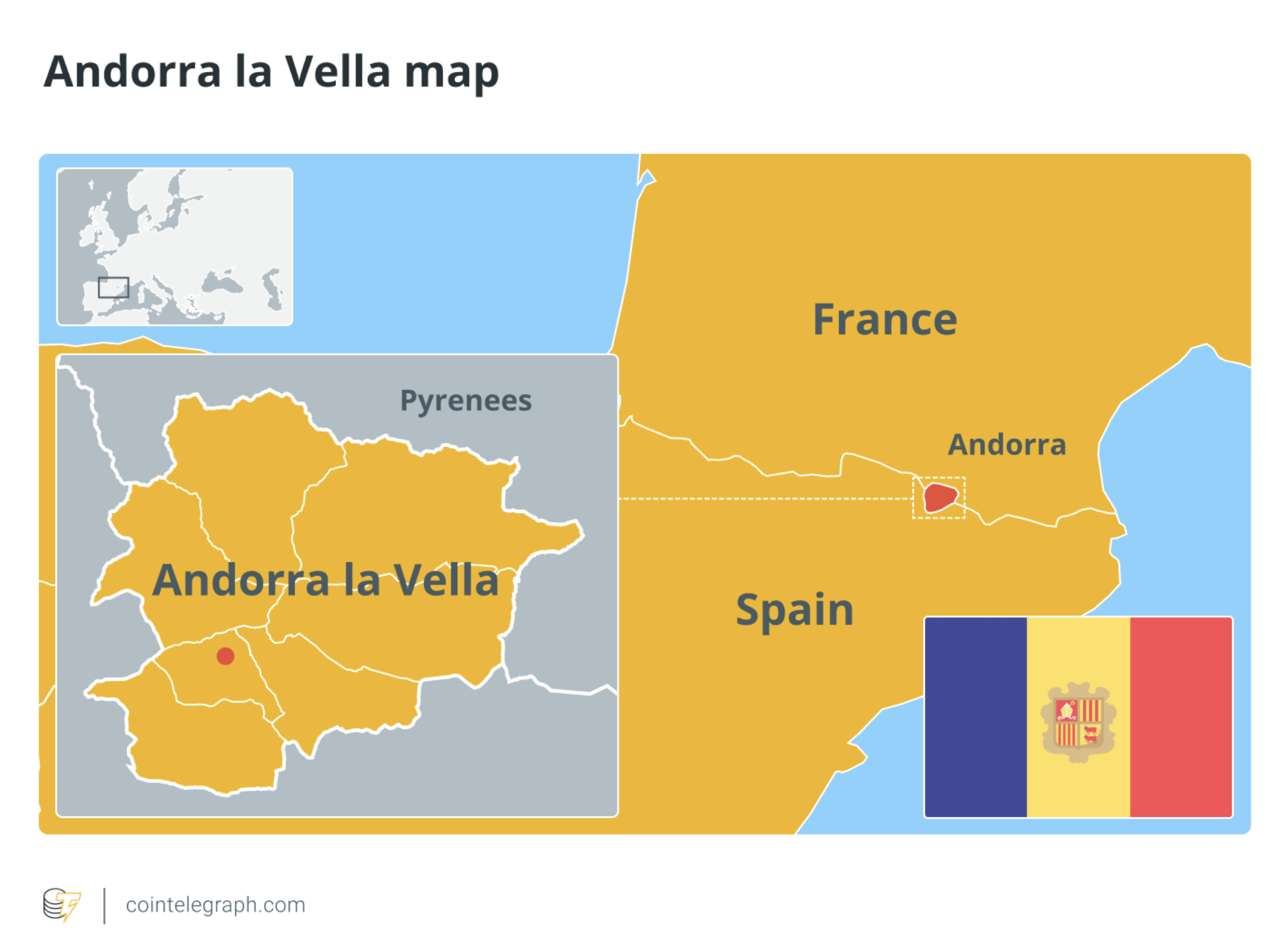

A little light of progress shines from Andorra, a small European country nestled between France and The country. The country’s government, the overall Council of Andorra, lately approved digital Assets Act, a regulatory framework for digital currencies and blockchain technology.

The act is split up into a double edged sword. The very first regards the development of digital money, or “programmable digital sovereign money,” which may be exchanged inside a closed system. Essentially, this could permit the Andorran condition to produce its very own token.

The 2nd 1 / 2 of the act describes digital assets as financial instruments and promises to create an atmosphere by which blockchain and distributed ledger technologies could be controlled. For Paul (who withheld his surname), Chief executive officer of local Bitcoin business 21Million, the brand new law could attract start up business. He told Cointelegraph:

“The outcome they’re attempting to achieve would be to really attract new companies to discover in the united states by providing some legal clarification which makes it simpler and much more transparent. They check this out in an effort to attract talents and entrepreneurs towards the new economy.”

Observe that cryptocurrencies and digital currencies aren’t legal tender in Andorra, and also the Digital Assets Act will not make any proposals surrounding way of exchange. That privilege is solely restricted to the most well-liked currency from the European Central Bank, the euro. It hasn’t stopped Paul, an enthusiastic Bitcoiner, from making the situation for Bitcoin (BTC) adoption in Andorra:

I have been focusing on that one for some time but I have finally made the decision to talk about it ! Here’s the situation I alllow for a bitcoin adoption in Andorra ! https://t.co/xHxl78YChO

— Paul ADW (@PaulADW) This summer 14, 2022

Inside a blog publish, Paul highlighted that Andorra could adopt a Bitcoin standard, mining Bitcoin with alternative energy, dealing with Bitcoin like a reserve asset, and welcoming Bitcoin-centric companies from all across the globe.

National newspaper Diari d’Andorra reported the Digital Assets Act is really a step toward “making cryptocurrencies each day-to-day reality.” From the business perspective, Paul stated that the amount of “crypto-friendliness” depends upon the game.

“I have an acquaintance who runs a mining operation here — not a problem —and electricity is affordable. Should you choose financial talking to, then your same: pretty friendly having a low tax rate. Should you desired to run an exchange, maybe it’s a bit difficult to find a financial institution that actually works along with you the federal government itself wouldn’t mind.”

Within an interview in May, Andorran Minister of Economy and Enterprise Jordi Gallardo pointed out that blockchain was among the top regions of investment for that small country. However, it’s not obvious when the minister known Bitcoin (the world’s foremost blockchain) or research into distributed ledger technologies that underpin blockchains.

Josselin Tonnellier, co-founding father of StackinSat, told Cointelegraph that there’s confusion regarding crypto, blockchain, nonfungible tokens and Bitcoin. StackinSat hosts a significant European Bitcoin conference, Surfin’ Bitcoin, in Biarritz, France just outdoors Andorra in which the group’s headquarters will also be located.

Paul, who’s a normal attendee of Surfin’ Bitcoin, confirms that in Andorra, the sentiment and confusion remain similar: “The regulator doesn’t create a differentiation between ‘crypto’ and Bitcoin. They haven’t been ‘orange-pilled’ yet.” To accept orange pill is Bitcoin parlance when ever a newcomer to Bitcoin starts to comprehend the concepts from the seminal cryptocurrency.

If you want surfing and Bitcoin, we’ve the right event for you personally : @SurfinBitcoin pic.twitter.com/zGHrhZIie6

— Joss Tonn (@Joss_do_it_BTC) June 18, 2022

Tonnellier emphasized that understanding of digital currencies and technologies is rising, but there is a chance of scams and losses without proper educational tools or frameworks in position:

“According to some recent report by KPMG, there are other French people uncovered to ‘crypto’ rather than the stock exchange […] France is proven to be a hotbed of ‘shitcoinery.’”

Although there’s no “shitcoin” classification chart, such coins are tokens apart from Bitcoin, which, based on the latter’s proponents, are vulnerable to plummeting to zero. Squid Game Token was probably the most newsworthy shitcoins of 2021.

In Andorra, Tonnellier described the country is better placed to operate with technologies for example Bitcoin. “Andorra is among the couple of Countries in europe outdoors the jurisdiction from the European Parliament.” Indeed, in lots of ways, it may be similar to Europe on the smaller sized scale:

“Andorra is extremely attractive for entrepreneurs because of its low tax, but Europe includes a great jump to promote the introduction of activities around Bitcoin and cryptocurrencies generally. This might alternation in in the future because of this text of laws and regulations which frames Bitcoin and blockchain activities.”

Related: French central bank mind announces Phase 2 of wholesale digital euro project

For less than 500 square kilometers of land, Andorra is one kind of Europe’s tiniest countries. Contrary to public opinion, Andorra isn’t a tax haven the micro-condition renounced banking secrecy in 2018. Nevertheless, taxes are significantly less than in neighboring France or The country, while financial services comprise as much as 20% from the economy.

While it’s unclear which digital assets the federal government promises to regulate using the Digital Assets Act, the economically motivated movement might help to diversify the Andorran economy and welcome blockchain- and crypto-based companies. For Paul, it’s one step nearer to Andorra adopting Bitcoin.