BlueBenx, a Brazilian crypto lending platform, apparently blocked all its 22,000 users from withdrawing their following an alleged hack that drained $32 million (or 160 million Brazilian real). While no information regarding the hack were created available, the organization allegedly let go the majority of its employees.

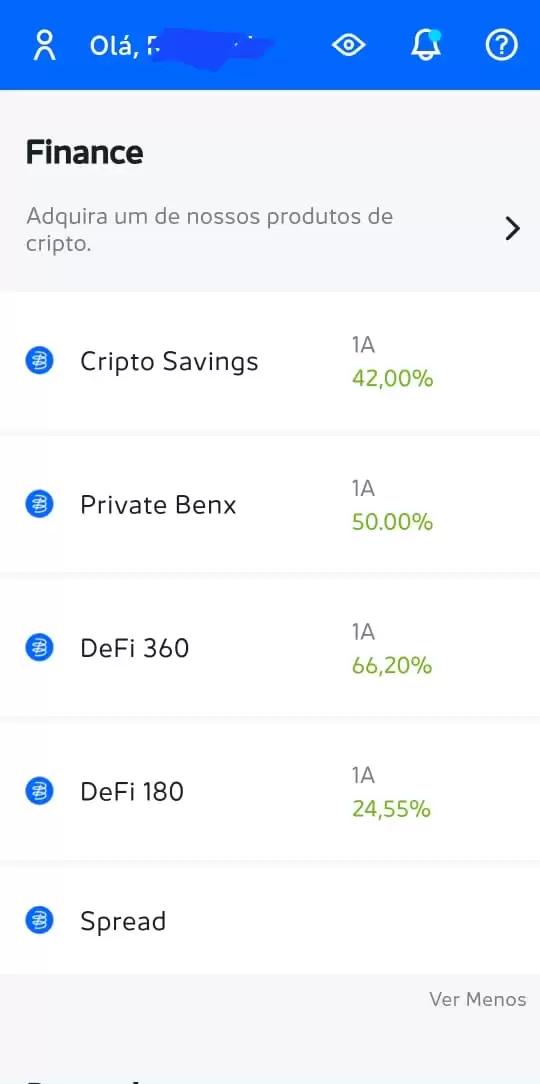

BlueBenx joins the growing listing of crypto firms that unsuccessful to provide on their own commitment of exorbitant yield returns this crypto winter. The Brazilian crypto loan provider guaranteed as much as 66% returns for users purchasing cryptocurrencies via various in-house earning avenues.

A report in the local news board Portal do Bitcoin highlighted that BlueBenx stopped all types of withdrawals after falling victim for an “extremely aggressive” hack. Based on BlueBenx’s lawyer, Assuramaya Kuthumi, the attack led to losing $32 million, which investors found difficult to believe — given the possible lack of clearness concerning the alleged hack.

Within the (roughly converted) words of the unnamed investor told Portal do Bitcoin:

“I think there’s a good venture from it as being a scam as this whole hacker attack story appears like lots of bullshit, something they invented.”

The possible lack of trust among investors comes from the truth that numerous crypto platforms — that provide high yields — have alleged similar scenarios previously, in which they finish up halting funds withdrawal while hiding their incompetency in fulfilling the formerly guaranteed returns towards the users.

Related: Investors shifting toward lower-risk crypto yields — Block Earner GM

Thinking about the growing risks involved with high-yield services, as mentioned above, crypto investors are actually on the go to testing out lower-risk crypto yields as safer strategies.

Block Earner, an Australian fintech company, observed an outburst of investors searching out for that “less dangerous version” of individuals returns. Talking with Cointelegraph, their gm Apurva Chiranewala mentioned:

“Given the risks go up considerably for individuals returns, individuals mankind has really began arriving engaging around because we glance such as the less riskier form of individuals double-digit return products.”

Because of this transformation in inverter sentiment, crypto the likes of Block Earner are needed to concurrently build institutional products because of the growing curiosity about that space.