Get your daily, bite-sized digest of crypto and blockchain-related news – investigating the stories flying under the radar of today’s news.

In this edition:

- BitMEX Sends Bitcoin to the Moon on Board of Peregrine-1

- Core Scientific to Settle $34M Claims from 70K Non-Existent Miners

- Bitcoin ETF Approval Window Opens Today

- John Lilic Joins the Telos Foundation as Executive Director

__________

BitMEX Sends Bitcoin to the Moon on Board of Peregrine-1

Crypto exchange BitMEX is sending Bitcoin (BTC) to the actual Moon on January 8 at 02:18 am ET from Cape Canaveral Space Force Station, Florida, USA.

BitMEX’s physical Bitcoin weighs 43g and is loaded with 1 BTC. It is amongst the 201 payloads from governments, companies, universities, and NASA’s Commercial Lunar Payload Services initiative to travel to the lunar surface, said the press release. The payloads also include a copy of the Genesis Block from Bitcoin Magazine.

The coin is engraved with a public address (1MoonBTCixFH3XTrWRCbMpK23o74nQrA1Q) and a private key. This will be the first-ever financial asset sent to the Moon.

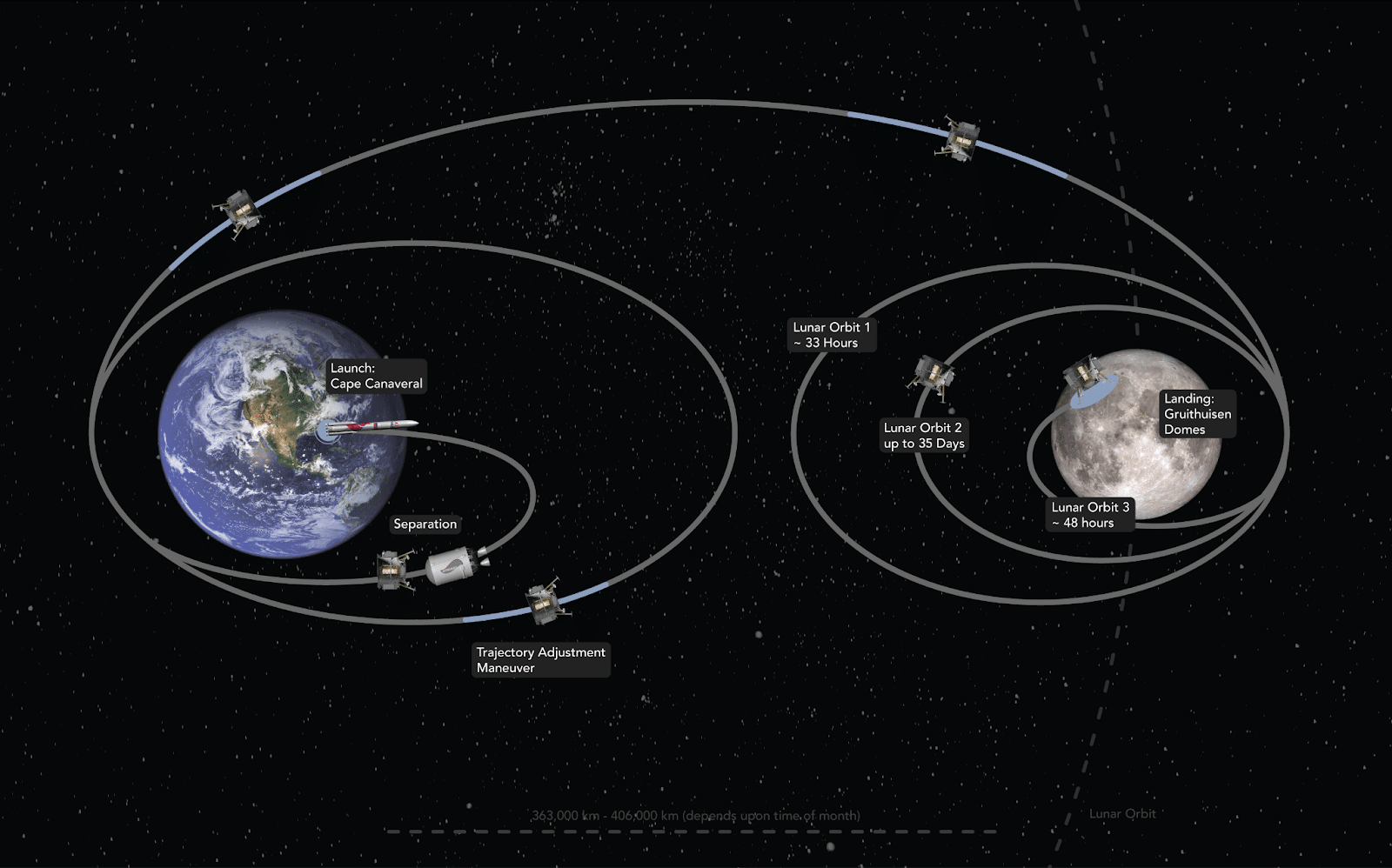

The Bitcoin is carried on the United Launch Alliance (ULA) Vulcan rocket and integrated into Peregrine-1, a commercial lunar lander. It is scheduled to reach the Moon around February 23, 2024.

After an Earth orbit, the Vulcan rocket will launch and place Peregrine-1 on a lunar trajectory outside the Earth’s atmosphere. Peregrine-1 will power on and continue to the 7-week lunar orbit phase.

“The Bitcoin will remain on the lunar surface with Peregrine, where BitMEX invites the crypto community and future generations to interact with the physical coin, whether on Earth or in space, enabling individuals to send personal messages and their own satoshis to the Moon.”

The mission is done in partnerships with Astrobotic, Bitcoin Magazine, and Oxcart Assembly. Its success will prove the potential of Bitcoin and blockchain technology in creating a borderless financial system, even beyond Earth, the announcement said.

BitMEX CEO Stephan Lutz called this “the first step of creating a monetary system for a space economy.”

Core Scientific to Settle $34M Claims from 70K Non-Existent Miners

The troubled publicly listed Bitcoin mining company Core Scientific has reached a settlement with two other Bitcoin mining companies, Sphere 3D and Gryphon Digital Mining, to resolve a $34 million unsecured claim resulting from 70,000 miners that never existed, according to the latest Miner Weekly report by BlocksBridge Consulting, citing Core’s filing earlier this week.

All this is happening as the company approaches the final hearing next week to exit bankruptcy.

Core Scientific is now seeking the bankruptcy court’s approval for an agreement with Sphere and Gryphon. The total unsecured claims allowed for the latter two would be $10 million.

But how did it get here?

Sphere and Gryphon pursued a merger deal in June 2021 to go public in the US. Soon after the merger announcement, Core said that Gryphon signed a hosting contract in October 2021 to colocate 70,000 units of Bitmain’s S19 or equivalent models at Core’s facilities.

However, Core claimed that Gryphon did not deliver the units as per the agreed schedule because of the lack of funding. Hene, it breached the contract.

Core further said that it received only about 300 units. Gryphon told it that “it would not be able to meet the quantity and type of units it had agreed to and that it was expecting delivery of miners from another manufacturer, NuMiner.”

In April 2022, Sphere and Gryphon ended their merger plan.

In July 2022, Sphere said it canceled the order after NuMiner failed to deliver by the deadline due to “supply chain issues.” It had “requested the prompt return of the Company’s $10 million deposit.”

Though neither Sphere nor Gryphon delivered the 70,000 miners for colocation, Gryphon made a prepayment of about $35 million, the report said.

Then, after Core Scientific filed for Chapter 11 bankruptcy protection in December 2022, Sphere submitted proof of claims seeking a refund of the prepayments. Core argued that the prepayment was not refundable. Furthermore, it said, it was Gryphon that signed the hosting contract and breached it by not delivering the miners.

Core filed an adversary complaint in November, claiming that Gryphon’s breach of contract caused it more than $100 million in site construction expenses and loss of hosting profits.

Bitcoin ETF Approval Window Opens Today

The approval or rejection period for the spot Bitcoin (BTC) exchange-traded fund (ETF) filings starts today, with the US Securities and Exchange Commission (SEC) expected to respond by January 10, wrote in an email Matteo Greco, Research Analyst at the publicly listed digital asset and fintech investment business Fineqia International.

“Market participants maintain expectations for the approval of the 21Shares filing, potentially triggering a cascade approval for all issuers,” Greco said.

Numerous meetings between the SEC, issuers, and exchanges have fuelled the narrative of an imminent approval, he opined.

Greco added that the introduction of ETFs could “usher in new investor cohorts from traditional finance, significantly improving market transparency and liquidity and bringing long-term capital inflow in the digital assets market.”

John Lilic Joins the Telos Foundation as Executive Director

The Telos Foundation announced the appointment of John Lilic as the organization’s Executive Director.

According to the press release, Lilic will help spearhead Telos’ evolution into a Layer 0 network underpinned by ZK technology aimed at attracting developers and users globally.

Lilic is set to transition into the public face of the Telos Foundation. He will represent the Telos community at various conferences and events around the world, it said.

He’ll also work to establish new relationships with key partners while providing direction and support for the foundation’s technology development, grant programs, research, budgeting, and educational efforts.

The announcement added that Lilic was an early adopter and volunteer at the Bitcoin Center NYC in 2014. He joined Consensys as one of the company’s first employees in 2015. While there, he helped build MetaMask and other transformational technologies.

More recently, he joined the Polygon team as a primary advisor. He is also a Top 50 Web3 Angel Investor.