In the monthly crypto tech column, Israeli serial entrepreneur Ariel Shapira covers emerging technologies inside the crypto, decentralized finance (DeFi) and blockchain space, in addition to their roles in shaping the economy from the twenty-first century.

The imminent Metaverse dominates crypto headlines as analysts almost obsessively race to calculate what innovations the brand new digital world brings. Facebook’s rebranding to Meta appears is the beginning, as Microsoft — and a few other Big Tech companies — announce their intends to integrate in to the Metaverse.

The hype round the Metaverse is just natural. There isn’t any question the humans for the future will expend more of time than some would choose to admit putting on a VR headset. However the keyword here’s future — most Metaverse developments are creating a digital world that most humans won’t have use for years to come. It’s vital that you save energy and a focus for that developments appearing out of mainstream crypto/DeFi since they’re already massively transforming economic incentives.

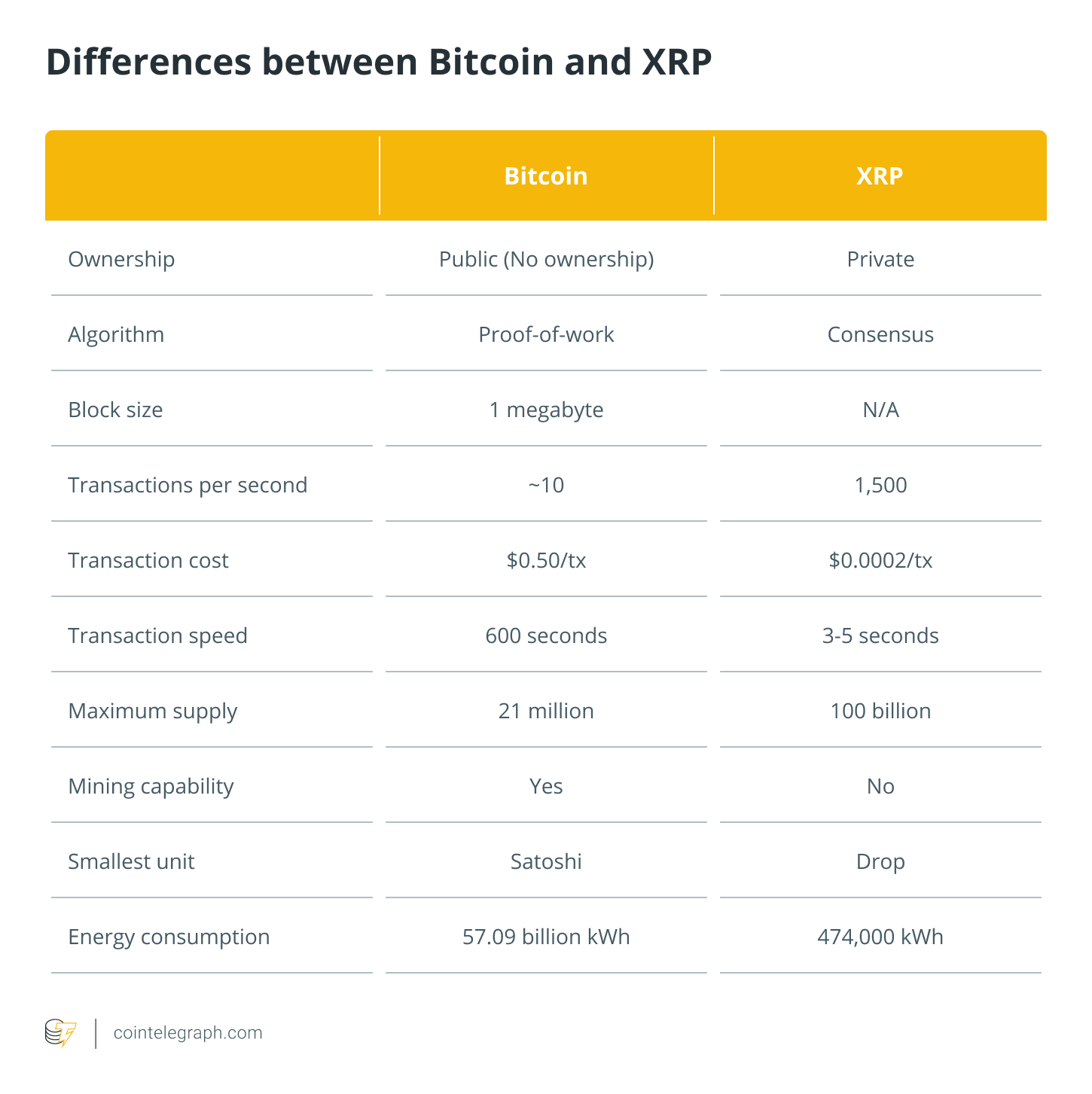

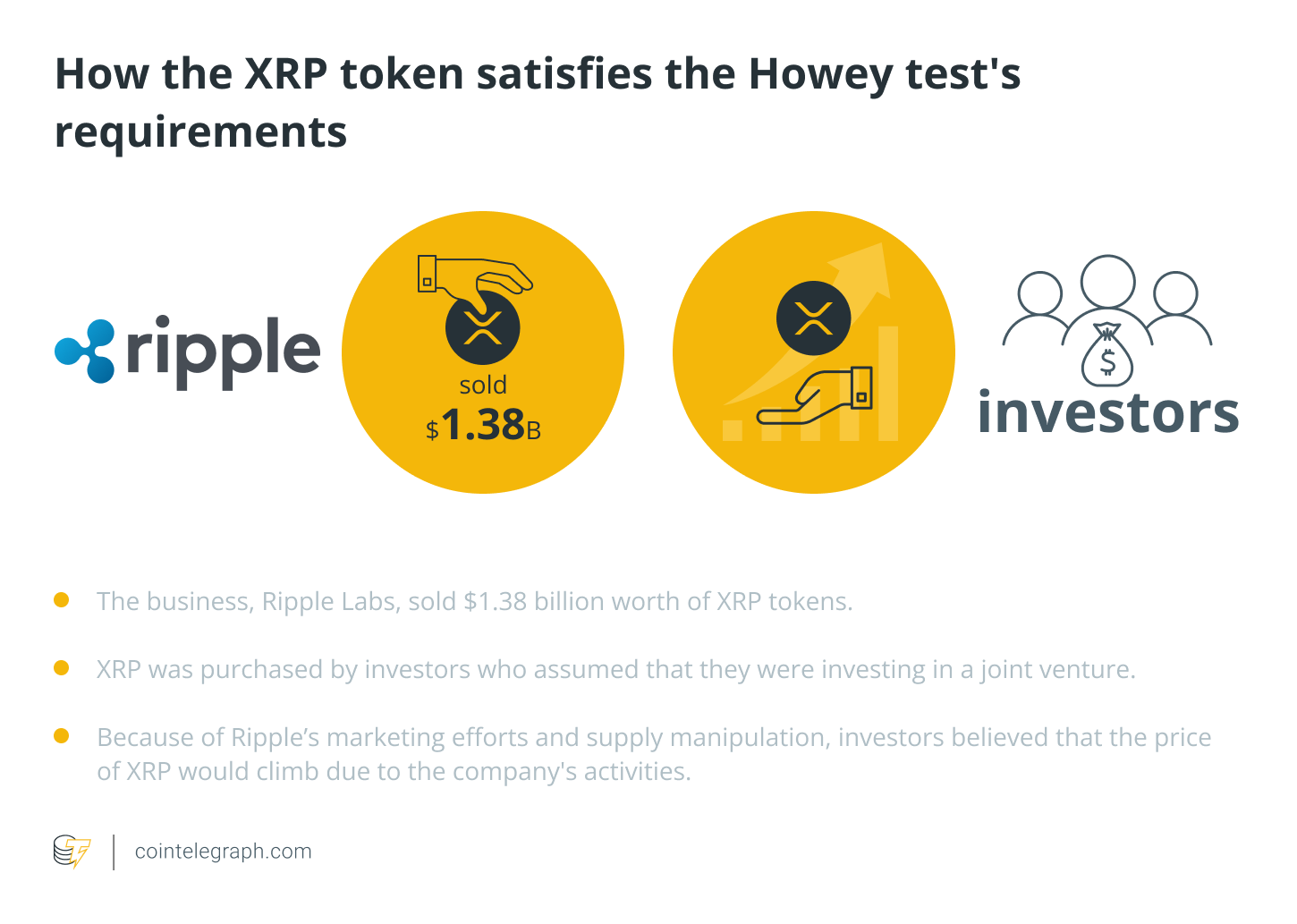

Take Ripple (XRP), that was sued through the U.S. Registration (SEC) for allegedly offering an unlawful securities offering through sales of their cryptocurrency token, XRP. The organization that steered the benefits of blockchain from the “let’s overthrow the banks” crowd towards the “let’s use them” crowd originates a lengthy way in the days by which many thought a Federal suit will be the last nail within the coffin of crypto being an industry, lately getting taken a maximum hands within the suit. Several 1000 miles south from the U . s . States, Bitcoin (BTC) has become the focus of the city in El Salvador.

Related: SEC versus. Ripple: A foreseeable but undesirable development

Both of these symbolic developments highlight the magnitude of blockchain-based finance and it is stride toward mass adoption, and it is worth test their way, along with other major blockchain successes searching forward. Just like many crypto investors secure their gains periodically instead of holding forever, also must the.

The Ripple effect

The current change of tides within the landmark SEC situation against Ripple could amp in the momentum for crypto adoption. 2 yrs ago, the SEC sued Ripple for allegedly raising “over $1.3 billion with an unregistered, ongoing digital asset securities offering.” The situation stirred fear within the hearts of comparable projects, in addition to investors worried about the implications of the investments. However the tables have switched, and Ripple claimed “a really big win,” once the judge denied the SEC’s request to reconsider shielding key documents.

Should Ripple battle the SEC suit, the world’s lone superpower might be well coming to going for a friendlier stance on crypto, which would open the floodgates. Which doesn’t always imply that probably the most radical crypto purists could be emboldened. Ripple’s work toward arming outdated banks and traditional financial infrastructure using the blockchain-powered tools already getting used by DeFi platforms could give authenticity to the thought of updating the centralized economic climate, instead of replacing it using the libertarian DeFi dream.

Related: The time is right for that US to produce a ‘Ripple test’ for crypto

This could have serious economic implications for future years from the global economy that analysts should spend a minimum of a few of the time they consider NFTs deliberating.

Making DeFi accessible

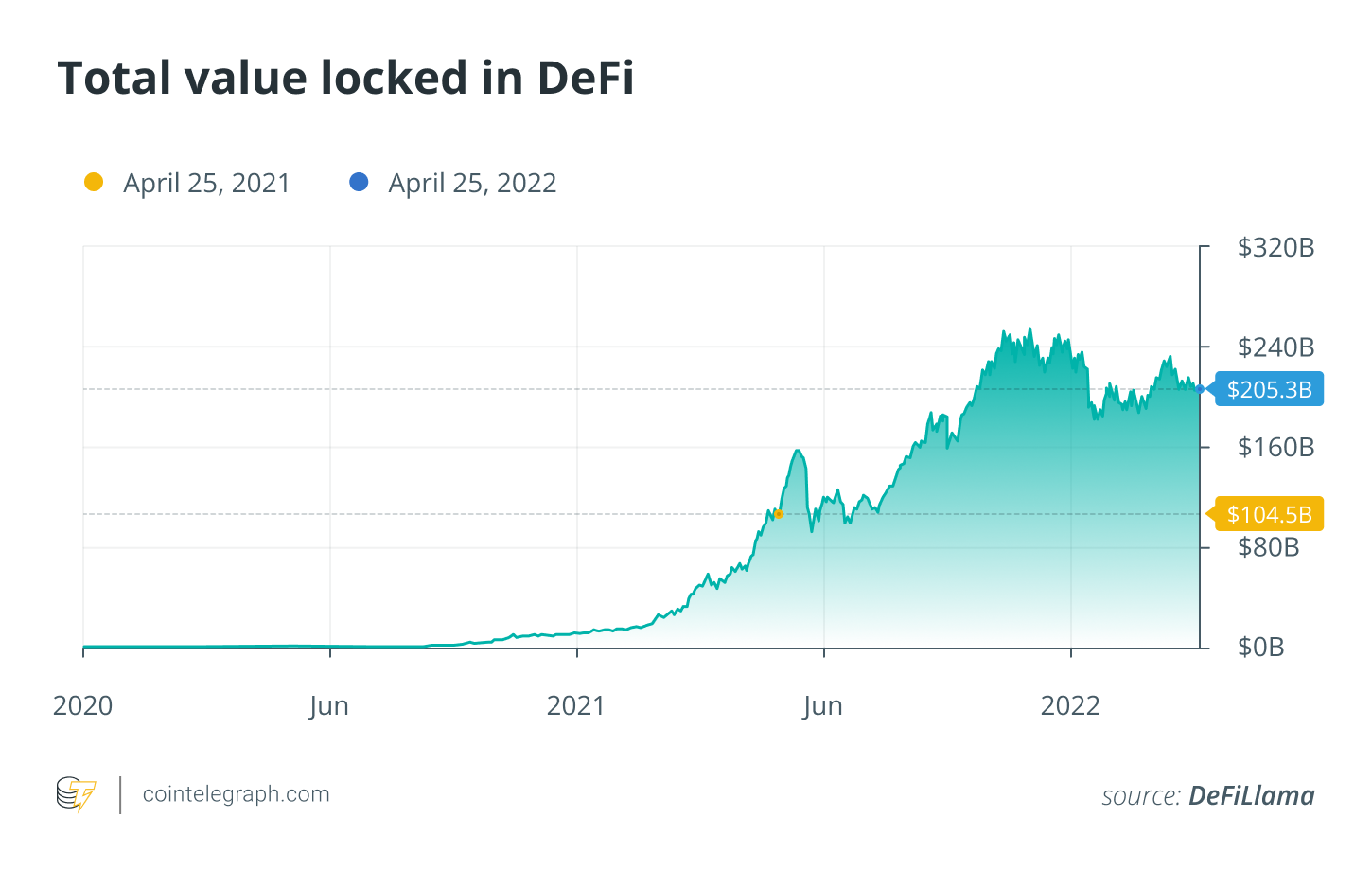

Even though Ripple makes waves and Bored Apes populate Twitter, what of DeFi? The marketplace is presently valued at 207 billion, when compared with slightly above 104 billion on April 25, 2021. DeFi is positively opening traditional investment possibilities to retail investors around the world. At any given time by which inflation is booming, and housing diminishes affordable around the world, use of investment possibilities for retail investors, also known as average people, could be a lifesaver.

And that’s what critics frequently miss about crypto being an industry. Individuals who argue blockchain is really a technology searching for any use situation miss developments by companies for example Levana, which really will introduce crypto investors to DeFi through games that educate them using leverage with lore in regards to a dystopian way forward for a Mars populated by humans. This kind of approach, referred to as gamification of investing, is distributing like wildfire, out of the box the in general. The DeFi world is forecasted to blow up by around 70% by 2026.

Related: DeFi gaming: A catalyst to mainstream adoption of decentralized finance

Government collaboration

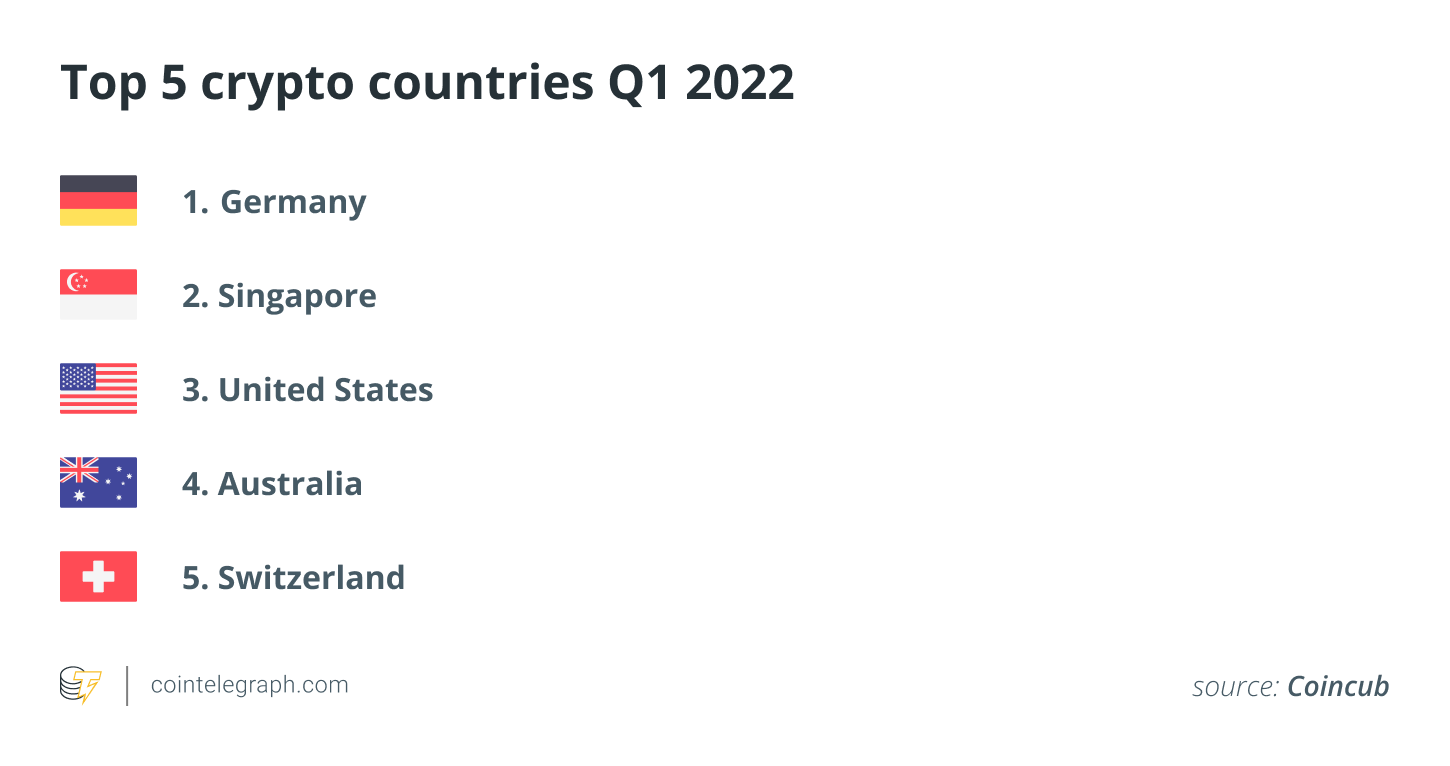

As Ripple makes headway in nudging the U . s . States toward greater crypto openness, countries ranging from Germany to Singapore are pushing crypto regulation forward. Obviously, in addition, there’s our prime-profile situation of El Salvador adopting Bitcoin as legal tender because the prime illustration of a rustic tinkering with crypto to try to innovate its path from bankruptcy. Other nations, too, take steps to leverage blockchain for their advantage.

The Philippines government is positively partnering having a company known as Oz Finance to provide economic possibilities through special economic zones (ecozones). The concept would be to empower individuals and firms to function virtually or physically in tax-free, privacy-protected, decentralized application (DApp)-friendly zones operated by Oz’s utility token TOTOz.

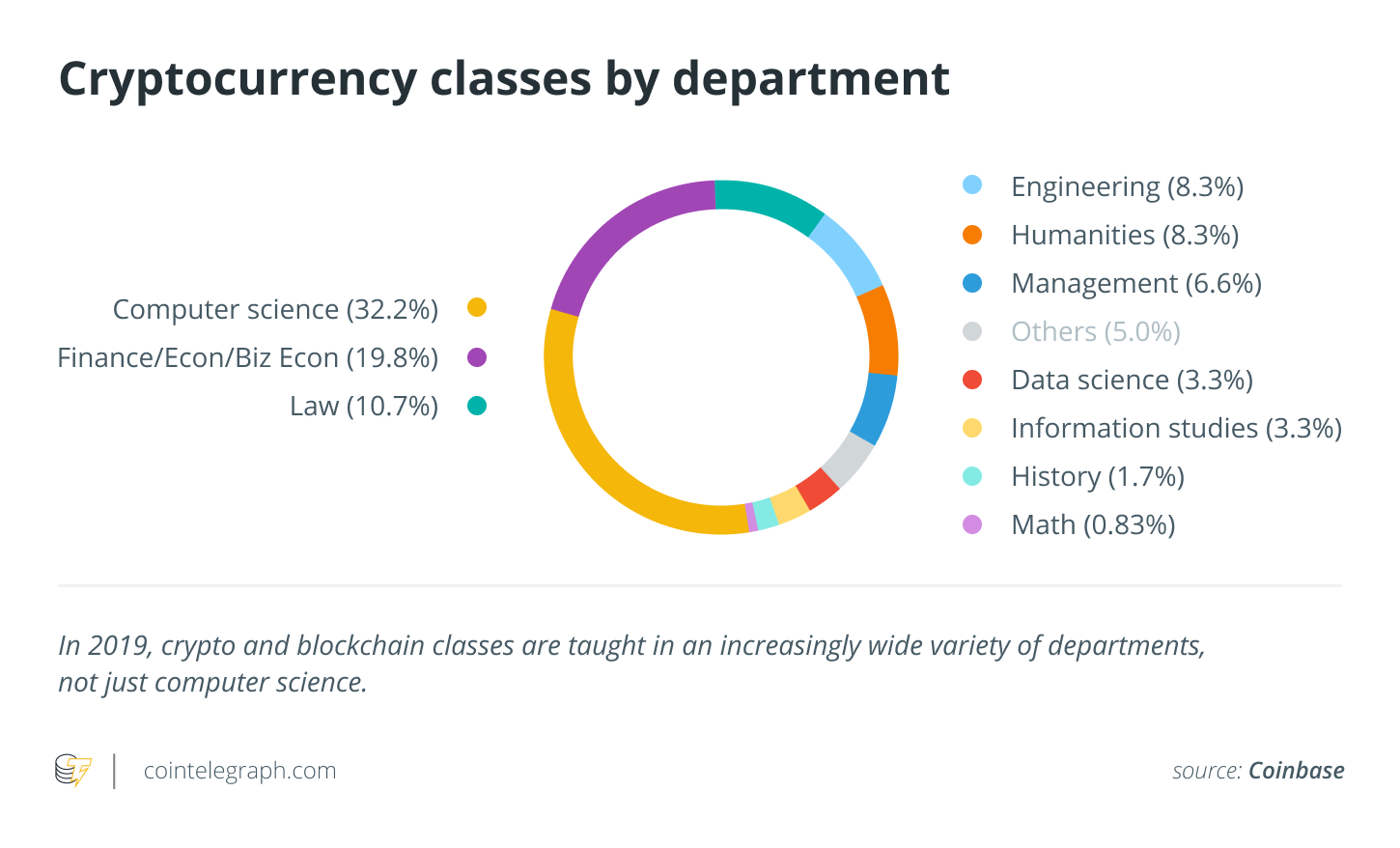

Blockchain has become so intertwined using the average person’s existence that universities for example Harvard and Durch are providing courses in blockchain, showing the way the world is shifting towards mainstream adoption even among academics.

While it’s constantly expanding, the blockchain industry in general has only a lot of sources to deploy in a given moment, particularly with developer shortages around the world. As a result, it’s vital that you keep things in perspective and learn initiatives increasing the financial lives of average people here, within this physical world, before all of us ape in to the Metaverse with all of those other Degens.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Ariel Shapira is really a father, entrepreneur, speaker, cyclist and can serve as founder and Chief executive officer of Social-Knowledge, a talking to agency dealing with Israeli startups and helping these to establish connections with worldwide markets.