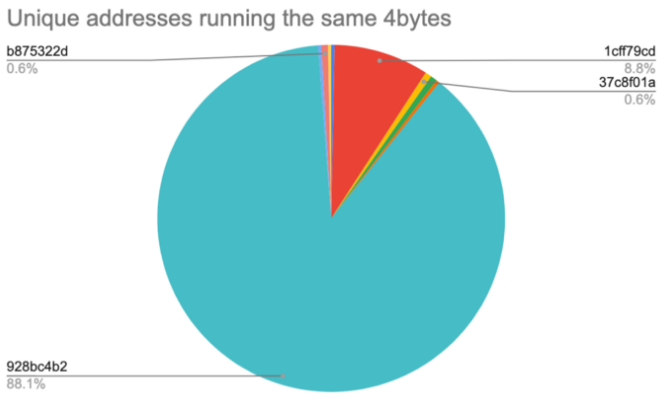

Near to 90% of addresses getting involved in the $186 million Nomad Bridge hack a week ago have being best known as “copycats,” making served by as many as $88 million price of tokens on August. 1, a brand new report has revealed.

Within an August. 10 Coinbase blog, authored by Peter Kacherginsky, Coinbase’s principal blockchain threat intelligence investigator, and Heidi Wilder, a senior affiliate from the special investigations team, the happy couple confirmed what many had suspected throughout the bridge hack on August. 1 — that when the first online hackers determined how you can extract funds, countless “copycats” became a member of the party.

Based on the security researchers, the “copycat” method would be a variation from the original exploit, which used a loophole in Nomad’s smart contract, allowing users to extract funds in the bridge that wasn’t their own.

The copycats then copied exactly the same code but modified the prospective token, token amount, and recipient addresses.

But as the first couple of online hackers were probably the most effective (when it comes to total funds extracted), when the method grew to become apparent towards the copycats, it grew to become a race for those involved to extract as numerous funds as you possibly can.

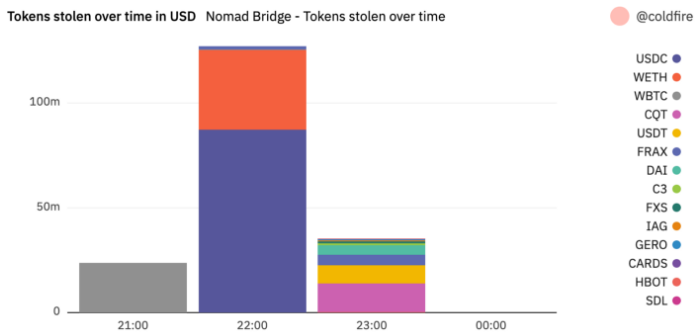

The Coinbase analysts also noted the original online hackers first targeted the Bridge’s wrapped-Bitcoin (wBTC), adopted by USD Gold coin (USDC) and wrapped-ETH (wETH).

Because the wBTC, USDC and wETH tokens were contained in the biggest concentrations within the Nomad Bridge, it made sense for that original online hackers to first extract these tokens.

White-colored-hat efforts

Surprisingly, Nomad Bridge’s request stolen funds produced a 17% return (by August. 9), with nearly all individuals tokens being by means of USDC (30.2%), Tether (USDT) (15.5%), and wBTC (14.%).

Since the original online hackers mostly exploited wBTC and wETH, the truth that the majority of the came back funds came by means of USDC and USDT suggests that almost all the funds came back were from white-colored-hat “copycats.”

Meanwhile, roughly 49% from the exploited funds (by August. 9) happen to be transferred elsewhere from each one of the recipient’s addresses.

Related: $2B in crypto stolen from mix-chain bridges this season: Chainalysis

Coinbase also noted the first three recipient addresses were funded by Tornado Cash, an Ethereum-based protocol that enables users to transact anonymously. On Monday, the U.S. Treasury sanctioned all USDC and ETH addresses from the protocol.

The Nomad Bridge hack is just about the 4th largest DeFi hack ever and also the third greatest in 2022, following a $250 million Wormhole Bridge hack in Feb and also the $540 million Ronin Bridge hack in March. Mix-chain bridges of those kinds happen to be charged with being too centralized, which makes it a perfect site for attackers to take advantage of.