TerraUSD (UST) flipping BinanceUSD (BUSD) for that third place on the market capital list didn’t last lengthy. The once-mighty stablecoin that forces the whole Terra ecosystem finds itself reduced to “Terra is much more than UST” tweets. While nobody knows without a doubt if LUNA can stage a comeback, UST will definitely go lower among the algorithmic stablecoins that went kaput within the same fashion as Basis Cash — which Terra creator Do Kwon was allegedly part of — and Mark Cuban-backed Iron Finance.

UST’s failure begs the issue if algorithmic stablecoins are really just condemned to fail? And, is fiat-backed or crypto-backed stablecoin the only method investors will find probably the most “stable” method to shield themselves in the crypto market’s volatility?

Benefits and drawbacks of various stablecoins

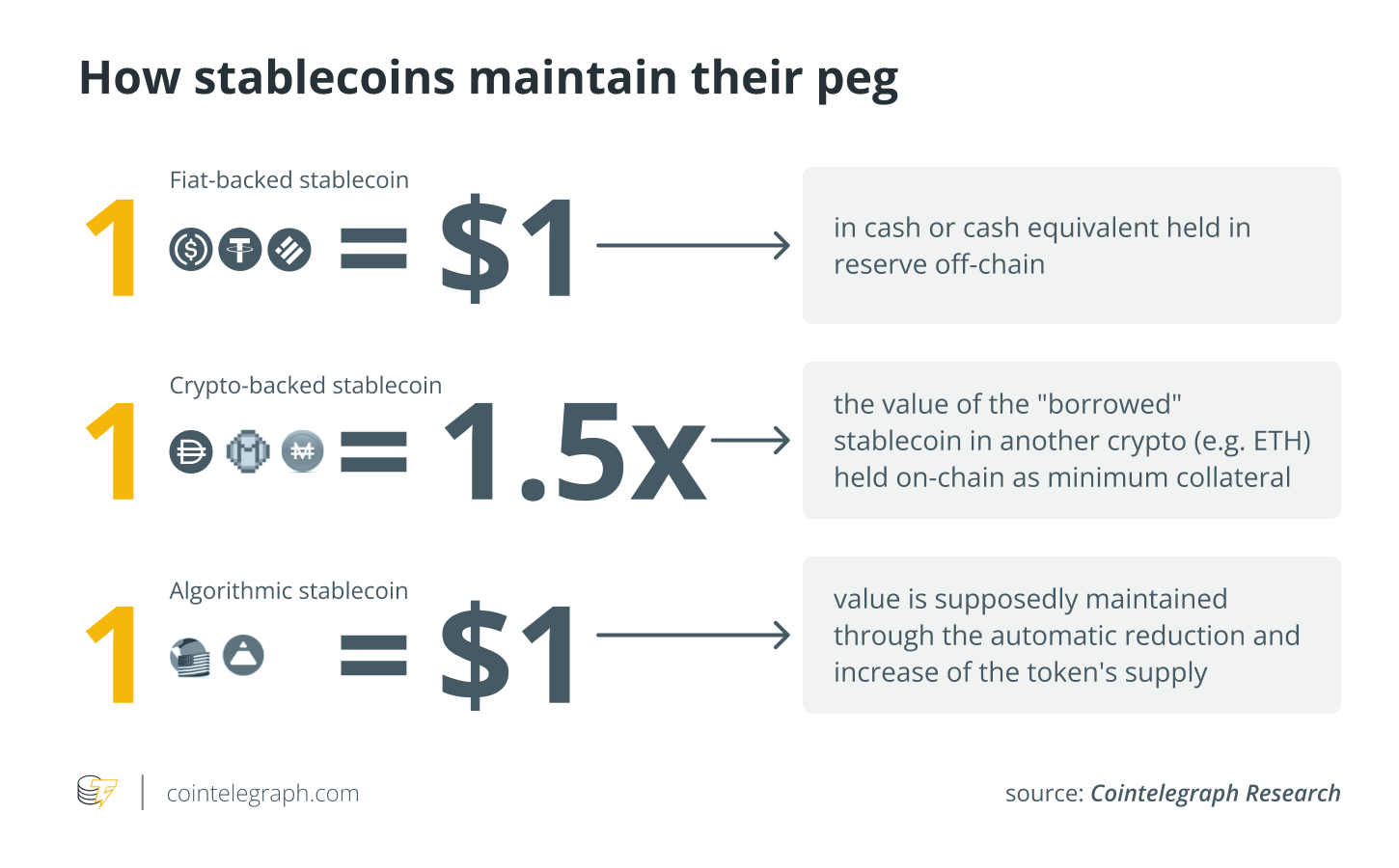

Right now, most understand the kinds of stablecoins for example fiat-backed stablecoins, crypto-collateralized stablecoins and algorithmic stablecoins. There’s also other kinds of stablecoins like commodity-backed and seigniorage, however the three pointed out above are typically the most popular.

Users get their causes of preferring one type of stablecoin over another. For example, some choose to use algo stablecoins due to their decentralized narrative. Others would choose fiat-backed cryptocurrencies like Tether (USDT) and USD Gold coin (USDC), while they are centralized because of the private businesses that keep up with the equivalent fiat reserves of every issued token. Still, the advantage of fiat-backed coins is there’s a real asset backing the gold coin.

The soundness of their peg will stay as lengthy because there are verifiable holdings of these fiat reserves. Still, probably the most apparent risk this is a bank run scenario, which for Tether may be difficult thinking about how it’s largely uncovered to commercial paper. Commercial papers are from large corporations and therefore are a kind of personal debt that may have a maturity in excess of 270 days. A lot of redemption can render Tether insolvent, and that’s why it’s slashed its commercial paper holdings during the last six several weeks.

Crypto-collateralized stablecoins like Dai (DAI), however, are supported by a surplus way to obtain another cryptocurrency, within this situation, Ether (ETH). DAI needs a minimum 150% collateralization ratio, and therefore the dollar worth of ETH deposited inside a smart contract must a minimum of cost 1.5 greater than the DAI being lent. For instance, for any user to gain access to $1,000 price of DAI, they need to secure $1,500 of Ether. When the market cost of Ether drops enough where the minimum collateralization ratio is not met, the collateral is instantly compensated into the smart contract to liquidate the positioning.

The situation of UST

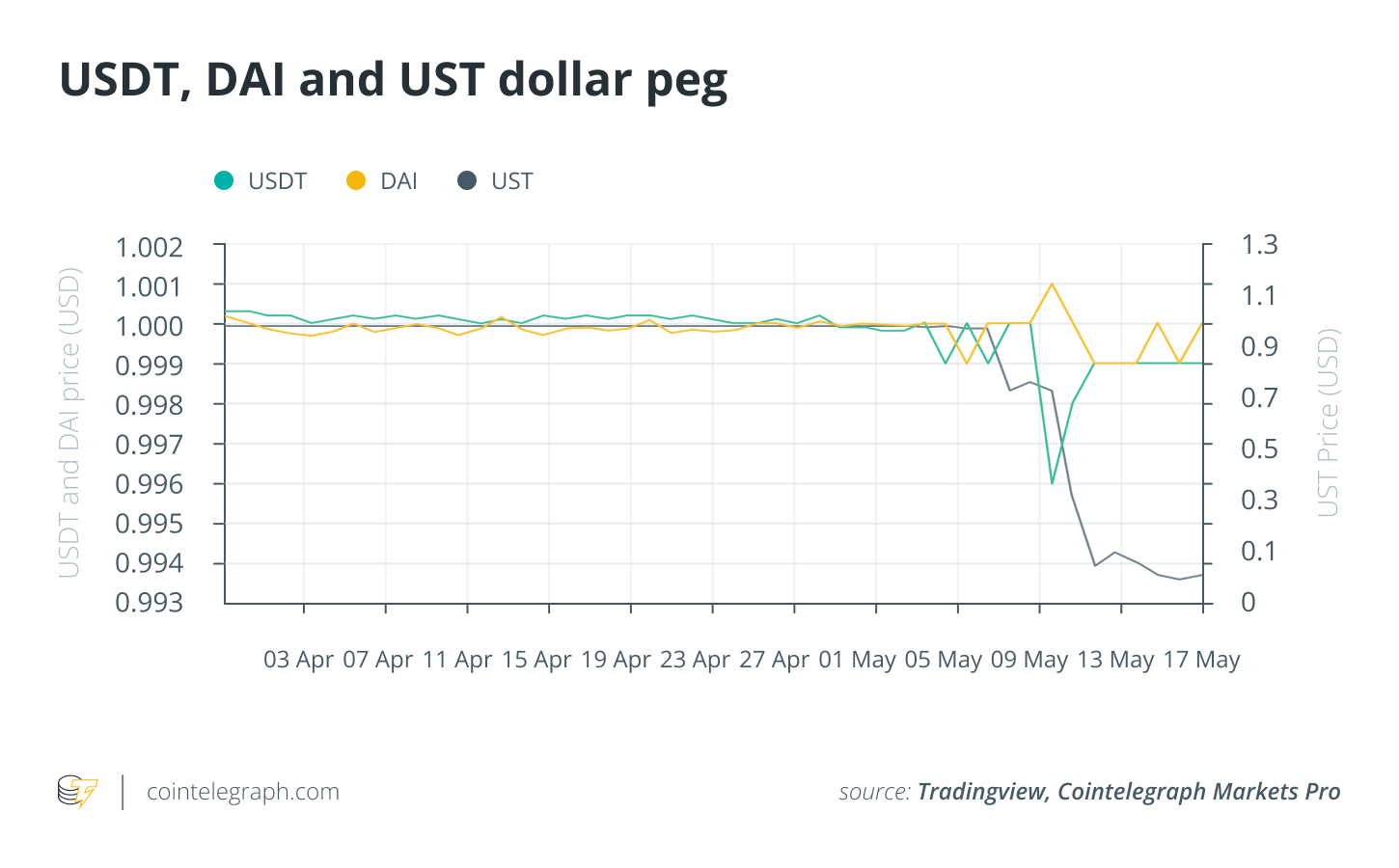

Stablecoins are, obviously, designed to retain their value for their peg. However, what went down to UST was remarkably unparalleled as well as threatened the collapse from the entire market. UST is really a hybrid between an algo stablecoin along with a crypto-collateralized stablecoin. Once the cost of UST moves above its dollar peg, users are incentivized to lose $1 price of LUNA for UST to market in a profit. When UST falls underneath the peg, users burns up UST in return for a reduced LUNA. It grew to become crypto-backed because the Luna Foundation Guard acquired great levels of Bitcoin (BTC) collateral like a contingency plan. This, because it switched out, was ineffective, and also the last couple of holdings of BTC along with other assets were allotted to smallholders as compensation.

Terra’s collapse began using the large withdrawals on Anchor Protocol on May 8. Countless UST were pulled out of the protocol and rapidly offered, creating a volitile manner. What ensued was more panic. The formula eventually couldn’t respond rapidly enough — by burning LUNA — towards the rapid decline of UST’s value.

In hindsight, evidence was apparent because the primary interest in UST was just produced from the demand in Terra’s Anchor Protocol. The reduced buying and selling amount of UST shows that users care more about ensure that is stays within the protocol than really deploying it for buying and selling.

DAI holding steady

Among the panic, with Tether even briefly losing its peg towards the U . s . States dollar, DAI had really continued to be relatively stable. At some point, USDT dropped to around $.994 on May 9, while DAI rose to $1.001. DAI has been hailed lately as “the” true decentralized stablecoin.

Getting existed since 2017, DAI has survived many two opposites on the market, which no algo stablecoin has ever were able to do. Yet, there can’t ever be lack of risk, mainly in the crypto market.

Cointelegraph’s Market Insights E-newsletter shares our understanding around the fundamentals that slowly move the digital asset market. The e-newsletter dives in to the latest data on social networking sentiment, on-chain metrics and derivatives.

We evaluate the industry’s most significant news, including acquisitions and mergers, alterations in the regulatory landscape, and enterprise blockchain integrations. Register now is the first to get this. All past editions of Market Insights can also be found on Cointelegraph.com.