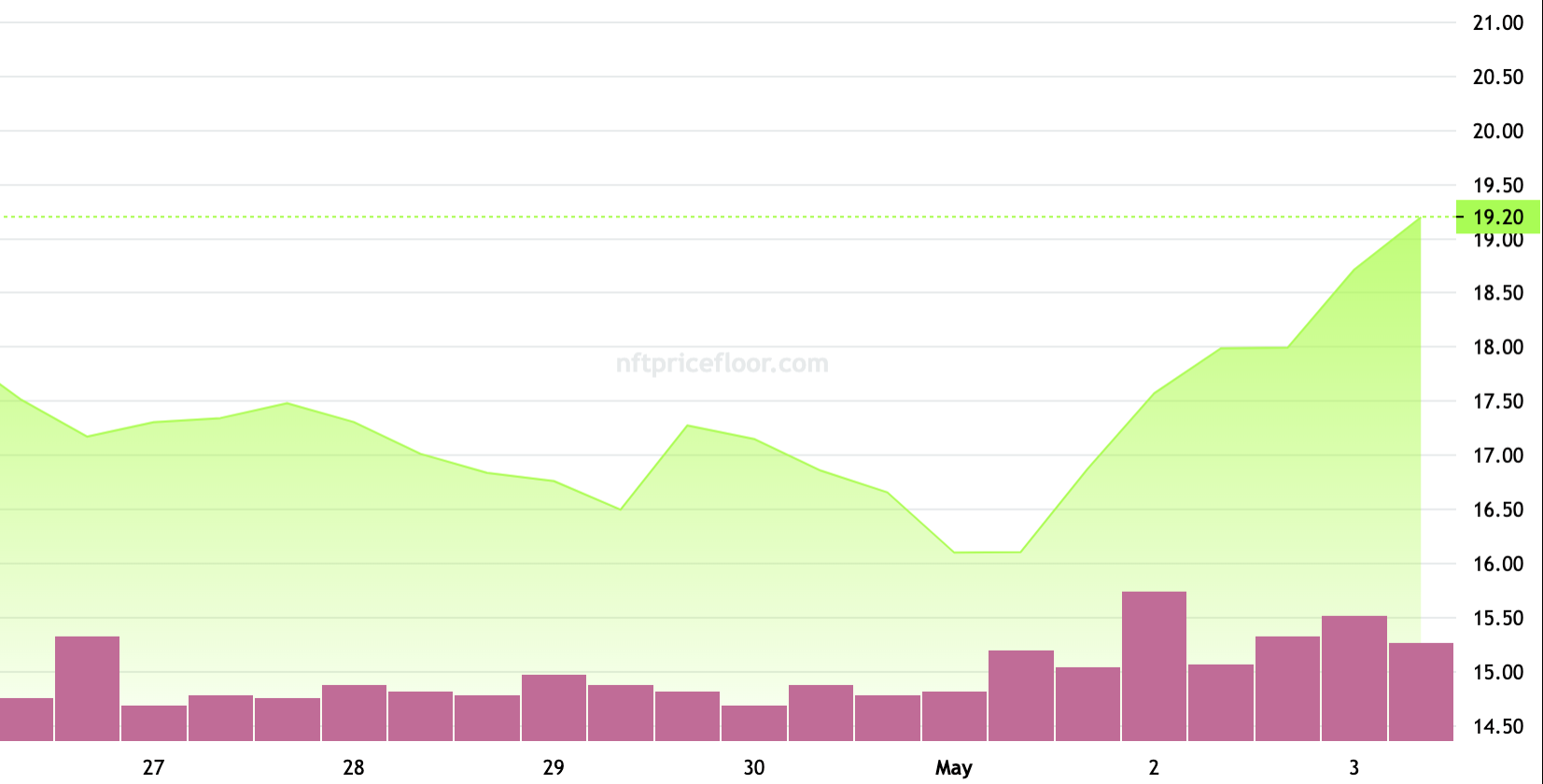

RTFKT Studios’ CloneX NFTs are also riding a wave. Only one week ago, floor prices gravitated round the 16.5 Ether to 17.5 Ether range, however they now stand at 19.7 Ether.

This boost in cost might be related to the MNLTH NFT reveal depicting the very first blockchain-powered Nike sneaker with morphing and forging abilities (meaning, it may be produced to put on in tangible existence).

Combined with the novel kicks, proprietors received a vial representing the very first “skin” as well as in revealing the MNLTH, the NFT was burned to mint the MNLTH 2, that is another mystery box. So, your way continues with RTFKT studios and it is ecosystem.

Although Ethereum-based NFTs have obtained the spotlight compared to projects on other blockchains, OpenSea’s recent support for Solana NFTs is leveling the arena.

Solana Summer time part deux?

Traders with virtually no contact with Solana are now able to communicate with the NFT ecosystem as OpenSea has added support for that chain. While Solana investors are adamant about using Solana’s Magic Eden marketplace, other traders are thrilled concerning the new option.

Making waves around the Solana project is ok Bears, the first Solana blockchain NFT to become rated in the top five on OpenSea volume charts. For around 83 SOL ($7,111), Okay Bears has stirred some debate regarding quality and cost. Because certain NFT influencers altered their profile pics to sport Okay Bears, the project’s total volume spiked over 34% within the last 7 days but is ongoing to even out.

The prosperity of Okay Bears has investors with another “Solana Summer” and also the Catalina Whale Mixer NFT can also be creating a splash on OpenSea.

Although the project launched in December 2021, NFT influencers and key players are circling to once they first leaped in to the project, and also have since made some large sales and notable gains.

Catalina Whale 2291

Offered! Bang Bang → 500.00 SOL ($49,080.00 USD)

https://t.co/RB7j7udX3nThanks for visiting the fucking Catalina Whale Mixer!

https://t.co/p2av2TxZ5y

https://t.co/m74Kf8NNZL pic.twitter.com/FkKQjKjT3v— Catalina Whale Mixer Sales Bot (@WhaleBouncer) April 28, 2022

Presently, 12 Solana NFT projects have been in OpenSea’s best players list for total volume which could indicate the above-average NFT collector might be diversifying across blockchains.

DeGods NFT ranks at the very top 40 NFT collections for total volume on OpenSea. Self-referred to as a deflationary assortment of misfits, punks and degenerates, DeGods floor presently is 310 SOL ($27,190) on OpenSea and 245 SOL ($20,851) on Magic Eden.

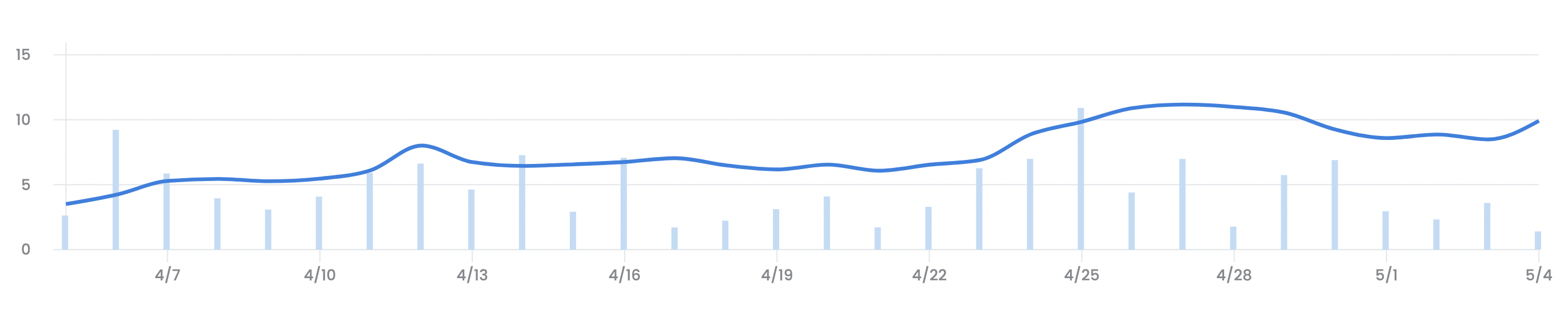

Data from Magic Eden implies that DeGods saw a 179% rise in floor cost in April along with a late surge is visible at OpenSea.

Considering that blue-nick tier NFTs like BAYC and CloneX have elevated the bar regarding brand equity and rewarding communities, investors seem to be doubling-lower on these collections.

It’s worth noting that although proof-of-profile NFTs have experienced slow volume, there are more kinds of music, literary and membership-based NFTs emerging. Ethereum NFTs have clearly cemented their mark ever but other blockchains with NFT projects will also be visiting the top.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.