The crypto market continues to be on the downward trajectory because the tail finish of 2021. At the begining of May 2022, it culminated inside a dip that impacted traditional markets just like hard. The current bust removed some speculation in the market. However the shakeup differs than previously. You may still find a lot more active users using the Bitcoin network than we view in past cycles. A lot more holders and true believers managed to get through to another side. However, because this increases with time, among the concerns some have over Bitcoin (BTC) may impact its adoption. There’s a fiscal incentive, not only utility, that privacy coins can provide like a solution.

At different points within the first 1 / 2 of 2022, in crypto market rallies and huge dumps, privacy coins for example Monero (XMR), Dash (DASH) and Zcash (ZEC) have fared relatively well against other altcoins. Performs this mean there’s an underlying interest in curiosity about crypto privacy?

The Bitcoin standard is finally here (well, not)

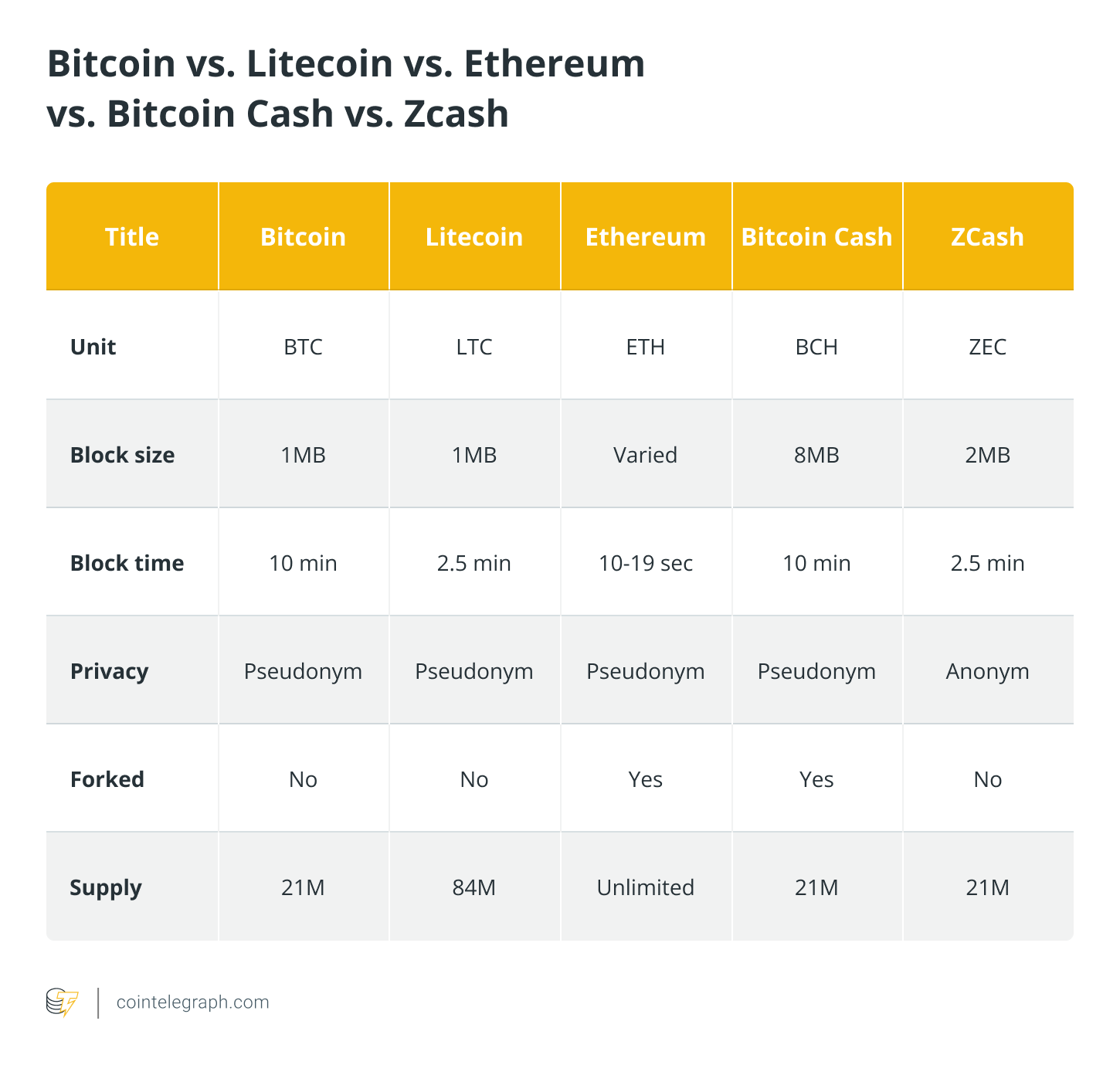

With regard to this discussion, let’s presume that Bitcoin managed to get. Bitcoin has become the dominant currency globally. But because of the pseudo-anonymous nature from the Bitcoin blockchain, anybody can easily see all the transactions for every wallet. As well as for each coffee purchased, the spending habits from the buyer, the place that the spending required place and all sorts of other dystopian trappings of the 1984-inspired nightmare really are a reality. This nightmare is exactly what has spurred on the development of the kind of Monero, Zcash, Dash, Decred (DCR), Secret (SCRT) and Horizen (ZEN), simply to name a couple of. A few of these have similar characteristics to Bitcoin. Zcash is modeled very much like Bitcoin having a 21 million hard cap supply and functions proof-of-work.

Can it be unthinkable that a couple of of those blockchain protocols could be adopted because the “everyday” transactional currency to enhance the Bitcoin standard? Protocols like Monero and Zcash have whether shallow inflation rate or perhaps a capped supply. They act using their tokenomics and don’t promise to complete greater than be considered a medium of exchange and store of worth, apart from, obviously, protecting the privacy from the user.

Related: Losing privacy: Why we have to fight for any decentralized future

Bimetallism: What’s that, and how come it matter?

Bimetallism is really a concept from lengthy ago and prior to the creation of cryptocurrencies. As suggested by its name, the concept behind bimetallism is the fact that various kinds of gold and silver would be employed to counterbalance the cost inflation rate relative to another. Gold typically had silver and the other way around to balance another out if a person began to possess an excessive amount of buying power. For instance, a horse may be worth one gold gold coin or 10 silver ones (silver and gold are rare to various levels but nonetheless have different intrinsic characteristics for utility). When the horse has become comparable to two gold annually later, at least 70 12 silver coins, making the trade more palatable towards the holder of silver, putting pressure around the inflation cost of gold. This bimetallism arrangement works theoretically if you have similar mediums of exchange like two gold and silver. Once the condition introduced fiat currency within the mix, Grisham’s Law kicked into effect, with a vengeance.

Grisham’s Law claims that bad money drives out good. If your holder has fiat or Bitcoin, there’s a good venture that they’ll value the greatOrsupport under they are doing BTC and trade away the fiat, with a potentially limitless supply. Which means that Bitcoin will sit, unused, in people’s wallets forever, destroying a few of the value proposition of seem decentralized money for that world. As to visualize the world will digital mediums of exchange, it won’t alter the laws and regulations of financial aspects.

There it’s still adjustments within the cost degree of items to tradable assets. To help keep these different mediums under control, other assets may be required as alternatives. However, if we don’t want Grisham’s Law engage in again, there has to be assets much like Bitcoin yet propose another value proposition. Enter privacy coins.

Related: Gold, Bitcoin or DeFi: Just how can investors hedge against inflation?

Privacy matters

Bitcoin could be a unit of account, medium of exchange, store of worth along with other characteristics that suit the gold 2. narrative. And also the traceability of Bitcoin is a great feature which has its uses. With with Bitcoin-backed loans, the transparency of assuring creditors the funds exist is a superb utility from the chain. But would you like the coffee barista to understand you frequent the antique store every Wednesday? Would you like your individual finance recognized to your manager? In order to anybody so what to appear using your payment history?

This is when the thought of bimetallism, or “bicryptoism,” can part of and solve these problems. If Bitcoin is adopted with a couple of different scarce and limited mediums of exchange (a privacy gold coin), these will help keep your purchasing power goods/services in constant “stable fluctuation” against one another. This really is, obviously, later on when Bitcoin may be the dominant currency around the globe.

Since these different protocols have different qualities (much like silver and gold), they are able to serve different functions in users’ lives. For daily transactions, users can savor the privacy that the privacy gold coin can provide while utilizing all the advantages of a decentralized ledger and blockchain technologies. When users need to transfer their cash into wallets which have a publically facing address, they are able to choose to have their funds in Bitcoin. Possibly, through functions like atomic swaps on-chain, this is often even simpler than the usual decentralized or centralized exchange.

Satoshi Nakamoto, the mysterious inventor(s) of Bitcoin, once authored: “For greater privacy, it’s better to use Bitcoin addresses just once.” A brand new BTC address for each user could be rather impractical for that 2022 crypto user, let alone a global where Bitcoin may be the standard medium of exchange. Users will either have to produce a Bitcoin improvement proposal (BIP) to alter Bitcoin to consider to incorporate privacy-enhancing features or co-exist with options inside a “bicryptoism” setup with a number of privacy coins. The second has additional economic advantages of keeping inflationary pressures lower on prices with time.

These are merely some ideas for future years, and also the greater crypto community must consider these potential issues once we move ahead. Financial aspects performed a huge part within the founding of Bitcoin and also the cryptocurrency revolution, and it ought to be a great resource of informing its future too.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Michael Tabone is definitely an economist at Cointelegraph Research. A Ph.D. candidate, engineer, economist and business strategist, also, he provides proper talking to to firms concentrating within the DeFi and blockchain space. Michael has co-authored several reports for Cointelegraph Research and writes an every three months venture capitalist report printed around the Cointelegraph Research Terminal. His Ph.D. dissertation is on DAOs as well as their practical applications in the realm of business.