The regulating cryptocurrencies around the globe is a continuing fight for investors inside a quickly expanding and also altering ecosystem.

Various regulatory agencies all over the world view digital assets inside a different light that fluctuate considerably from each other.

Lately, executive board person in the ecu Central Bank (ECB) Fabio Panetta pointed out inside a written statement for any speech to Columbia College that regulators should consume a globally coordinated approach while controlling digital assets. He stated the world must have digital assets controlled through the Anti-Money Washing (AML) and Countering the financial lending of Terrorism (CFT) rules from the Financial Action Task Pressure.

Panetta also spoke about strengthening public disclosure, reporting on regulatory compliance in the market and establishing certain “transparency requirements” and “standards of conduct.” He mentioned:

“We desire to make coordinated efforts in the global level to create crypto-assets in to the regulatory purview. And, we have to ensure that they’re susceptible to standards consistent with individuals put on the economic climate. We ought to make faster progress to make sure that crypto-assets don’t trigger a lawless craze of risk-taking.”

Functionality of worldwide regulation under consideration

The ECB applying such rules over the Eu is a factor, and getting exactly the same rules affect the all of the countries on the planet is really a whole other because of the fact that ECB can become the regulatory entity within the EU. Still, there’s no obvious knowledge of which regulatory body might have the legal right to conduct such coordinated regulatory activities.

Much more lately, Ashley Alder, chair from the Worldwide Organization of Securities Commissions — a connection of market regulators — spoke relating to this take into account a web-based conference organized through the Official Financial and Banking Institutions Forum. He elaborated on the requirement for some pot body that’ll be given the job of coordinating the regulating digital assets all over the world and can also be a real possibility in this particular year.

On May 16, the Basel Institute of Governance and also the Worldwide Academy of monetary Crime Litigators printed a paper which known as for more coordinated action against illegal crypto markets. The paper recommended that investigators which are associated with cryptocurrencies should purchase learning approaches and technologies to maintain pace using the evolving techniques of criminal organizations and entities.

Cointelegraph spoken with Bianca Veleva, mind of legal and regulatory compliance at Nexo — a crypto lending platform — about the benefits of a worldwide regulatory approach. She stated:

“The adoption of the unified legal framework and/or concepts for crypto-related activities may prove advantageous when it comes to speeding up the legislative efforts of nations which haven’t yet recognized the benefits the crypto industry brings, following in the comprehensive framework more forward-searching countries have previously adopted and implemented.”

Because the digital assets landscape expands and rules start to get clearer, a brand new paradigm might be going ahead in which worldwide regulatory consensus unifies. The mass adoption and growing use-installments of digital assets and blockchain technology alike will likely give a solid reason for eventuality of the consensus among controlling physiques and nations.

However, there are lots of countries which have outright banned their citizens from involving in cryptocurrencies as well as their professional services. An excellent illustration of that might be China, which announced an outright ban on digital assets in September this past year. There’s a total of nine countries which have banned cryptocurrencies, additionally to China: Algeria, Bangladesh, Egypt, Iraq, The other agents, Nepal, Qatar and Tunisia possess a blanket ban on crypto, according to some Law Library of Congress report from November 2021.

Recent: El Salvador’s Bitcoin play: Exactly what does the present slump mean for adoption?

This difference in the manner various countries view digital assets could help as the greatest obstacle to some globally coordinated regulatory framework. Igneus Terrenus, policy advocate at Bybit, told Cointelegraph that although a worldwide regulatory system is sensible for tracking fund flows and reducing regulatory arbitrage, in fact there’s no universal regulatory body able to imposing it upon sovereign states. Realistically, it’ll have broader impacts on citizens and residents of nations that responded positively instead of countries that not partake.

Terrenus added that “A blanket framework that matches the world doesn’t appear to become attainable because of the disparities between countries in even existing financial rules. A achievable model would concentrate on easing the exchange of knowledge between entities and jurisdictions, which tax government bodies happen to be doing through the banking system, deploying zero-understanding proof technology to avoid fraud and improving regulatory clearness and consistency.”

Another consideration within the hypothetical eventuality of globally recognized rules for cryptocurrencies is the fact that a consensus between various countries at different stages of adoption can lead to innovation being stifled along with a plateau in adoption rates. Veleva stated:

“Any joint efforts of unifying the presently pending EU regime for crypto-assets using the U . s . State’s legislative framework can be a double-edged sword. They might, actually, hamper the interest rate of innovation and crypto adoption in an EU level and result in greater regulatory damage to crypto companies.”

Coordination like never before

Regardless of the difficulties and challenges involved, some participants within the digital assets ecosystem remain tolerant of moving toward globally coordinated crypto regulation.

Justin Choo, group mind of compliance of Cabital — a cryptocurrency buying and selling and passive earnings platform — told Cointelegraph the current approach that countries took couldn’t become more varied in comparison with traditional asset classes like equity, debentures and managed investment schemes that make use of a controlled framework.

In comparison with crypto-forward countries, Choo mentioned that “I would suppose a globally coordinated regulatory system wouldn’t go as far ahead as what El Salvador and Argentina do due to the fact the governments of civilized world whose currencies are reserve currencies wouldn’t anticipate to quit the economical prowess — that is frequently accustomed to influence worldwide diplomacy — that they have in support of cryptocurrencies.”

Global coordination on crypto regulation will need collaboration inside the industry and from regulators around the globe in a fashion that isn’t seen before. Terrenus stated:

“Paternalistic protections according to decades-old laws and regulations might not be probably the most useful approach. Truly sensible, significant and impactful rules should encourage transparency with regards to the terms, possession breakdown, vesting schedules and accurate representation of annual percentage yield of crypto projects. This could enhance the overall information symmetry and reward investors that do their very own research.”

Especially following the recent highly-publicized fiasco using the Terra blockchain and it is stablecoin, TerraUSD (UST), regulators have started to take particular notice in the practicality and viability of stablecoins too. The Ecu Commission has additionally revealed its intentions of putting a blanket ban on large-scale stablecoins, thinking about the huge economic and investor impact which was triggered through the crash of UST and Terra (LUNA) within the Terra blockchain.

Recent: Enforcement and adoption: Exactly what do UK’s recent regulatory aims for crypto mean?

Because the adoption of digital assets increases, moving in one adoption and innovation cycle to a different, the evolving regulatory landscape would be the most significant area of the transition of digital assets penetrating everyone. A worldwide regulatory framework appears like what you want for that transition, however the obstacles set when it comes to applying this type of framework can make the transition a lengthy process which is highly unlikely it happens inside a year.

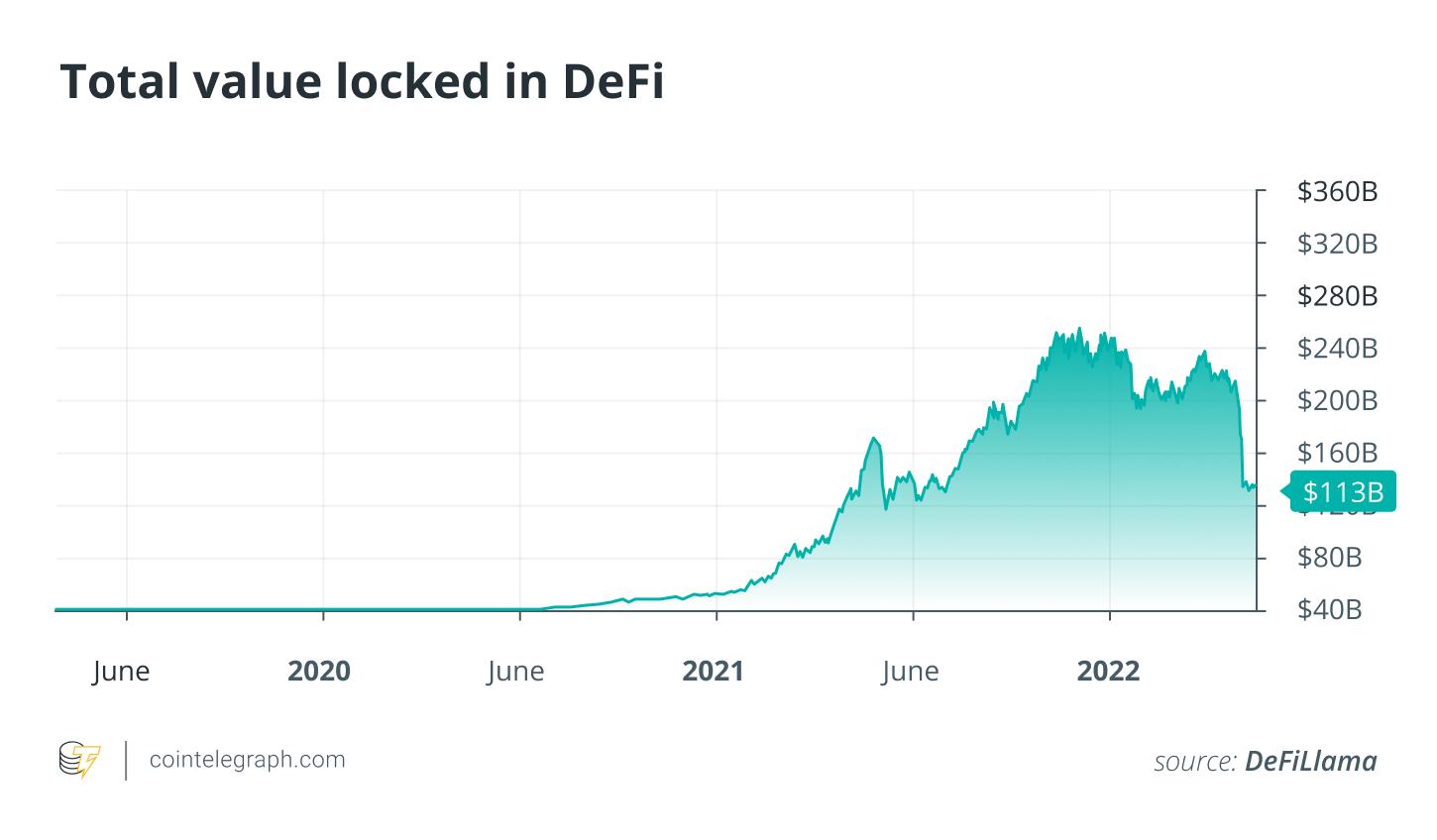

Andreessen Horowitz — a crypto-friendly investment capital firm — lately released its “2022 Condition of Crypto” report, highlighting the development of decentralized markets went to some total value locked in excess of $100 billion just within 2 yrs following the concept was initially introduced. The report estimates that decentralized finance (DeFi) will be the 31st largest U.S. bank by assets under management.

It is common that this type of quickly expanding industry will need regulators and central banks to innovate and evolve in the same pace. Even when a very laborious globally-coordinated regulatory framework slightly stifles innovation, the security of investors is definitely the best concern for regulatory physiques around the world.